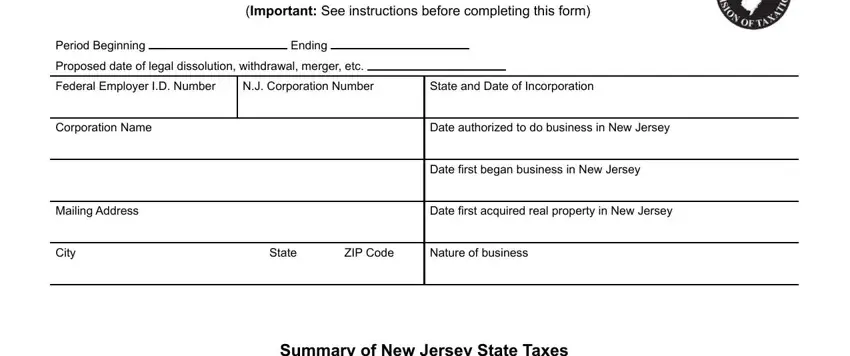

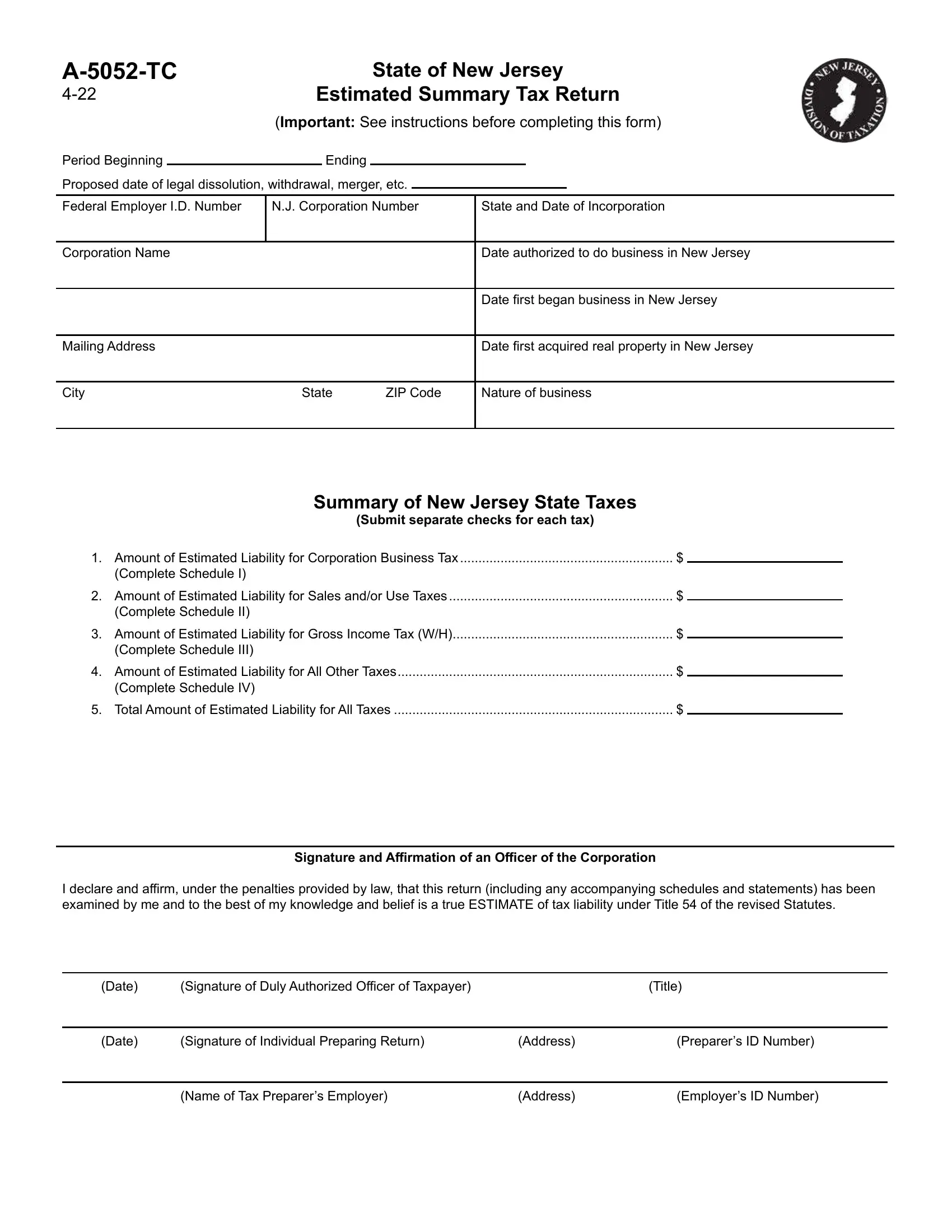

STATE OF NEW JERSEY

ESTIMATED SUMMARYTAX RETURN

(IMPORTANT: See General Instructions on page 3 before completing this form)

Period Beginning ________________________ Ending _________________________

Proposed date of legal dissolution, withdrawal, merger, etc. ____________________________________

Federal Employer I.D. Number |

N.J. Corporation Number |

|

|

Corporation Name

Mailing Address

State and Date of Incorporation_________________________________

Date authorized to do business in New Jersey_____________________

Date first began business in New Jersey _________________________

Date first acquired real property in New Jersey_____________________

Nature of business ___________________________________________

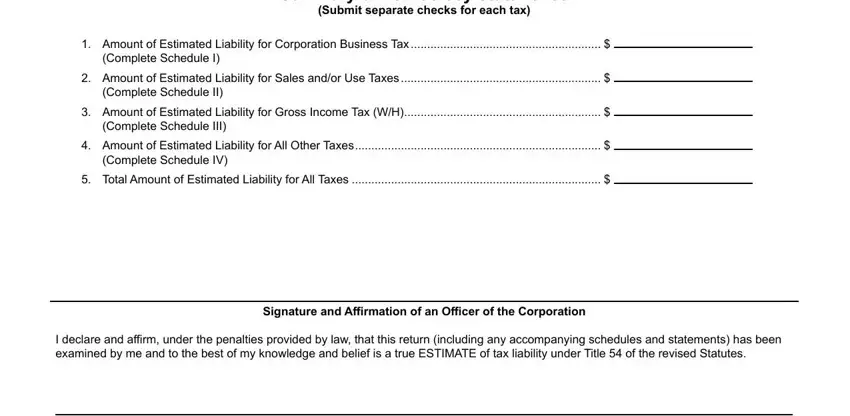

SUMMARYOF NEW JERSEYSTATE TAXES

(Submit separate checks for each tax)

1. |

Amount of Estimated Liability for Corporation Business Tax |

$_______________________ |

|

