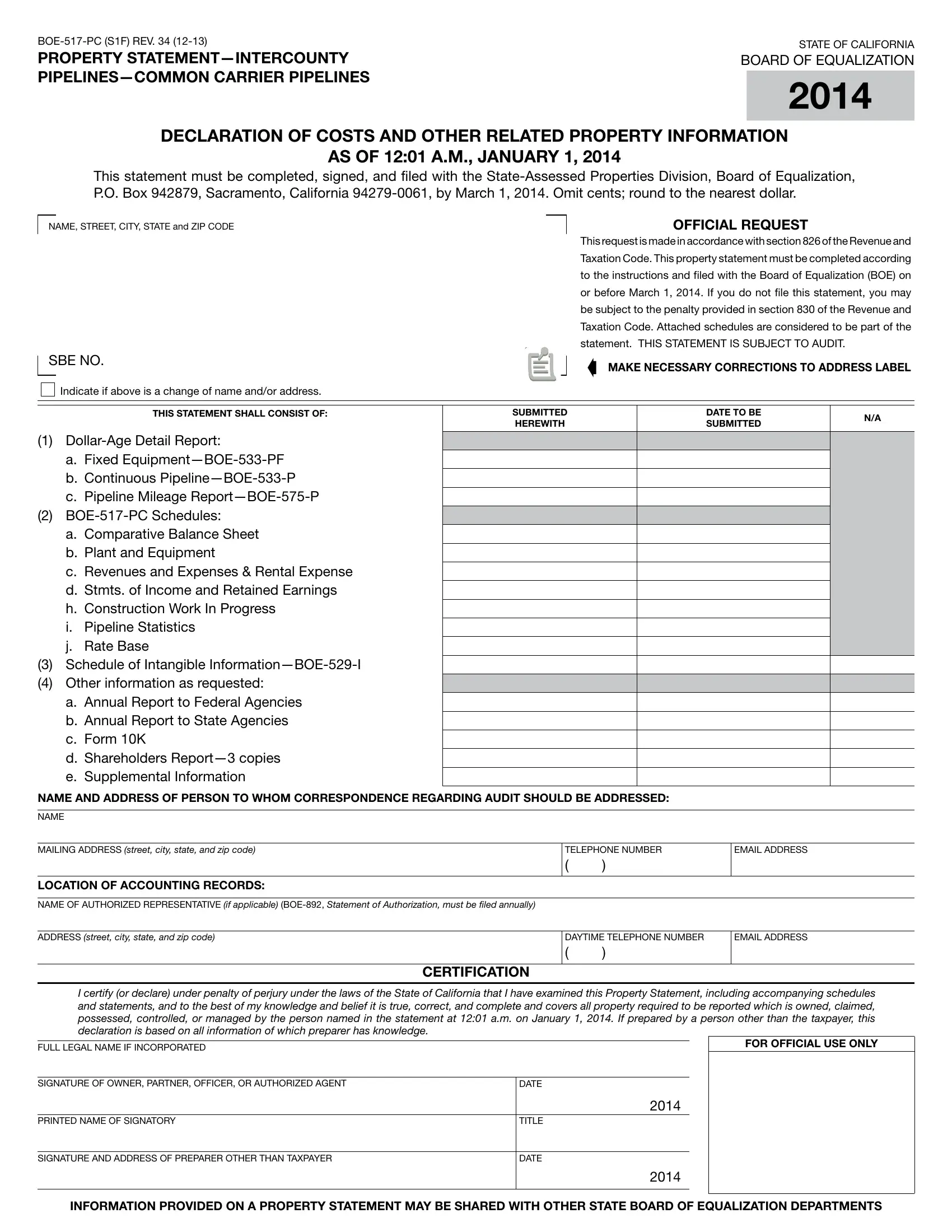

BOE-517-PC (S1F) REV. 34 (12-13) |

STATE OF CALIFORNIA |

|

PROPERTY STATEMENT—INTERCOUNTY |

BOARD OF EQUALIZATION |

PIPELINES—COMMON CARRIER PIPELINES |

2014 |

|

DECLARATION OF COSTS AND OTHER RELATED PROPERTY INFORMATION

AS OF 12:01 A.M., JANUARY 1, 2014

This statement must be completed, signed, and filed with the State-Assessed Properties Division, Board of Equalization, P.O. Box 942879, Sacramento, California 94279-0061, by March 1, 2014. Omit cents; round to the nearest dollar.

