Filing taxes and contributions may often seem daunting, especially when it involves understanding specific forms like the 941/C1-ME form used by Maine businesses. This comprehensive document serves a dual purpose, streamlining the process for reporting both income tax withholdings and unemployment contributions in one fell swoop for the fiscal year 2010. It's specifically designed for Maine Revenue Services and the Maine Department of Labor, highlighting the efficiency driven by combined filings. Businesses are required to list their withholding account number, unemployment compensation employer account number, and detail the period covered. The form meticulously divides itself into parts focusing on income tax withholding, where the number of payees and the total income tax withheld for the quarter are reported. It continues with the unemployment contributions segment, asking for detailed workforce information such as the number of full-time and part-time workers and total gross wages paid, ultimately calculating taxable wages. The form wraps up by aiding businesses in calculating the total amount due, considering both income tax and unemployment contributions. With explicit sections for both the employer's certification and information needed if prepared by a paid preparer, the form ensures that all necessary details for compliance are carefully considered and accounted for.

| Question | Answer |

|---|---|

| Form Name | Form 941 C1 Me |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | 941C1_10 form941c1 me |

FORM |

MAINE REVENUE SERVICES |

|||||||

|

|

|

|

MAINE DEPARTMENT OF LABOR |

||||

2010 |

|

|

|

COMBINED FILING FOR INCOME TAX WITHHOLDING |

||||

|

|

|

|

AND UNEMPLOYMENT CONTRIBUTIONS |

||||

QUARTER # |

|

|

|

Withholding Account No: |

|

|

|

|

|

|

|

|

|||||

Name: |

UC Employer Account No: |

|||||||

99

*1008520*

-

Period Covered:

File On or Before:

-

-

-

-

-

-

Part One - Income Tax Withholding

A. Number of payees subject to

Maine income tax withholding:

1.Maine income tax withheld this quarter (from Schedule 2/C1, line 19b)

(Semiweekly fi lers complete Schedule 1/C1 on reverse side) |

1. |

$ |

|

|

, |

|

|

|

, |

|

|

|

|

||||||

|

|

|

|

|

|

2.Less any semiweekly payments (From Schedule 1/C1, line 13 on reverse side)

(See instructions for Schedule 1/C1 on page 7) |

2. |

$ |

|

|

, |

|

|

|

|

|

, |

|

|

|

|

|

|||||||

$ |

|

|

, |

|

|

|

|

|

, |

||

3. Income tax withholding due (line 1 minus line 2) |

3. |

|

|

|

|

|

|

||||

|

|

|

Part Two - Unemployment Contributions Report

,

.

.

.

|

Seasonal Code: |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Seasonal Period: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1st Month |

|||||||||||||

4. |

For each month, enter the total of all |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

or received pay reportable for unemployment insurance purposes for the payroll period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

which includes, the 12th of each month. If you had no employment in the payroll period, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

enter zero (0) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

5. |

Number of female employees included on line 4. |

If none, enter zero (0) |

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

6.Total Unemployment Compensation Gross Wages Paid this quarter (from Schedule 2/C1,line 19a) |

... 6. |

$ |

|

|

|

, |

|||||||

|

|

||||||||||||

7. |

DEDUCT EXCESS WAGES (SEE INSTRUCTIONS ON PAGE 6) |

7. |

$ |

|

|

|

|

, |

|||||

|

|

|

|||||||||||

|

NOTE: THE TAXABLE WAGE BASE IS $12,000 FOR EACH EMPLOYEE. |

|

|

|

|

|

|

|

|||||

8. |

Taxable wages paid in this quarter (line 6 minus line 7) |

8. |

$ |

|

|

|

|

, |

|||||

|

|

|

|||||||||||

9a. |

UC Contribution rate . |

|

|

|

|

UC Contributions due (line 8 times line 9a) |

9b. |

$ |

|

|

|

, |

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

$ |

|

|

|

|

, |

||||

9c. |

CSSF rate .0006 |

|

|

|

CSSF Assessment (line 8 times line 9c) |

9d. |

|

|

|

|

|||

|

|

|

|||||||||||

|

Note: The CSSF Assessment does not apply to direct reimbursable employers. See instructions. |

|

|

|

|||||||||

10. |

Total Contributions and CSSF assessment due (line 9b plus line 9d) |

10. |

$ |

|

|

|

|

, |

|||||

|

|

||||||||||||

Part Three - Calculate the Total Amount Due

2nd Month

,

,

,

,

,

,

3rd Month

.

