SPECIAL INFORMATION

AR8453-OL

If you choose to ile your State of Arkansas tax return by using one of the online web providers, you are required to complete the AR8453-OL. You must keep the completed and signed AR8453-OL along with your tax return and any W-2’s and/or 1099’s. If you have claimed the Individuals with Developmental Disabilities Credit or Other State Tax Credit, see the instructions below:

Individuals with Developmental Disabilities Credit

If the taxpayer is claiming the Individuals with

Developmental Disabilities credit, the AR1000RC5 or recertiication letter must be sent to the E-File

Section by one of the methods below:

•E-mail To: AR8453@dfa.arkansas.gov

Subject: Taxpayer name and RC5

Attachment: AR8453-OL along with the AR1000RC5 or Recertiication Letter must be attached to the e-mail.

NOTE: Attachments must be in one of the fol- lowing formats: .tif, .pdf, .bmp, .jpg, or

.jpeg

•Fax To: 501-682-7393 - AR8453-OL along with the AR1000RC5 or Recertiication Letter must be included in the fax transmission.

•Mail To: Arkansas Electronic Filing Group

P. O. Box 8094

Little Rock, AR 72203-8094

Other State Tax Credit

If the taxpayer is claiming the Other State Tax Credit, the Other State Tax return(s) must be sent to the E-File Section by one of the methods below:

•E-mail To: AR8453@dfa.arkansas.gov

Subject: Taxpayer name and Other State Tax Return

Attachment: AR8453-OL along with the Other State Tax returns must be attached to the e-mail.

NOTE: Attachments must be in one of the fol- lowing formats: .tif, .pdf, .bmp, .jpg, or

.jpeg

•Fax To: 501-682-7393 - AR8453 along with the Other State Tax return(s) must be included in the fax transmission.

