2013 can be completed very easily. Just make use of FormsPal PDF editor to get it done promptly. FormsPal professional team is always endeavoring to enhance the tool and ensure it is even faster for clients with its handy features. Enjoy an ever-evolving experience now! Starting is easy! Everything you need to do is take the following basic steps down below:

Step 1: Press the "Get Form" button at the top of this webpage to get into our PDF editor.

Step 2: The editor grants the capability to change PDF documents in various ways. Transform it by writing customized text, correct what is already in the document, and put in a signature - all within the reach of a couple of mouse clicks!

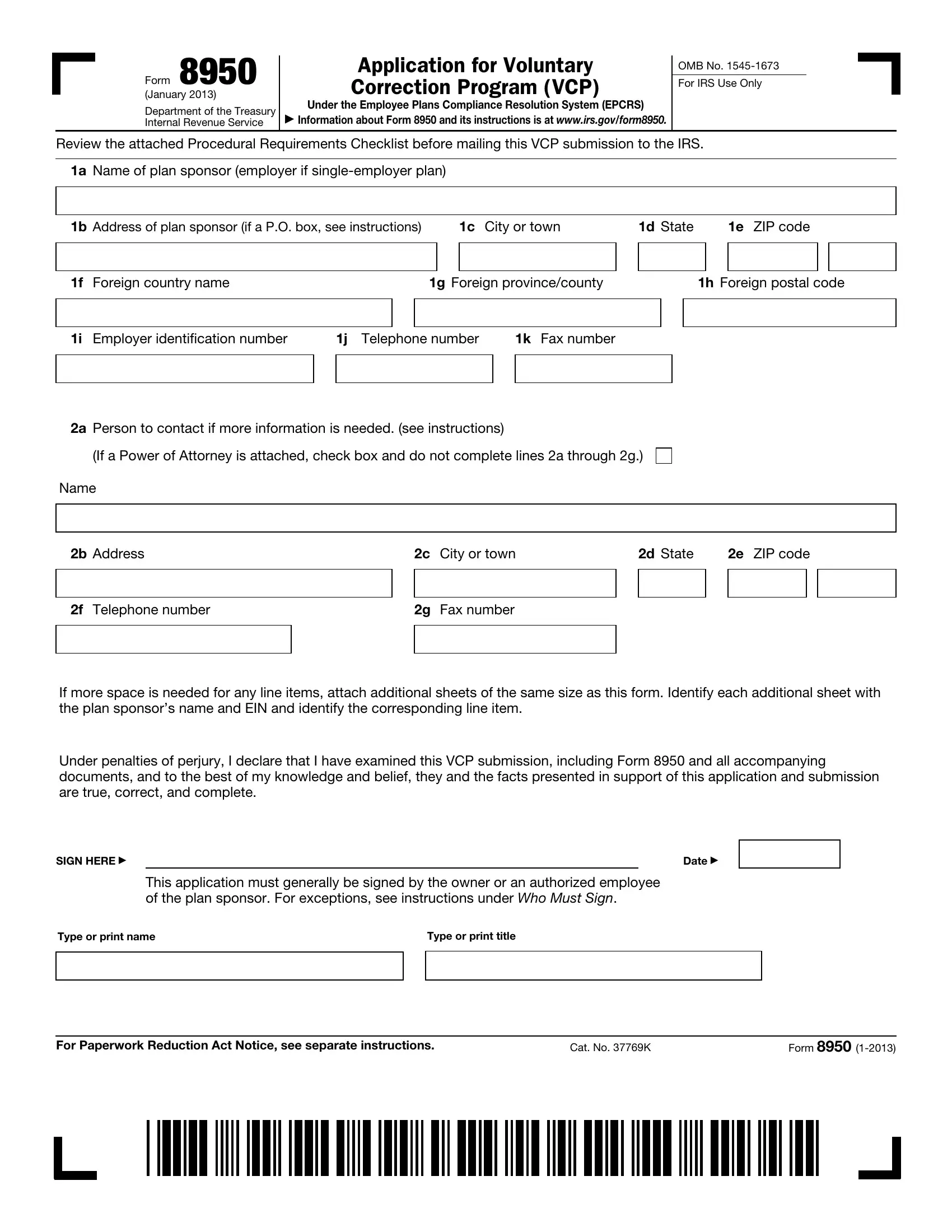

If you want to fill out this PDF form, ensure that you enter the necessary details in each area:

