When you need to fill out form chapter 7, there's no need to download any kind of software - simply use our PDF editor. To keep our editor on the leading edge of efficiency, we work to adopt user-driven capabilities and improvements regularly. We're routinely happy to receive feedback - help us with reshaping how we work with PDF docs. To start your journey, go through these basic steps:

Step 1: Click the "Get Form" button in the top part of this page to open our editor.

Step 2: The editor offers the ability to modify most PDF documents in a range of ways. Improve it by including your own text, correct what is originally in the file, and place in a signature - all close at hand!

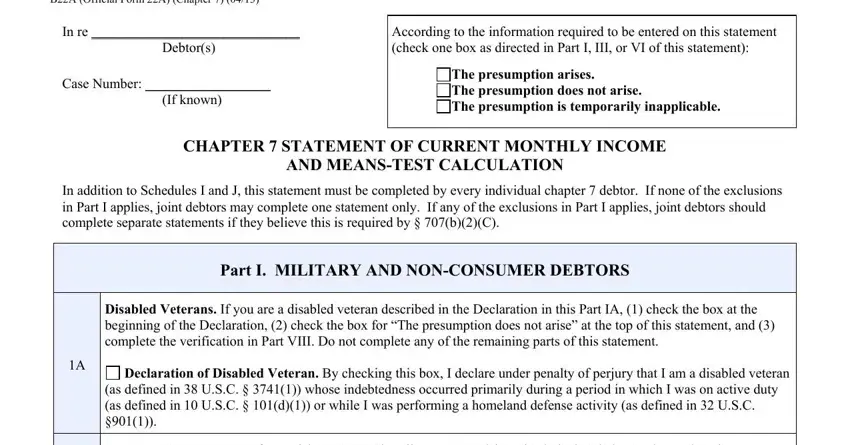

In order to finalize this PDF form, make sure that you type in the required details in every blank field:

1. First of all, when filling in the form chapter 7, beging with the page that includes the subsequent fields:

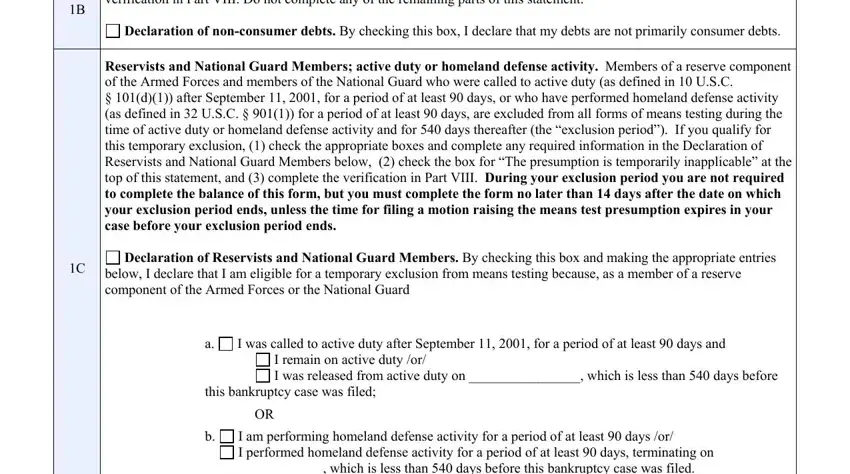

2. The next part is to submit the next few blanks: Nonconsumer Debtors If your debts, Declaration of nonconsumer debts, Reservists and National Guard, Declaration of Reservists and, below I declare that I am eligible, I was called to active duty after, I remain on active duty or I was, a this bankruptcy case was filed, I am performing homeland defense, and b which is less than days before.

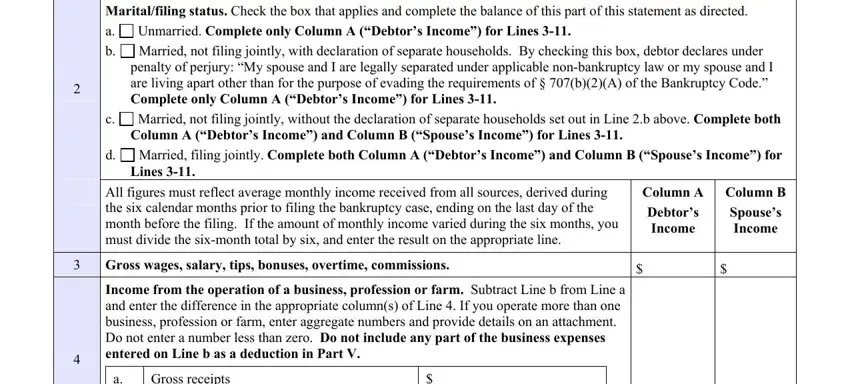

3. The following segment is about Maritalfiling status Check the box, Unmarried Complete only Column A, Married not filing jointly with, Married not filing jointly without, Married filing jointly Complete, All figures must reflect average, Column A, Column B, Debtors Income, Spouses Income, Gross wages salary tips bonuses, Income from the operation of a, Gross receipts Ordinary and, and Subtract Line b from Line a - complete all of these empty form fields.

Many people frequently make some errors while completing Column B in this area. Be certain to reread what you enter here.

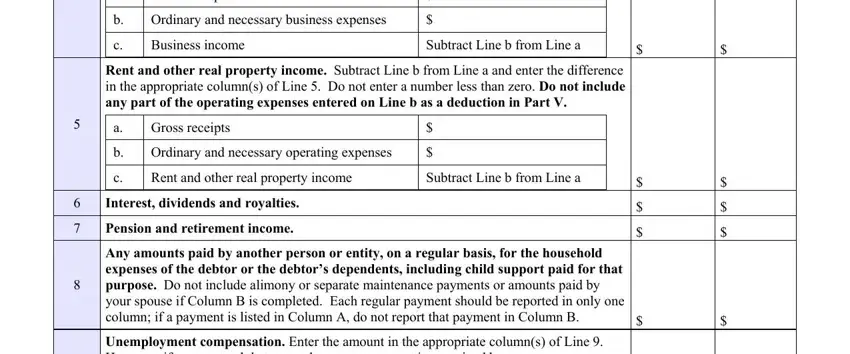

4. The form's fourth subsection arrives with all of the following form blanks to fill out: Income from the operation of a, Gross receipts Ordinary and, Subtract Line b from Line a, Rent and other real property, Gross receipts Ordinary and, Subtract Line b from Line a, Interest dividends and royalties, Any amounts paid by another person, and Unemployment compensation Enter.

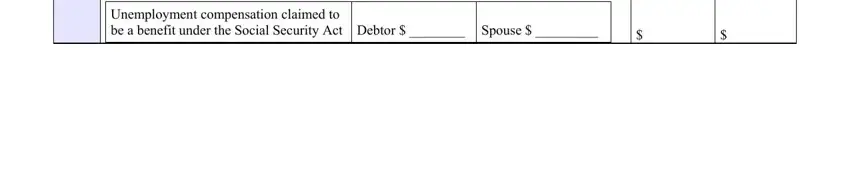

5. Since you come close to the final sections of this form, you will find just a few more requirements that must be satisfied. In particular, Unemployment compensation claimed, Debtor, and Spouse should be filled out.

Step 3: Prior to obtaining the next step, ensure that all blanks are filled in the proper way. When you are satisfied with it, click on “Done." Join FormsPal now and easily get form chapter 7, set for download. Each and every change made is conveniently preserved , so that you can edit the file at a later time when necessary. If you use FormsPal, you can complete forms without worrying about data leaks or entries getting shared. Our secure software makes sure that your personal details are stored safely.