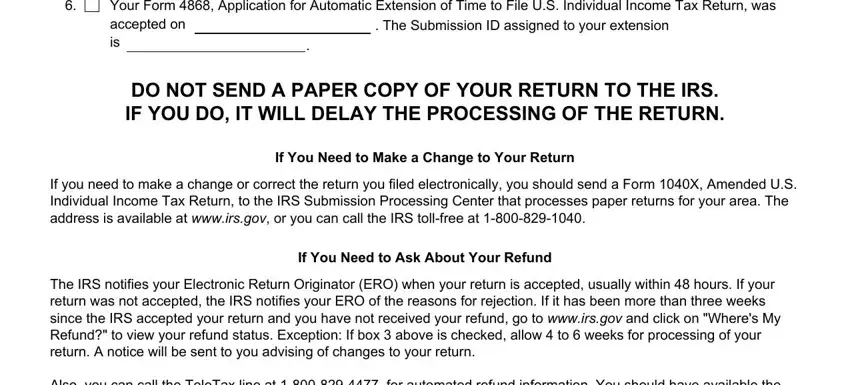

The IRS uses refunds to cover overdue taxes and notifies you when this occurs. The Fiscal Service offsets refunds through the Treasury Offset Program to cover past due child support, federal agency non-tax debts such as student loans and state income tax obligations. Fiscal Service sends you an offset notice if it applies your refund or part of your refund to non-tax debts. If you have questions about the offset, contact the agency identified in the notice. You may also call the Treasury Offset Program Call Center at 1-800-304-3107, if you have additional questions.

If You Owe Tax

If your return has a balance due, you must pay the amount you owe by the prescribed due date. If you paid by electronic funds withdrawal (direct debit) or by credit card, no voucher is needed. The credit card service providers will charge a convenience fee based on the amount of taxes you are paying. The fees and the type of credit or debit cards accepted may vary between providers. You will be told the amount of the fee during the transaction and you will be given the option to either continue or end the transaction. For information on paying your taxes electronically, including by credit or debit card, go to www.irs.gov/e-pay.

If you are not paying electronically you may use Form 1040-V, Payment Voucher, which you can obtain from your Electronic Return Originator. If the IRS does not receive your payment by the prescribed due date, you will receive a notice that requests full payment of the tax due, plus penalties and interest. If you can not pay the amount in full, complete Form 9465, Installment Agreement Request, which you may file electronically. To apply for an installment agreement online, go to www.irs.gov. You may also order Form 9465 by calling 1-800-TAX-FORM (1-800-829-3676). If approved, the IRS charges a user fee to set up an installment agreement.

If You Need to Inquire About Your Electronic Funds Withdrawal Payment

You may call 1-888-353-4537 to inquire about the status of your electronic funds withdrawal payment. If there is a change to the bank account information included on your return, you should call this number to cancel a scheduled payment. You should have available the social security number of the first person listed on the tax return, the payment amount, and the bank account number. Cancellation requests must be received no later than 11:59 p.m. E.T. two business days prior to the scheduled payment date.

Tax Refund Related Financial Products

Financial institutions offer a variety of financial products to taxpayers based on their refunds. Contracts for financial products are between you and the financial institution. The IRS is not associated with the contract. If you have questions about tax refund related products, contact your Electronic Return Originator or the lender.