•Mail To: Arkansas Electronic Filing Group

P. O. Box 8094

Little Rock, AR 72203-8094

LINE INSTRUCTIONS

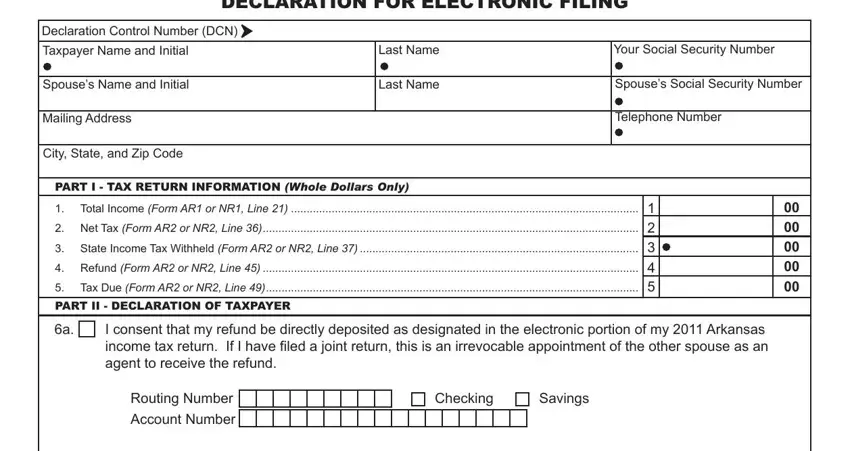

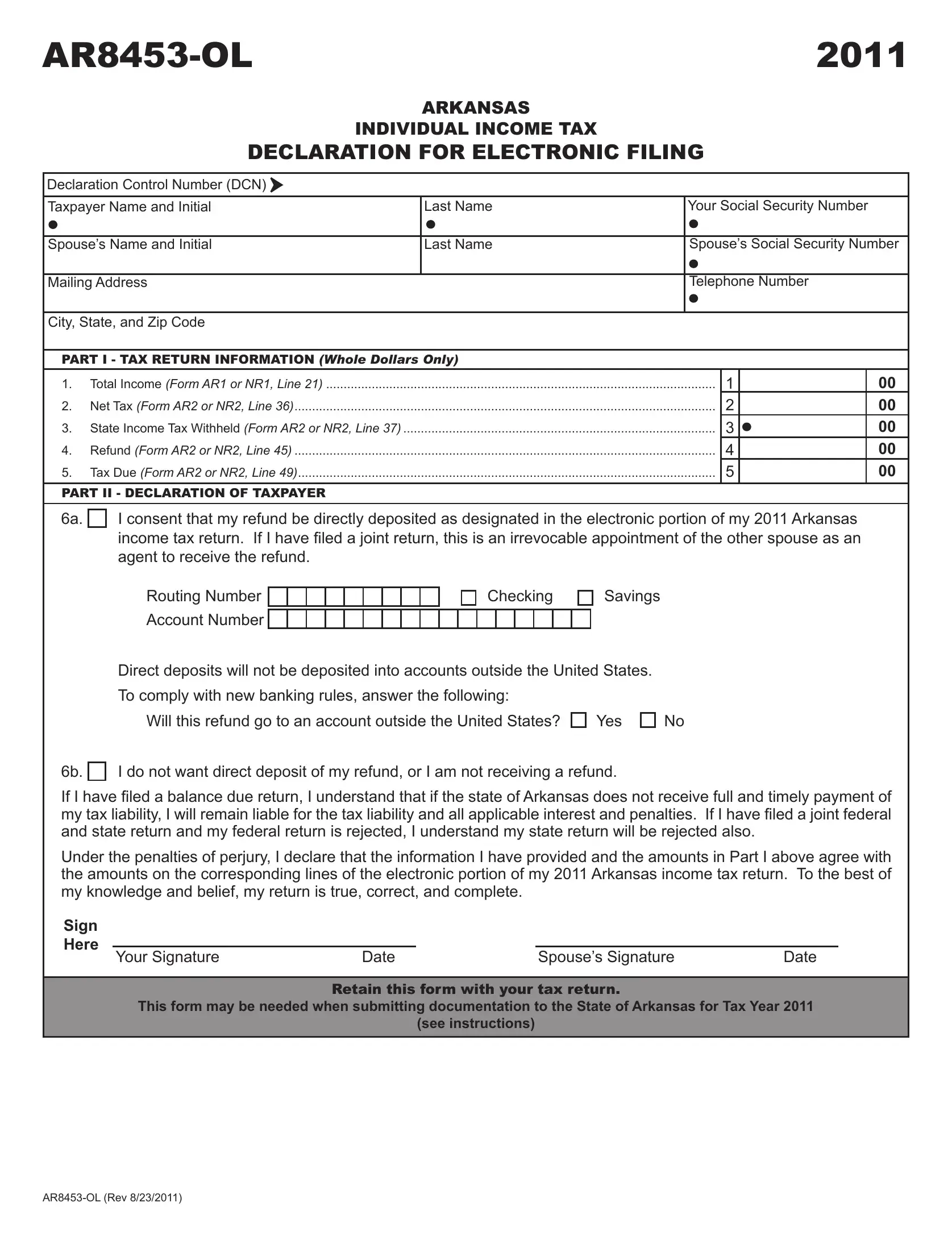

Name, Address, and Social Security Number

Verify the Name(s), Address and Social Security Number(s) are correct. An incorrect or missing

social security number may delay any refund. If iling a joint return, be sure the names and social

security numbers are listed in the same order.

NOTE: |

THE ADDRESS MUST MATCH THE ADDRESS |

|

shown on the electronically iled Form |

|

AR1000F. |

|

ALL W-2(S) AND 1099(S) MUST BE ATTACHED |

|

TO THE AR8453-OL. |

Part I - Tax Return Information

Line 3. Enter the total State of Arkansas withhold- ing from Form(S) W-2 and/or 1099.

Part II - Declaration of Taxpayer

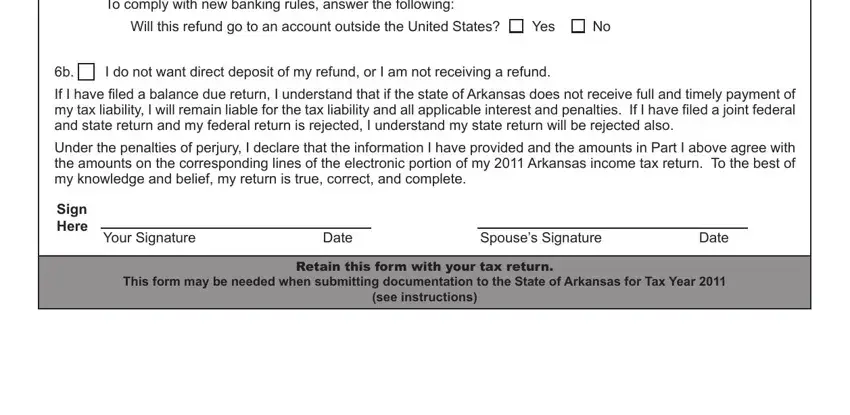

If Line 6a is marked, you’ve chosen to have your state refund direct deposited into the account shown on the form under Routing and Account Number. See Refund Information in next column.

If Line 6b is marked, you’ve chosen to have your state refund mailed to the address shown above.

You must sign the AR8453-OL. If iling a joint return,

your spouse must also sign the AR8453-OL.

TAX DUE

Do Not attach your check or money order to Form AR8453-OL.

Do not mail a copy of your AR1000F/AR1000NR. Mail your payment with Form AR1000-V on or before April 17, 2012 to:

State Income Tax – E-File Payment

P. O. Box 8149

Little Rock, AR 72203-8149

If you do not have Form AR1000-V, you may get it from your on-line service provider and/or transmitter. You can also download it from the State of Arkansas’s web site, www.arkansas.gov/eile.

REFUND INFORMATION

After the State of Arkansas has accepted your elec- tronically iled return, the refund should be issued

within 7 to 10 business days.

You can check on the status of your refund if it has

been at least 72 hours since State of Arkansas acknowledged receipt of your e-iled return. To

check the status of your refund, do one of the following.

•Go to www.arkansas.gov/dfa. Click on “Income

Tax Refund Inquiry”.

•Call 501-682-1100 or 1-800-882-9279. (Monday through Friday from 8:00 a.m. to 4:30 p.m. central standard time).

DIRECT DEPOSITS

Direct Deposit is offered on electronically iled Arkansas Individual Income Tax returns with United States address only, including Hawaii and Alaska. You must use the same account that is being used for the direct deposit of your Federal refund. If the Federal return is a tax due, your State refund can be direct deposited, if supported by your software.

Direct deposits are not offered to those iling with either a foreign address or an account outside the

United States. This includes the following countries:

Guam, Virgin Islands, and Puerto Rico.

ATAP

ATAP (Arkansas Taxpayer Access Point) allows taxpayers or their representatives to log on to a

secure site and manage their account online. You can access ATAP at www.atap.arkansas.gov

Some features are listed below:

•Make name and address changes

•View account letters

•Make payments

•Check refund status

(Registration is not required to make payments or to check refund status.)