(Complete Schedule I) |

|

|

2. |

Amount of Estimated Liability for Sales and/or Use Taxes |

$_______________________ |

|

(Complete Schedule II) |

|

|

3. |

Amount of Estimated Liability for Gross Income Tax (W/H) |

$_______________________ |

|

(Complete Schedule III) |

|

|

4. |

Amount of Estimated Liability for All Other Taxes |

$_______________________ |

|

(Complete Schedule IV) |

|

|

5. |

Total Amount of Estimated Liability for All Taxes |

$ |

|

|

SIGNATURE AND AFFIRMATION OF AN OFFICER OF THE CORPORATION

I declare and affirm, under the penalties provided by law, that this return (including any accompanying schedules and statements) has been examined by me and to the best of my knowledge and belief is a true ESTIMATE of tax liability under Title 54 of the revised Statutes.

______________________x_____________________________________________________________________________________________________

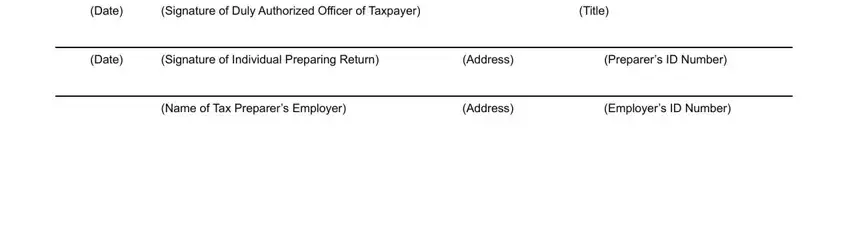

(Date) (Signature of Duly Authorized Officer of Taxpayer)(Title)

