When you need to fill out ar withholding affidavit form, you don't have to download and install any kind of software - simply use our online PDF editor. Our editor is constantly evolving to present the best user experience attainable, and that is due to our resolve for continuous development and listening closely to user comments. By taking a couple of simple steps, you can begin your PDF journey:

Step 1: Simply hit the "Get Form Button" at the top of this webpage to open our pdf form editor. There you'll find everything that is needed to fill out your file.

Step 2: The tool enables you to change PDF forms in a variety of ways. Modify it by writing your own text, adjust existing content, and place in a signature - all within the reach of several mouse clicks!

This PDF doc requires some specific details; to guarantee accuracy and reliability, be sure to bear in mind the next tips:

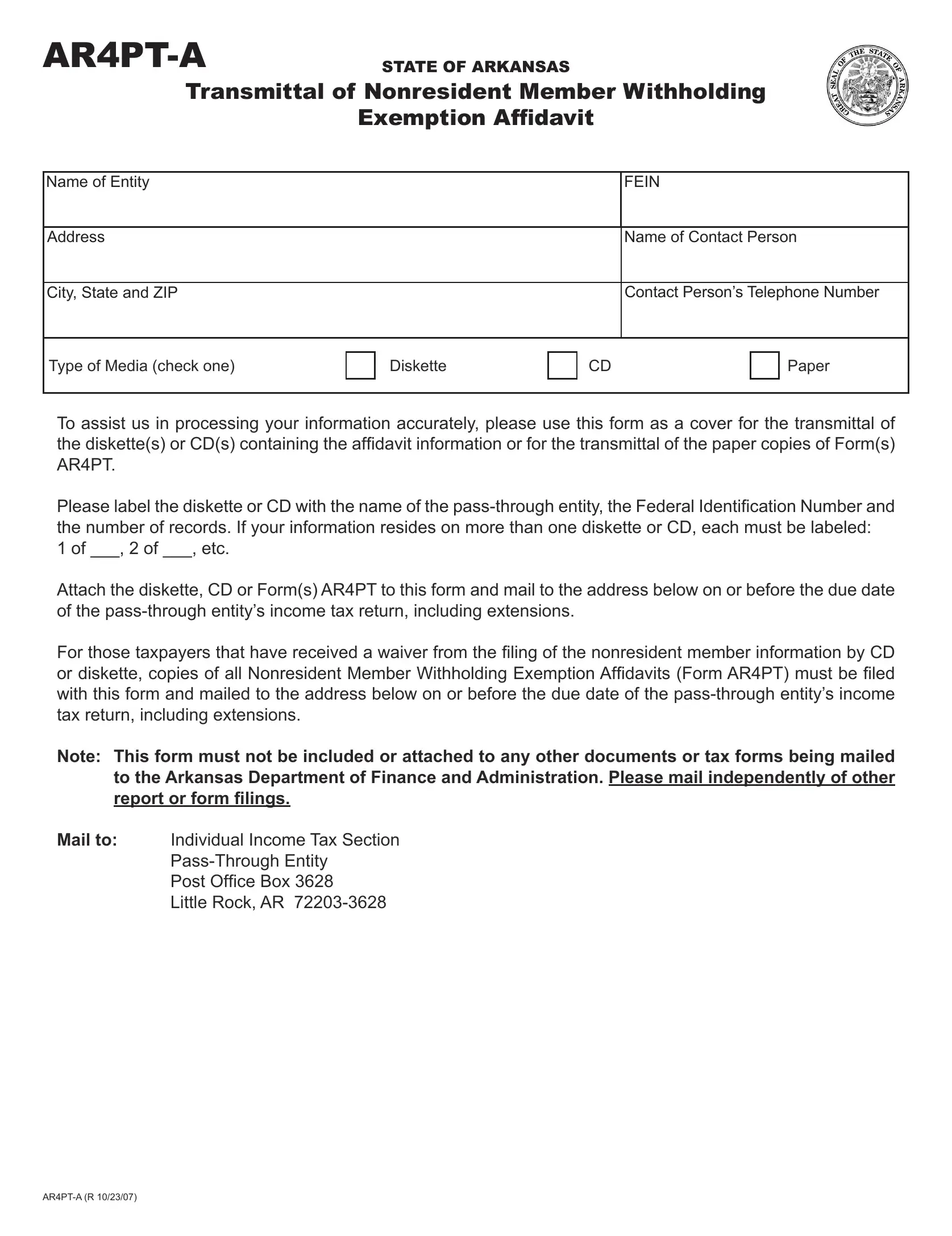

1. It is important to complete the ar withholding affidavit form correctly, so pay close attention while working with the segments containing these particular blanks:

Step 3: Check that your details are right and then simply click "Done" to complete the task. After setting up afree trial account with us, you will be able to download ar withholding affidavit form or send it through email right off. The form will also be accessible in your personal cabinet with your every edit. We don't sell or share the information you use whenever completing forms at FormsPal.