You'll be able to work with form aos1 revenue effortlessly by using our online tool for PDF editing. The tool is continually maintained by us, getting handy features and becoming better. With some basic steps, you'll be able to start your PDF journey:

Step 1: Hit the orange "Get Form" button above. It will open our editor so you could begin filling out your form.

Step 2: With the help of our advanced PDF editor, you can do more than just complete forms. Express yourself and make your documents look high-quality with customized text incorporated, or modify the file's original input to excellence - all that comes with an ability to incorporate almost any pictures and sign it off.

It will be an easy task to complete the pdf using this helpful tutorial! Here is what you have to do:

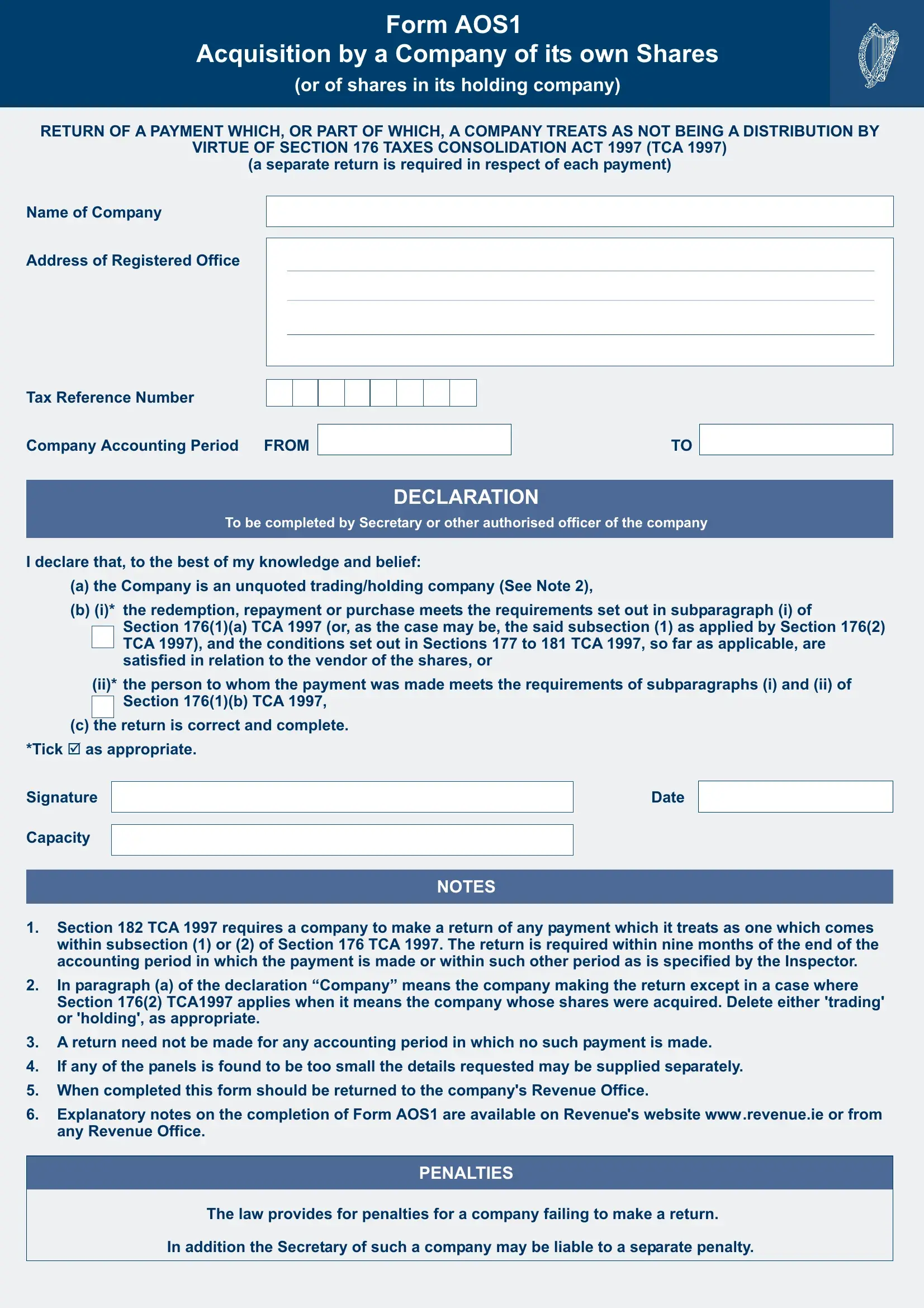

1. It is important to complete the form aos1 revenue properly, therefore take care while filling out the parts that contain these specific blank fields:

