BOE-261-G (P1) REV. 22 (05-13)

2014 CLAIM FOR DISABLED VETERANS’ PROPERTY TAX EXEMPTION

Ilolqj# ghdgolqhv# ydu|# ghshqglqj# xsrq# wkh# hyhqw# zklfk# d# fodlpdqw# lv# olqj1# Sohdvh#vhh#lqvwuxfwlrqv#rq#sdjh#6#iru#olqj#ghdgolqhv1#

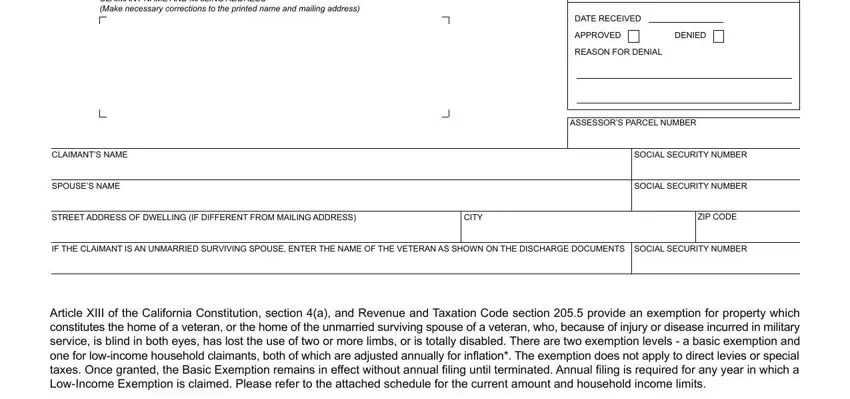

CLAIMANT NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

Kristen Spears, Placer County Assessor

2980 Richardson Drive Auburn, CA 95603-2640

Phone: (530) 889-4300

Email: assessor@placer.ca.gov

FOR ASSESSOR’S USE ONLY

DATE RECEIVED

APPROVED DENIED

REASON FOR DENIAL

ASSESSOR’S PARCEL NUMBER

STREET ADDRESS OF DWELLING (IF DIFFERENT FROM MAILING ADDRESS)

IF THE CLAIMANT IS AN UNMARRIED SURVIVING SPOUSE, ENTER THE NAME OF THE VETERAN AS SHOWN ON THE DISCHARGE DOCUMENTS

Article XIII of the California Constitution, section 4(a), and Revenue and Taxation Code section 205.5 provide an exemption for property which constitutes the home of a veteran, or the home of the unmarried surviving spouse of a veteran, who, because of injury or disease incurred in military

service, is blind in both eyes, has lost the use of two or more limbs, or is totally disabled. There are two exemption levels - a basic exemption and rqh#iru#orz0lqfrph#krxvhkrog#fodlpdqwv/#erwk#ri#zklfk#duh#dgmxvwhg#dqqxdoo|#iru#lqdwlrq-1#Wkh#h{hpswlrq#grhv#qrw#dsso|#wr#gluhfw#ohylhv#ru#vshfldo# wd{hv1#Rqfh#judqwhg/#wkh#Edvlf#H{hpswlrq#uhpdlqv#lq#hiihfw#zlwkrxw#dqqxdo#olqj#xqwlo#whuplqdwhg1#Dqqxdo#olqj#lv#uhtxluhg#iru#dq|#|hdu#lq#zklfk#d#

Low-Income Exemption is claimed. Please refer to the attached schedule for the current amount and household income limits.

Totally disabled means that the United States Veterans Administration or the military service from which discharged has rated the disability at 100 percent or has rated the disability compensation at 100 percent by reason of being unable to secure or follow a substantially gainful occupation.

The Disabled Veterans’ Property Tax Exemption is also available to the unmarried surviving spouse of a veteran who, as a result of service- connected injury or disease: 1) died either while on active duty in the military service or after being honorably discharged and 2) served either in time of war or in time of peace in a campaign or expedition for which a medal has been issued by Congress. This law provides that the Veterans Administration shall determine whether an injury or disease is service-connected.

