Working with PDF documents online can be very simple using our PDF tool. You can fill in form 982 irs here within minutes. Our editor is continually evolving to give the best user experience achievable, and that's due to our commitment to continual enhancement and listening closely to comments from users. To get started on your journey, take these simple steps:

Step 1: Access the form inside our editor by pressing the "Get Form Button" above on this webpage.

Step 2: With our handy PDF editor, you'll be able to accomplish more than just fill out forms. Express yourself and make your documents seem professional with custom text incorporated, or optimize the file's original content to excellence - all that backed up by an ability to insert almost any photos and sign the PDF off.

Filling out this document calls for attention to detail. Make certain all necessary areas are filled in accurately.

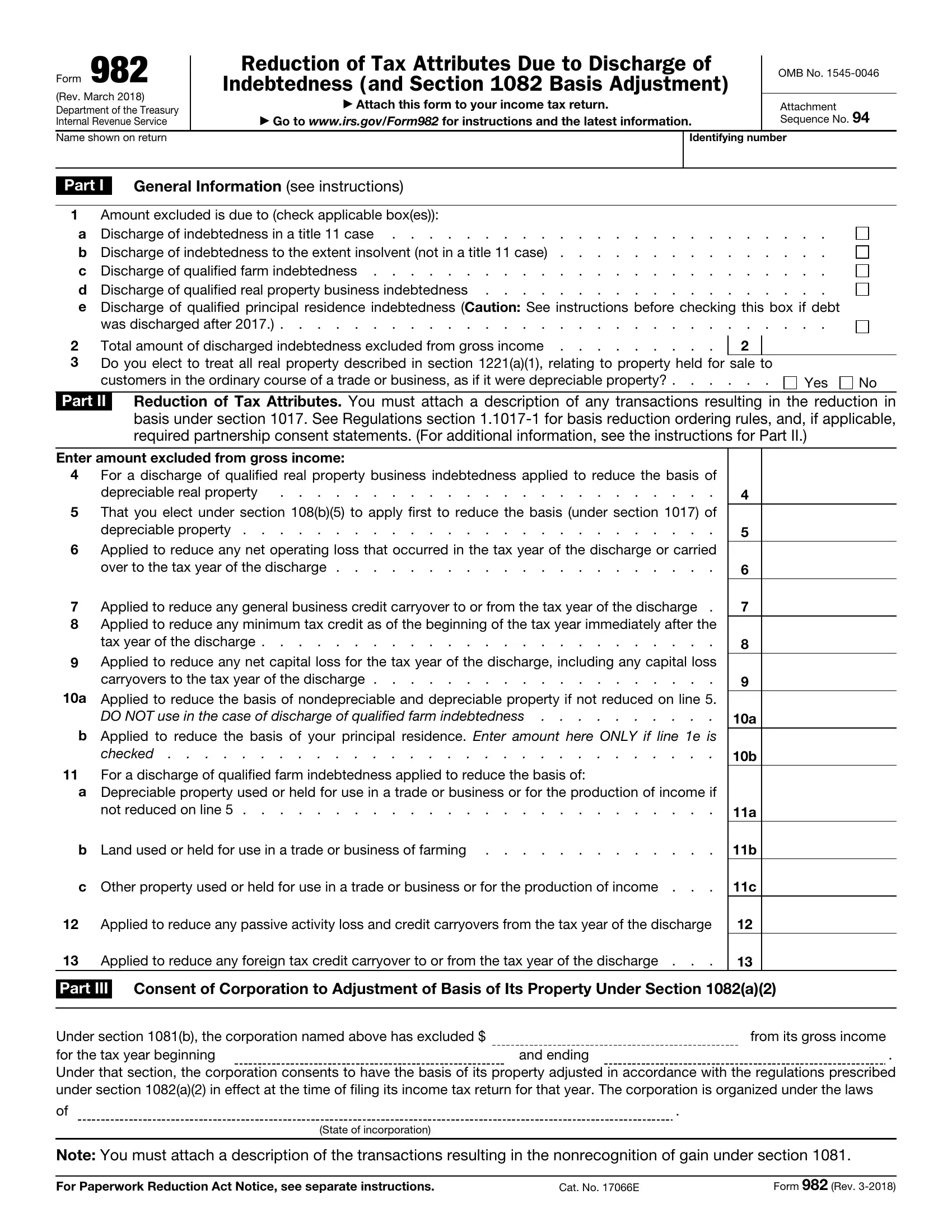

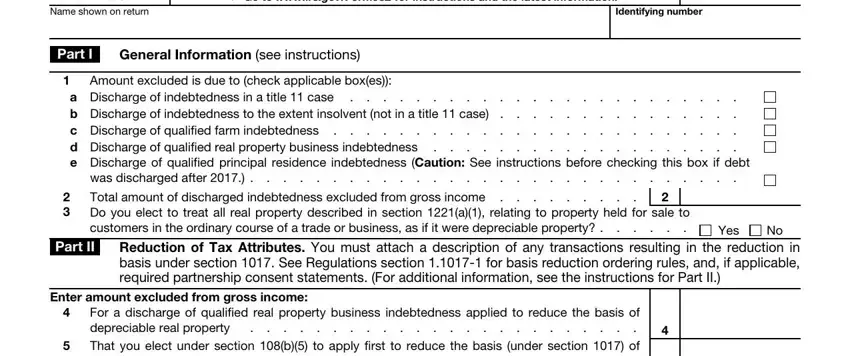

1. Fill out your form 982 irs with a number of major blank fields. Get all of the information you need and ensure there is nothing forgotten!

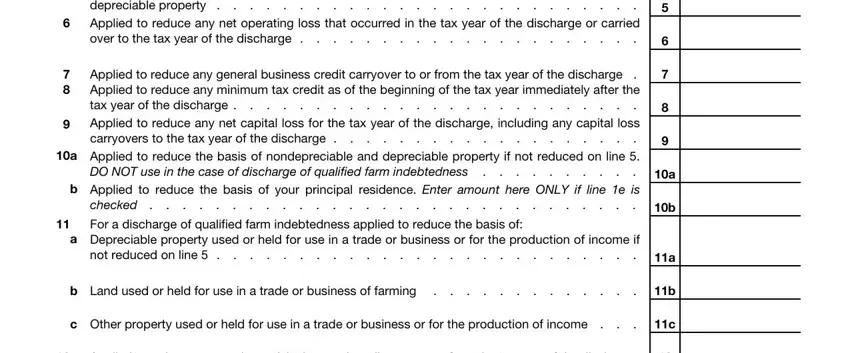

