underreported can be filled in online without any problem. Just try FormsPal PDF tool to accomplish the job in a timely fashion. To keep our tool on the cutting edge of convenience, we strive to adopt user-oriented features and enhancements regularly. We are at all times looking for suggestions - play a vital part in revolutionizing PDF editing. All it takes is a few easy steps:

Step 1: Access the PDF inside our editor by clicking on the "Get Form Button" at the top of this webpage.

Step 2: This tool helps you customize your PDF in a variety of ways. Transform it with any text, adjust what's already in the PDF, and include a signature - all within a few clicks!

Filling out this PDF needs thoroughness. Make certain all required fields are filled out correctly.

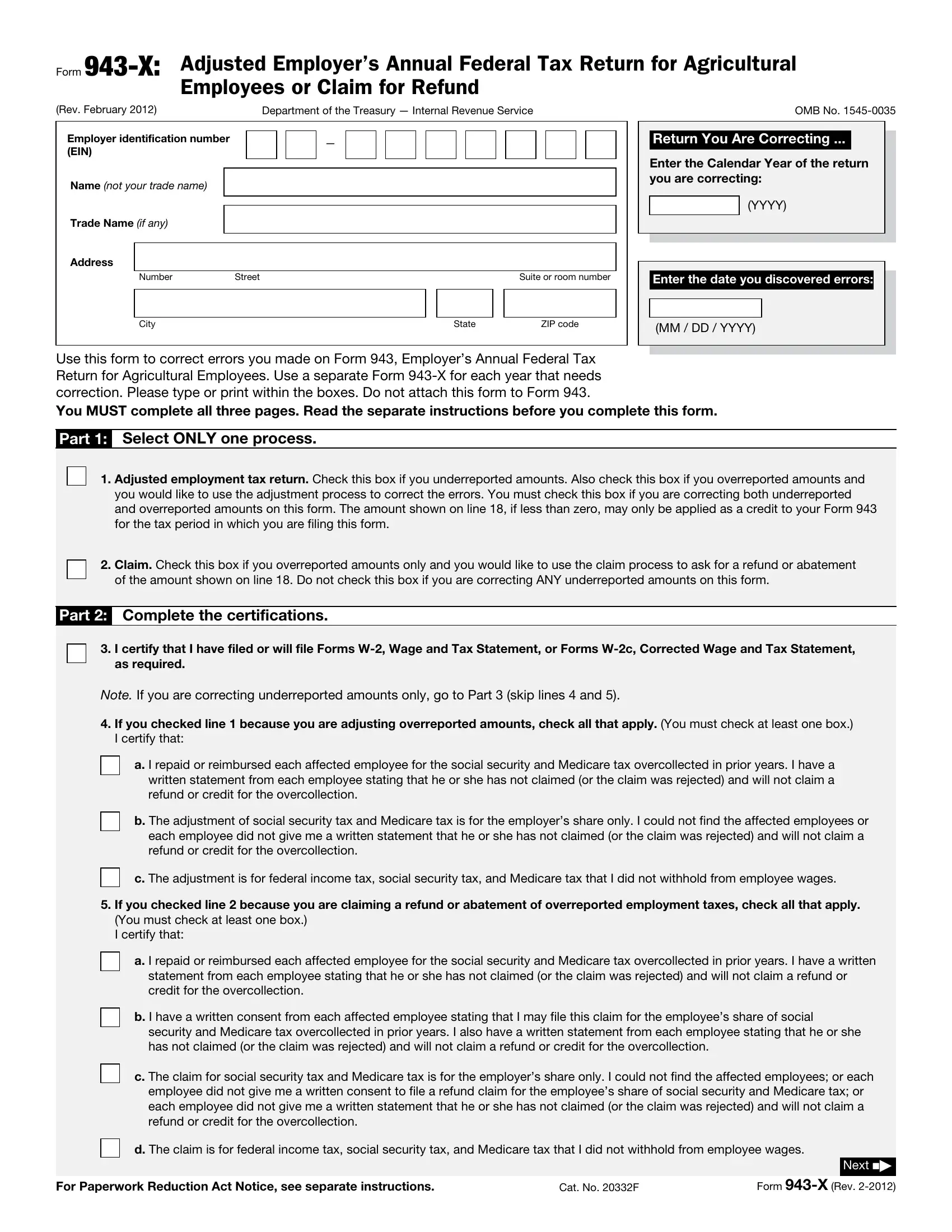

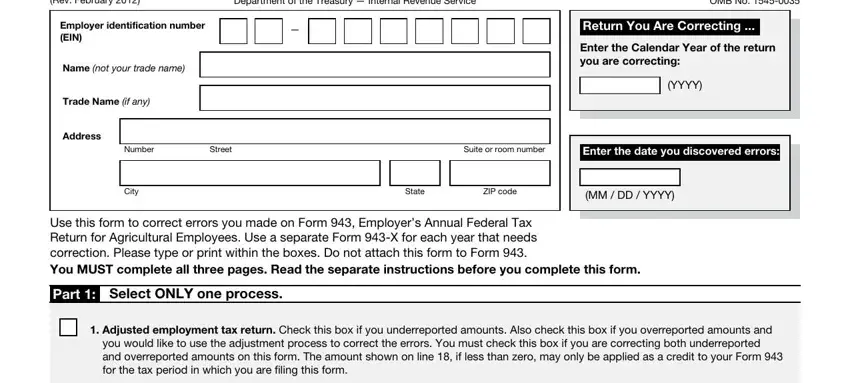

1. It's important to complete the underreported accurately, hence be attentive when working with the segments containing these particular blanks:

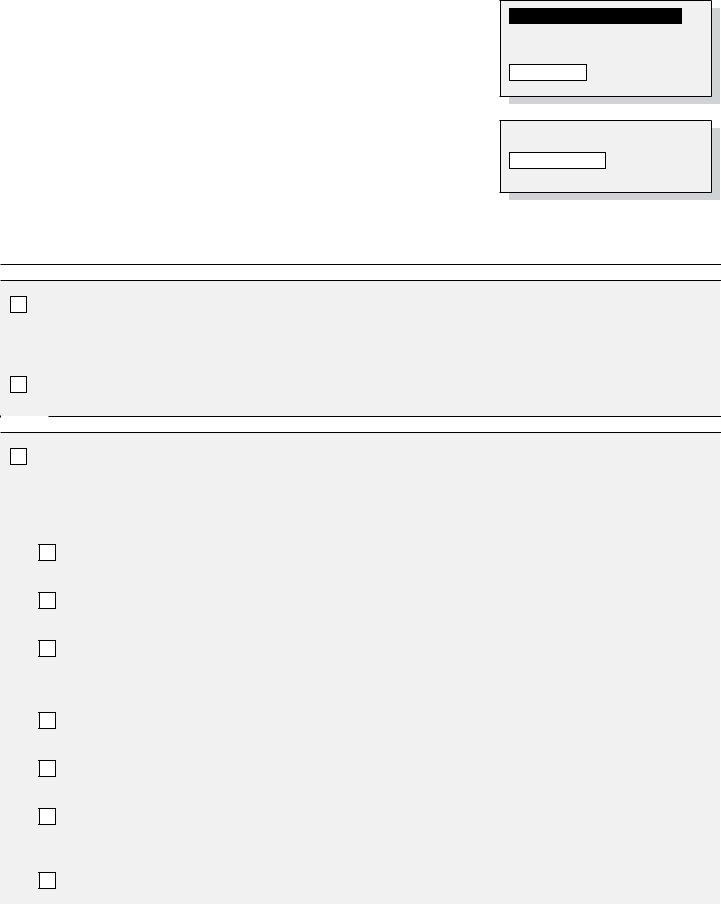

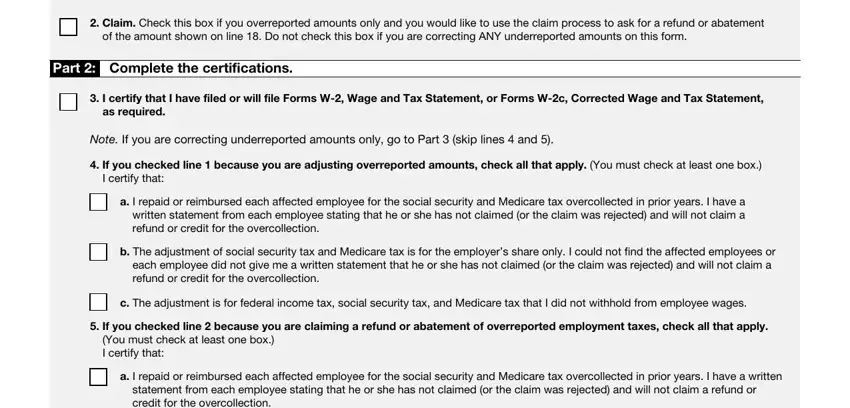

2. The third step is usually to fill in these particular blank fields: Claim Check this box if you, of the amount shown on line Do, Part, Complete the certifications, I certify that I have filed or, as required, Note If you are correcting, If you checked line because you, I certify that, a I repaid or reimbursed each, b The adjustment of social, c The adjustment is for federal, If you checked line because you, You must check at least one box I, and a I repaid or reimbursed each.

People often make errors while filling in I certify that I have filed or in this section. Remember to read twice what you enter here.

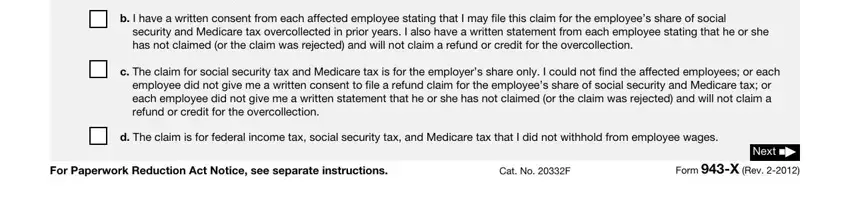

3. This third section should also be pretty simple, statement from each employee, b I have a written consent from, security and Medicare tax, c The claim for social security, employee did not give me a written, d The claim is for federal income, For Paperwork Reduction Act Notice, Cat No F, and Next Form X Rev - these empty fields is required to be completed here.