The Disabled Veterans’ Property Tax Exemption provides for the cancellation or refund of taxes paid 1) when property becomes eligible after the olhq#gdwh#+qhz#dftxlvlwlrq#ru#rffxsdqf|#ri#d#suhylrxvo|#rzqhg#surshuw|,#ru#5,#xsrq#d#yhwhudqᄊv#glvdelolw|#udwlqj#ru#ghdwk1#Wklv#ixuwkhu#surylghv#iru#

the termination of the exemption on the date of sale or transfer of a property to a third party who is not eligible for the exemption or on the date a person previously eligible for the exemption becomes ineligible.

*As provided by Revenue and Taxation Code section 205.5, the exemption amount and the household income limit shall be compounded annually e|#dq#lqdwlrq#idfwru#wlhg#wr#wkh#Fdoliruqld#Frqvxphu#Sulfh#Lqgh{1#

ThIS DOCUMENT IS NOT SUBjECT TO PUBLIC INSPECTION

BOE-261-G (P2) REV. 22 (05-13)

STATEMENTS

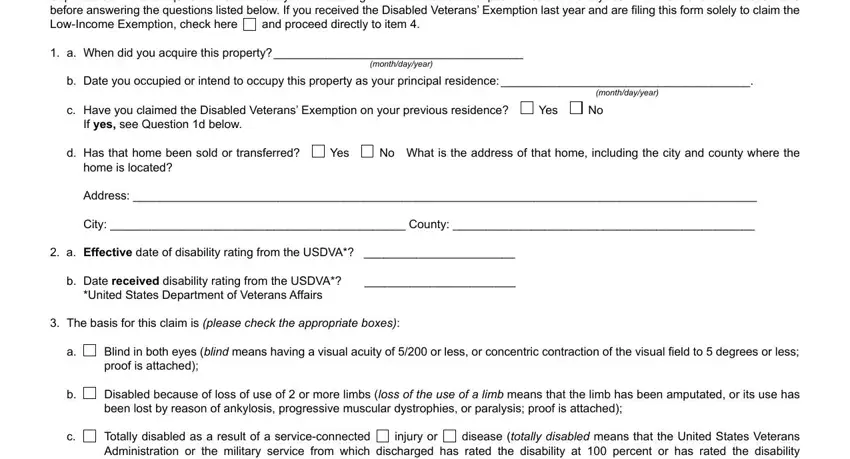

Wklv#fodlp#irup#pd|#eh#xvhg#wr#oh#iru#wkh#Glvdeohg#Yhwhudqvᄊ#H{hpswlrq#iru#wkh#uhjxodu#dvvhvvphqw#uroo#dqg#wkh#vxssohphqwdo#dvvhvvphqw#uroo1# Vhsdudwh#fodlpv#duh#uhtxluhg#iru#hdfk#vfdo#|hdu#zkhq#olqj#wkh#Orz0Lqfrph#H{hpswlrq1#Sohdvh#fduhixoo|#uhdg#wkh#lqirupdwlrq#dqg#lqvwuxfwlrqv# ehiruh#dqvzhulqj#wkh#txhvwlrqv#olvwhg#ehorz1#Li#|rx#uhfhlyhg#wkh#Glvdeohg#Yhwhudqvᄊ#H{hpswlrq#odvw#|hdu#dqg#duh#olqj#wklv#irup#vroho|#wr#fodlp#wkh#

Low-Income Exemption, check here |

and proceed directly to item 4. |

41# d1# Zkhq#glg#|rx#dftxluh#wklv#surshuw|B#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb#

(month/day/year)

#e1# Gdwh#|rx#rffxslhg#ru#lqwhqg#wr#rffxs|#wklv#surshuw|#dv#|rxu#sulqflsdo#uhvlghqfh=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb1#

|

|

|

|

|

|

(month/day/year) |

# |

f1# Kdyh#|rx#fodlphg#wkh#Glvdeohg#Yhwhudqvᄊ#H{hpswlrq#rq#|rxu#suhylrxv#uhvlghqfhB# |

