You are able to work with Form 9400 376 without difficulty with our PDFinity® PDF editor. Our team is committed to providing you with the ideal experience with our editor by regularly releasing new capabilities and enhancements. With these updates, using our tool becomes easier than ever before! It merely requires a few basic steps:

Step 1: Click on the "Get Form" button above on this page to open our editor.

Step 2: With the help of this state-of-the-art PDF editor, it is easy to do more than simply fill out blank form fields. Express yourself and make your docs appear high-quality with customized textual content added, or tweak the original content to excellence - all that comes with an ability to insert stunning images and sign the file off.

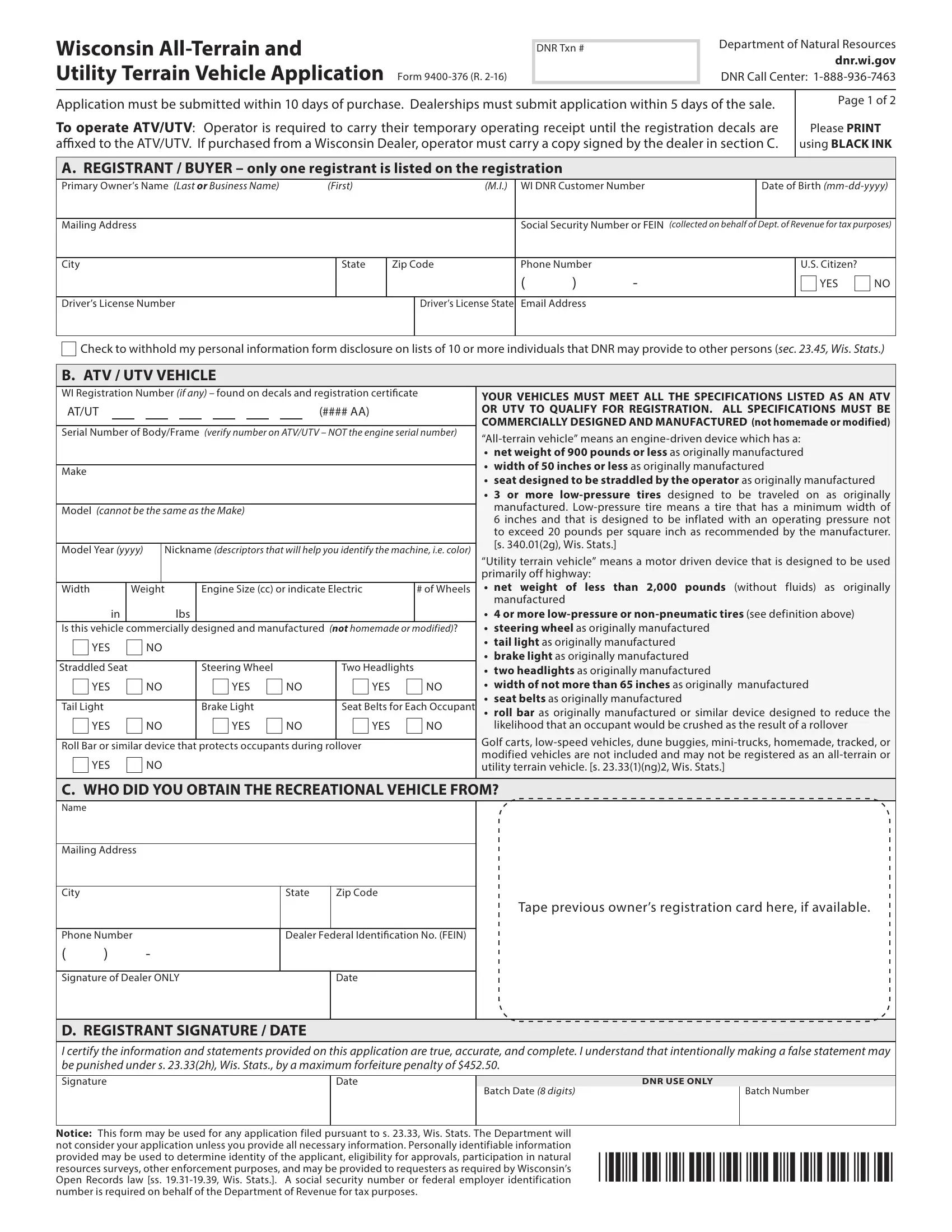

This document requires specific details to be filled in, so be certain to take the time to provide what is required:

