944ss forms can be completed online easily. Just make use of FormsPal PDF editing tool to accomplish the job quickly. Our team is focused on providing you with the absolute best experience with our tool by consistently introducing new capabilities and enhancements. Our editor is now even more user-friendly as the result of the most recent updates! At this point, filling out PDF documents is a lot easier and faster than before. It merely requires a couple of simple steps:

Step 1: Click on the "Get Form" button above. It'll open up our tool so that you can start filling out your form.

Step 2: Once you start the online editor, you will notice the form prepared to be completed. Other than filling in various fields, you may as well perform some other actions with the file, including putting on your own words, editing the initial textual content, inserting illustrations or photos, putting your signature on the form, and a lot more.

Pay attention while filling in this pdf. Ensure that each and every blank field is filled out accurately.

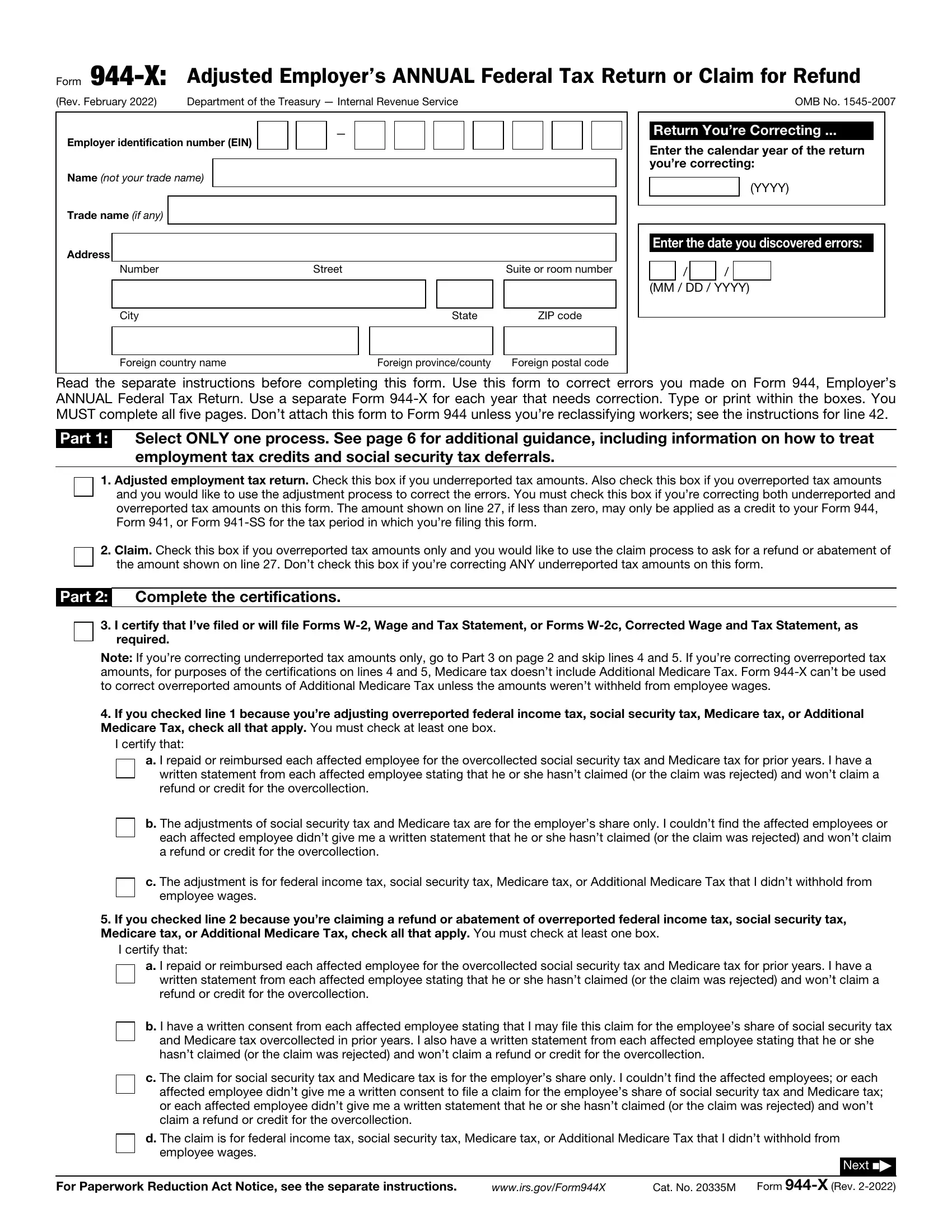

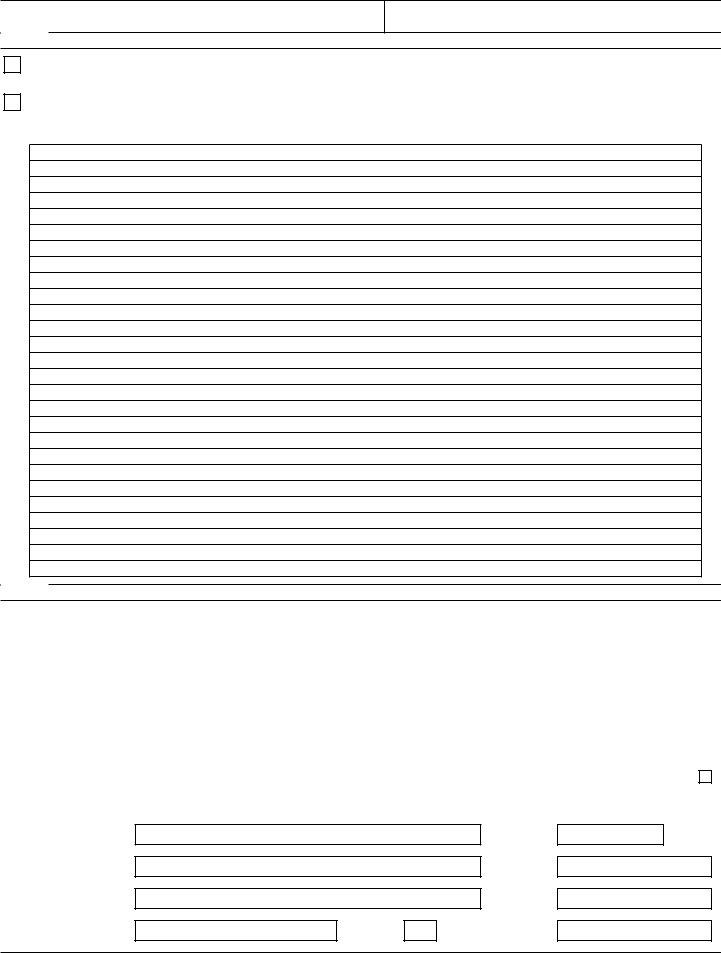

1. While filling out the 944ss forms, be certain to incorporate all of the essential blanks within the associated section. This will help speed up the work, enabling your details to be processed fast and appropriately.

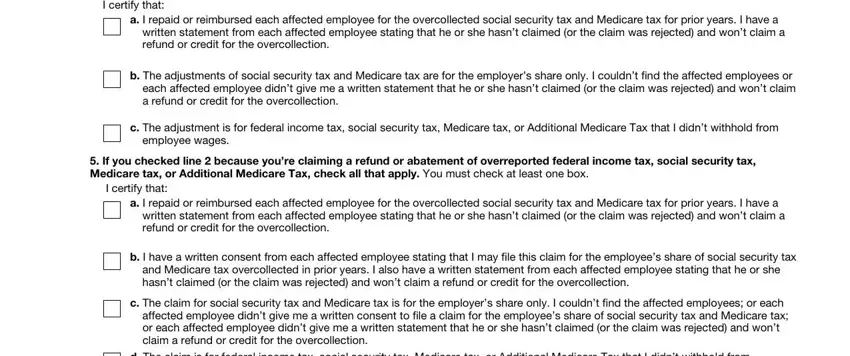

2. Your next stage is to fill out these particular fields: I certify that, a I repaid or reimbursed each, written statement from each, b The adjustments of social, c The adjustment is for federal, employee wages, If you checked line because, I certify that, a I repaid or reimbursed each, written statement from each, b I have a written consent from, and Medicare tax overcollected in, c The claim for social security, and d The claim is for federal income.

