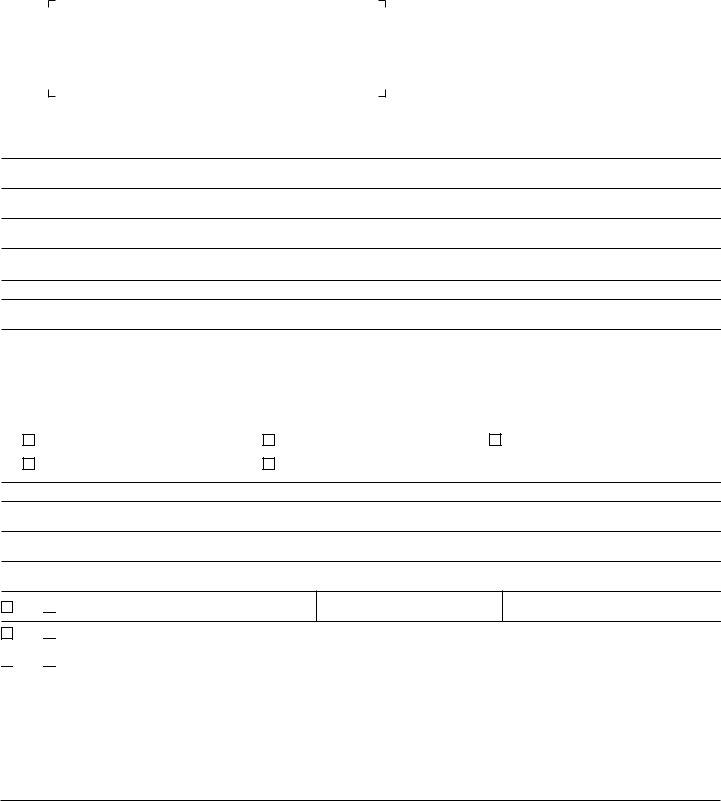

BOE-268-A (P1) REV. 08 (05-12)

PUBLIC SCHOOL EXEMPTION

PROPERTY USED EXCLUSIVELY BY A PUBLIC SCHOOL, COMMUNITY COLLEGE, STATE COLLEGE, STATE UNIVERSITY, OR UNIVERSITY OF CALIFORNIA

FISCAL YEAR OF CLAIM 20 _____ - 20 _____ (SEE INSTRUCTIONS)

SUSAN M. RANOCHAK, Mendocino County Assessor 501 Low Gap Rd., Room 1020

Ukiah, CA 95482 Phone (707) 234-6800 Fax (707) 463-6597

NAME AND MAILING ADDRESS

(Make necessary corrections to the printed name and mailing address)

A claimant must complete and ile this form with the Assessor by February 15.

IDENTIFICATION OF APPLICANT

NAME OF SCHOOL DISTRICT, ORGANIZATION, ETC.

MAILING ADDRESS

CITY, STATE, ZIP CODE

CORPORATE ID (IF ANY)

IDENTIFICATION OF PROPERTY

NAME OF SCHOOL

ADDRESS OF PROPERTY (NUMBER AND STREET)

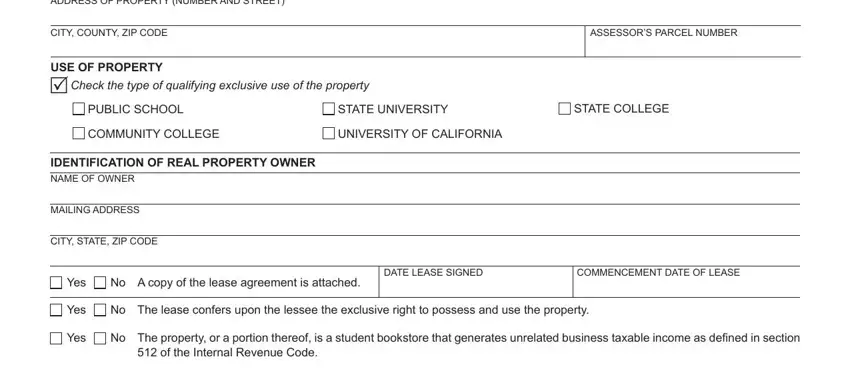

CITY, COUNTY, ZIP CODE |

ASSESSOR’S PARCEL NUMBER |

|

|

USE OF PROPERTY

RCheck the type of qualifying exclusive use of the property

PUBLIC SCHOOL

COMMUNITY COLLEGE

STATE UNIVERSITY

UNIVERSITY OF CALIFORNIA

IDENTIFICATION OF REAL PROPERTY OWNER

NAME OF OWNER

MAILING ADDRESS

CITY, STATE, ZIP CODE

YES NO A copy of the lease agreement is attached.

COMMENCEMENT DATE OF LEASE

YES NO The lease confers upon the lessee the exclusive right to possess and use the property.

YES NO The property, or a portion thereof, is a student bookstore that generates unrelated business taxable income as deined in section 512 of the Internal Revenue Code.

If Yes, a copy of the institution’s most recent tax return iled with the Internal Revenue Service must accompany this afidavit. Property taxes are determined by establishing a ratio of the unrelated business taxable income to the bookstore’s gross

INCOME.

