Using the online editor for PDFs by FormsPal, you can fill in or change NONRESIDENT here and now. Our editor is constantly developing to deliver the best user experience attainable, and that's because of our dedication to continuous development and listening closely to user comments. Starting is easy! All that you should do is take the next easy steps directly below:

Step 1: Access the PDF inside our editor by clicking on the "Get Form Button" above on this page.

Step 2: As you launch the online editor, you will get the form prepared to be completed. Other than filling out different blanks, you can also do some other things with the form, namely writing any textual content, changing the initial text, adding graphics, signing the form, and more.

It will be straightforward to finish the pdf with our helpful guide! This is what you should do:

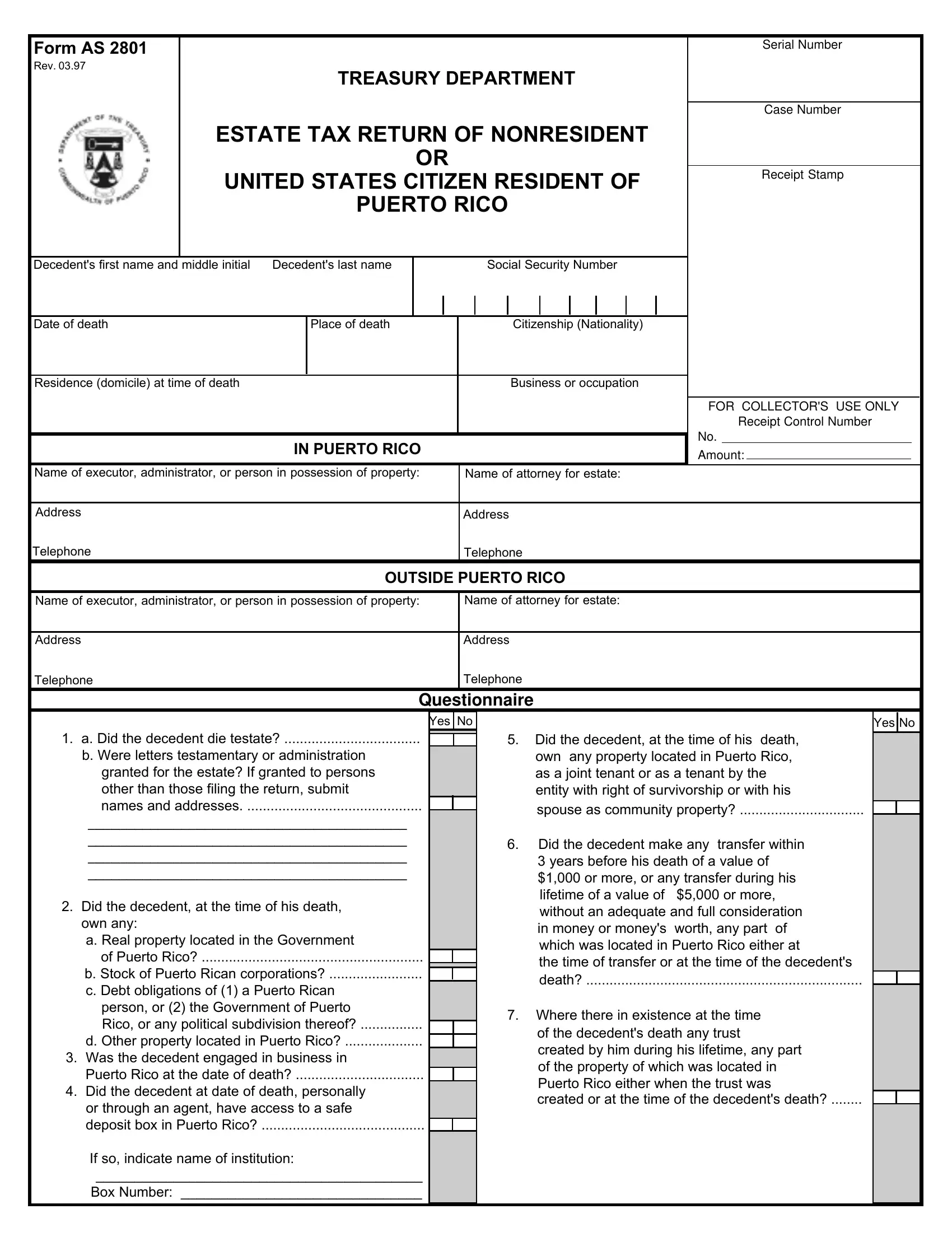

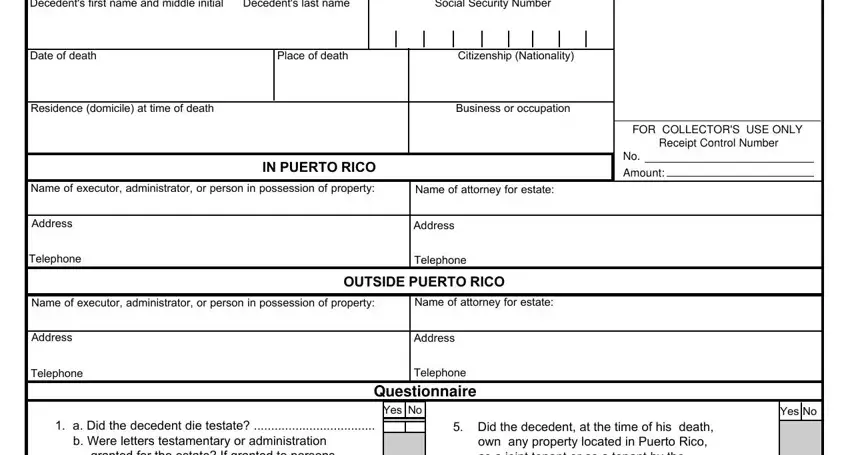

1. It is important to fill out the NONRESIDENT properly, therefore pay close attention while working with the parts including these particular blank fields:

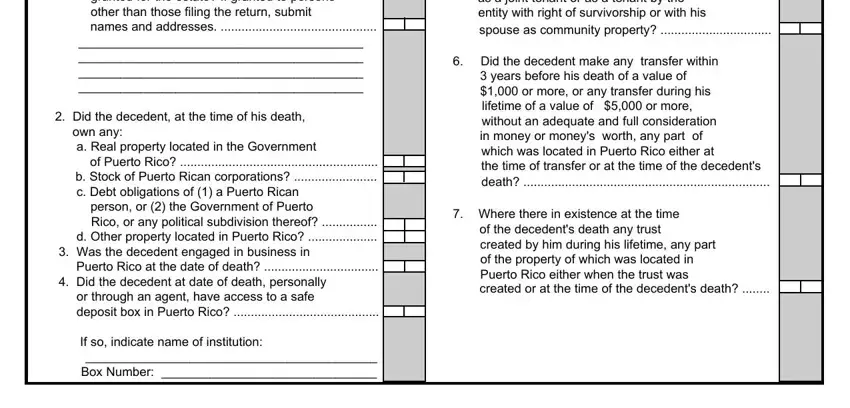

2. After filling out this section, go to the subsequent stage and complete all required details in these fields - a Did the decedent die testate b, Did the decedent at the time of, If so indicate name of institution, Did the decedent at the time of, Did the decedent make any, and Where there in existence at the.