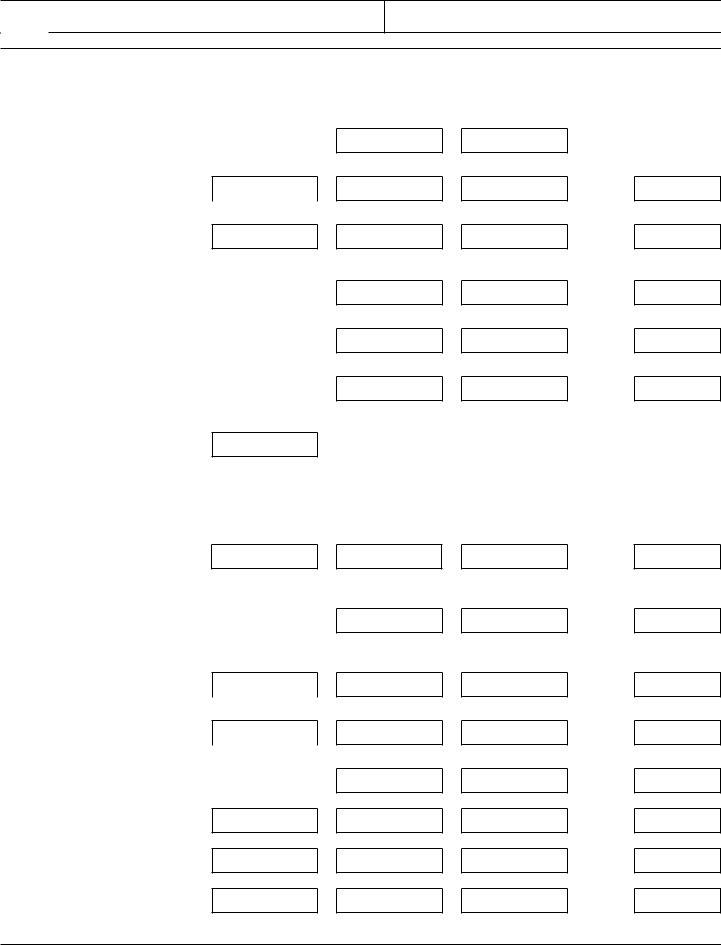

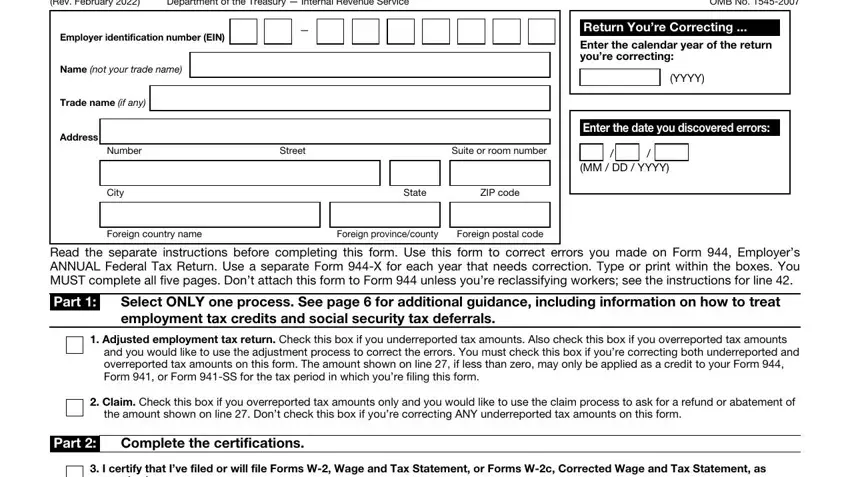

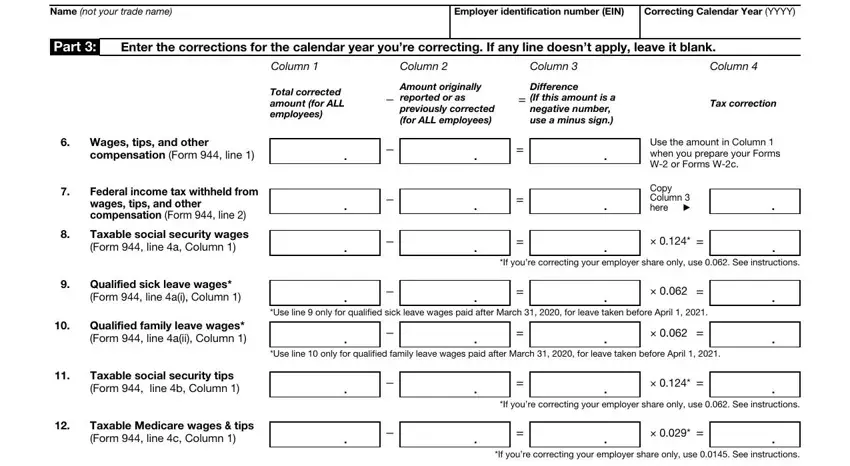

3. In this specific step, review Name not your trade name, Employer identification number EIN, Correcting Calendar Year YYYY, Part, Enter the corrections for the, Column, Column, Column, Column, Amount originally reported or as, Difference If this amount is a, Tax correction, Use the amount in Column when you, Copy Column here, and Total corrected amount for ALL. These need to be filled in with greatest focus on detail.