.

.

.

.

.

11. Amount due with this return (line 3 plus line 10) |

11. |

$ |

|

, |

|

|

|

See Page 8 for Electronic Filing and Payment Requirements and Options

,

.

Under penalties of perjury, I certify that the information contained on this return, report and attachment(s) is true and correct.

Signature:__________________________________________________________________________________ Date:_______________________________

Print Name: ___________________________________________ Telephone:_____________________ Contact person email:_______________________________

For Paid Preparers Only

Paid Preparer’s Signature:________________________________________________ Date:__________________ Telephone:__________________________________

Firm’s Name (or yours, if

Address:_______________________________________________________________

Make check payable to: Treasurer, State of Maine

Mail return and check to: Maine Revenue Services P.O. Box 9103 Augusta, ME

Paid Preparer EIN: |

|

|

|

|

- |

|

|

Maine Payroll Processor License Number:

Offi ce use only

PWD

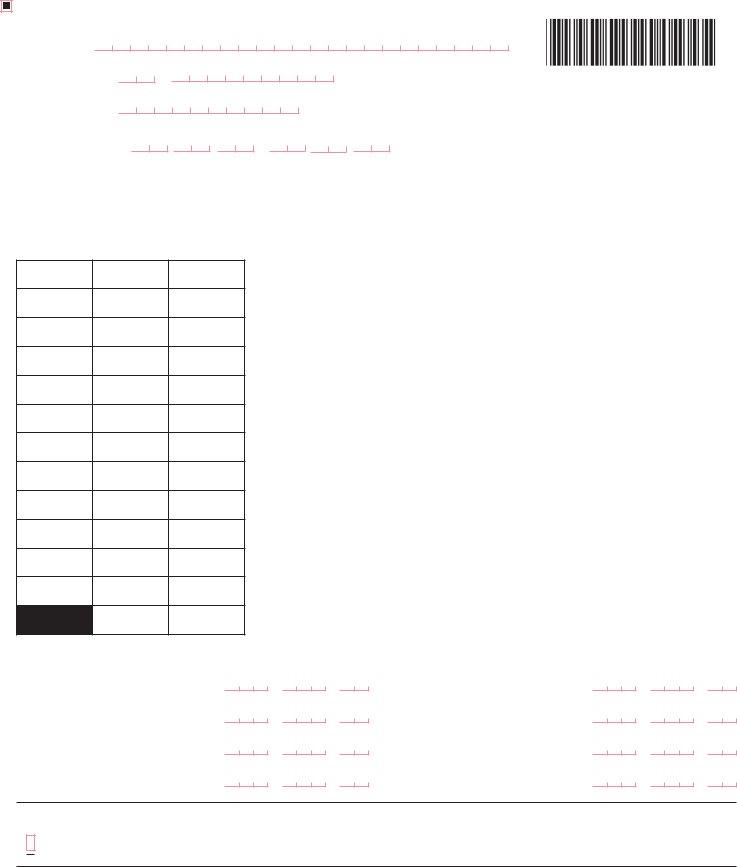

SCHEDULE 1/C1 (FORM 941/C1- ME) 2010

Name:

Withholding Account No.:

UC Employer Account No:

Period Covered:

-

- - -

-

-

99

*1008521*

Reconciliation of 900ME Voucher Payments or Electronic Payments of Income Tax Withholding

For employers or

Date Wages |

Withholding |

Payment |

Date Wages |

Withholding |

Payment |

Date Wages |

Withholding |

Payment |

|

or |

or |

or |

|||||||

Amount |

Amount |

Amount |

Amount |

Amount |

Amount |

||||

Paid |

Paid |

Paid |

|||||||

|

|

|

|

|

|

Subtotal A

12. Withholding Amount this Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subtotal B |

|

|

|

Subtotal C |

|

|

|

|

|

|

|

|

|

13. Payment Amount this Quarter

Subtotal A |

$ |

|

|

, |

|

|

|||

Subtotal B |

$ |

|

|

, |

|

|

|||

Subtotal C |

$ |

|

|

, |

|

|

|||

Total (Enter on Form |

|

|

|

, |

line 1) |

$ |

|

|

|

|

|

|

,

,

,

,

.