Yes |

No |

|

|

If yes, see Question 1d below. |

|

|

|

|

# |

g1# Kdv#wkdw#krph#ehhq#vrog#ru#wudqvihuuhgB# |

Yes |

No What is the address of that home, including the city and county where the |

# |

# |

krph#lv#orfdwhgB# |

|

|

|

|

#Dgguhvv=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb#

#Flw|=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb#Frxqw|=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb#

2.a. Effective#gdwh#ri#glvdelolw|#udwlqj#iurp#wkh#XVGYD-B###bbbbbbbbbbbbbbbbbbbbbbb

b. Date received#glvdelolw|#udwlqj#iurp#wkh#XVGYD-B#######bbbbbbbbbbbbbbbbbbbbbbb

# -Xqlwhg#Vwdwhv#Ghsduwphqw#ri#Yhwhudqv#Diidluv

3.The basis for this claim is (please check the appropriate boxes):

a.

# # #

b.

# # #

c.

# # #

Blind in both eyes (blind#phdqv#kdylqj#d#ylvxdo#dfxlw|#ri#82533#ru#ohvv/#ru#frqfhqwulf#frqwudfwlrq#ri#wkh#ylvxdo#hog#wr#8#ghjuhhv#ru#ohvv># surri#lv#dwwdfkhg,>#

Disabled because of loss of use of 2 or more limbs (orvv#ri#wkh#xvh#ri#d#olpe#means that the limb has been amputated, or its use has ehhq#orvw#e|#uhdvrq#ri#dqn|orvlv/#surjuhvvlyh#pxvfxodu#g|vwursklhv/#ru#sdudo|vlv>#surri#lv#dwwdfkhg,>#

Totally disabled as a result of a service-connected injury or disease (totally disabled means that the United States Veterans

Administration or the military service from which discharged has rated the disability at 100 percent or has rated the disability frpshqvdwlrq#dw# 433#shufhqw#e|#uhdvrq#ri#ehlqj#xqdeoh#wr#vhfxuh#ru#iroorz#d#vxevwdqwldoo|#jdlqixo#rffxsdwlrq>#surri#lv#dwwdfkhg,>#

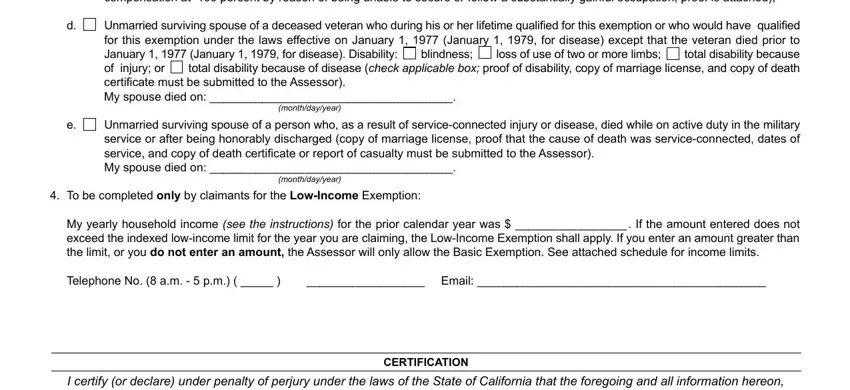

d. # Xqpduulhg#vxuylylqj#vsrxvh#ri#d#ghfhdvhg#yhwhudq#zkr#gxulqj#klv#ru#khu#olihwlph#txdolhg#iru#wklv#h{hpswlrq#ru#zkr#zrxog#kdyh# txdolhg#

|

|

|

|

|

|

|

|

|

|

|

for this exemption under the laws effective on January 1, 1977 (January 1, 1979, for disease) except that the veteran died prior to |

|

|

|

January 1, 1977 (January 1, 1979, for disease). Disability: # eolqgqhvv># |

# orvv#ri#xvh#ri#wzr#ru#pruh#olpev># |

total disability because |

# |

# |

# |

ri# lqmxu|>#ru# |

total disability because of disease (check applicable box; proof of disability, copy of marriage license, and copy of death |

