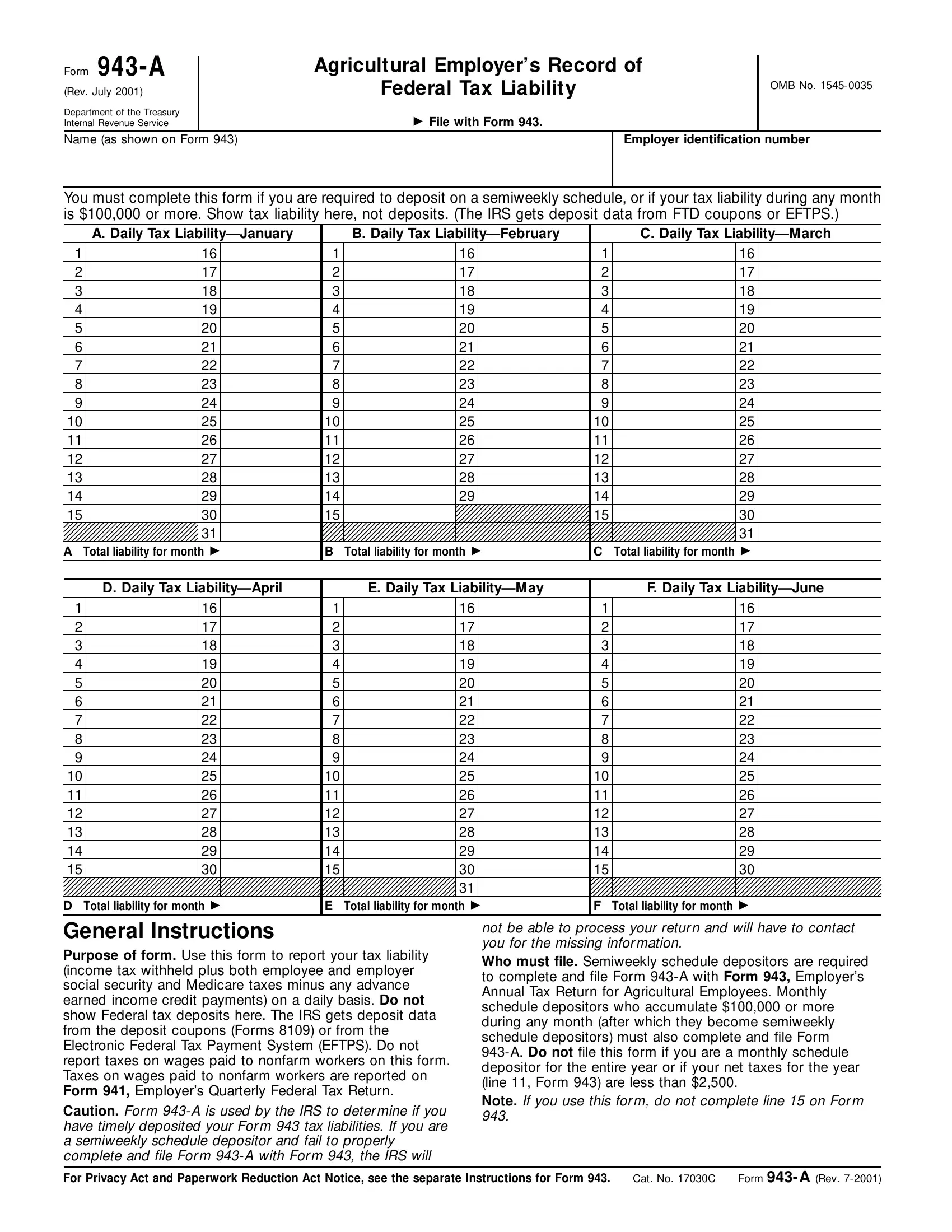

Working with PDF forms online is very simple with our PDF tool. You can fill out 943a form here painlessly. We are aimed at giving you the perfect experience with our tool by consistently adding new capabilities and improvements. Our tool has become much more helpful thanks to the newest updates! So now, editing PDF forms is simpler and faster than ever before. All it takes is several simple steps:

Step 1: Press the "Get Form" button at the top of this page to get into our tool.

Step 2: Using this advanced PDF file editor, you can do more than just complete blanks. Try all the functions and make your docs seem high-quality with custom text incorporated, or adjust the original input to excellence - all accompanied by the capability to insert any type of photos and sign the file off.