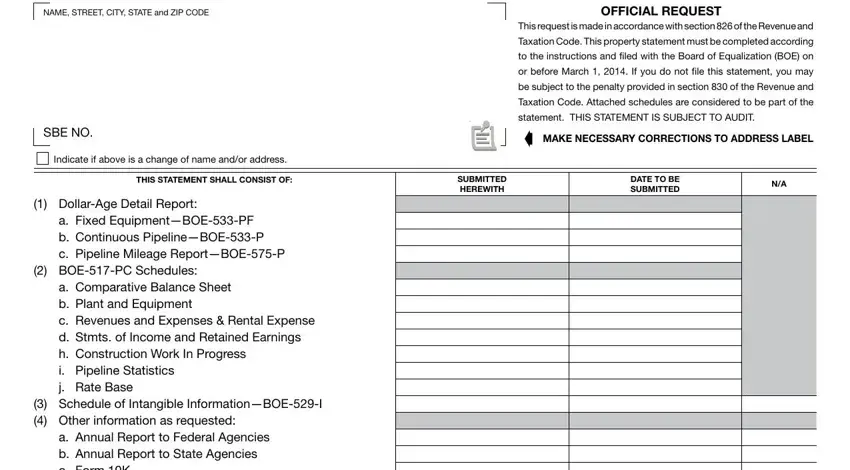

NAME, STREET, CITY, STATE and ZIP CODE

SBE NO.

Indicate if above is a change of name and/or address.

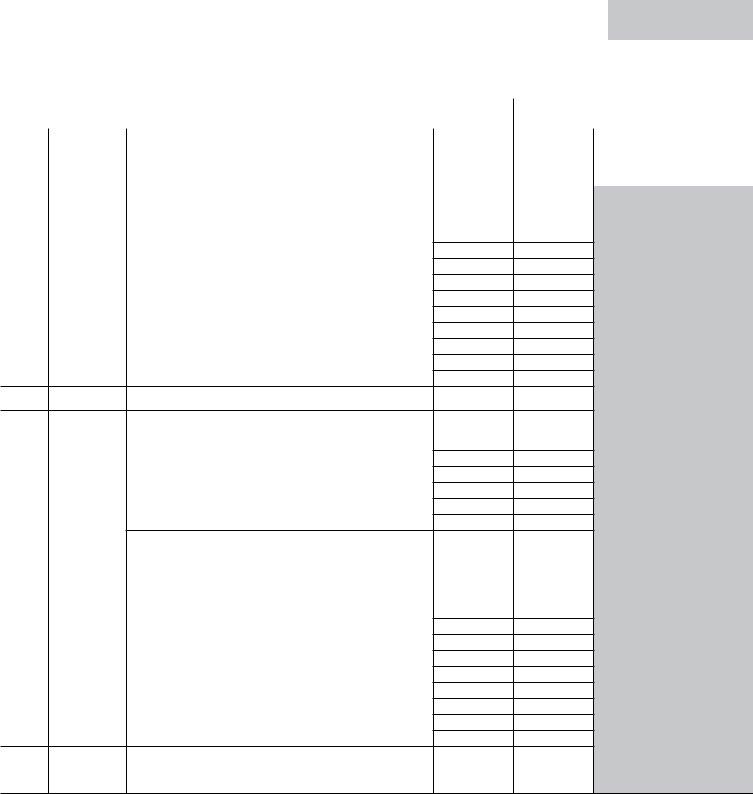

THIS STATEMENT SHALL CONSIST OF:

(1)Dollar-Age Detail Report:

a.Fixed Equipment—BOE-533-PF

b.Continuous Pipeline—BOE-533-P

c.Pipeline Mileage Report—BOE-575-P

(2)BOE-517-PC Schedules:

a.Comparative Balance Sheet

b.Plant and Equipment

c.Revenues and Expenses & Rental Expense

d.Stmts. of Income and Retained Earnings

h.Construction Work In Progress

i.Pipeline Statistics

j.Rate Base

(3)Schedule of Intangible Information—BOE-529-I

(4)Other information as requested:

a.Annual Report to Federal Agencies

b.Annual Report to State Agencies

c.Form 10K

d.Shareholders Report—3 copies

e.Supplemental Information

This request is made in accordance with section 826 of the Revenue and Taxation Code. This property statement must be completed according to the instructions and filed with the Board of Equalization (BOE) on or before March 1, 2014. If you do not file this statement, you may be subject to the penalty provided in section 830 of the Revenue and Taxation Code. Attached schedules are considered to be part of the statement. THIS STATEMENT IS SUBJECT TO AUDIT.

|

|

|

|

|

➧ |

MAKE NECESSARY CORRECTIONS TO ADDRESS LABEL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUBMITTED |

|

|

DATE TO BE |

|

N/A |

|

|

|

|

|

HEREWITH |

|

|

SUBMITTED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

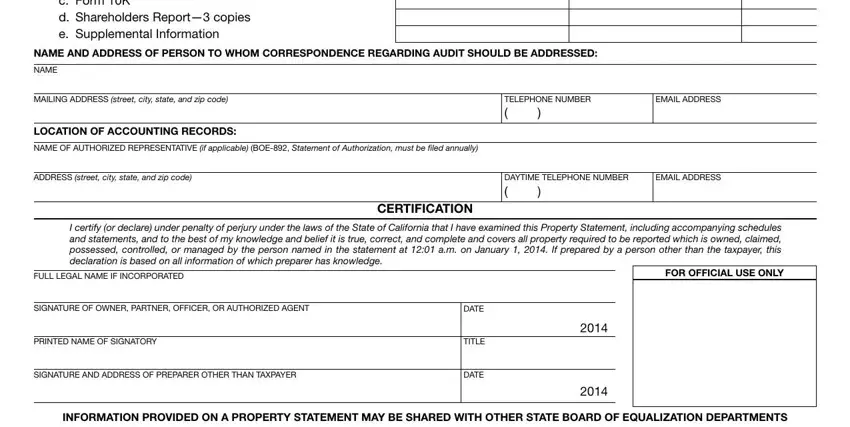

NAME AND ADDRESS OF PERSON TO WHOM CORRESPONDENCE REGARDING AUDIT SHOULD BE ADDRESSED:

NAME

MAILING ADDRESS (street, city, state, and zip code) |

TELEPHONE NUMBER |

EMAIL ADDRESS |

|

( |

) |

|

|

|

|

|

LOCATION OF ACCOUNTING RECORDS: |

|

|

|

|

|

|

|

NAME OF AUTHORIZED REPRESENTATIVE (if applicable) (BOE-892, Statement of Authorization, must be filed annually) |

|

|

|

|

|

|

ADDRESS (street, city, state, and zip code) |

DAYTIME TELEPHONE NUMBER |

EMAIL ADDRESS |

|

( |

) |

|

|

|

|

|

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that I have examined this Property Statement, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete and covers all property required to be reported which is owned, claimed, possessed, controlled, or managed by the person named in the statement at 12:01 a.m. on January 1, 2014. If prepared by a person other than the taxpayer, this declaration is based on all information of which preparer has knowledge.