# |

# |

# |

fhuwlfdwh#pxvw#eh#vxeplwwhg#wr#wkh#Dvvhvvru,1# |

|

|

|

# |

# |

# |

P|#vsrxvh#glhg#rq=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb1# |

# |

# |

|

(month/day/year)

Unmarried surviving spouse of a person who, as a result of service-connected injury or disease, died while on active duty in the military

service or after being honorably discharged (copy of marriage license, proof that the cause of death was service-connected, dates of vhuylfh/#dqg#frs|#ri#ghdwk#fhuwlfdwh#ru#uhsruw#ri#fdvxdow|#pxvw#eh#vxeplwwhg#wr#wkh#Dvvhvvru,1#

P|#vsrxvh#glhg#rq=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb1

(month/day/year)

4. To be completed only by claimants for the Low-Income Exemption:

My yearly household income (see the instructions) iru#wkh#sulru#fdohqgdu#|hdu#zdv#'#bbbbbbbbbbbbbbbbb#1#Li#wkh#dprxqw#hqwhuhg#grhv#qrw# exceed the indexed low-income limit for the year you are claiming, the Low-Income Exemption shall apply. If you enter an amount greater than the limit, or you do not enter an amount, the Assessor will only allow the Basic Exemption. See attached schedule for income limits.

# |

Whohskrqh#Qr1#+;#d1p1#0#8#s1p1,#+#bbbbb#,# |

#bbbbbbbbbbbbbbbbbb# ###Hpdlo=#bbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbbb# |

CERTIFICATION

L#fhuwli|#+ru#ghfoduh,#xqghu#shqdow|#ri#shumxu|#xqghu#wkh#odzv#ri#wkh#Vwdwh#ri#Fdoliruqld#wkdw#wkh#iruhjrlqj#dqg#doo#lqirupdwlrq#khuhrq/#

lqfoxglqj#dq|#dffrpsdq|lqj#vwdwhphqwv#ru#grfxphqwv/#lv#wuxh/#fruuhfw#dqg#frpsohwh#wr#wkh#ehvw#ri#p|#nqrzohgjh#dqg#eholhi1#

SIGNATURE OF PERSON MAKING CLAIM

w

BOE-261-G (P3) REV. 22 (05-13)

GENERAL INFORMATION

There are a number of alternatives by which a Disabled Veterans’ Property Tax Exemption may be granted:

Alternative 1: The exemption is available to an eligible owner or the veteran spouse of an owner of a dwelling that is occupied as the principal

place of residence for the veteran as of: a)#45=34#d1p1#Mdqxdu|#4#hdfk#|hdu>#b)#wkh#gdwh#ri#wkh#yhwhudqᄊv#txdoli|lqj#glvdelolw|#ru#frpshqvdwlrq#udwlqj# iurp#wkh#XVGYD>#c)#wkh#gdwh#uhvlghqf|#lv#hvwdeolvkhg#dw#d#surshuw|#douhdg|#rzqhg#e|#wkh#txdoli|lqj#fodlpdqw>#ru#d) the date the veteran died as a

result of a service connected injury or disease where the unmarried surviving spouse is the claimant.

Alternative 2: The exemption is available to an eligible owner or veteran spouse of the owner of a dwelling subject to supplemental assessment(s) resulting from a change in ownership or completion of new construction on or after January 1, provided:

(a)The owner or the owner’s veteran spouse occupies or intends to occupy the property as his or her principal place of residence within 90 days after the change in ownership or completion of construction, and

(b)The property is not already receiving the Disabled Veterans’ Exemption or another property tax exemption of greater value. If the property received an exemption of lesser value on the current roll, the difference in the amount between the two exemptions shall be applied to the supplemental assessment.

