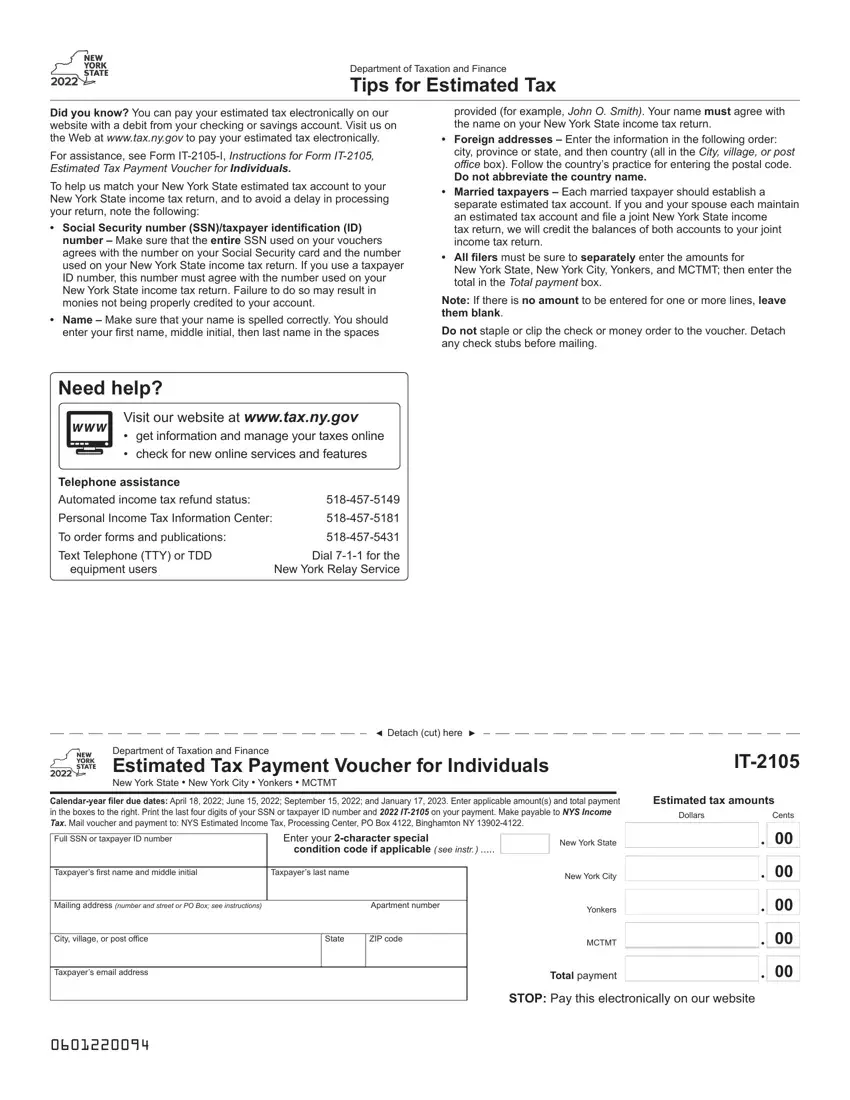

It shouldn’t be difficult to complete it 2105 i making use of our PDF editor. Here's how it is easy to successfully create your template.

Step 1: On the following web page, hit the orange "Get form now" button.

Step 2: When you have entered the editing page it 2105 i, you should be able to find each of the actions available for the document in the upper menu.

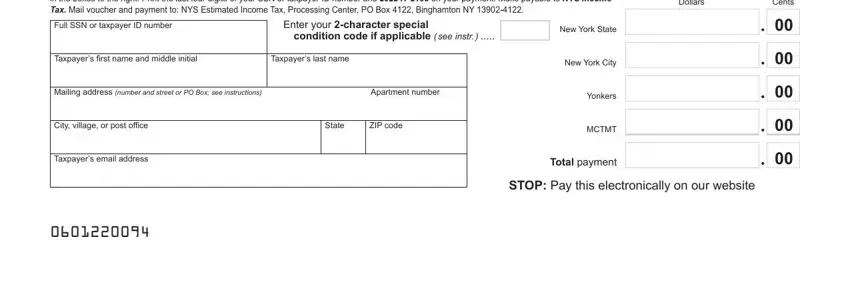

For every single area, prepare the data requested by the software.

Step 3: As soon as you press the Done button, your prepared form can be transferred to each of your devices or to email specified by you.

Step 4: Try to get as many duplicates of the form as possible to prevent possible troubles.