This document will involve specific details; in order to guarantee accuracy and reliability, please be sure to take heed of the guidelines directly below:

1. While completing the 943a form, make certain to incorporate all needed blanks in its relevant part. It will help to hasten the process, enabling your details to be handled efficiently and appropriately.

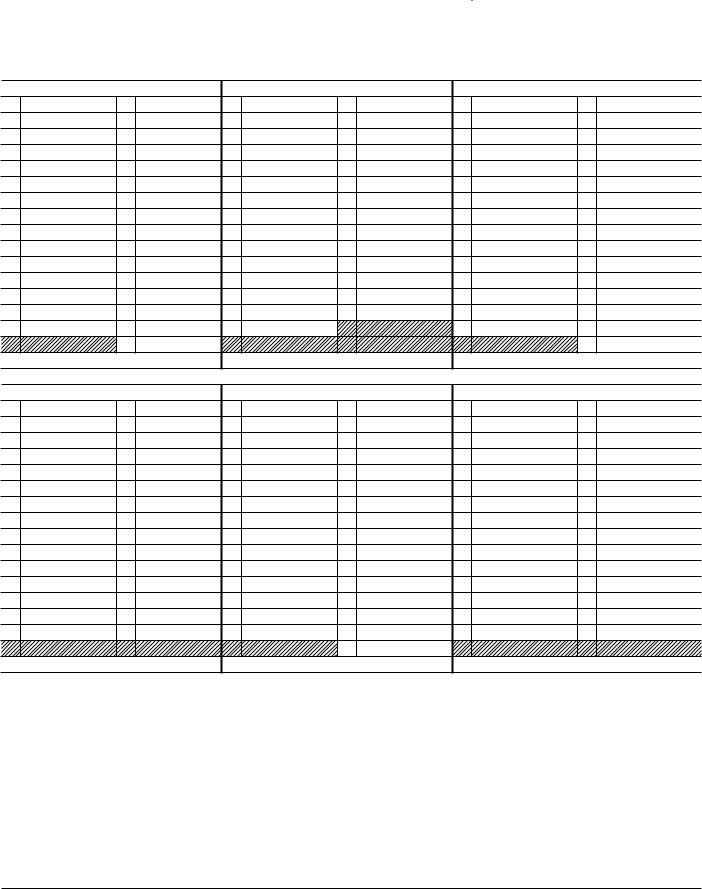

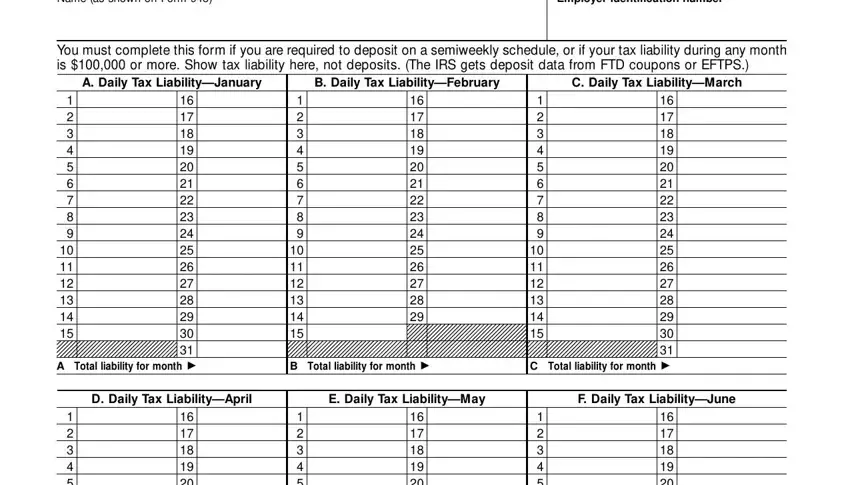

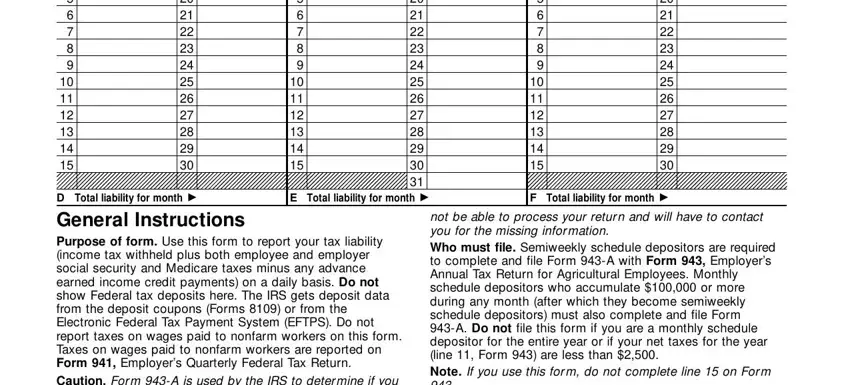

2. Once your current task is complete, take the next step – fill out all of these fields - E Total liability, D Total liability for month, F Total liability for month, and not be able to process your retur with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

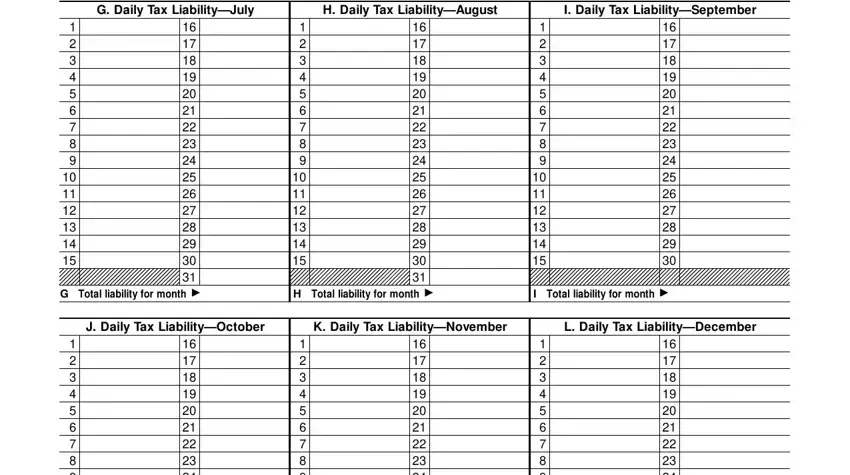

3. This 3rd segment is considered pretty uncomplicated, G Daily Tax LiabilityJuly, H Daily Tax LiabilityAugust, I Daily Tax LiabilitySeptember, G Total liability, H Total liability for month, I Total liability for month, J Daily Tax LiabilityOctober, K Daily Tax LiabilityNovember, L Daily Tax LiabilityDecember, J Total liability, and L Total liability - all these empty fields will have to be filled in here.

