For organizations navigating the administrative requirements of the Associations Incorporation Act 2009, the A12 Form serves as a crucial annual touchpoint. This comprehensive document, required for the annual financial affairs summary, ensures that associations maintain transparency and compliance in their operations. The form captures a wide variety of information ranging from basic association details and principal activities to intricate financial summaries including income, expenditure, assets, and liabilities. In addition, it covers changes in the official address or the appointment of public officers, details on mortgages, charges, and other securities affecting the property of the association, and information on grant funding and fundraising activities. The A12 Form must be meticulously filled out and submitted within specific deadlines—either one month post the annual general meeting (AGM) or seven months after the financial year-end. Furthermore, Tier 1 associations, distinguished by their gross receipts or current assets, face additional auditing and documentation requirements. The submission of this form, complete with the prescribed fee, is not just a regulatory obligation but an opportunity for associations to affirm their commitment to financial stewardship and operational transparency.

| Question | Answer |

|---|---|

| Form Name | Form A12 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | fair trading form a12, form a12, fairtrading, a12 fair trading |

ABN 81 913 830 179

Annual summary of financial affairs

Associations Incorporation Act 2009 (sections 45 & 49)

Form

A12

Office use only

AFFIX DOCUMENT BARCODE LABEL HERE

Received at:

Date:

Receipt no.:

Please read the information provided before completing this form. |

Fee must accompany form |

This form should be completed in BLACK or BLUE ink and in BLOCK LETTERS. |

SEE INFORMATION SHEET |

|

|

Association details |

|

|

|

Incorporation number

INC / Y

Name

The principal activity of the association is

X

(cross 1 box only)

Incorporated

|

1. |

Aged care/respite care/home care |

|

5. |

Education/employment/training/research |

|

9. |

Religious |

|

|

|

|

|

|

|

|

|

|

2. |

Arts/culture/literary/heritage |

|

6. |

Environment/horticulture/animal protection |

|

10. |

Social services/community association |

|

|

|

|

|

|

|

|

|

|

3. |

Business & professional association |

|

7. |

Legal/civic/advocacy services |

|

11. |

Sporting |

|

|

|

|

|

|

|

|

|

|

4. |

Child care services |

|

8. |

Personal interest/hobby group/social group |

|

12. |

Other |

|

|

|

|

|

|

|

|

|

ABN (if any)

Details of current public officer

Name

Has the public officer changed?

Has the official address changed?

Yes

Yes

No

No

If you answered 'Yes" to either or both questions, you are required to lodge a Form A9, 'Notice of appointment of public officer & Notice of change of association address'.

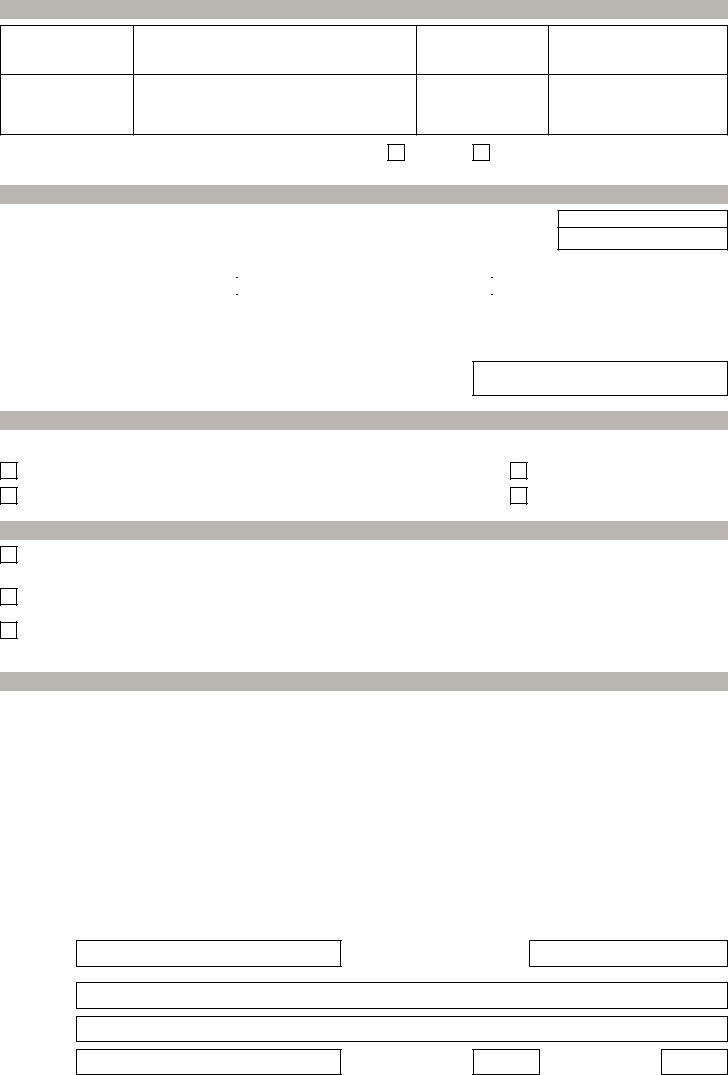

Financial summary

The association's financial year ended on:

//

DD MM YYYY

The annual general meeting was held on:

/ /

Details of income, expenditure, assets & liabilities of the |

Association |

Trust |

|

association & of any trust to which the association is a trustee |

|

|

|

|

|

|

|

Gross receipts*/total income |

$ |

|

$ |

|

|

|

|

Expenditure |

$ |

|

$ |

Current assets* |

$ |

|

$ |

|

|

|

|

Total assets (includes current assets) |

$ |

|

$ |

Liabilities |

$ |

|

$ |

|

|

|

|

*See attached notes for the definition of gross receipts/total income and current assets. |

Amounts must be entered above. |

||

Were the accounts audited?

Number of members at end of financial year

Yes

No

Number of employees at end of financial year

Contact details of the person lodging this document |

PLEASE TURN OVER |

|

|

Surname

Title

(Mr/Mrs/Ms)

Address

Town/suburb

Given name (s)

Daytime telephone

|

State |

|

|

|

|

|

|

|

|

|

Postcode |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM BM3AC |

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Particulars of mortages, charges and other securities affecting the property of the incorporated association

State if mortgage,

charge or

other security

Property affected

Amount of

indebtedness at financial year end

Name and address of holder of security, etc

Are details of other mortages, charges or securities attached? |

Yes |

No |

Grant funding and fundraising (this section is optional)

Please indicate the total grant funding received by the association from all Commonwealth, State or local government agencies during the financial year

Please indicate which agency/ies provided the funding by placing a ' X ' in the box/es below

TOTAL GRANT FUNDING

$

|

1. |

Arts NSW |

|

5. |

Department of Education & Training |

|

9. |

Local Council |

|

|

|

|

|

|

|

|

|

|

2. |

Dept of Ageing, Disability & Home Care |

|

6. |

Department of Planning - Heritage Office |

|

10. |

Other |

|

|

|

|

|

|

|

|

|

|

3. |

Department of Community Services |

|

7. |

NSW Sport & Recreation |

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

Department of Education, Employment & |

|

8. |

Department of Families, Housing, |

|

|

|

|

|

|

|

|

||||

|

|

Workplace Relations |

|

|

Community Services & Indigenous Affairs |

|

|

|

|

|

|

|

|

|

|

If the association is registered as a charity under the

Charitable Fundraising Act 1991 please provide charitable registration number

The following information is optional and is used for statistical purposes only

Is the association specifically established for the benefit of (tick one or more)

Aboriginal and Torres Strait Islanders

People from cultural and linguistically diverse backgrounds

Tier 1 associations only (tick boxes and ensure the documents are attached)

People with a disability

Women

The association's financial statements for the relevant financial year (including a separate income and expenditure statement and balance sheet for each trust for which for which the association is trustee).

The auditor's report for those financial statements.

If a resolution was passed at the annual general meeting in connection with the above documents, tick box and attach a copy of the resolution.

Declaration as to the financial affairs of the association and privacy acknowledgement

I declare that

I am authorised by the committee to make the following statements,

Othe association's financial statements for the last financial year were presented to the members of the association at the annual general meeting,

Othe particulars set out in this document are correct and give a true and fair view of the financial matters to which they relate and are not misleading, and

Othere are reasonable grounds to believe, at the date of this statement that the association will be able to pay its debts as and when they fall due, and

I acknowledge that

NSW Fair Trading is collecting and holding information (including personal information) supplied in this form for the purposes of the Associations Incorporation Act 2009 and in particular, inclusion in a register maintained under that Act which is open to public inspection,

NSW Fair Trading may disclose personal information to persons or bodies and to receive information from them in respect of purpose(s) related to the association's incorporation and activities, and

I have a right to seek access to and correction of the personal information supplied/collected from me.

Signature

Full name

Date

//

DD MM YYYY

Address

Town/suburb

State

Postcode

Annual summary of financial affairs

Associations Incorporation Act 2009 (sections 45 & 49)

ABN 81 913 830 179

Form A12

Please read the information before completing this form.

