Within the sphere of commercial fishing operations, understanding and efficiently managing taxation and applicable refunds is crucial for financial management and compliance. The Au 631 form, issued by the New York State Department of Taxation and Finance, serves as a vital tool for individuals and entities engaged in commercial fishing, allowing them to claim refunds or reimbursements for taxes paid on fuel used in vessels for this purpose. Structured under the guidelines of Tax Law — Articles 12-A, 13-A, 28, and 29, the form addresses various tax components including motor fuel excise, diesel motor fuel excise, and petroleum business taxes, alongside state and local sales taxes. Detailed instructions guide the claimant through the process, requiring specific information such as the Employer Identification Number (EIN) or Social Security Number (SSN), legal and DBA names, detailed vessel information, and a comprehensive breakdown of fuel purchases and taxes paid. The provisions for a third-party designee and the stringent certification requirement underscore the form's emphasis on accuracy and accountability. Furthermore, the document outlines clear eligibility criteria, filing timelines, and the necessity for proper documentation, ensuring claimants are well-informed of their obligations and rights. With its comprehensive approach, the Au 631 form stands as an essential document for those within the commercial fishing sector seeking to navigate the complexities of tax refunds and reimbursements with ease and precision.

| Question | Answer |

|---|---|

| Form Name | Form Au 631 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | au631_411 town of north hempstead taxes form |

New York State Department of Taxation and Finance

Claim for Refund/Reimbursement of Taxes Paid on Fuel Used in a Vessel Engaged in Commercial Fishing

Tax Law — Articles

(4/11)

Employer identiication number (EIN) or social security number (SSN) Business telephone number

( )

Legal name

For tax period:

Beginning |

|

Ending |

|

|

/ |

/ |

/ |

/ |

|

For office use only

DBA (doing business as) name (if different from legal name) |

Total approved |

Street address |

Audited by |

Date |

City, state, and ZIP code |

Approved by |

Date |

Name of vessel |

Approved by |

Date |

|

|

|

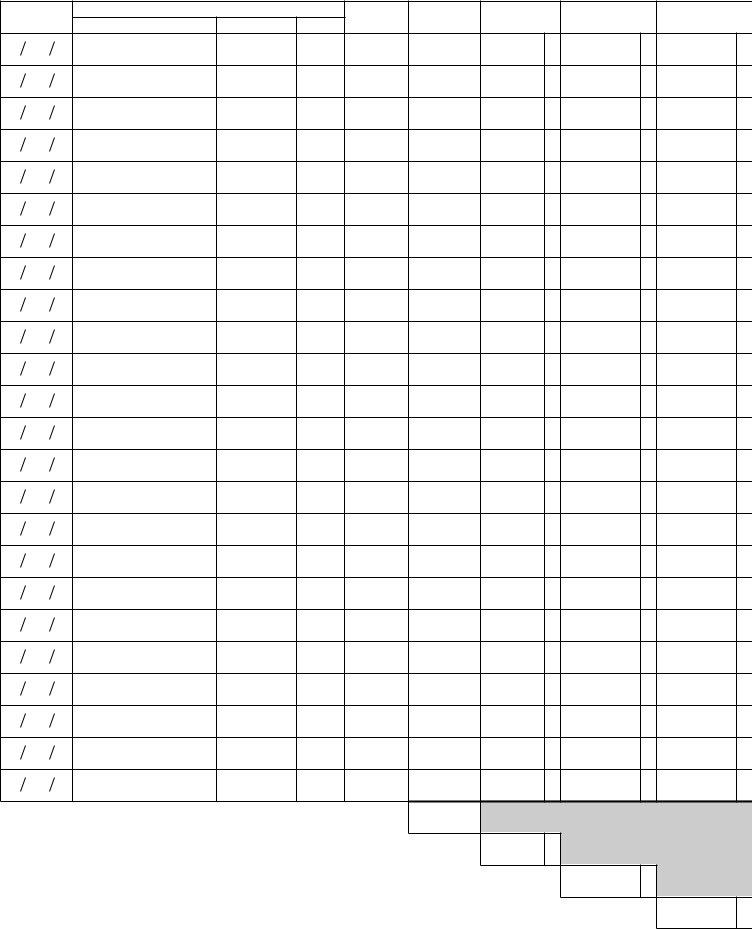

Column A |

Column B |

Column C |

||

Computation of Refund/Reimbursement |

Gallons (from schedules) |

Tax paid (from schedules) |

Totals |

||||

|

Motor fuel excise tax paid |

|

|

|

|

|

|

1 |

1 |

|

|

|

|

|

|

2 |

Diesel motor fuel excise tax paid |

2 |

|

|

|

|

|

3 |

Total Article 12‑A reimbursement requested |

|

|

|

|

|

|

|

(add lines 1 and 2, Column B) |

3 |

|

|

|

|

|

4 |

Petroleum business tax paid (motor fuel) |

4 |

|

|

|

|

|

5 |

Petroleum business tax paid (diesel motor fuel) .... |

5 |

|

|

|

|

|

6 |

Total Article 13‑A reimbursement requested |

|

|

|

|

|

|

|

(add lines 4 and 5, Column B) |

6 |

|

|

|

|

|

7 |

State and local sales tax (motor fuel) |

7 |

|

|

|

|

|

8 |

State and local sales tax (diesel motor fuel) |

8 |

|

|

|

|

|

9 |

Total state and local sales tax refund requested |

|

|

|

|

|

|

|

(add lines 7 and 8, Column B) |

9 |

|

|

|

|

|

10 |

Total refund/reimbursement requested (add lines 3, |

|

|

|

|

|

|

|

6 and 9, Column C) |

10 |

|

|

|

|

|

Third –

party

designee

Do you want to allow another person to discuss this claim with the Tax Dept? (see instructions) |

Yes |

|

|

(complete the following) No |

|

||||||||

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

||||

Designee’s name |

Designee’s phone number |

|

Personal identiication |

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||||||

|

( |

) |

|

number (PIN) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certification: I declare that to the best of my knowledge and belief this claim is just true, and correct. I understand that a willfully false representation is a misdemeanor under sections 1812, 1812(f), and 1817 of the New York State Tax Law and section 210.45 of the Penal Law, punishable by imprisonment for up to a year and a ine of up to $10,000 for an individual or $20,000 for a corporation. I understand that the Tax Department is authorized to investigate the validity of the exemption claimed or the accuracy of any information entered on this form.

Signature of authorized person |

|

|

Oficial title |

|

Date |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

Preparer’s signature |

|

Date |

Preparer’s NYTPRIN |

Preparer’s SSN or PTIN |

|

Mark |

|

|

|||

preparer |

|

|

|

|

|

|

|

|

|

an X if |

|

|

|

|

|

|

|

|

|

|

|

||||

use |

Preparer’s irm name (or yours, if |

Firm’s EIN |

|

|

|

|

|

|

|

|

||

only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

Telephone number |

||||

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail to: NYS TAX DEPARTMENT, FUEL TAX REFUND UNIT, PO BOX 5501, ALBANY NY