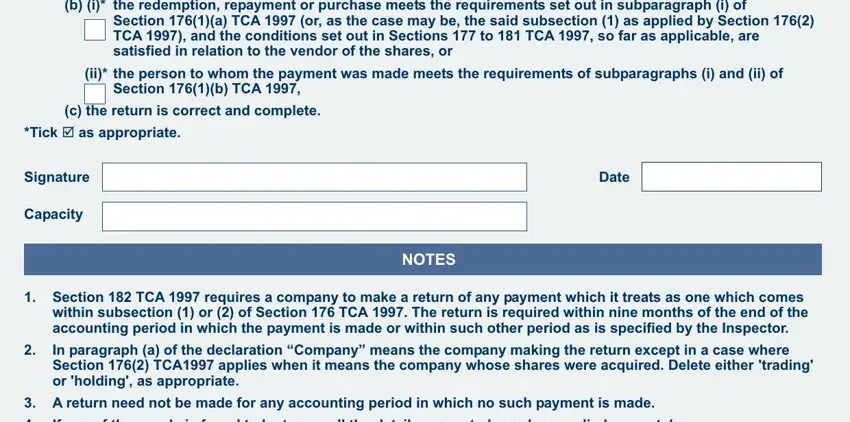

2. Soon after the previous selection of blanks is filled out, go on to type in the relevant information in these: b i the redemption repayment or, Section a TCA or as the case may, ii the person to whom the payment, Section b TCA, c the return is correct and, Tick þ as appropriate, Signature, Capacity, Date, NOTES, Section TCA requires a company, In paragraph a of the declaration, A return need not be made for any, and If any of the panels is found to.