______________________x_____________________________________________________________________________________________________

(Date) (Signature of Individual Preparing Return) (Address) (Preparer’s ID Number)

____________________________________________________________________________________________________________________________

(Name of Tax Preparer’s Employer) |

(Address) |

(Employer’s ID Number) |

A-5052-TC (11-13, R-16)Page 2

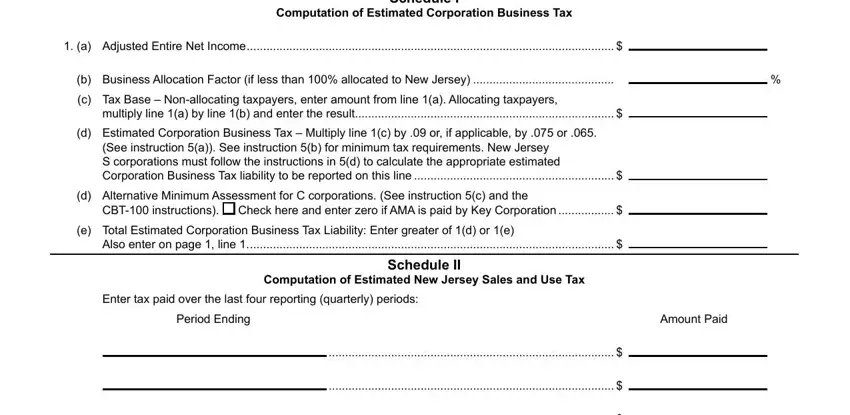

SCHEDULE I

COMPUTATION OF ESTIMATED CORPORATION BUSINESS TAX - |

|

1. (a) |

ADJUSTED ENTIRE NETINCOME |

$_______________________________ |

(b) |

Business Allocation Factor (if less than 100% allocated to New Jersey) |

______________________________% |

(c)Tax Base - In the case of a non-allocating taxpayer, enter amount at Item 1(a); if allocating,

multiply Item 1(a) by Item 1(b) and enter product here |

$_______________________________ |

(d)Estimated Corporation Business Tax - Multiply line 1(c) by .09 or, if applicable, by .075 or .065. (Refer to instruction 5(a)). Refer to instruction 5(b) for minimum tax requirements. New Jersey S Corporations must follow the instructions in 5(d) to calculate the appropriate estimated

corporation business tax liability to be reported on this line. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $_______________________________

(e)Alternative Minimum Assessment for C corporations. (See instruction 5(c) on page 3 and refer to

CBT-100 instructions). Check here and enter zero if AMAis paid by Key Corporation. . . . . $_______________________________

(f)Total Estimated Corporation Business Tax Liability: Enter greater of 1(d) or 1(e)

(Carry to Page 1, Line 1) |

$_______________________________ |

SCHEDULE II |

|

|

COMPUTATION OF ESTIMATED NEW JERSEY SALES & USE TAX - |

|

|

Enter tax paid over the last four reporting (quarterly) periods: |

|

|

PERIOD ENDING |

|

AMOUNTPAID |

________________________________________________ |

$ |

_______________________________ |

________________________________________________ |

$ |

_______________________________ |

________________________________________________ |

$ |

_______________________________ |

________________________________________________ |

$ |

_______________________________ |

Enter Estimated Tax for current or subsequent period (as applicable). (Carry to Page 1, Line 2) |