FULL LEGAL NAME IF INCORPORATED

SIGNATURE OF OWNER, PARTNER, OFFICER, OR AUTHORIZED AGENT |

DATE |

|

2014 |

PRINTED NAME OF SIGNATORY |

TITLE |

|

|

SIGNATURE AND ADDRESS OF PREPARER OTHER THAN TAXPAYER |

DATE |

2014

INFORMATION PROVIDED ON A PROPERTY STATEMENT MAY BE SHARED WITH OTHER STATE BOARD OF EQUALIZATION DEPARTMENTS

BOE-517-PC (S1B) REV. 34 (12-13)

SPECIAL INSTRUCTIONS PERTAINING TO STATE ASSESSEES

OF INTERCOUNTY PIPELINES—COMMON CARRIER PIPELINES

Under the provisions of section 826 and 830 of the Revenue and Taxation Code and section 901, Title 18, California Code of Regulations, the BOE requests that you file a property statement with the BOE between January 1, 2014 and 5:00 p.m., on March 1, 2014. The property statement shall be completed in accordance with instructions included with the property statement and in publication 67PL, Instructions for Reporting State-Assessed Property, for lien date 2014. Reporting instructions are available on the Internet at www.boe.ca.gov/proptaxes/psricont.htm.

All parts of the property statement must be filed by March 1 (exception—see “N/A” below). Extensions of time for filing the property statement or any of its parts, may be granted only on a showing of good cause under a written request made prior to March 1. If you do not file timely, it may result in an added penalty of ten percent of the assessed value as required by section 830 of the Revenue and Taxation Code.

A positive response is required for all parts of the property statement. If a requested item does not apply, please so state. If you do not respond to all parts of the property statement, you may be subject to the penalties of section 830 of the Revenue and Taxation Code.

Item 3 requirements need not be returned if there is nothing to report. However, a positive response under the “N/A” column on page S1F is required for those forms not returned.

THE PROPERTY STATEMENT INCLUDES:

1.BOE-517-PC Schedule C3, System Rental Expense, should include 2013 payments to governmental agencies for the use of public property located in California.

2.BOE-517-PC Schedule I, California Pipeline Load Factors, may include a statement of future use if a major difference from the prior year is forecasted.

3.A statement of changes in revenue and/or costs for the future that are certain, such as rate increases ordered by Federal Energy Regulatory Commission (FERC) and/or the California Public Utilities Commission or other regulatory agencies or contracts signed by management and labor unions.

4.A copy of your 2013 annual report to stockholders.

5.A copy of your 2013 Form 10K filed with the Securities and Exchange Commission, if required to file.

6.A copy of your 2013 annual report to the California Public Utilities Commission, if required to file.

7.A copy of your 2013 annual report(s) to federal regulatory agencies, such as the FERC 6, if required to file.

8.Supplemental information as required.

Report book cost (100 percent of actual cost). Include excise, sales and use taxes (see instructions below for important use tax information), freight-in, installation charges, finance charges during construction, and all other relevant costs required to place the property in service. Do not reduce costs for depreciation (which must be reported separately). Report separately the details of any write-downs of cost, extraordinary damage or obsolescence, or any other information that may help the BOE in estimating fair market value.

N/A—Not Applicable

For purposes of these instructions, pipelines shall include the facilities and appurtenances that are essential to the intercounty transportation or transmission systems, but shall exclude the contents of such pipelines, except operating oil supply which is taxable.

DOLLAR-AGE DETAIL REPORT: Fixed Equipment—(BOE-533-PF)

Items shall be identified by location, description (i.e., account number and account name), acquisition date, and acquisition cost. No more than one location per page.

DOLLAR-AGE DETAIL REPORT: Continuous Pipeline—(BOE-533-PP)

Pipelines shall be identified by location, description (i.e., account number and name), acquisition date, and acquisition cost. No more than one flume, canal, ditch, or aqueduct per page.

PIPELINE MILEAGE REPORT—(BOE-575-P)

Each pipeline shall be identified by name with lengths shown to the nearest hundredth of a mile for each county. No more than one pipeline, flume, canal, ditch, or aqueduct per page.