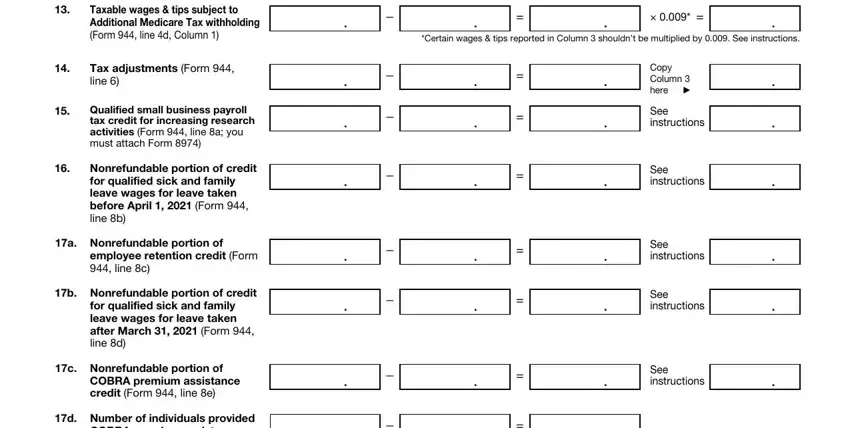

4. The subsequent section needs your attention in the subsequent areas: Taxable wages tips subject to, Tax adjustments Form line, Qualified small business payroll, Nonrefundable portion of credit, a Nonrefundable portion of, employee retention credit Form, b Nonrefundable portion of credit, for qualified sick and family, c Nonrefundable portion of, COBRA premium assistance credit, d Number of individuals provided, COBRA premium assistance Form, Certain wages tips reported in, Copy Column here, and See instructions. Just be sure you enter all requested info to move further.

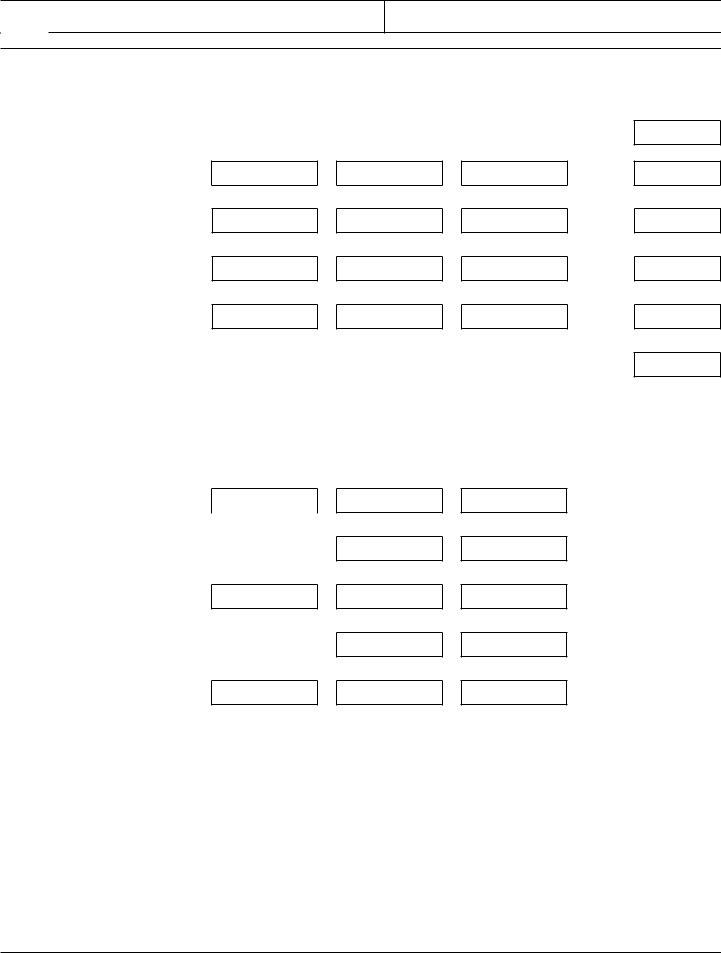

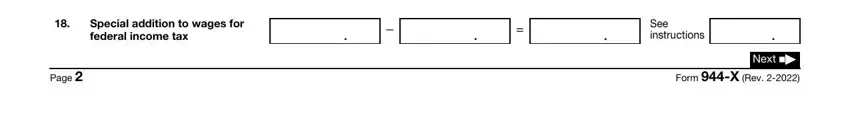

5. The document has to be concluded by dealing with this area. Here you have a full list of blank fields that require appropriate details for your document usage to be accomplished: Special addition to wages for, Page, See instructions, and Next Form X Rev.

It is easy to make a mistake when filling in the Next Form X Rev, therefore make sure that you go through it again before you finalize the form.

Step 3: You should make sure your information is accurate and press "Done" to continue further. Sign up with FormsPal today and easily gain access to 944ss forms, ready for downloading. Every single edit made is handily kept , helping you to edit the file further anytime. With FormsPal, you're able to complete forms without needing to be concerned about information leaks or records being distributed. Our protected platform ensures that your private data is maintained safe.