(c)The owner does not own other property which is currently receiving the Disabled Veterans’ Exemption.

Exemption under Alternative 2 will apply to the supplemental assessment(s), if any, and any remaining exemption amount may be applied toward the regular assessment.

Effective date: The Disabled Veteran’s Exemption applies beginning on: 1) the effective date, as determined by the USDVA, of a disability rating wkdw#txdolhv#wkh#fodlpdqw#iru#wkh#h{hpswlrq/#ru#5,#wkh#gdwh#wkh#fodlpdqw#sxufkdvhv#dqg2ru#pryhv#lqwr#d#txdolhg#surshuw|/#ru#6,#wkh#gdwh#ri#d# txdolhg#yhwhudqᄊv#ghdwk#zkhuh#wkh#xqpduulhg#vxuylylqj#vsrxvh#lv#wkh#fodlpdqw1#

To obtain the exemption, the claimant must be an owner or co-owner, a veteran spouse of an owner, a purchaser named in a contract of sale, or a

shareholder in a corporation where the rights of shareholding entitle the claimant to possession of a home owned by the corporation. The dwelling pd|#eh#dq|#sodfh#ri#uhvlghqfh#vxemhfw#wr#surshuw|#wd{>#d#vlqjoh0idplo|#uhvlghqfh/#d#vwuxfwxuh#frqwdlqlqj#pruh#wkdq#rqh#gzhoolqj#xqlw/#d#frqgrplqlxp#

or unit in a cooperative housing project, a houseboat, a manufactured home (mobilehome), land you own on which you live in a state-licensed trailer

or manufactured home (mobilehome), whether leased or owned, and the cabana for such a trailer or manufactured home (mobilehome). A dwelling grhv#qrw#txdoli|#iru#wkh#h{hpswlrq#li#lw#lv/#ru#lv#lqwhqghg#wr#eh/#uhqwhg/#ydfdqw#dqg#xqrffxslhg/#ru#wkh#ydfdwlrq#ru#vhfrqgdu|#krph#ri#wkh#fodlpdqw1#

If the Disabled Veterans’ Exemption is granted and the property later becomes ineligible for the exemption, you are responsible for notifying the Assessor of that fact immediately. You will be sent a notice on or shortly after January 1 each year to ascertain whether you have retained your eligibility. Section 279.5 of the Revenue and Taxation Code provides for a penalty of 25 percent of the escape assessment added for failure to notify the Assessor when the property is no longer eligible for the exemption. To avoid the penalty, you must notify the Assessor by the following June 30.

Rqfh#judqwhg/#wkh#Edvlf#H{hpswlrq#uhpdlqv#lq#hiihfw#xqwlo#whuplqdwhg1#Dqqxdo#olqj#lv#uhtxluhg#zkhuh#wkh#Orz#Lqfrph#H{hpswlrq#lv# fodlphg1#Rqfh#whuplqdwhg/#d#qhz#fodlp#irup#pxvw#eh#rewdlqhg#iurp#dqg#ohg#zlwk#wkh#Dvvhvvru#wr#uhjdlq#holjlelolw|1#

DEADLINES FOR TIMELY FILINGS

Alternative 1a: Wkh#ixoo#h{hpswlrq#lv#dydlodeoh#wr#wkh#Orz0Lqfrph#H{hpswlrq#fodlpdqw#li#wkh#olqj#lv#pdgh#e|#8#s1p1#rq#Iheuxdu|#48#ri#hdfk#|hdu1# Li#d#fodlp#iru#wkh#Orz0Lqfrph#h{hpswlrq#lv#ohg#diwhu#wkdw#wlph#exw#e|#8#s1p1#rq#Ghfhpehu#43/#<3#shufhqw#ri#wkh#h{hpswlrq#lv#dydlodeoh1#Iru#fodlpv# ohg#diwhu#wkdw#wlph/#;8#shufhqw#ri#wkh#h{hpswlrq#lv#dydlodeoh1#