2. Once your current task is complete, take the next step – fill out all of these fields - For a discharge of qualified real, Applied to reduce any general, a Applied to reduce the basis of, DO NOT use in the case of, b Applied to reduce the basis of, checked, For a discharge of qualified farm, a Depreciable property used or, not reduced on line, b Land used or held for use in a, c Other property used or held for, and Applied to reduce any passive with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

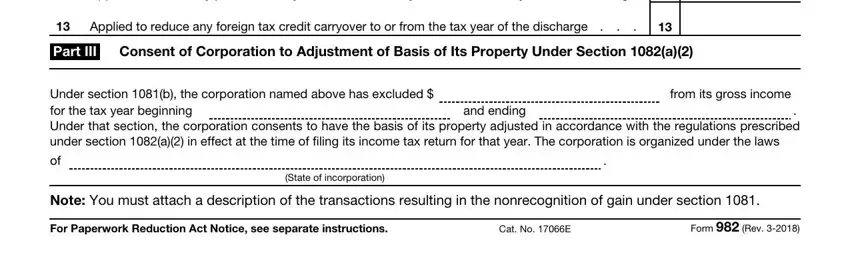

3. This subsequent segment should also be pretty uncomplicated, Applied to reduce any passive, Applied to reduce any foreign tax, Part III, Consent of Corporation to, Under section b the corporation, from its gross income, and ending, State of incorporation, Note You must attach a description, For Paperwork Reduction Act Notice, Cat No E, and Form Rev - all these blanks is required to be completed here.

Always be really careful when completing Note You must attach a description and and ending, because this is the part in which most users make mistakes.

Step 3: Prior to finalizing your file, double-check that form fields were filled in the proper way. Once you believe it's all fine, click on “Done." Create a free trial plan with us and get direct access to form 982 irs - available from your FormsPal account. FormsPal is committed to the personal privacy of all our users; we always make sure that all personal data coming through our tool remains protected.