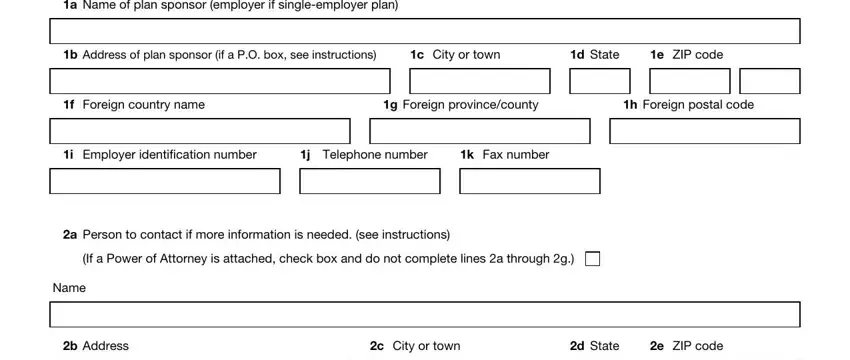

1. To start with, when filling out the 2013, begin with the area that features the next blank fields:

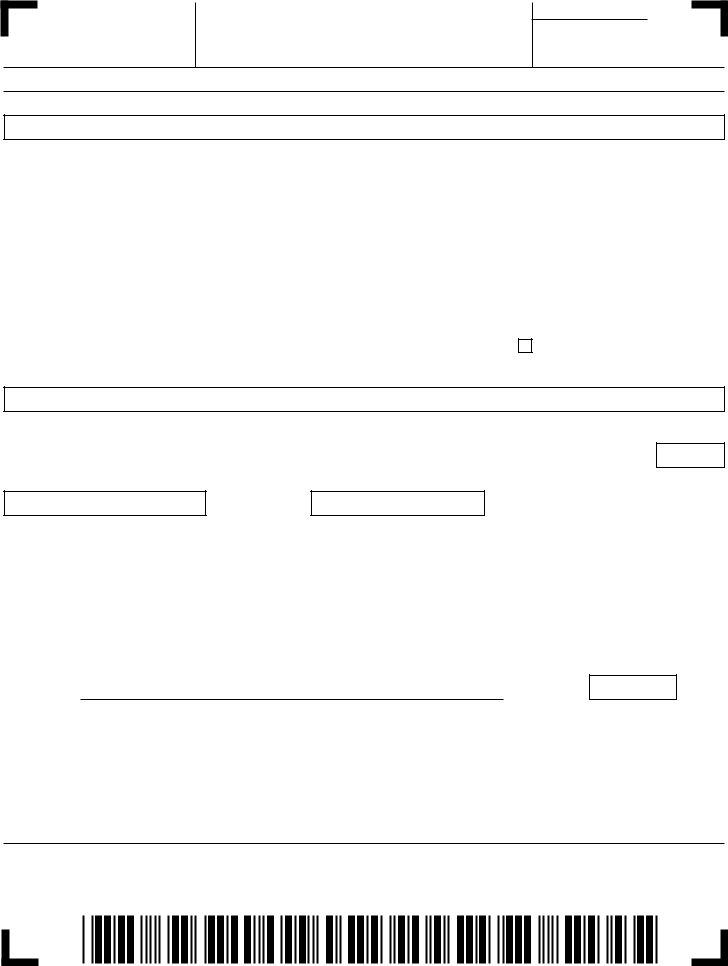

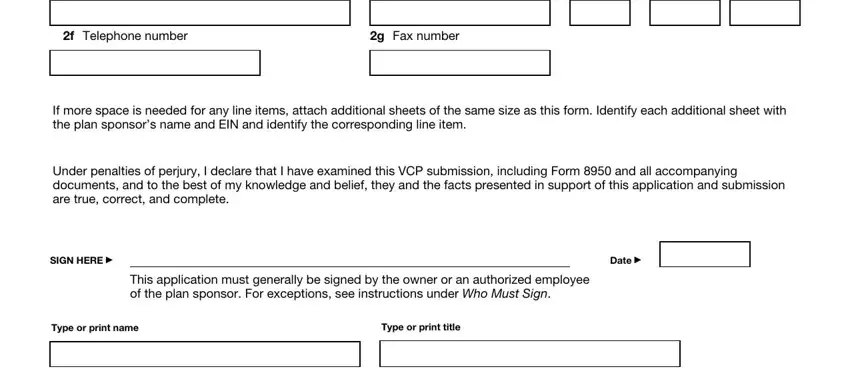

2. Now that the last section is done, you'll want to insert the necessary details in f Telephone number, g Fax number, If more space is needed for any, Under penalties of perjury I, SIGN HERE, Date, This application must generally be, Type or print name, and Type or print title so that you can progress to the third stage.

Concerning Type or print name and Type or print title, be sure you take another look here. The two of these are the key ones in this form.