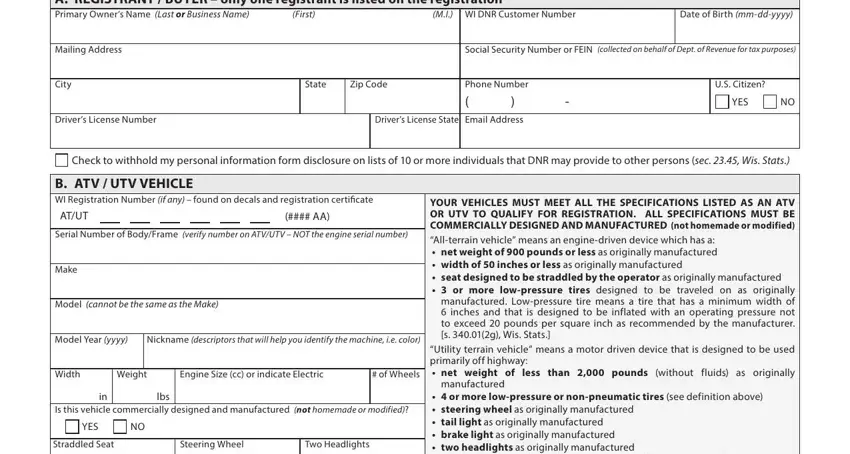

1. You'll want to fill out the Form 9400 376 correctly, therefore pay close attention when working with the parts containing all of these blanks:

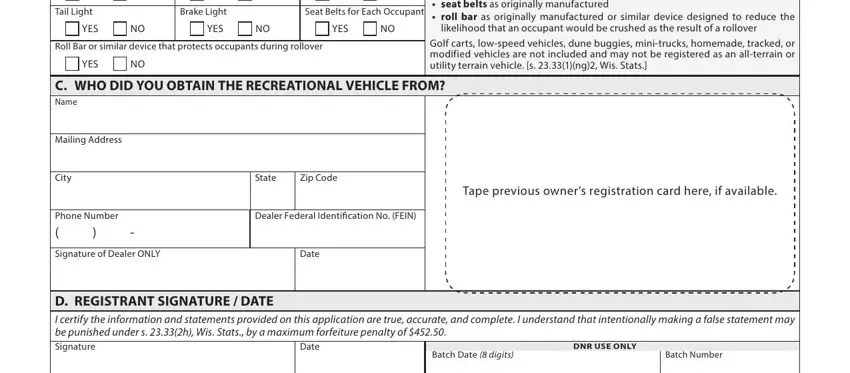

2. When this part is done, go to type in the suitable details in these - YES, YES, YES, Tail Light, Brake Light, Seat Belts for Each Occupant, YES, YES, YES, Roll Bar or similar device that, YES, or more lowpressure or, likelihood that an occupant would, Golf carts lowspeed vehicles dune, and C WHO DID YOU OBTAIN THE.