Li#d#odwh#ohg#fodlp#lv#pdgh#iru#wkh#Orz0Lqfrph#H{hpswlrq/#vxevhtxhqw#wr#d#wlpho|#ohg#fodlp#iru#wkh#Edvlf#H{hpswlrq/#d#fodlpdqw#vkdoo#txdoli|#iru# <3#shufhqw#ru#;8#shufhqw#ri#wkh#dgglwlrqdo#h{hpswlrq#dprxqw/#ghshqglqj#xsrq#wkh#olqj#gdwh=#

($150,000 - $100,000 = $50,000 x 90% = $45,000 additional exemption amount allowed.)

Alternatives 1b, 1c, and 1d: Wkh# ixoo# h{hpswlrq# lv# dydlodeoh/# surudwhg# wr# wkh# gdwh# ri# holjlelolw|/# li# wkh# olqj# lv# pdgh# rq# ru# ehiruh# January 1 of the year next following the year in which 1) the disability rating was received, or 2) residency is established on a property already owned by the claimant, or 3) the veteran died due to a service-connected injury or disease, or 90 days after any such event, whichever is later.

Wkhuhdiwhu/#li#dq#dssursuldwh#dssolfdwlrq#iru#h{hpswlrq#lv#ohg/#;8#shufhqw#ri#wkh#h{hpswlrq#dydlodeoh#vkdoo#eh#doorzhg/#vxemhfw#wr#d#irxu0|hdu#vwdwxwh#

of limitations.

Alternative 2:#D#ixoo#h{hpswlrq#+xs#wr#wkh#dprxqw#ri#wkh#vxssohphqwdo#dvvhvvphqw/#li#dq|,#lv#dydlodeoh#li#wkh#olqj#lv#pdgh#e|#8#s1p1#rq#wkh#63wk#gd|# iroorzlqj#wkh#qrwlfh#ri#vxssohphqwdo#dvvhvvphqw1# Qlqhw|#suhfhqw#ri#wkh#h{hpswlrq#dydlodeoh#vkdoo#eh#doorzhg/#li#d#fodlp#lv#ohg#diwhu#wkh#63wk#gd|# iroorzlqj#wkh#gdwh#ri#wkh#qrwlfh#ri#vxssohphqwdo#dvvhvvphqw/#exw#rq#ru#ehiruh#wkh#gdwh#rq#zklfk#wkh#uvw#lqvwdoophqw#ri#wd{hv#rq#wkh#vxssohphqwdo# wd{#eloo#ehfrphv#gholqtxhqw1##Wkhuhdiwhu/#li#dq#dssursuldwh#fodlp#lv#ohg/#;8#shufhqw#ri#wkh#h{hpswlrq#vkdoo#eh#doorzhg#vxemhfw#wr#d#irxu#|hdu#vwdwxh# ri#olplwdwlrqv1##Li#qr#vxssohphqwdo#qrwlfh#lv#uhfhlyhg/#wkh#fodlp#pxvw#eh#ohg#rq#ru#ehiruh#wkh#Mdqxdu|#4#iroorzlqj#wkh#gdwh#lq#zklfk#wkh#surshuw|#

was purchased.

INSTRUCTIONS

If your name is printed on the form, make sure that it is correct and complete. Change the printed address if it is incorrect. If you are the unmarried vxuylylqj#vsrxvh#ri#d#yhwhudq/#hqwhu#wkh#yhwhudqᄊv#qdph#dv#vkrzq#rq#wkh#glvfkdujh#grfxphqwv>#li#|rx#duh#xvlqj#|rxu#pdlghq#qdph#ru#d#vxuqdph#

other than the deceased veteran’s name, attach an explanation.

If there are no entries printed on the form when you receive it, enter your full name and mailing address, including your zip code.

