S-Corporation can be completed without any problem. Simply use FormsPal PDF editing tool to do the job in a timely fashion. FormsPal is dedicated to making sure you have the absolute best experience with our tool by constantly introducing new capabilities and upgrades. Our tool is now a lot more intuitive with the newest updates! Currently, working with PDF forms is simpler and faster than ever. In case you are looking to get going, this is what you will need to do:

Step 1: Simply click the "Get Form Button" in the top section of this webpage to get into our form editing tool. There you will find all that is required to fill out your document.

Step 2: As soon as you access the tool, you'll see the form ready to be filled out. Aside from filling out various blanks, it's also possible to perform other actions with the form, specifically adding custom textual content, changing the initial textual content, adding graphics, placing your signature to the form, and much more.

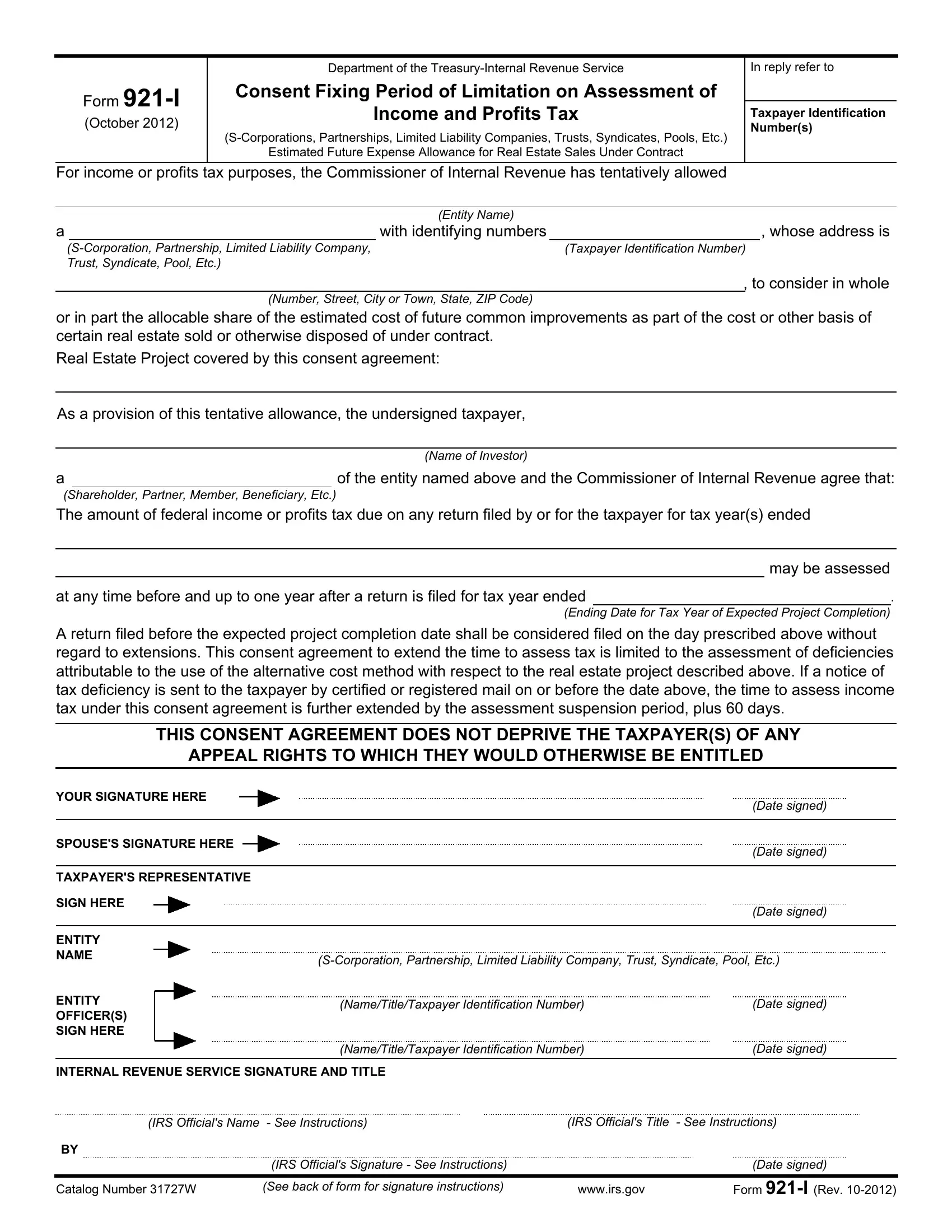

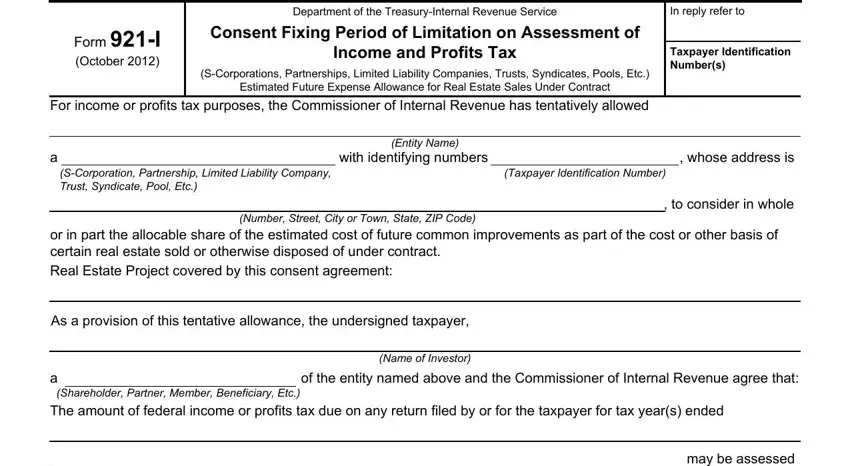

To be able to finalize this form, ensure you enter the right information in every single field:

1. Begin completing the S-Corporation with a group of necessary blank fields. Collect all of the necessary information and be sure not a single thing missed!

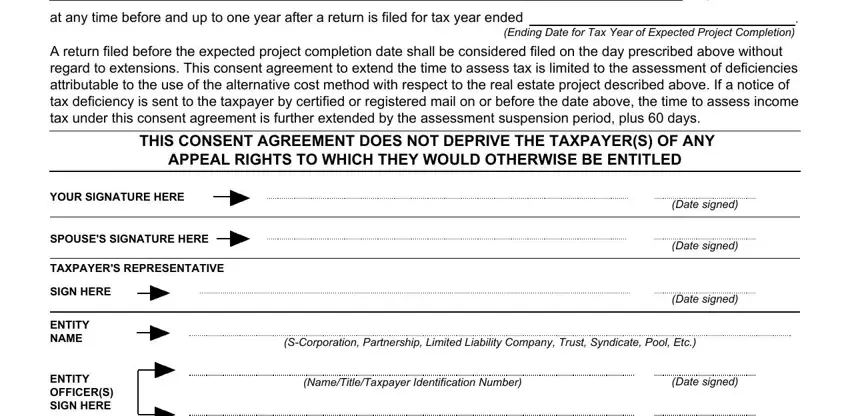