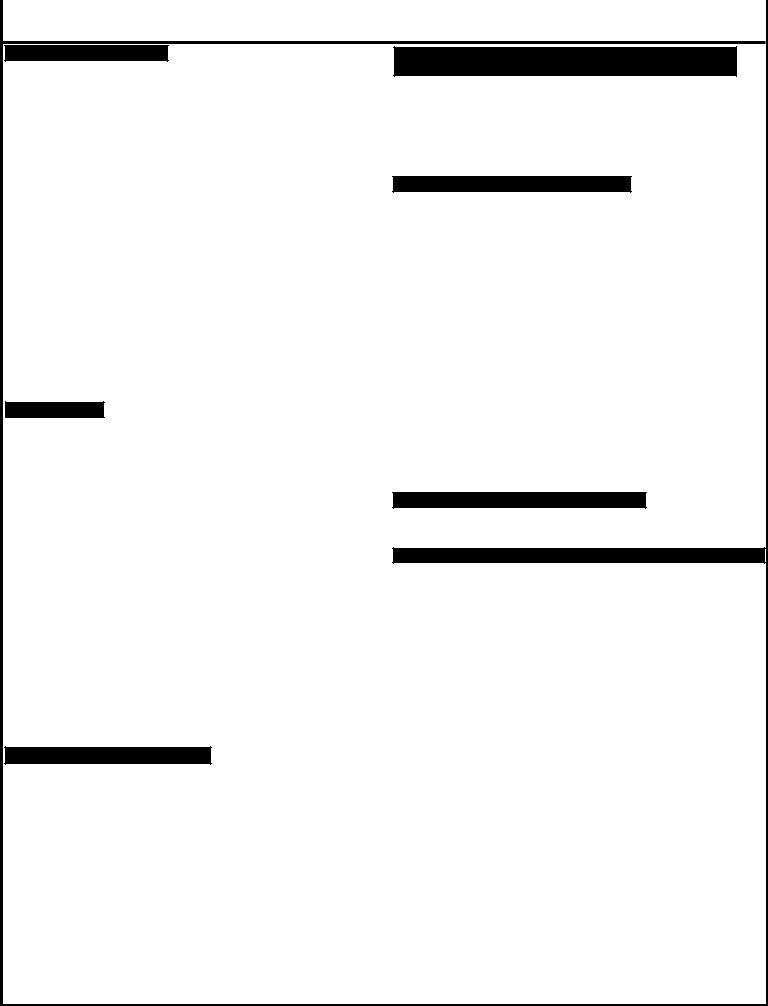

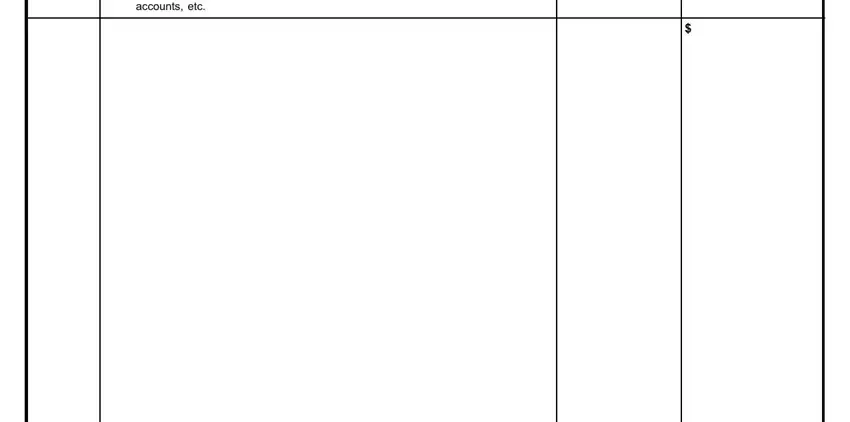

3. This subsequent section is fairly straightforward, Complete description of real - every one of these blanks needs to be filled in here.

4. The following paragraph needs your input in the subsequent areas: Total Schedule A. Just remember to enter all requested details to go onward.

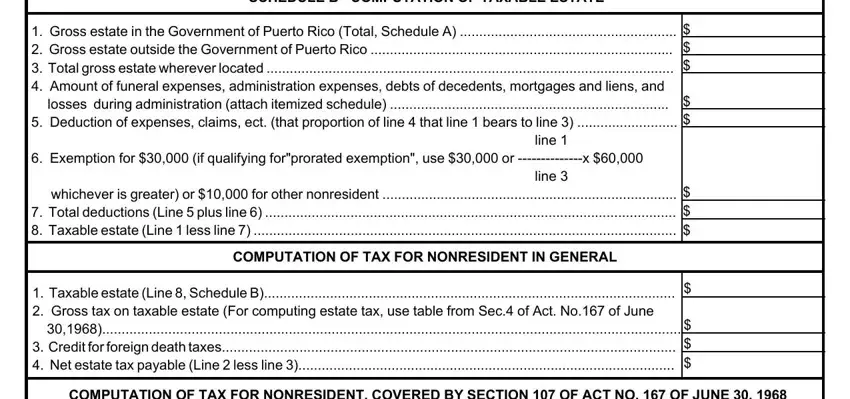

5. The very last point to finalize this document is critical. Be certain to fill in the required form fields, for instance SCHEDULE B COMPUTATION OF TAXABLE, Gross estate in the Government of, COMPUTATION OF TAX FOR NONRESIDENT, Taxable estate Line Schedule B, and COMPUTATION OF TAX FOR NONRESIDENT, prior to using the form. If not, it might give you an unfinished and potentially nonvalid form!

As to SCHEDULE B COMPUTATION OF TAXABLE and COMPUTATION OF TAX FOR NONRESIDENT, ensure you don't make any errors in this current part. Both of these could be the most significant fields in this PDF.

Step 3: Soon after taking one more look at the filled in blanks, press "Done" and you're done and dusted! Go for a free trial option with us and obtain instant access to NONRESIDENT - download or edit in your FormsPal cabinet. FormsPal is invested in the privacy of all our users; we always make sure that all information used in our system stays confidential.