$ |

______________________________ |

(ATTACH RIDER FOR METHOD OF COMPUTATION OF ESTIMATED TAX, IF APPLICABLE) |

|

|

|

|

|

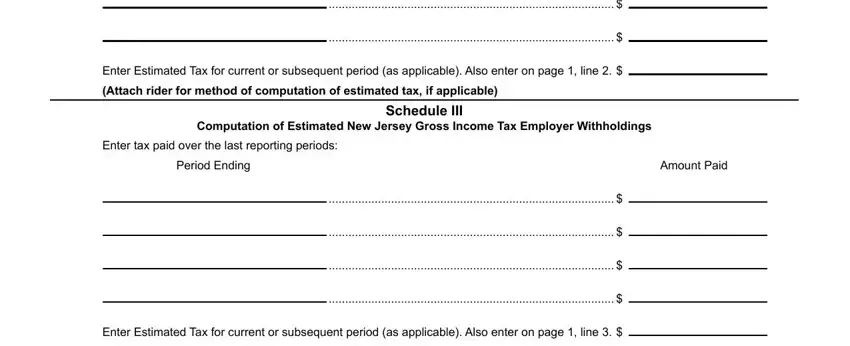

SCHEDULE III |

|

|

COMPUTATION OF ESTIMATED NEW JERSEY GROSS INCOME TAX EMPLOYER WITHHOLDINGS - |

|

|

Enter tax paid over the last reporting periods: |

|

|

PERIOD ENDING |

|

AMOUNTPAID |

________________________________________________ |

$ |

_______________________________ |

________________________________________________ |

$ |

_______________________________ |

________________________________________________ |

$ |

_______________________________ |

________________________________________________ |

$ |

_______________________________ |

Enter Estimated Tax for current or subsequent period (as applicable). (Carry to Page 1, Line 3) |

$ |

______________________________ |

(ATTACH RIDER FOR METHOD OF COMPUTATION OF ESTIMATED TAX, IF APPLICABLE) |

|

|

|

|

|

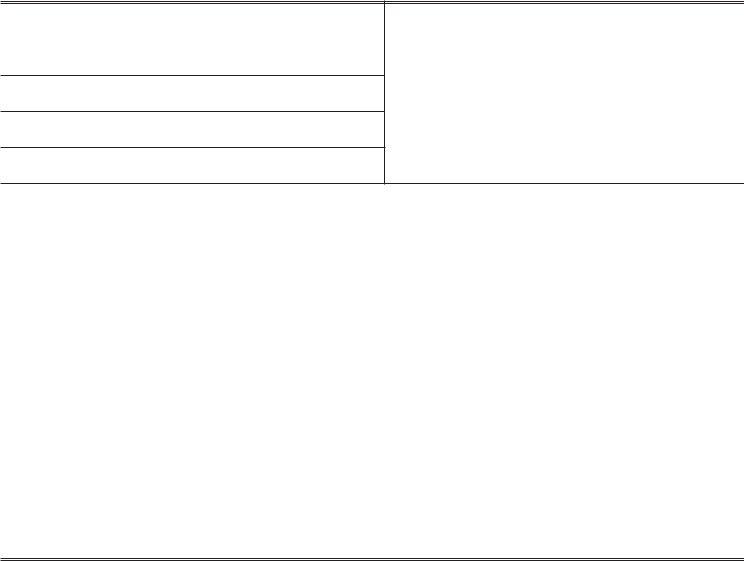

SCHEDULE IV |

|

|

COMPUTATION OF ALLOTHER NEW JERSEYTAXES AND FEES - |

|

|

NAME OF TAX/FEE |

|

AMOUNTDUE |

Professional Corporation Fee |

$ |

_______________________________ |

Other Taxes/Fees (UI/DI, etc.) |

$ |

_______________________________ |

TOTALEstimated Fees and Other Taxes. (Carry to Page 1, Line 4) |

$ |

_______________________________ |

(ATTACH RIDER FOR METHOD OF COMPUTATION OF ESTIMATED TAX, IF APPLICABLE)

A-5052-TC |

Page 3 |

(11-13, R-16) |

|

INSTRUCTIONS FOR COMPLETING FORM A-5052

1.This form must be filed with the Application for Tax Clearance Certificate unless taxpayer complies with instruction #8 of Procedure for Dissolution (Form A-5033).

2.This form must be completed before a Tax Clearance Certificate may be issued. It is to be completed on an estimated basis, for the current period from the close of the last accounting period for which a return is required to be filed with the Division to the proposed date of dissolution, merger, withdrawal, etc.

3.There must be annexed to the Estimated Summary Tax Return an affidavit of a corporate officer covering the following items:

(a)Computation of taxpayer’s actual entire net income from the close of its last accounting period for which a return is required to be filed with the Division to the latest practicable data.