Note: All replacement cost studies, obsolescence requests, and other voluntary information that assessees believe affects the value of their property must be filed with the property statement or by a date granted by a formal extension. If such information is not filed by that date, staff is not required to consider it in determining its unitary value recommendation.

USE TAX INFORMATION

California use tax is imposed on consumers of tangible personal property that is used, consumed, given away or stored in this state. Businesses must report and pay use tax on items purchased from out-of-state vendors not required to collect California tax on their sales. If your business is not required to have a seller’s permit with the BOE, the use tax may be reported and paid on your California State Income Tax Return or choose to report and pay use tax directly to the BOE. Simply use the online registration at www.boe.ca.gov/taxprograms/usetax/file.html to report and pay the tax due. Obtain additional use tax information by calling the Customer Service Center at 1-800-400-7115 (TTY:711).

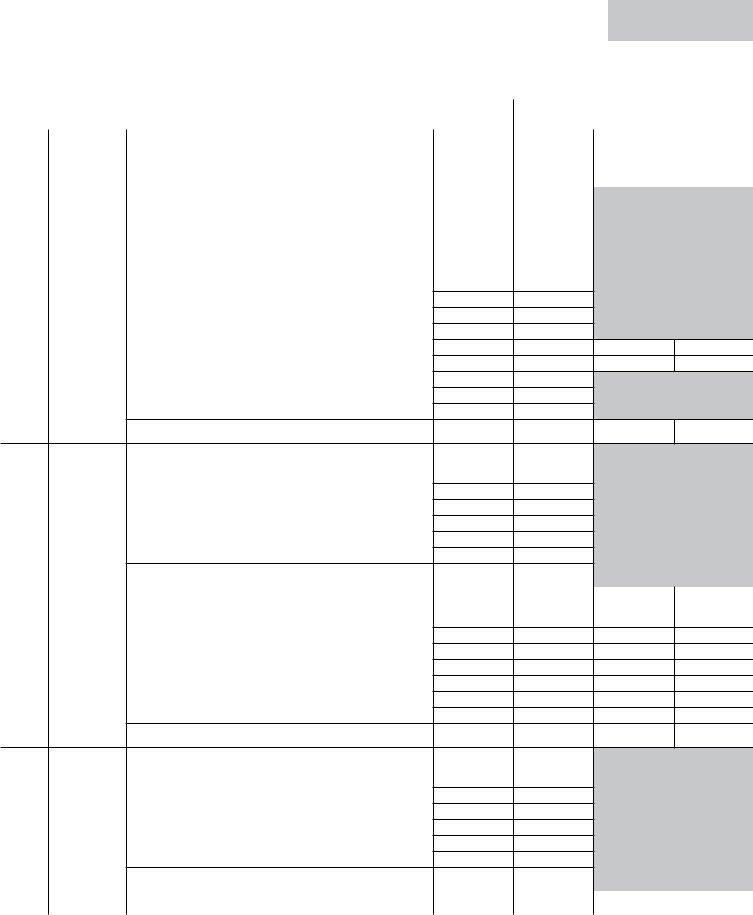

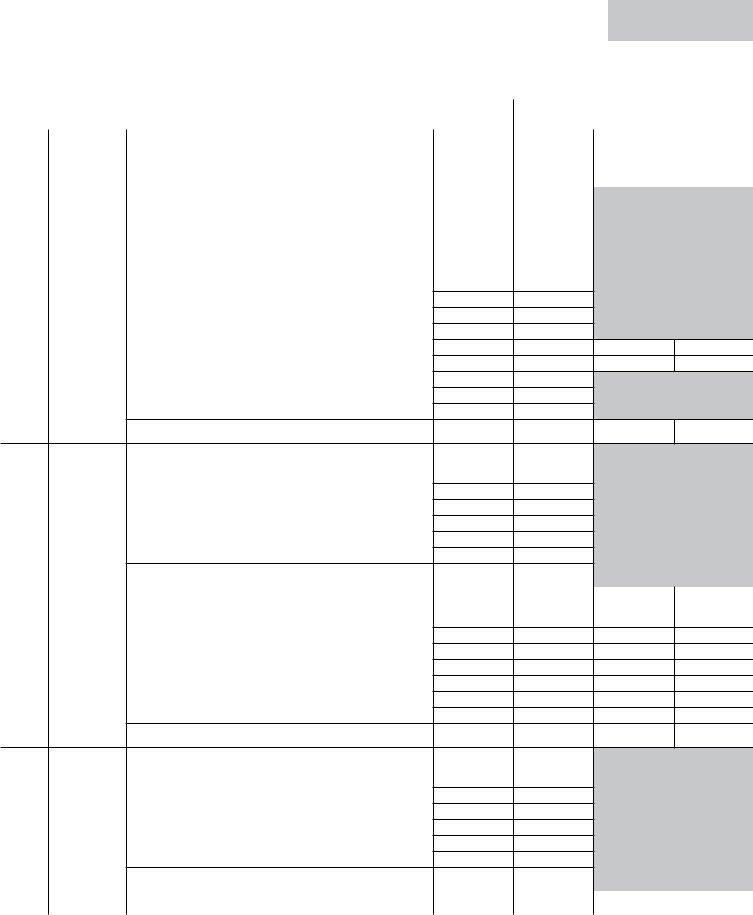

BOE-517-PC (S2F) REV. 34 (12-13) |

|

|

|

STATE OF CALIFORNIA |

|

|

|

|

|

|

|

|

|

|

|

|

BOARD OF EQUALIZATION |

|

|

|

|

|

|

2014 |

|

|

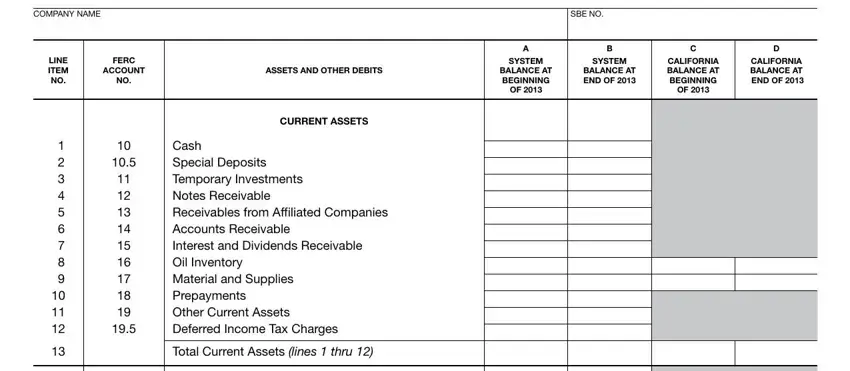

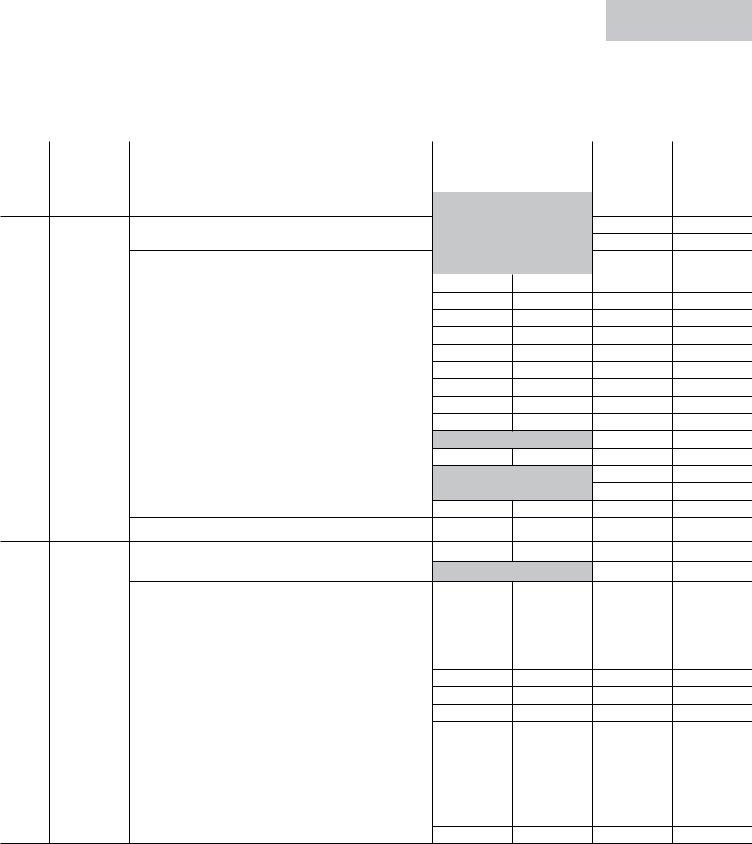

SCHEDULE A—COMPARATIVE BALANCE SHEET (1 OF 2) |

|

|

|

|

|

(see Note 1) |

|

|

|

|

|

|

|

|

|

|

|

COMPANY NAME |

|

|

|

|

SBE NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

C |

D |

LINE |

FERC |

|

|

SYSTEM |

SYSTEM |

CALIFORNIA |

CALIFORNIA |

ITEM |

ACCOUNT |

ASSETS AND OTHER DEBITS |

|

BALANCE AT |

BALANCE AT |

BALANCE AT |

BALANCE AT |

NO. |

NO. |

|

|

BEGINNING |

END OF 2013 |

BEGINNING |

END OF 2013 |

|

|

|

|

OF 2013 |

|

OF 2013 |