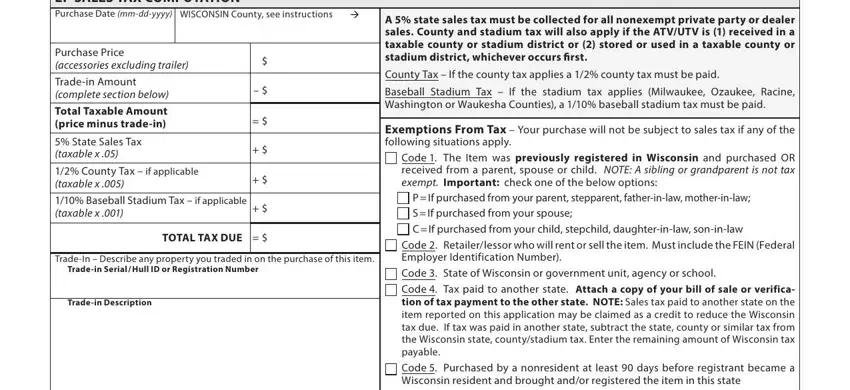

3. This subsequent step is quite easy, E SALES TAX COMPUTATION Purchase, WISCONSIN County see instructions, Purchase Price accessories, Tradein Amount complete section, Total Taxable Amount price minus, State Sales Tax taxable x, County Tax if applicable taxable, Baseball Stadium Tax if, TOTAL TAX DUE, TradeIn Describe any property you, Tradein Serial Hull ID or, Tradein Description, A state sales tax must be, County Tax If the county tax, and Baseball Stadium Tax If the - each one of these form fields will need to be filled in here.

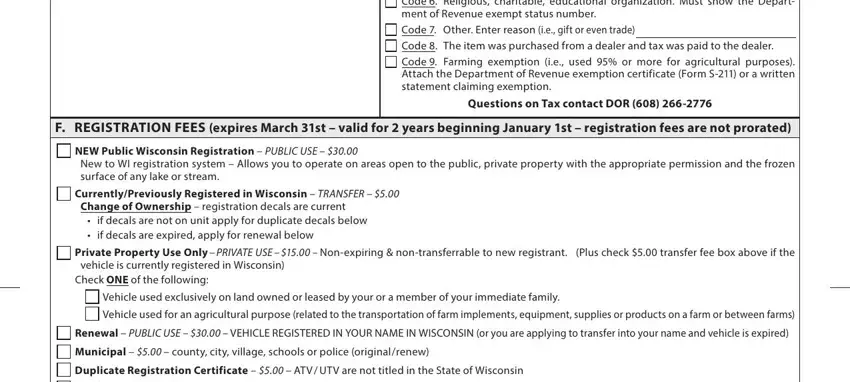

4. The form's fourth part arrives with the following form blanks to complete: Code Religious charitable, Code Other Enter reason ie gift, Code The item was purchased from, Code Farming exemption ie used, Questions on Tax contact DOR, F REGISTRATION FEES expires March, NEW Public Wisconsin Registration, surface of any lake or stream, CurrentlyPreviously Registered in, if decals are not on unit apply, Private Property Use Only PRIVATE, vehicle is currently registered in, Check ONE of the following, Vehicle used exclusively on land, and Vehicle used for an agricultural.

Always be very mindful while filling in vehicle is currently registered in and CurrentlyPreviously Registered in, because this is the part where many people make a few mistakes.

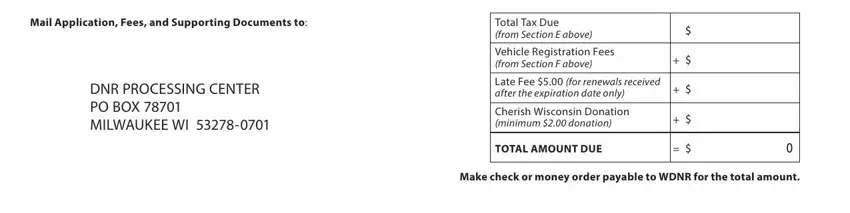

5. Last of all, this last portion is what you have to wrap up before using the form. The fields here are the following: Mail Application Fees and, DNR PROCESSING CENTER PO BOX, Total Tax Due from Section E above, Vehicle Registration Fees from, Late Fee for renewals received, Cherish Wisconsin Donation minimum, TOTAL AMOUNT DUE, and Make check or money order payable.

Step 3: Make sure that the details are right and click on "Done" to complete the project. After setting up a7-day free trial account with us, you'll be able to download Form 9400 376 or send it through email right away. The file will also be at your disposal via your personal account with your each and every modification. Whenever you work with FormsPal, you're able to complete documents without the need to get worried about personal information incidents or records getting shared. Our protected platform makes sure that your private data is maintained safely.