2. After this selection of blank fields is filled out, proceed to type in the applicable information in all these - at any time before and up to one, may be assessed, A return filed before the expected, Ending Date for Tax Year of, THIS CONSENT AGREEMENT DOES NOT, APPEAL RIGHTS TO WHICH THEY WOULD, YOUR SIGNATURE HERE, SPOUSES SIGNATURE HERE, TAXPAYERS REPRESENTATIVE, SIGN HERE, ENTITY NAME, ENTITY OFFICERS SIGN HERE, Date signed, Date signed, and Date signed.

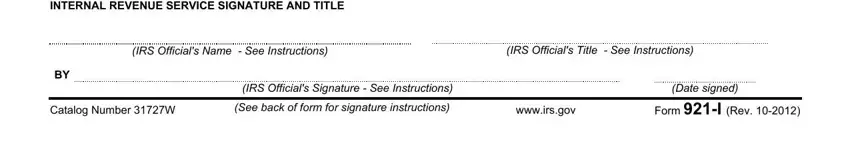

3. This next step is normally hassle-free - fill in all the fields in INTERNAL REVENUE SERVICE SIGNATURE, IRS Officials Name See, IRS Officials Title See, IRS Officials Signature See, Catalog Number W, See back of form for signature, wwwirsgov, Date signed, and Form I Rev in order to finish this process.

Be very careful when filling in Form I Rev and IRS Officials Signature See, as this is the part where many people make some mistakes.

Step 3: Before finalizing this document, ensure that blanks are filled in the proper way. The moment you believe it's all good, click “Done." Sign up with FormsPal now and immediately use S-Corporation, available for downloading. All adjustments you make are preserved , so that you can modify the file further if necessary. At FormsPal, we do our utmost to be certain that all your information is kept protected.