Whenever you want to fill out artx form, it's not necessary to download any sort of software - simply use our online tool. Our professional team is relentlessly endeavoring to develop the tool and help it become much better for people with its extensive functions. Enjoy an ever-improving experience now! For anyone who is looking to get started, here's what it's going to take:

Step 1: Hit the "Get Form" button above on this page to open our PDF tool.

Step 2: Using this online PDF tool, it's possible to do more than simply complete forms. Edit away and make your documents seem high-quality with customized textual content added, or tweak the original input to excellence - all comes along with an ability to add any images and sign the PDF off.

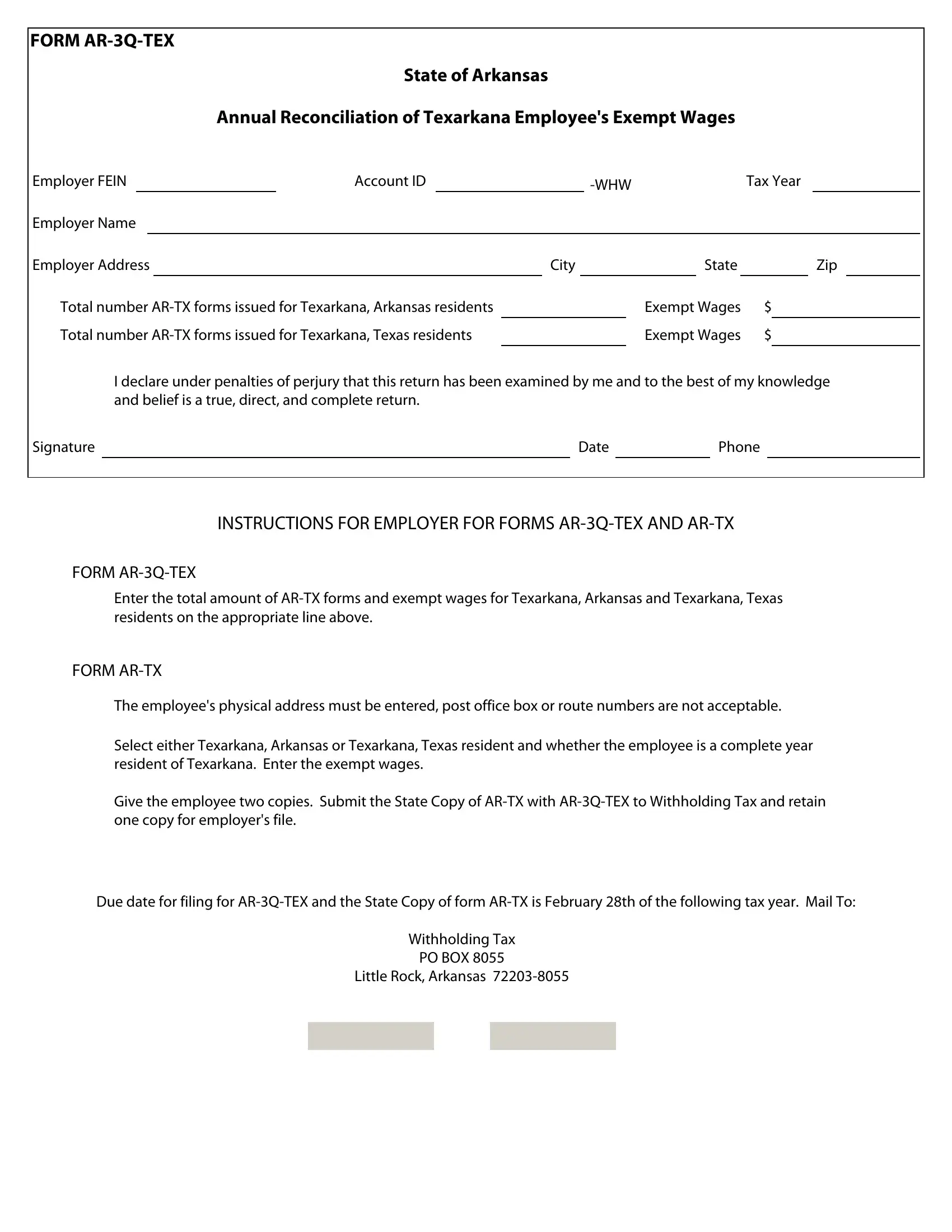

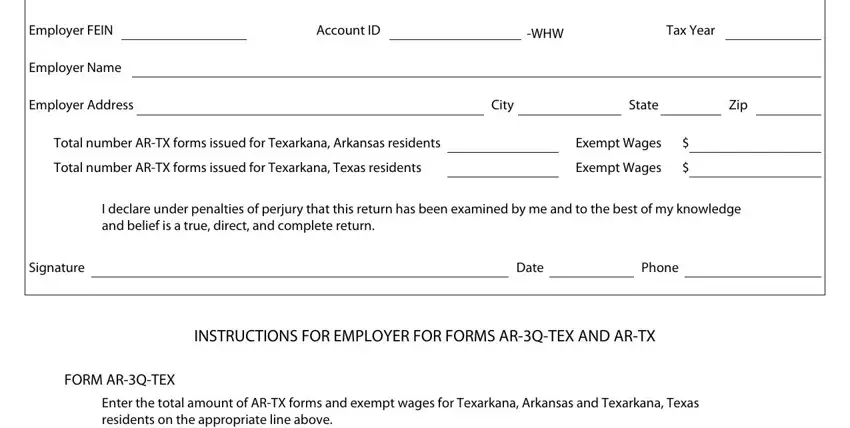

This PDF requires specific details to be entered, thus you should take your time to type in exactly what is asked:

1. The artx form needs specific details to be entered. Make certain the subsequent blanks are finalized:

Step 3: Right after going through the form fields you've filled in, click "Done" and you're done and dusted! Make a free trial option with us and acquire immediate access to artx form - download, email, or change from your personal account. FormsPal is dedicated to the privacy of our users; we ensure that all personal data used in our tool is kept confidential.