Navigating the complexities of obtaining a license for coin-operated amusement machines in Georgia is made straightforward with the ATT-300B form, a critical document for all seeking to comply with state regulations. This form, evolving over time with its latest revision in February 2012, serves as a comprehensive application for a Master License - Class B, which is indispensable for businesses operating such machines. The Georgia Department of Revenue carefully outlines the process, requiring details ranging from state taxpayer identifiers to the fine calculations for license fees, including penalties for non-compliance and specifics for machines in operation. The ATT-300B not only facilitates the legal operation of entertainment devices like pinball machines, video games, and jukeboxes but also imposes a structured fee schedule. License fees, processing charges, annual permit sticker fees, and penalties for late submissions or non-adherence to regulations underscore the financial obligations of applicants. Further, it details the requirements for both U.S. citizens and qualified aliens, ensuring applicants are aware of their eligibility. With mandates for information on payment, business identity, and contact details, the form acts as a gateway to obtaining lawful authorization to engage in this sector of the entertainment industry, emphasizing the importance of accuracy and timeliness in submissions to avoid penalties, including the possibility of license denial for outstanding account liabilities. As such, the ATT-300B form is a pivotal tool in maintaining the integrity and financial accountability of Georgia's amusement machine industry.

| Question | Answer |

|---|---|

| Form Name | Form Att 300B |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ga coam master license for sale, FEIN, ga coam, ga coam master license list |

|

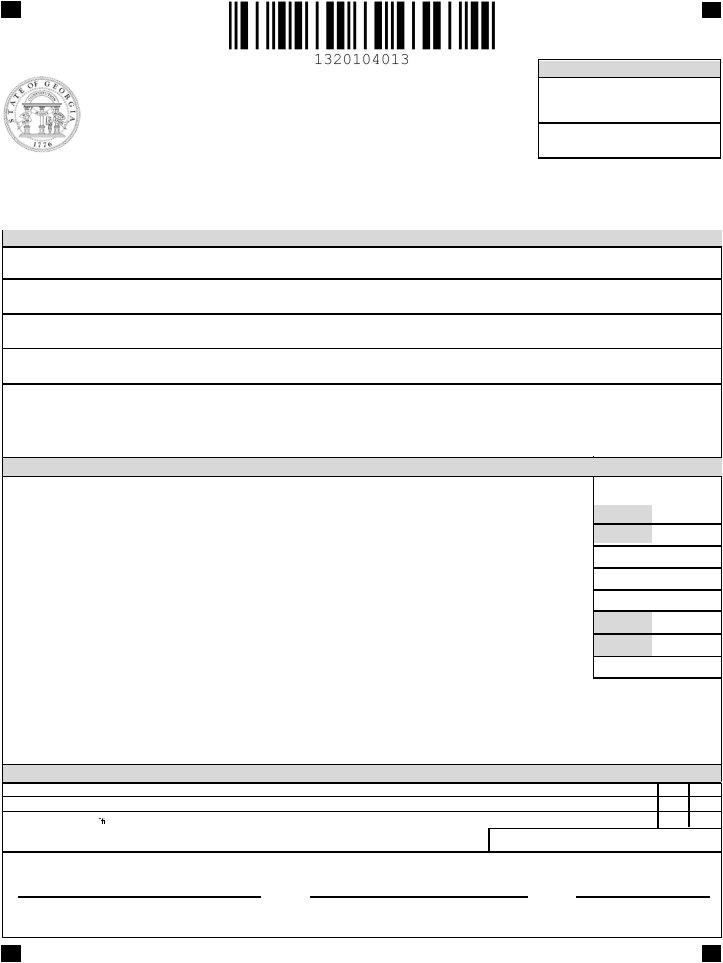

MASTER LICENSE - CLASS B |

|

|

COIN OPERATED |

|

AMUSEMENT MACHINE |

||

APPLICATION |

||

|

||

|

OFFICE USE ONLY |

|

Georgia Department of Revenue |

TOTAL AMOUNT RECEIVED |

|

|

||

P.O. Box 105458 |

$ ______________________ |

|

Atlanta, Georgia |

||

LICENSE PERIOD |

||

(404) |

MASTER LICENSE NUMBER |

|

ATDIV@dor.ga.gov |

|

|

___ ___ / ___ ___ |

/ ___ ___ ___ ____ |

||

|

|

(PLEASE PRINT OR TYPE) |

||

|

|

IDENTIFICATION SECTION |

||

1. |

STATE TAXPAYER IDENTIFIER (STI) NUMBER |

|

|

1a. FEDERAL EMPLOYER IDENTIFICATION NUMBER (FEIN) |

|

|

|||

2. |

LEGAL BUSINESS NAME |

|

|

2a. DBA or TRADE NAME (if applicable) |

3. |

PRIMARY LOCATION ADDRESS (number and street) |

|

|

3a. EMAIL ADDRESS |

|

|

|

|

|

4. CITY |

COUNTY |

STATE |

ZIP CODE+4 |

PHONE |

5. MAILING ADDRESS (number and street) |

|

|

|

|

|

|

|

|

|

6. CITY |

COUNTY |

STATE |

ZIP CODE+4 |

PHONE |

PAYMENT SECTION

7.LICENSE FEES: (Check the appropriate box(es) and return the total amount due with the application.)