BOE-261-G (P4) REV. 22 (05-13)

LOCATION OF THE DWELLING. If the parcel number or the legal description of the property and the address of the dwelling are printed on the form, check to see that they are printed correctly and correct them if they are not. These entries identify the dwelling on which you claim the exemption.

Li#wkh#gzhoolqj#kdv#qr#vwuhhw#dgguhvv/#vr#vwdwh1#Gr#qrw#hqwhu#d#srvw#rifh#er{#qxpehu#iru#wkh#dgguhvv#ri#wkh#gzhoolqj1#

INSTRUCTIONS FOR STATEMENTS

Lwhp#41# Sohdvh#dqvzhu#wkh#dssolfdeoh#txhvwlrqv1#Wkh#Dvvhvvru#zloo#doorz#wkh#surshu#h{hpswlrq+v,1#

Lwhp#51# Sohdvh#dqvzhu#wkh#dssolfdeoh#txhvwlrqv1#

Lwhp#61# D#yhwhudq#pxvw#fkhfn#rqh#ri#wkh#er{hv#+d,/#+e,/#ru#+f,1#Dq#xqpduulhg#vxuylylqj#vsrxvh#pxvw#fkhfn#hlwkhu#er{#+g,#ru#er{#+h,>#li#er{#+g,# is checked, the surviving spouse must also check the box indicating the disability of the deceased veteran. Proof of disability must be attached to the claim. If original documents are forwarded to the Assessor, the Assessor will make a copy and return the originals to you. The unmarried surviving spouse must include both a marriage license and proof of the deceased veteran’s disability.

Item 4. If you are claiming the Low-Income Exemption, compute your household income as determined below and enter the net household income +wrwdo#ri#D#ohvv#wrwdo#ri#E, on item 4 of the claim.

household Income (section 20504)

Household income means all income received by all persons of a household while members of such household. Include only the income of persons who were members of the household during the calendar year prior to the year of this claim (if the claim is for 2012, the income would be for the calendar year 2011.)

The term household lqfoxghv#wkh#fodlpdqw#dqg#doo#rwkhu#shuvrqv/#h{fhsw#erqd#gh#uhqwhuv/#plqruv/#ru#vwxghqwv1#

A.Household income includes:

#+\rx#zloo#qrw#eh#uhtxluhg#wr#dwwdfk#d#olvw#vkrzlqj#|rxu#lqfrph/#exw#vxfk#d#olvw#vkrxog#eh#uhwdlqhg#e|#|rx#iru#dxglw#sxusrvhv1,#

(1)Wages, salaries, tips, and other employee compensation.

(2)Social Security, including the amount deducted for Medi-Care premiums.

(3)Railroad retirement.

(4)Interest and dividends.

(5)Pensions, annuities and disability retirement payments.

(6)SSI/SSP (Supplemental Security Income/State Supplemental Plan), AB (Aid to the Blind), ATD (Aid to Totally Disabled), AFDC (Aid to Families with Dependent Children), and APSB (Aid to the Potentially Self-Supporting Blind).

(7)Rental income (or loss).

(8)Net income (or loss) from a business.

(9)Income (or loss) from the sale of capital assets.

(10)Life insurance proceeds that exceed expenses.

#+44,# Yhwhudqv#ehqhwv#uhfhlyhg#iurp#wkh#Yhwhudqv#Dgplqlvwudwlrq1#

(12)Gifts and inheritances in excess of $300, except between members of the household.

#+46,# Xqhpsor|phqw#lqvxudqfh#ehqhwv1#

(14)Workers compensation for temporary disability (not for permanent disability).

(15)Amounts contributed on behalf of the claimant to a tax sheltered or deferred compensation plan (also a deduction), see (c) below.

(16)Sick leave payments.

(17)Nontaxable gain from the sale of a residence.

(18)Income received by all other household members while they lived in the claimant’s home during the last calendar year except a minor, student, or renter.