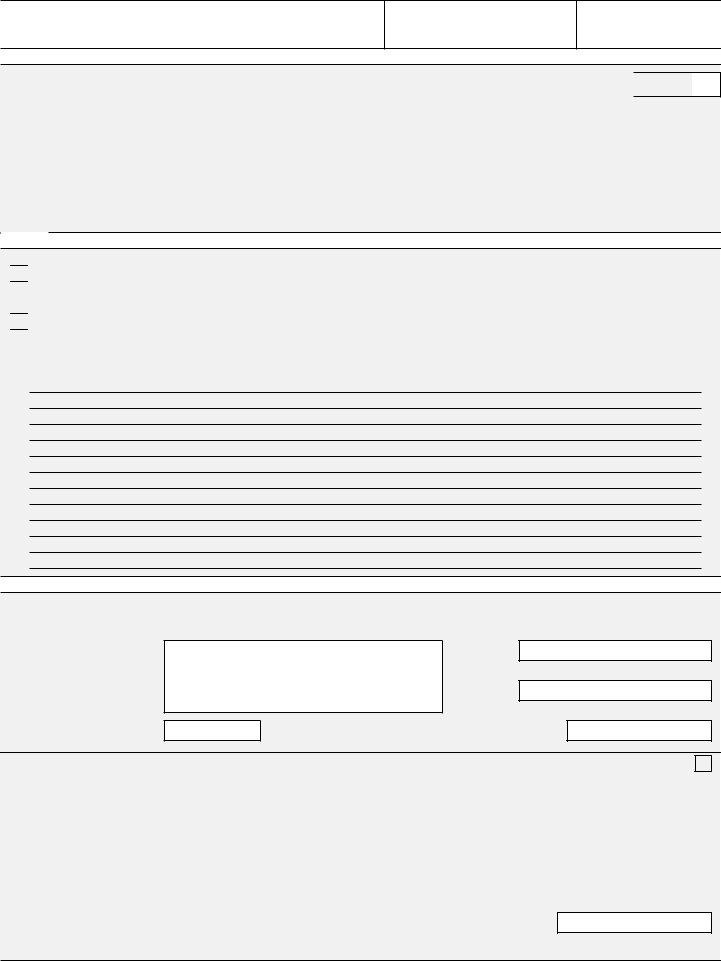

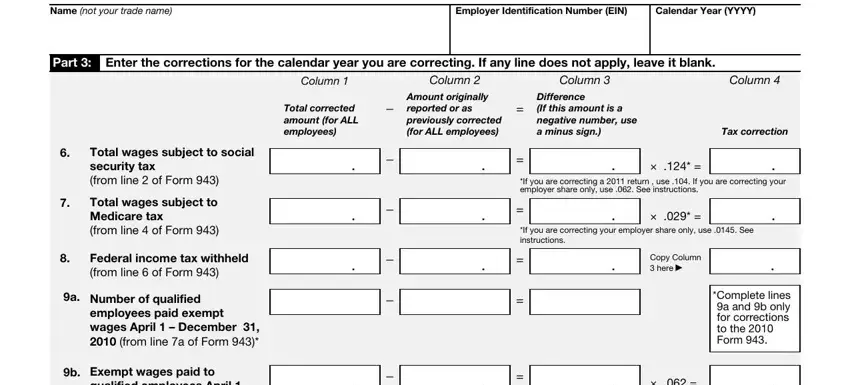

4. The form's fourth section comes with all of the following blank fields to consider: Name not your trade name, Employer Identification Number EIN, Calendar Year YYYY, Part, Enter the corrections for the, Column, Column, Column, Column, Total corrected amount for ALL, Amount originally reported or as, Difference If this amount is a, Tax correction, If you are correcting a return, and If you are correcting your.

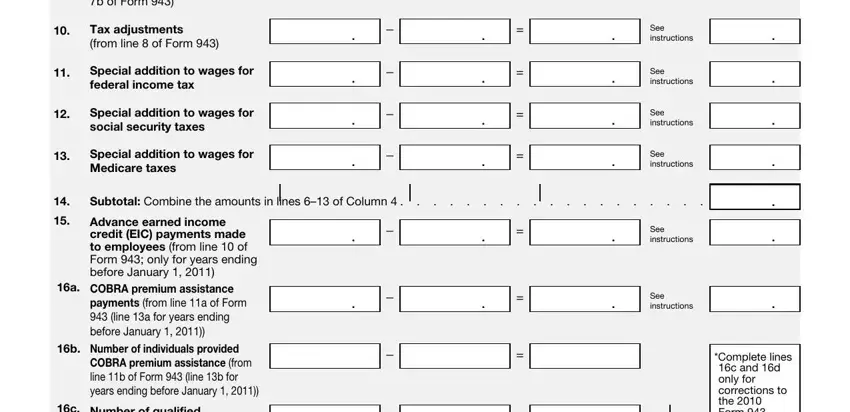

5. This pdf needs to be finalized by filling in this part. Here you can find a full listing of form fields that must be completed with specific details in order for your document submission to be complete: See instructions, See instructions, See instructions, See instructions, qualified employees April, Tax adjustments from line of Form, Special addition to wages for, Special addition to wages for, Special addition to wages for, Advance earned income credit EIC, a COBRA premium assistance, payments from line a of Form line, b Number of individuals provided, COBRA premium assistance from line, and c Number of qualified.

Step 3: Soon after looking through the fields, press "Done" and you are done and dusted! Go for a free trial subscription at FormsPal and obtain immediate access to underreported - downloadable, emailable, and editable from your FormsPal account page. FormsPal guarantees protected document tools with no data recording or any kind of sharing. Be assured that your information is in good hands here!