The form should be completed in BLACK or BLUE ink and BLOCK LETTERS.

When should this form be used?

This form must be lodged by the association

•Within one month of the date of the annual general meeting (AGM) for the current financial year, or

•no later than 7 months after the end of the previous financial year,

whichever is earlier unless further time is allowed by the

NOTE: The association's financial statements must be presented to the AGM BEFORE this form can be lodged.

Association details

Name - please ensure the correct name and incorporation number of the association is included in this section.

Principal activity of the association - insert an X in the box that corresponds to the activity that best describes the main activity of the association.

ABN number - not all associations have ABN numbers. If your association currently has an ABN please insert the relevant number.

Current public officer

The association is required to notify the Registry of

Form A9, `Notice of appointment of public officer & Notice of change of association address', is required to be lodged with this form if the public officer or official address has changed.

Financial summary

The association is required to set out its gross receipts, expenditure, current assets, total assets and total liabilities at the end of its financial year in this section.

Gross receipts/total income - is the total revenue recorded in the association's income and expenditure statement.

Current assets - are assets, other than real property or assets capable of depreciation, held by the association at the end of the association's last financial year. Current assets include amounts held in financial institutions including bank accounts and term deposits, inventory and debtors.

Trusts - if the association is the trustee of any trust the amount of the income, expenditure, current and total assets and liabilities for the trust must be set out in the

appropriate boxes. If the association is the trustee of more than one trust the relevant details for any additional trust should be provided on a separate sheet.

Number of employees - include any full time, part time or casual employees of the association at the end of the financial year. Do not include unpaid volunteers.

Particulars of mortgages, charges & other securities

This part should be completed if there are any mortgages, charges or other securities affecting property owned by the association. If there is insufficient space details should be set out on a separate sheet.

Grant funding & fundraising (this section is optional)

This information may be provided to relevant Commonwealth, State and local government agencies in connection with any application for, or ongoing funding arrangements, with those bodies.

Please enter the amount of total grant funding received by the association. Place an X in the boxes that correspond to the agency or agencies that provided funding to the association during the financial year, eg. if the association received total grant funding of $70,000 from Arts NSW, NSW Sport & Recreation and Department of Community Services, this amount should be recorded as Total grant funding received and an X placed in the boxes corresponding to each of the three funding bodies.

Tier 1 associations

The Associations Incorporation Act 2009 established a two tier reporting regime for associations registered in NSW, which applies from 1 July 2010. The majority of associations are Tier 2 associations. Tier 2 associations are required to lodge this form with the Registry.

Tier 1 associations must have their financial statements audited and must lodge this form together with the documents listed under the heading Tier 1 associations only on page 2. An association is a Tier 1 association if

•the gross receipts/total income of the association for the association's financial year exceeds $250,000, or

•the current assets of the association for the association's financial year exceeds $500,000.

The fact sheet titled `Financial reporting requirements' on www.fairtrading.nsw.gov.au provides information on the reporting requirements for Tier 1 and Tier 2 associations - including details of exemptions that may be given in respect of the reporting requirements for Tier 1 associations.

Declaration

The declaration on the reverse of the form MUST be completed by a person authorised by the association.

Fees

The following fees apply for the lodgement of an Annual summary of financial affairs (Form A12):

•If lodged not more than one month after the

annual general meeting |

$49.00 |

•If lodged more than one month but less that two

months after the annual general meeting |

$72.00 |

•If lodged more than two months after the

annual general meeting |

$79.00 |

Lodging the form and paying the fee

•This form can be lodged with the Registry of

•For the address of your nearest Fair Trading Centre please telephone 13 32 20 or visit

www.fairtrading.nsw.gov.au

•Fair Trading Centres will accept payment by cheque, cash, money order or credit card. Fees for mailed applications should be paid by cheque or money order.

•Cheques and money orders should be payable to `NSW Fair Trading'.

(Please note receipts will only be issued upon request).

•The fee is not subject to GST.

•This form may be returned if

o it is not completed correctly,

o it does not have the necessary attachments, or o it is received without payment.

Contacting the Registry

Telephone |

(02) 6333 1400 or 1800 502 042 |

Registry of |

|

|

PO Box 22 |

|

Bathurst NSW 2795 |

Website |

www.fairtrading.nsw.gov.au |

Language assistance

Telephone - 13 14 50

Ask for an interpreter in your language.

TTY - 1300 723 404

Telephone service for the hearing impaired.