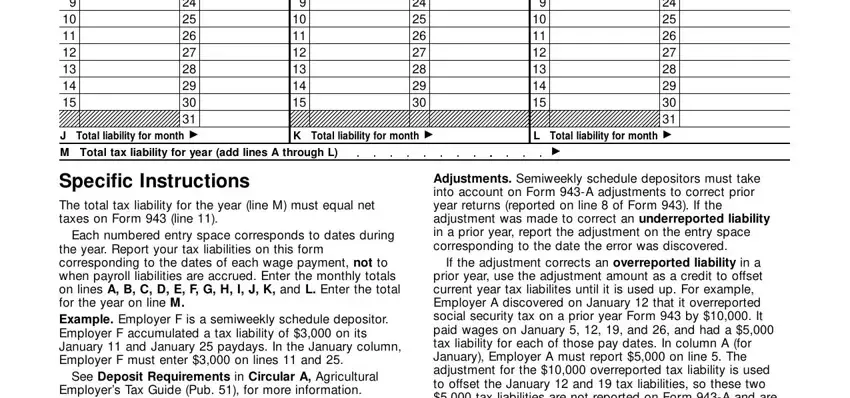

4. Filling out J Total liability, K Total liability for month, M Total tax liability for year add, Specific Instructions The total, Each numbered entry space, the year Report your tax, See Deposit Requirements in, Employers Tax Guide Pub for more, L Total liability, Adjustments Semiweekly schedule, and If the adjustment corrects an is crucial in the next step - be sure to devote some time and take a close look at every blank area!

Lots of people often get some things wrong when completing K Total liability for month in this part. Be sure you reread everything you type in right here.

Step 3: Once you've looked over the information in the document, just click "Done" to finalize your FormsPal process. Join us today and easily access 943a form, available for download. Each and every edit you make is handily kept , helping you to modify the file at a later stage anytime. We don't sell or share the details that you use while dealing with documents at FormsPal.