Instructions for Electronic Return Originators

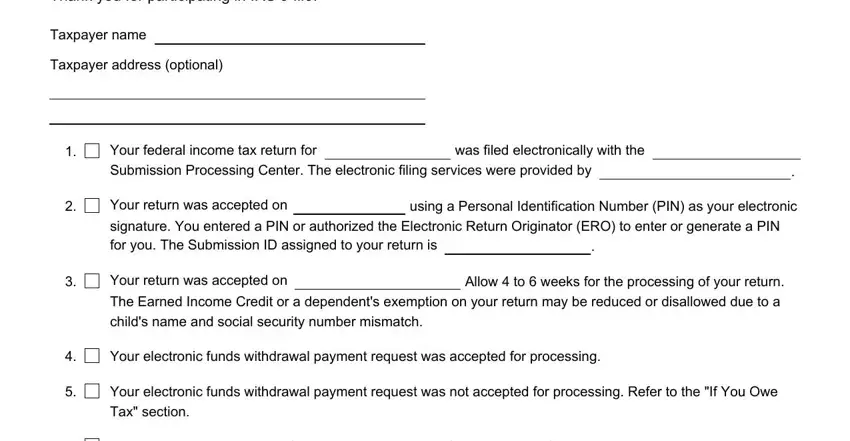

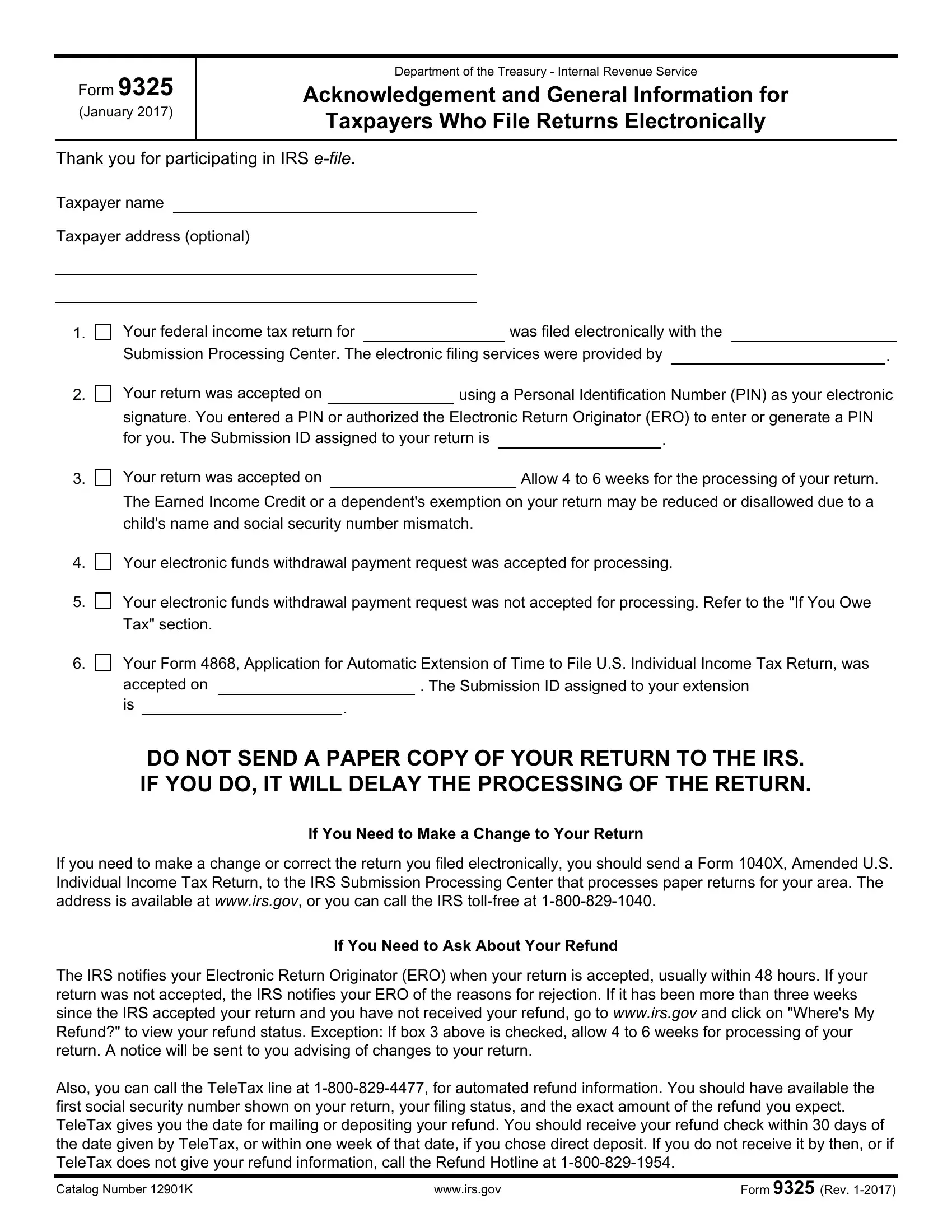

Line 2 - PIN Presence Indicator - Check box 2 if the taxpayer entered a PIN or authorized the ERO to enter or generate the PIN for the taxpayer, and the Acknowledgement File PIN Presence Indicator is a "Practitioner PIN," "Self-Select PIN" or "Online Filer PIN." Form 8879, IRS e-file Signature Authorization, is required if the ERO enters or generates the PIN or if the Practitioner PIN method is used. Use Form 8453, U.S. Individual Income Tax Transmittal for an IRS E-FILE

Return, to send required paper forms or supporting documentation listed next to the form check boxes (do not send Forms W-2, W-2G, or 1099R).

Line 3 - Exception Processing - Check box 3 if the Acknowledgement File Acceptance Code equals "Exception." The acceptance code indicates that this return has been previously rejected and this subsequent submission still has invalid data.

Line 4 - Payment Acknowledgement Literal - Check box 4 if the taxpayer requested to use electronic funds withdrawal to pay the balance due, and the Acknowledgement File Payment Acknowledgement Literal field equals "Payment Request Received."

Line 5 - Payment Acknowledgement Literal - Check box 5 if the taxpayer requested to use electronic funds withdrawal to pay the balance due, and the Acknowledgement File Payment Acknowledgement Literal field does not equal "Payment Request Received." If box 5 is checked, inform the taxpayer that he/she must pay by check, money order, debit card, or credit card.

Note: EROs can use the Acknowledgement File information, translated by the transmitter, to complete Form 9325.