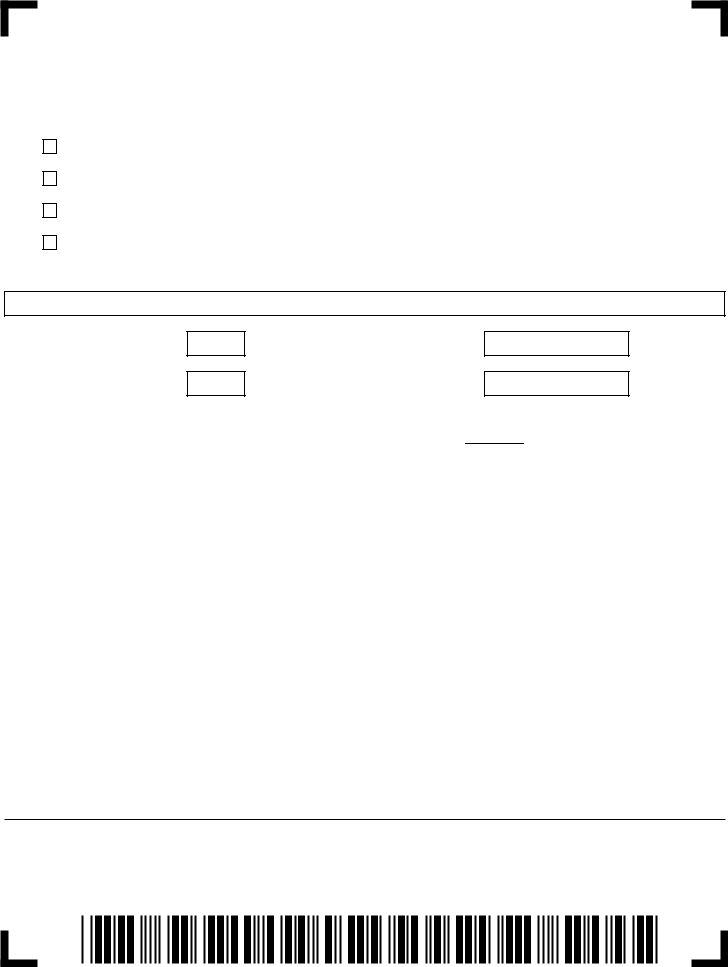

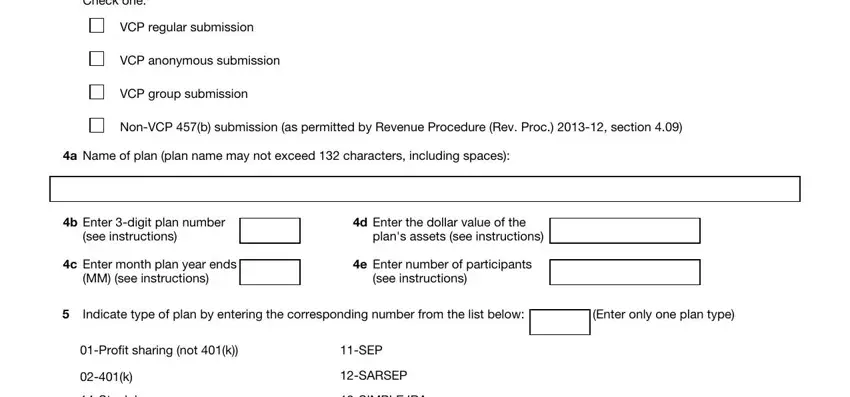

3. The following section focuses on Check one, VCP regular submission, VCP anonymous submission, VCP group submission, NonVCP b submission as permitted, a Name of plan plan name may not, b Enter digit plan number, see instructions, d Enter the dollar value of the, plans assets see instructions, c Enter month plan year ends, MM see instructions, e Enter number of participants, see instructions, and Indicate type of plan by entering - fill out these blank fields.