B.Adjustments to Income

Section 17072 of the Revenue and Taxation Code provides for an dgmxvwhg#jurvv#lqfrph/#which means, in the case of an individual, gross income minus the following deductions:

(a)Forfeited interest penalty.

(b)Alimony paid.

#+f,# Lqglylgxdo#uhwluhphqw#duudqjhphqw/#Nhrjk#+KU#43,/#Vlpsolhg#Hpsor|hh#Sodq#+VHS,/#ru#VLPSOH#sodqv1#

(d)Employee business expenses.

(e)Moving expenses and deductions of expenses (already taken) for the production of income (or loss) reported in Items 7 (rental), 8 (business), and 9 (sale of capital assets) included in income.

(f)Student loan interest.

(g)Medical savings account.

BOE-261-G (P5) REV. 22 (05-13)

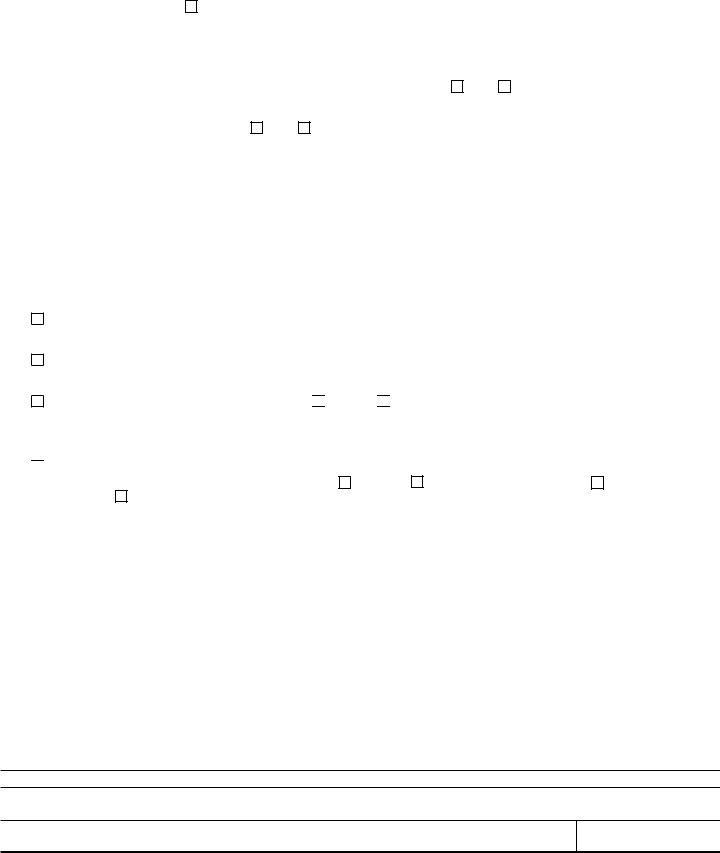

SCHEDULE FOR DISABLED VETERANS’ EXEMPTION

EXEMPTION AMOUNTS AND HOUSEHOLD INCOME LIMITS

Lien Date |

Basic Exemption |

Low-Income Exemption |

#Low-Income household Limit |

|

|

|

|

2014 |

$124,932 |

$187,399 |

$56,101 |

2013 |

$122,128 |

$183,193 |

$54,842 |

2012 |

$119,285 |

$178,929 |

$53,566 |

2011 |

$116,845 |

$175,269 |

$52,470 |

2010 |

$115,060 |

$172,592 |

$51,669 |

2009 |

$114,634 |

$171,952 |

$51,478 |

2008 |

$111,296 |

$166,944 |

$49,979 |

2007 |

$107,613 |

$161,420 |

$48,325 |

2006 |

$103,107 |

$154,661 |

$46,302 |

2005 |

$100,000 |

$150,000 |

$44,907 |

2004 |

$100,000 |

$150,000 |

$44,302 |

2003 |

$100,000 |

$150,000 |

$42,814 |

##