Page 2 of 4

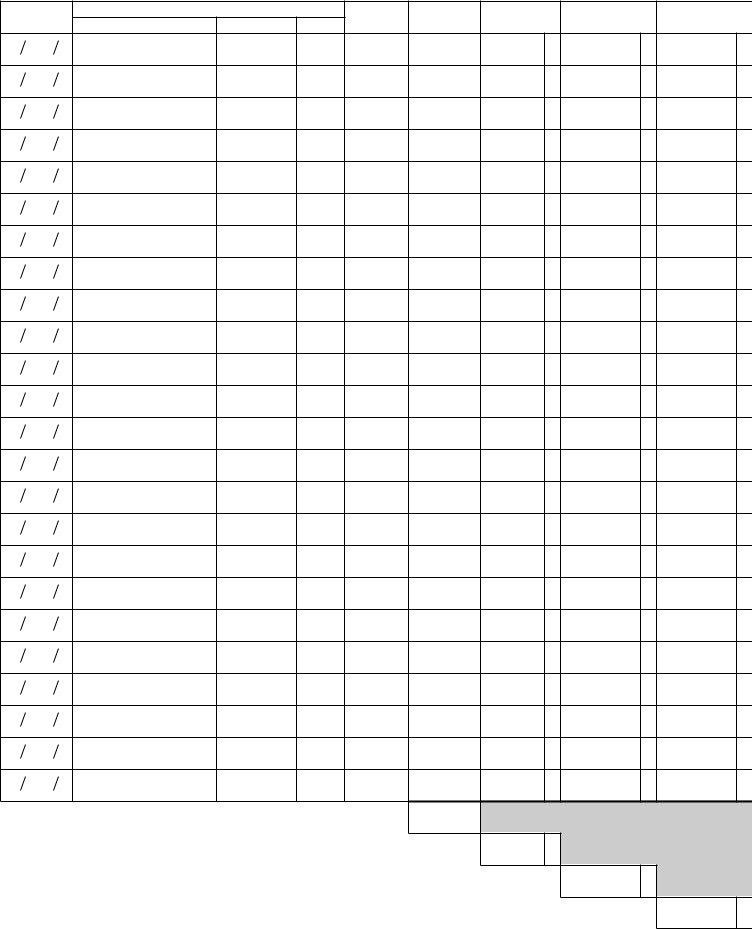

Schedule A - Motor Fuel Purchases

(Attach additional sheets if necessary.)

Date of |

|

Seller’s |

|

Invoice |

Number of |

Excise |

Petroleum business |

Sales |

purchase |

Name |

City |

County |

number |

gallons |

tax paid |

tax paid |

tax paid |

11 Total gallons purchased (enter here and on lines 1, 4, and 7, Column A) ........

12 Total excise tax paid/reimbursement claimed (enter here and on line 1, Column B) ..........

13 Total petroleum business tax paid/reimbursement claimed (enter here and on line 4, Column B) .............

14 Total state and local sales tax paid/refund claimed (enter here and on line 7, Column B) ......................................................

Schedule B - Diesel Motor Fuel Purchases

(Attach additional sheets if necessary.)

Date of |

|

Seller’s |

|

Invoice |

Number of |

Excise |

Petroleum business |

Sales |

purchase |

Name |

City |

County |

number |

gallons |

tax paid |

tax paid |

tax paid |

15 Total gallons purchased (enter here and on lines 2, 5, and 8, Column A) ........

16 Total excise tax paid/reimbursement claimed (enter here and on line 2, Column B) ..........

17 Total petroleum business tax paid/reimbursement claimed (enter here and on line 5, Column B) .............

18 Total state and local sales tax paid/refund claimed (enter here and on line 8, Column B) ......................................................

Page 4 of 4

Instructions

Who may use this form

Any person who is a commercial fisherman, deined as a person licensed by an appropriate federal or state agency for the purpose of engaging in the commercial harvesting of fish and who is engaged in the business of harvesting fish for sale, must use this form to claim a refund/reimbursement of the motor fuel or diesel motor fuel excise tax, the petroleum business tax, and the state and local sales tax on the fuel purchased for use in the operation of a commercial ishing vessel engaged in the harvesting of ish for sale.

When to File

A claim for refund/reimbursement should be iled for a full monthly period; however, a claimant may include more than one month in a single claim. Each monthly period should begin on the irst and end on the last day of a calendar month.

Claims for reimbursement of the motor fuel or diesel motor fuel excise tax and the petroleum business tax must be iled within three years from the date of purchase. Claims for refund of the New York State and local sales tax should be iled within three years from the date the tax was due.