.

.

.

Subtotal A |

$ |

|

|

, |

Subtotal B |

$ |

|

|

, |

Subtotal C |

$ |

|

|

, |

Total (Enter on Form |

|

|

|

|

line 2) |

$ |

|

|

, |

,

,

,

,

.

.

.

.

For the Third Quarter Only: all employers or

I fi le my return electronically or my return is prepared by a tax preparer and I do not need Maine tax forms mailed to me next year.

For Field Advisor Use: ___________________________________________________

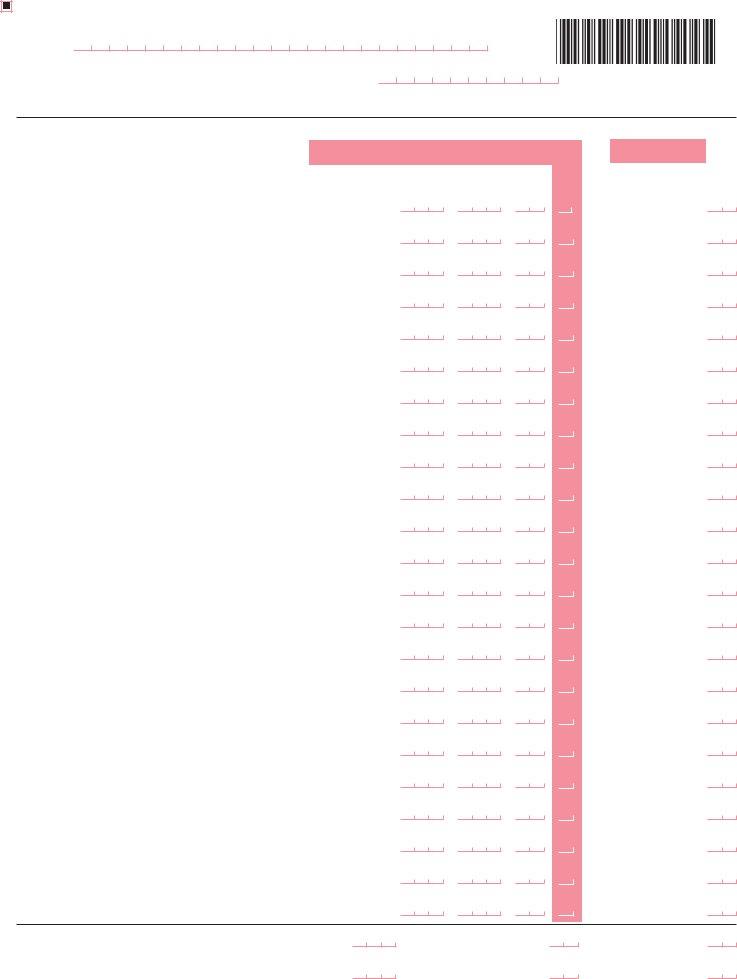

SCHEDULE 2/C1 (FORM 941/C1- ME) 2010

Name:

Withholding |

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UC Employer |

|||||||

Account No.: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Account No: |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Period Covered: |

|

|

- |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

- |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

99

*1008522*

Quarterly Income Tax Withholding and Unemployment Compensation Wages Listing

All employers designated SEASONAL by Department of Labor, see instructions for column 16 on page 7.

INCOME TAX

WITHHOLDING

Maine Income Tax

14. Payee Name (Last, First, MI) |

15. Social Security Number |

|

|

|

|

|

|

|||||||||||||||

a. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

b. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

c. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

d. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

e. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

f. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

g. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

h. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

i. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

j. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

k. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

l. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

m. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

n. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

o. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

p. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

q. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

r. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

s. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

t. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

u. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

v. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

w. |

______________________________ |

|

|

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

|

18.Total of columns 16 and 17 on this page......................... 18a. $ ,

19.Total of columns 16 and 17 for ALL pages....................... 19a. $ ,

16. UC Gross Wages Paid

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

$ , .

, . 18b. $

, . 19b. $

17. Withheld in the Quarter

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

. |

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

. |

||||||

, |

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

|

|

|

. |

||||||