Our PDF editor allows you to manage the New_York form. You will be able to generate the file instantly through these simple steps.

Step 1: The following website page includes an orange button that says "Get Form Now". Hit it.

Step 2: You will find all of the functions that it's possible to use on your file once you have accessed the New_York editing page.

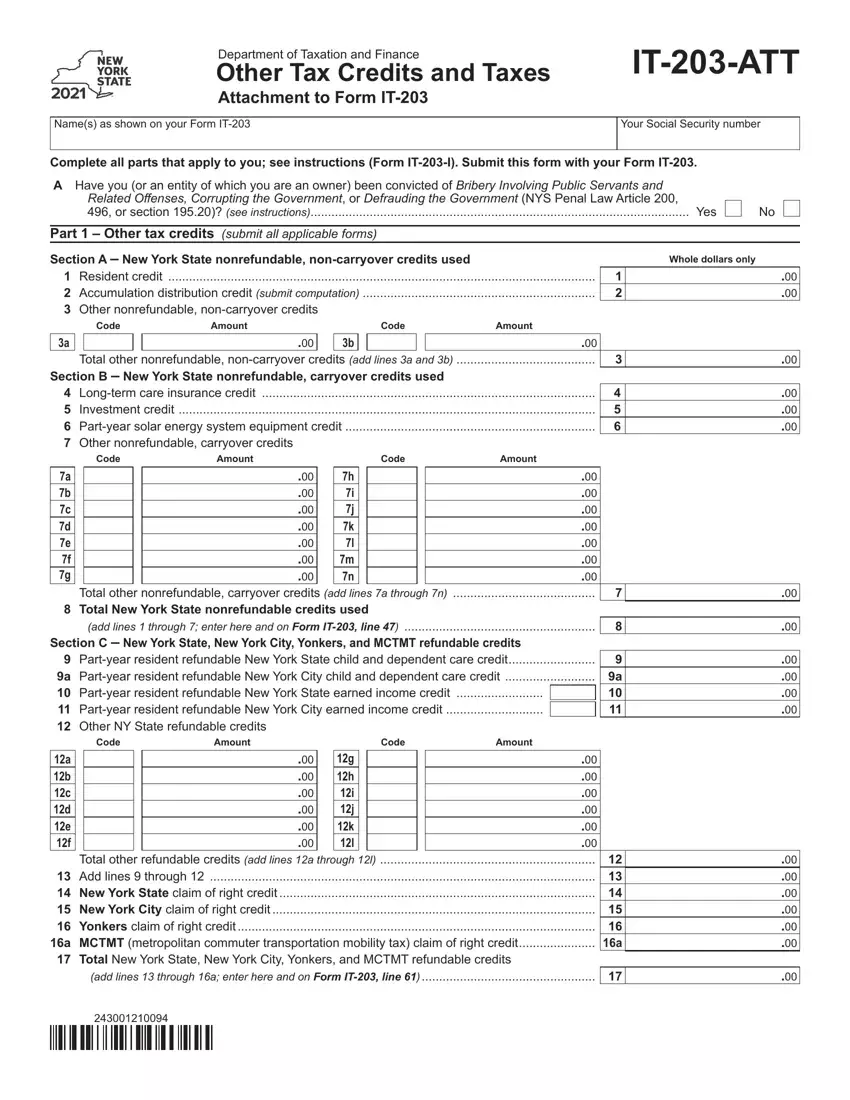

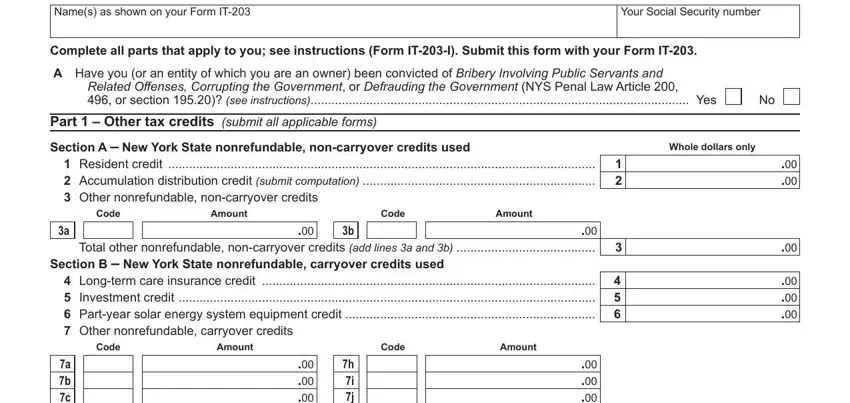

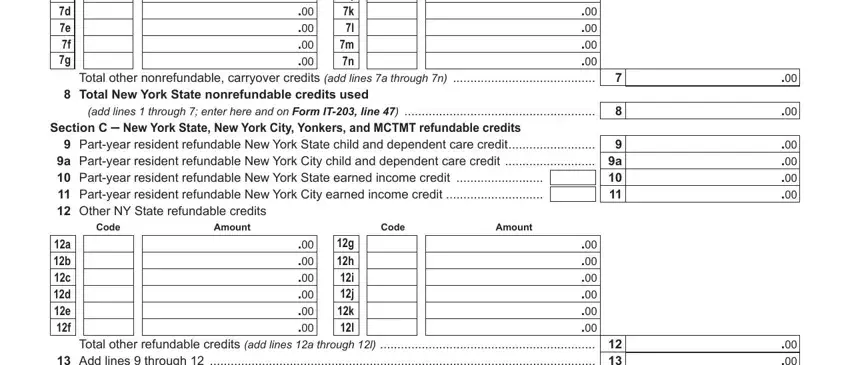

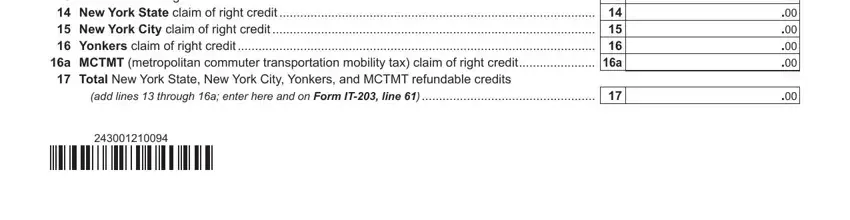

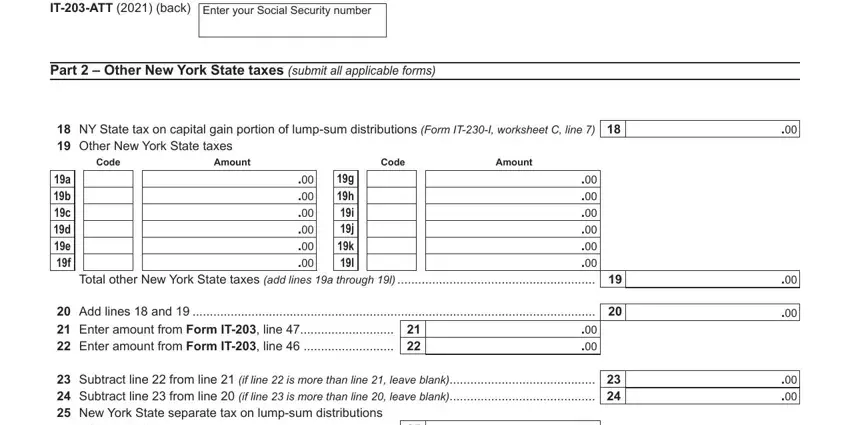

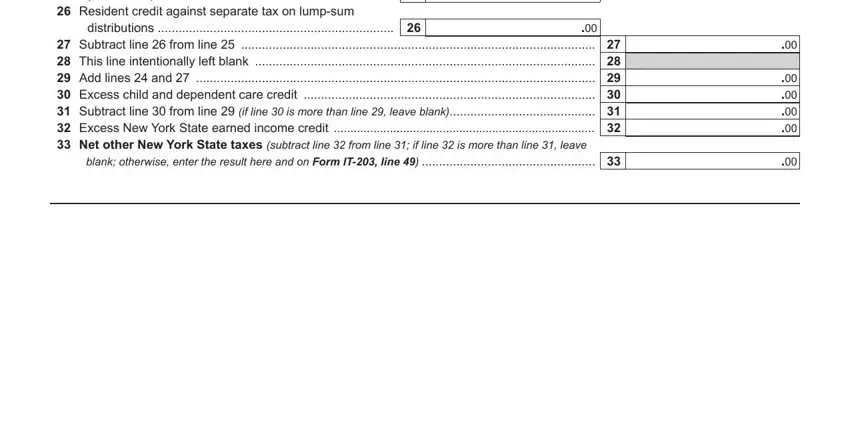

The PDF form you desire to create will consist of the following parts:

Feel free to submit the a b c d e f g, Total other nonrefundable, h i j k l m n, Total New York State, add lines through enter here and, Section C New York State New York, Code, Amount, Code, Amount, a b c d e f, and g h i j k l Total other refundable box with the necessary information.

Highlight the most crucial details about the g h i j k l Total other refundable, and add lines through a enter here field.

When it comes to paragraph ITATT back, Enter your Social Security number, Part Other New York State taxes, NY State tax on capital gain, Code, Amount, Code, Amount, a b c d e f, g h i j k l Total other New York, Add lines and Enter amount, and Subtract line from line if line, indicate the rights and responsibilities.

Check the fields Form IT, Resident credit against separate, distributions, Subtract line from line This, and blank otherwise enter the result and then complete them.

Step 3: Select "Done". It's now possible to transfer your PDF form.

Step 4: Get a minimum of several copies of your form to keep away from all of the potential problems.