Important: Failure to submit this afidavit will result in denial of the exemption. This claim only applies when lessees are public schools, community colleges, state colleges, state universities or the University of California. Submission of this claim after the due date will result in a portion of the exemption being denied.

THIS DOCUMENT IS SUBJECT TO PUBLIC INSPECTION

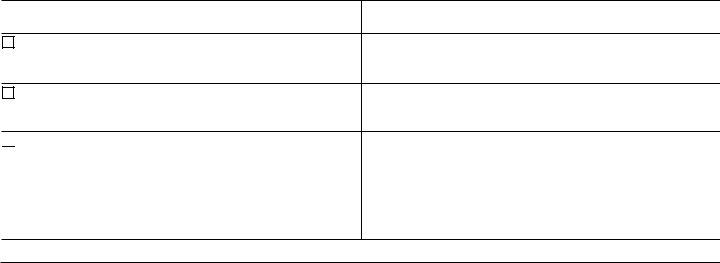

BOE-268-A (P2) REV. 08 (05-12)

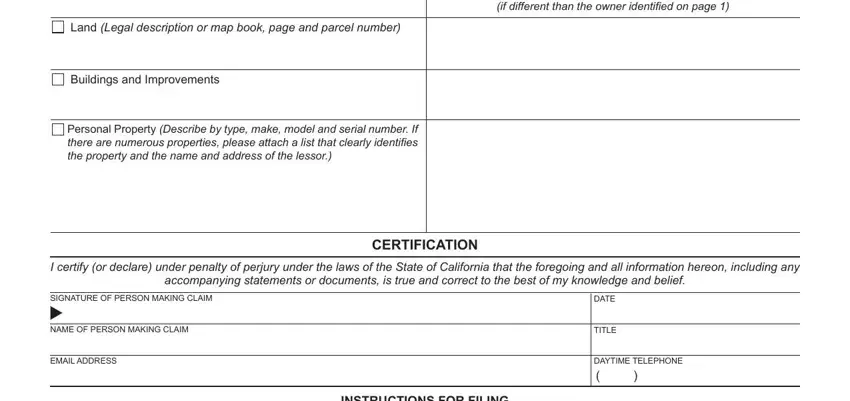

LEASED PROPERTY AS OF JANUARY 1 |

NAME AND ADDRESS OF PROPERTY OWNER |

|

(if different than the owner identiied on page 1) |

LAND (Legal description or map book, page and parcel number)

Buildings and Improvements

Personal Property (Describe by type, make, model and serial number. If there are numerous properties, please attach a list that clearly identiies

the property and the name and address of the lessor.)

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any

accompanying statements or documents, is true and correct to the best of my knowledge and belief.

SIGNATURE OF PERSON MAKING CLAIM |

DATE |

|

t |

|

|

|

|

|

NAME OF PERSON MAKING CLAIM |

TITLE |

|

|

|

EMAIL ADDRESS |

DAYTIME TELEPHONE |

|

( |

) |

|

|

|

INSTRUCTIONS FOR FILING

This afidavit is required under section 3(d) of Article XIII of the Constitution of the State of California and the provisions of sections 202, 202.2, 202.5, 202.6, 251, 254, 255, 259.10, 260, and 270 of the Revenue and Taxation Code.

IMPORTANT NOTICE

A qualifying institution is one whose property is used exclusively for public schools, community colleges, state colleges, state universities, and University of California. It may include off-campus facilities owned or leased by an apprenticeship program sponsor, if such facilities are used exclusively by the public school for classes of related and supplemental instruction for apprentices or trainees conducted by the public school.

It is not necessary for the lessor to also ile the Lessors' Exemption Claim for the property listed. The beneit of a property tax exemption must inure to the lessee institution; the lessee may be entitled to claim a refund of taxes paid by the lessor. (See section 202.2 of the Revenue and Taxation Code.)

Include the terms of the agreement by which the public school obtained the use of real or personal property. When the agreement is in writing, a copy of the document must accompany this claim form.

FILING OF AFFIDAVIT

To receive the full exemption, this form must be iled with the Assessor by February 15. (Section 270 provides a partial exemption for late iling of the Public School Exemption.)

IDENTIFICATION OF APPLICANT

Identify the name of the school, district or organization seeking exemption on the property. Include the mailing address, and corporate identiication number (if any).

IDENTIFICATION OF PROPERTY

Identify the location of the property of which you are seeking exemption; include the parcel number. A separate claim form must be iled for each

LOCATION.

FISCAL YEAR

The iscal year for which an exemption is sought must be entered correctly. The proper iscal year follows the lien date (12:01 a.m., January 1) as of which the taxable or exempt status of the property is determined. For example, a person iling a timely claim in February 2011 would enter “2011-2012” on line four of the claim; a “2010-2011” entry on a claim iled in February 2011 would signify that a late claim was being iled for the preceding iscal year.

USE OF PROPERTY

Please check the applicable box that best describes the type of qualifying use of the property identiied on this claim form. Also check the type of property of which you are seeking exemption. Identify whether your organization, as the lessee of the property, has the exclusive right of possession and use of the property.

IDENTIFICATION OF OWNER

Identify owner of the property, include the mailing address. Indicate if a copy of the lease agreement is attached to the claim form and provide the date the lease was signed and the commencement date of the lease.