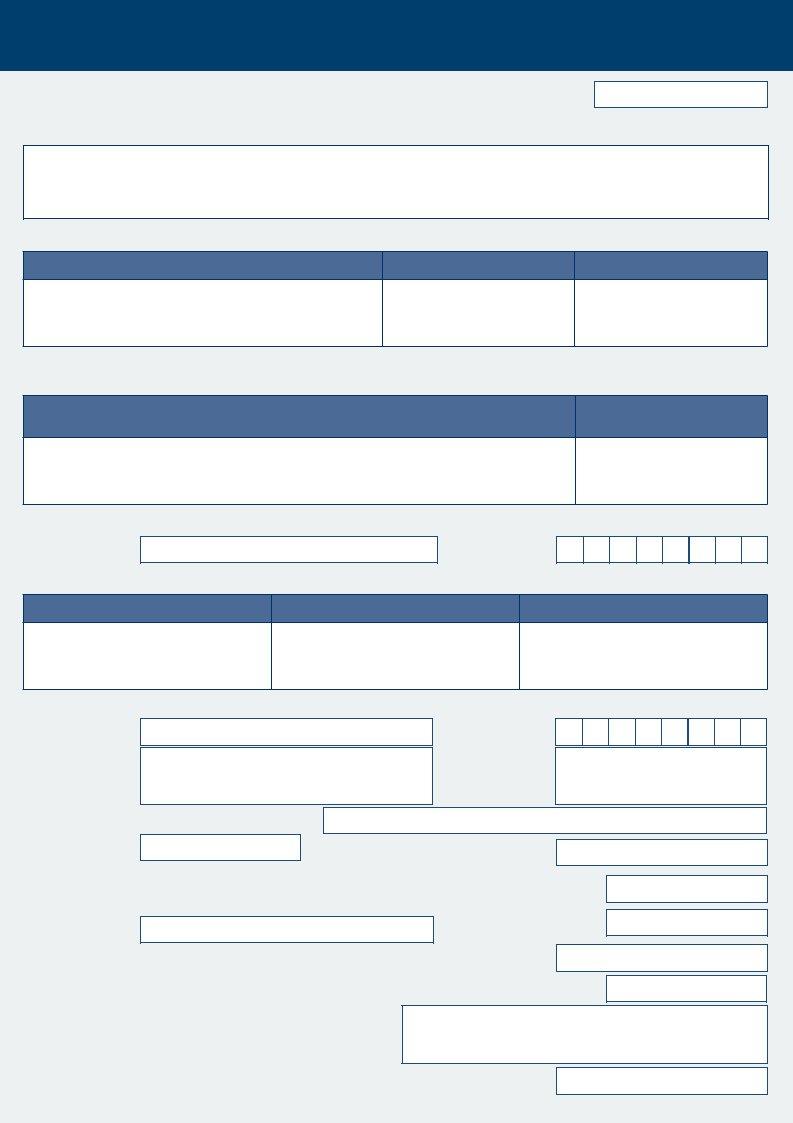

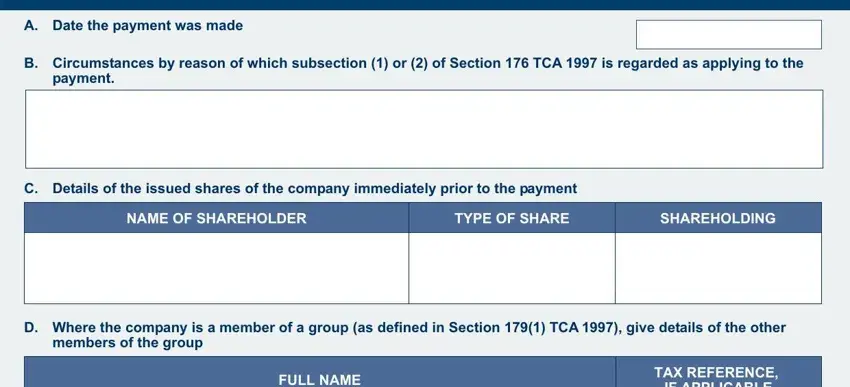

3. This next section will be about A Date the payment was made, B Circumstances by reason of which, payment, C Details of the issued shares of, NAME OF SHAREHOLDER, TYPE OF SHARE, SHAREHOLDING, D Where the company is a member of, members of the group, FULL NAME, and TAX REFERENCE IF APPLICABLE - fill in these blanks.

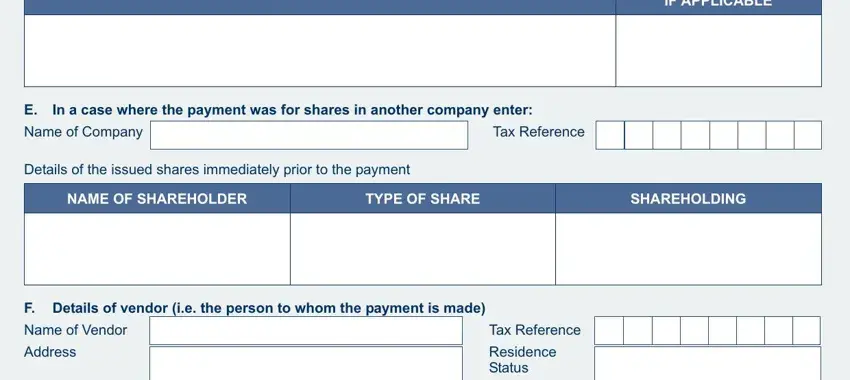

4. The next subsection will require your input in the following places: FULL NAME, TAX REFERENCE IF APPLICABLE, In a case where the payment was, Name of Company, Tax Reference, Details of the issued shares, NAME OF SHAREHOLDER, TYPE OF SHARE, SHAREHOLDING, F Details of vendor ie the person, Name of Vendor, Address, Tax Reference, and Residence Status. Make certain you enter all required info to go forward.

Regarding Address and SHAREHOLDING, be sure that you do everything right here. These two could be the most significant fields in this form.

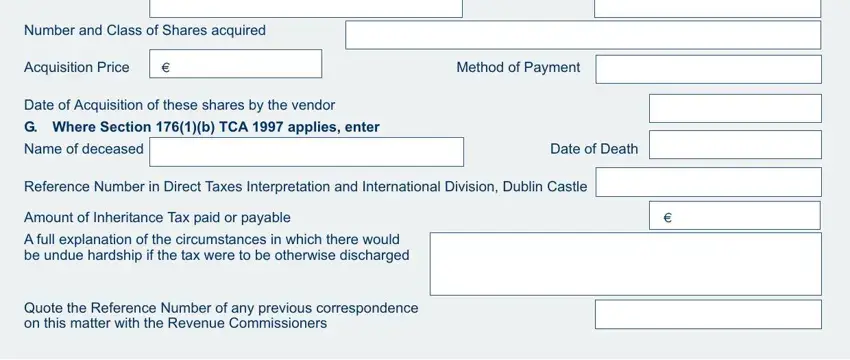

5. And finally, this last subsection is what you should wrap up prior to finalizing the PDF. The fields at this stage include the following: Number and Class of Shares acquired, Acquisition Price, Method of Payment, Date of Acquisition of these, G Where Section b TCA applies, Name of deceased, Date of Death, Reference Number in Direct Taxes, Amount of Inheritance Tax paid or, A full explanation of the, and Quote the Reference Number of any.

Step 3: As soon as you've looked over the details in the fields, click "Done" to conclude your FormsPal process. Join us today and easily obtain form aos1 revenue, prepared for downloading. All modifications made by you are saved , enabling you to modify the document at a later point anytime. We don't sell or share any information that you enter when dealing with forms at our site.