General Instructions

In order to expedite the processing of a refund/reimbursement claim, a claimant must furnish the necessary substantiation and adhere to the following procedures:

•You must complete the entire claim form, including schedules A and B. Attach a worksheet, if necessary, and include adding machine tapes if the worksheet is not computer‑generated.

•You must furnish legible copies of purchase invoices showing each tax (motor fuel and/or diesel motor fuel excise tax, petroleum business tax, and sales tax) listed separately.

•You must include a copy of your current United States Coast Guard documentation, if your vessel is required to be documented, and with the irst claim each calendar year include a copy of your current Federal Fisheries Permit and/or your current license issued by the New York State Department of Environmental Conservation.

•You must include the telephone number for your business in case we need to contact you concerning your refund/reimbursement.

Additional documentation may be requested by the Tax Department upon review of the refund/reimbursement claim submitted.

If you want to authorize another person (third‑party designee) to discuss your claim with the New York State Tax Department, mark an X in the Yes box in the

If you mark the Yes box, you are authorizing the Tax Department to discuss with the designee any questions that may arise during the processing of your claim. You are also authorizing the designee to:

•give the Tax Department any information that is missing from your claim;

•call the Tax Department for information about the processing of your claim or the status of your refund; and

•respond to certain Tax Department notices that you shared with the designee about math errors, offsets, and claim preparation. The notices will not be sent to the designee.

You are not authorizing the designee to receive your refund check, bind you to anything (including any additional tax liability), or otherwise represent you before the Tax Department. If you want the designee to perform those services for you, you must ile Form POA‑1, Power of Attorney, making that designation with the Tax Department. Copies of statutory tax notices or documents (such as a Notice of Deficiency) will only be sent to your designee if you ile Form POA‑1.

You cannot revoke the third‑party designee authorization or change the PIN. However, the authorization will automatically end on the due date (without regard to extensions) for iling your claim.

Paid preparer

If you pay someone to prepare Form

must also sign it and ill in the other blanks in the paid preparer’s area. If someone prepares Form

that person should not sign it.

Note to paid preparers — When signing Form

Line instructions

Lines 1 and 2 — Enter the number of gallons and applicable excise tax paid from Schedule A and Schedule B.

Lines 4 and 5 — Enter the number of gallons and applicable petroleum business tax paid from Schedule A and Schedule B.

Lines 7 and 8 — Enter the number of gallons and applicable state and local sales tax paid from Schedule A and Schedule B.

Schedules A and B

Complete all columns of Schedules A and B. Enter information for those purchases for which a refund/reimbursement is claimed. Attach copies of all invoices listed. Attach additional sheets if necessary. Be sure to total the Number of gallons, Excise tax paid, Petroleum business tax paid and Sales tax paid columns. The totals of these columns must be carried to the front page as indicated.

Need help?

Internet access: www.tax.ny.gov

(for information, forms, and publications)

Miscellaneous Tax Information Center: |

(518) |

To order forms and publications: |

(518) |

Text Telephone (TTY) Hotline |

|

(for persons with hearing and |

|

speech disabilities using a TTY): |

(518) |

Privacy notification — The Commissioner of Taxation and Finance may collect and maintain personal information pursuant to the New York State

Tax Law, including but not limited to, sections 5‑a, 171, 171‑a, 287, 308, 429, 475, 505, 697, 1096, 1142, and 1415 of that Law; and may require disclosure of social security numbers pursuant to 42 USC 405(c)(2)(C)(i).

This information will be used to determine and administer tax liabilities and, when authorized by law, for certain tax offset and exchange of tax information programs as well as for any other lawful purpose.

Information concerning quarterly wages paid to employees is provided to certain state agencies for purposes of fraud prevention, support enforcement, evaluation of the effectiveness of certain employment and training programs and other purposes authorized by law.

Failure to provide the required information may subject you to civil or criminal penalties, or both, under the Tax Law.

This information is maintained by the Manager of Document Management, NYS Tax Department, W A Harriman Campus, Albany NY 12227; telephone (518) 457‑5181.