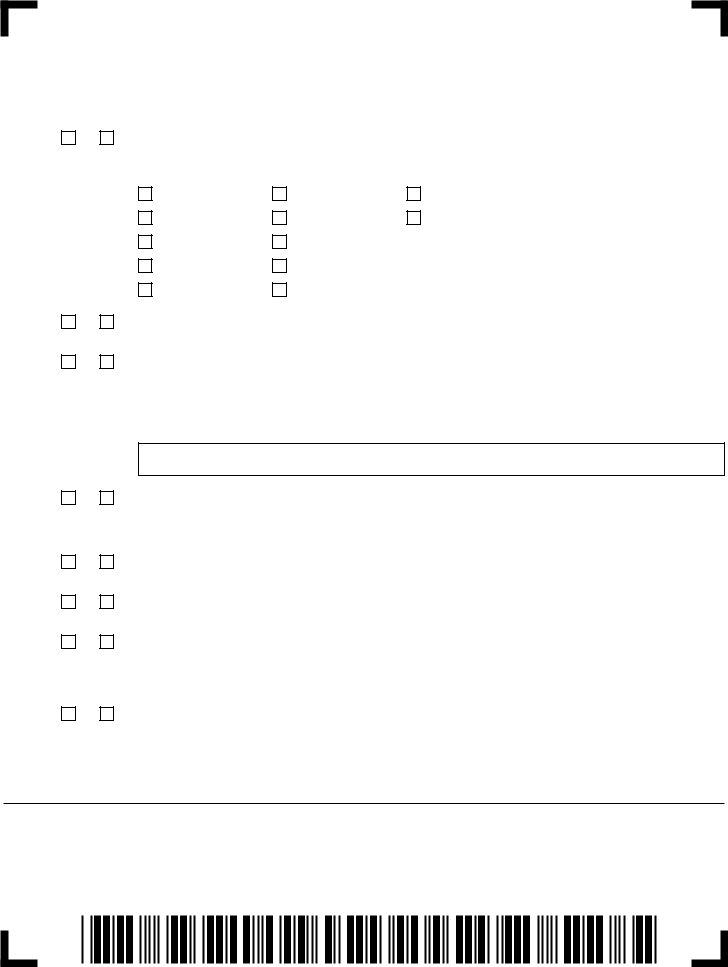

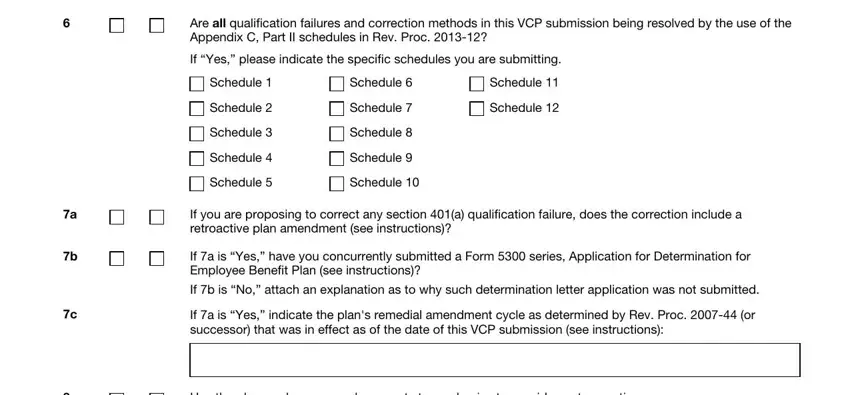

4. Filling in Yes, Are all qualification failures and, If Yes please indicate the, Schedule, Schedule, Schedule, Schedule, Schedule, Schedule, Schedule, Schedule, Schedule, Schedule, Schedule, and Schedule is essential in this next part - you'll want to don't hurry and be mindful with every single empty field!

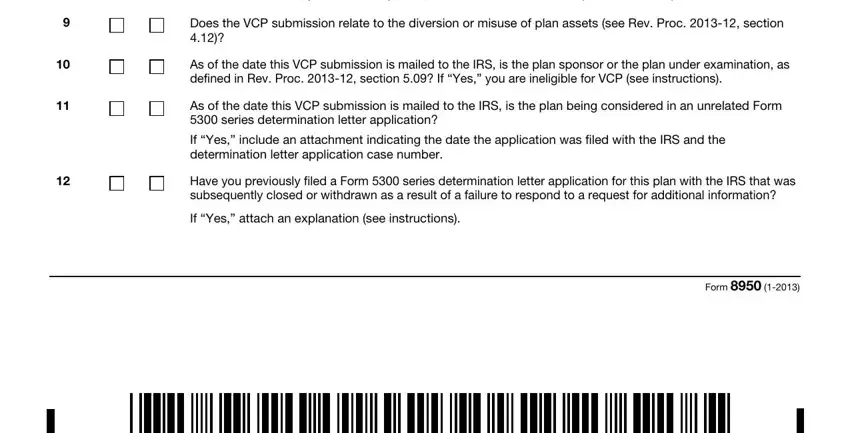

5. To conclude your document, the particular subsection involves a couple of extra blank fields. Entering If Yes attach an explanation that, Does the VCP submission relate to, As of the date this VCP submission, As of the date this VCP submission, If Yes include an attachment, Have you previously filed a Form, If Yes attach an explanation see, and Form should wrap up everything and you're going to be done in a blink!

Step 3: After proofreading your form fields you've filled in, press "Done" and you are done and dusted! Download the 2013 as soon as you join for a free trial. Quickly use the pdf form in your personal cabinet, together with any modifications and adjustments being automatically kept! We do not sell or share the details that you enter while filling out forms at our site.