With the online PDF tool by FormsPal, you are able to fill in or alter boe447 here and now. Our editor is consistently developing to grant the best user experience possible, and that is thanks to our commitment to continuous enhancement and listening closely to user comments. To begin your journey, take these basic steps:

Step 1: Click the "Get Form" button above. It's going to open our pdf editor so that you could start filling in your form.

Step 2: This editor grants the capability to work with nearly all PDF files in a variety of ways. Enhance it with your own text, adjust what's already in the PDF, and add a signature - all close at hand!

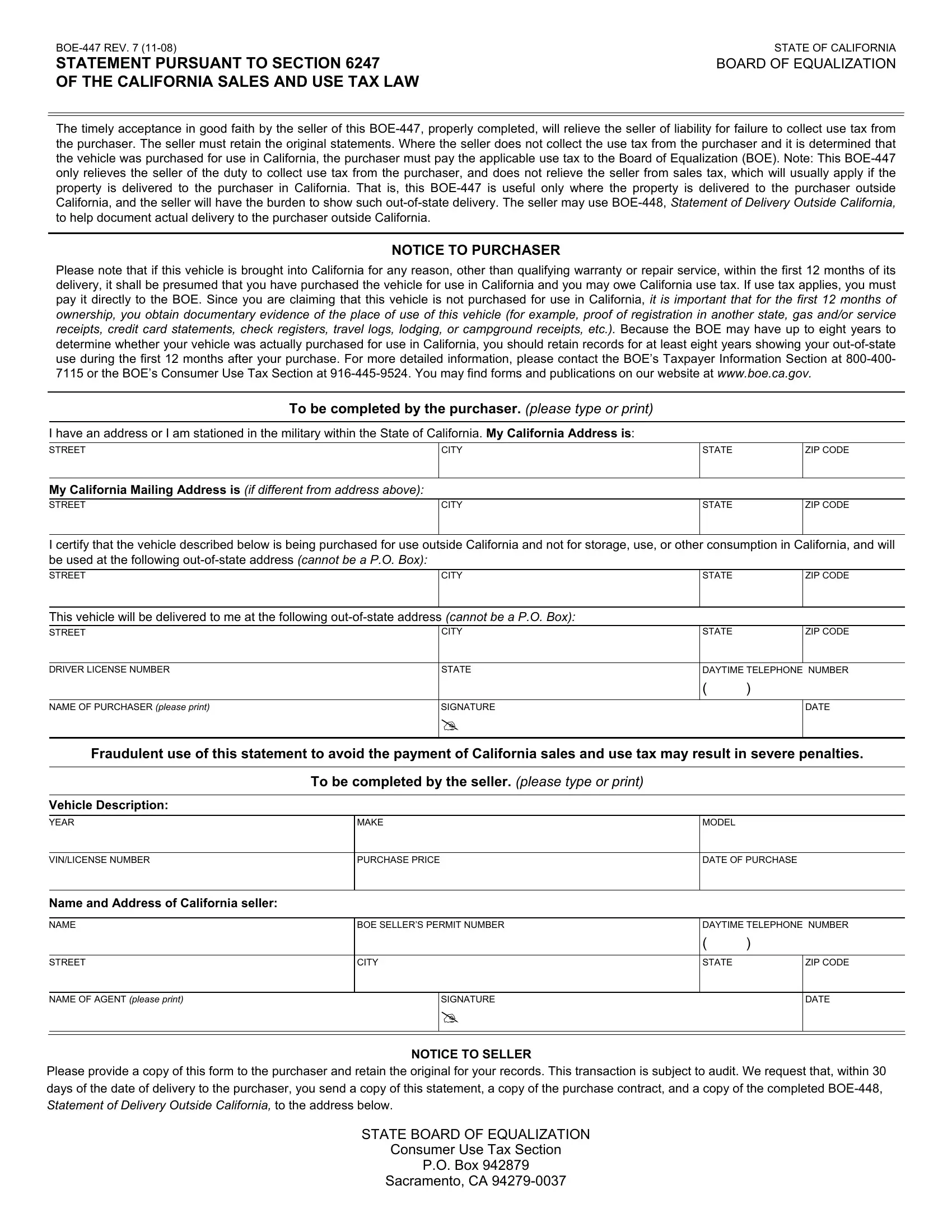

This PDF will require specific information to be filled in, hence make sure you take some time to fill in precisely what is requested:

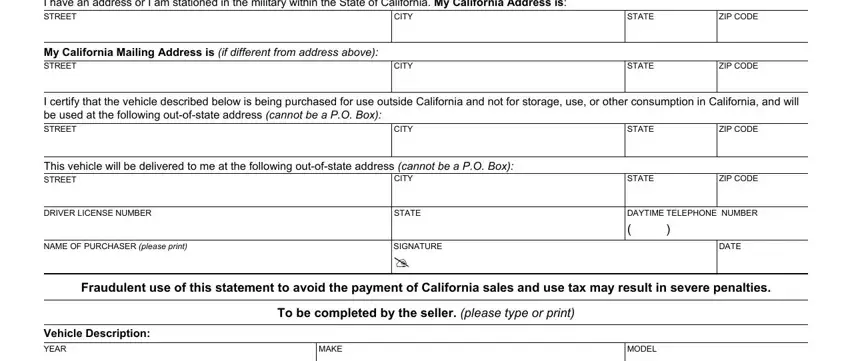

1. The boe447 needs specific details to be typed in. Be sure that the subsequent blanks are filled out:

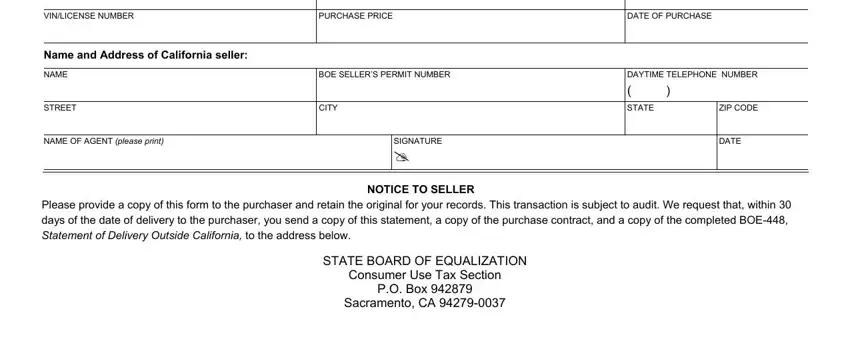

2. Once your current task is complete, take the next step – fill out all of these fields - VINLICENSE NUMBER, Name and Address of California, PURCHASE PRICE, DATE OF PURCHASE, NAME, STREET, NAME OF AGENT please print, BOE SELLERS PERMIT NUMBER, DAYTIME TELEPHONE NUMBER, CITY, SIGNATURE, cid, NOTICE TO SELLER, STATE, and ZIP CODE with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Concerning ZIP CODE and Name and Address of California, be sure that you double-check them in this section. Both of these could be the key fields in this document.

Step 3: As soon as you've reread the details provided, press "Done" to finalize your form. After getting afree trial account at FormsPal, it will be possible to download boe447 or email it directly. The form will also be accessible via your personal account with your each and every modification. At FormsPal.com, we do our utmost to make certain that all your details are maintained secure.