(b)Explanation of taxpayer’s method of computing estimated entire net income between such latest practicable date and the proposed date of filing such Certificate with the Division of Revenue, Business Liquidations.

(c)Astatement indicating whether taxpayer has realized or anticipates a gain on the sale, transfer, exchange, or conversion of any capital or other assets, other than normal sales of inventories, for the period covered by this return. The actual or estimated amount of such gains and the extent to which such gains have been included by the taxpayer in estimating its net income for the period covered by this return must be indicated.

4.Upon receipt of this form and the application for tax clearance certificate, the taxpayer will be advised of any additional data required and of the amount of any additional payment that must be submitted before the Tax Clearance Certificate can be issued. Upon completion of our audit, after receipt of final return, any tax found to have been overpaid will be refunded.

5.Computation of Estimated Corporation Business Tax

(a)The tax rate is 9.0% (.09) on adjusted entire net income or such portion thereof as may be allocable to New Jersey. For taxpayers with entire net income of $100,000 or less, the tax rate is 7.5% (.075). For accounting periods beginning on or after January 1, 2002, if entire net income is $50,000 or less, the tax rate is 6.5% (.065).

(b)Minimum Tax:

(1)For the tax periods beginning on or after January 1, 2002, the minimum tax is $500, provided however that for a taxpayer that is a member of an affiliated or controlled group (as per section 1504 or 1563 of the Internal Revenue Code of 1986) which has a total payroll of $5,000,000 or more for the return period, the minimum tax shall be $2,000. Tax periods of less than 12 months are subject to the higher minimum tax if the prorated total payroll exceeds $416,667 per month. The minimum tax cannot be prorated.

(2)For the tax periods beginning on or after January 1, 2006, the minimum tax is based on New Jersey Gross Receipts as follows (except for corporations that are members of affiliated groups with total payroll of $5,000,000 or more, whose minimum tax is $2,000 annually - see 5(b)(1) above).

New Jersey Gross Receipts |

Minimum Tax for period begin: |

|

CBT-100 |

CBT-100S |

|

|

On or after 01/01/2012 |

Less than $100,000 |

$500.00 |

$375.00 |

$100,000 or more but less than $250,000 |

$750.00 |

$562.50 |

$250,000 or more but less than $500,000 |

$1,000.00 |

$750.00 |

$500,000 or more but less than $1,000,000 |

$1,500.00 |

$1,125.00 |

$1,000,000 or more |

$2,000.00 |

$1,500.00 |

(c)If the taxpayer is subject to the Alternative Minimum Assessment, refer to the instructions included in the Corporation Business Tax Return (CBT-100) to compute the AMA. CBT Return and instructions can be accessed on the Division’s website at www.state.nj.us/treasury/taxation/.

The maximum AMAfor a taxpayer is $5,000,000 for a privilege period. The AMAthreshold limit is $20,000,000 for an affiliated group of five or more members.

(d)Tax Rates for New Jersey S Corporations:

(1)For a taxpayer that has entire net income in excess of $100,000 for the privilege periods ending on or after July 1, 2001 but on or before June 30, 2006, the tax rate shall be 1.33% and for the privilege periods ending on or after July 1, 2006 but on or before June 30, 2007, the tax rate shall be 0.67%; and

(2)For a taxpayer that has entire net income of $100,000 or less or the privilege periods ending on or after July 1, 2001, there shall be no rate of tax imposed. However, minimum tax shall apply. See 5(b) above.

(3)The tax rate is 9% (.09) of entire net income that is subject to Federal income taxation or such portion thereof as may be allocable to New Jersey. For a taxpayer that has entire income of $100,000 or less, the tax rate is 7.5% (.075) and if the entire income is $50,000 or less, the tax rate is 6.5% (.065).

(4)The tax rate on the net pro rata share of the S Corporation income allocated to New Jersey for the nonconsenting shareholders is 8.97%.

6.Signature

Taxpayers who fail to sign the return shall have their applications rejected and returned causing delay in issuing tax clearance certificates and eventual dissolution, withdrawal or merger proceedings. Tax prepares who fail to sign the return or provide their assigned tax identification number will be liable for $25.00 penalty for each such failure.