a. MASTER LICENSE (All Machines) Master License Fee - $5,000.00

b. PROCESSING FEE FOR INITIAL OR RENEWAL APPLICATION - $50.00

c. ANNUAL PERMIT STICKER FEE ($125.00 PER MACHINE) (Total machines x $125.00)

d. PENALTY FEE: Machine in operation without a sticker ($250.00 per machine) (Total machines x $250.00)

e. REINSTATEMENT FEE ($75.00 per machine) (Total machines x $75.00)

f. DUPLICATE ORIGINAL LICENSE FEE (notarizd aavit be attached) - $100.00

g. LATE PENALTY FEE - $125.00

TOTAL PAYMENT DUE

Note: Sticker must be ad to machine.

No REFUND of any of these fees/costs are authorized if owner ceases operation prior to the end of the License period.

MAKE CHECK PAYABLE TO THE “GEORGIA DEPARTMENT OF REVENUE”, GEORGIA LAW STIPULATES THAT TAXES AND FEES/COSTS SHALL BE PAID IN LAWFUL MONEY OF THE U.S. FREE OF EXPENSE TO GEORGIA.

SIGNATURE SECTION |

|

|

The applicant is a United States citizen or legal permanent resident at least eighteen (18) years old. |

|

|

The applicant is a qual ed alien or |

|

|

at least eighteen (18) years old and is lawfully present in the United States. The applicants alien number issued by |

Alien Number: |

|

the Department of Homeland Security or other federal immigration agency must be provided. |

||

|

Under penalty of law, I delcare this application has been completed or thoroughly examined by me and is true and correct.

(Signature) |

(T itle) |

Number of |

|

License Fee |

|

Machines |

|

|

|

YES NO

(Date)

(Must be signed by the owner, partner or authorized officer of the corportation. Stamped signature is not acceptable.)

SEE REVERSE SIDE FOR ADDITIONAL INFORMATION

STATE OF GEORGIA

DEPARTMENT OF REVENUE

INSTRUCTIONS FOR THE COMPLETION OF

(FORM

TYPE OR PRINT IN INK – DO NOT USE PENCIL

Use this form to apply for a license and decals for

This form can be used as a COAM renewal or initial registration application. When used as a renewal application the data is prepopulated in the correct fields on the front of the form. If being used as an initial registration application, form

INSTRUCTIONS FOR COMPLETING FORM

A.IDENTIFICATION SECTION

Line 1- Enter your Georgia State Taxpayer Identifier (STI). (If you do not have one, leave blank) 1a - Enter your Federal Employer Identification Number (FEIN), if applicable.

Line 2 - Enter your legal business name listed on Form

Line 3 - Enter the physical location address of your business. (A Post Office Box or PMB is not an acceptable location address). 3a - Enter your business email address.

Line 4 - Enter your business city, county, state, zip code and phone number. Line 5 - Enter the mailing street address.

Line 6 - Enter your mailing city, county, state, zip and phone number (if applicable).

B.PAYMENT SECTION

Line 7 - Enter the number of machines and all applicable fees and calculate totals.

-Enter all other applicable fees (a - h) for Master License A or all other application fees

-Enter the TOTAL PAYMENT DUE.

*NOTE: Master License A upgrade calculation example: Enter master license fee on line 7a. |

$2,000.00 |

Enter existing license fee credit on line 7c. |

|

Enter TOTAL PAYMENT DUE |

$1,500.00 |

License payments are not prorated.

Failure to timely apply for a Master License will result in the imposition of a $125.00 penalty. Failure to order and affix decals for Class A machines will result in the imposition of a $50.00 per machine penalty and a $250.00 per machine penalty for Class B. Any violation of this law can result in suspension or revocation of your license, seizure of equipment, and debarment for repeat offenders. Equipment can be sold at public auction after 30 days advertisement. The Revenue Commissioner will charge a fee of $75.00 per machine for the release of any machine that has been seized and sealed. No one is authorized to remove the seals after they are in place without written authoriz- ation from the Revenue Commissioner or his authorized agents after payment of penalities.

NOTICE: Master License Processing Fee - The application processing fees is

**NOTICE: In order to continue operating

When applying for a duplicate license you must attach an affidavit, showing the reason that you need a duplicate (e.g. lost license, etc.).

The registration fee must be made payable to the GEORGIA DEPARTMENT OF REVENUE. Georgia law stipulates that taxes and fees shall be paid in lawful money of the U.S. and be free of expense to Georgia.

C.SIGNATURE SECTION

This application must be signed by the owner, a partner, or an authorized officer of the corporation.

D.INSTRUCTION FOR MAILING

Mail the original application, with payment attached, to the address shown below. Please retain copies for your files.

GEORGIA DEPARTMENT OF REVENUE

POST OFFICE BOX 105458

ATLANTA, GEORGIA

Please allow 4 to 6 weeks for processing. For further information, call (404)