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS |

|

|

|

|

|

1 |

10 |

Cash |

|

|

|

|

|

|

|

|

|

|

2 |

10.5 |

Special Deposits |

|

|

|

|

|

|

|

|

|

|

3 |

11 |

Temporary Investments |

|

|

|

|

|

|

|

|

|

|

4 |

12 |

Notes Receivable |

|

|

|

|

|

|

|

|

|

|

513 Receivables from Affiliated Companies

614 Accounts Receivable

715 Interest and Dividends Receivable

816 Oil Inventory

917 Material and Supplies

1119 Other Current Assets

1219.5 Deferred Income Tax Charges

13 |

Total Current Assets (lines 1 thru 12) |

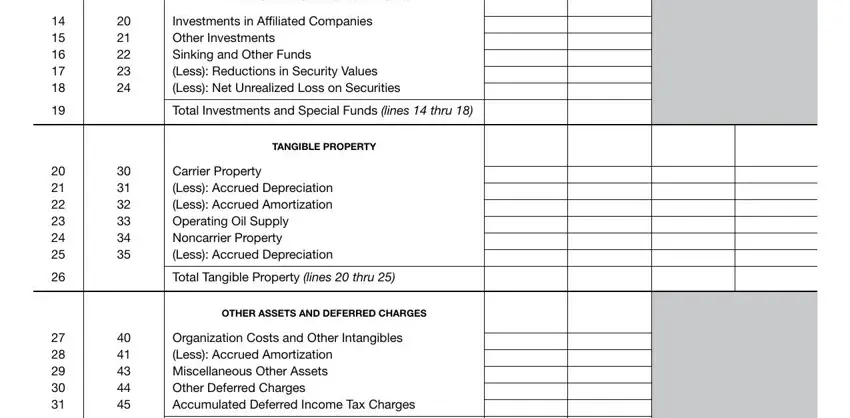

INVESTMENTS AND SPECIAL FUNDS

1420 Investments in Affiliated Companies

1521 Other Investments

1622 Sinking and Other Funds

1723 (Less): Reductions in Security Values

1824 (Less): Net Unrealized Loss on Securities

19 |

|

Total Investments and Special Funds (lines 14 thru 18) |

|

|

|

|

|

TANGIBLE PROPERTY |

20 |

30 |

Carrier Property |

2131 (Less): Accrued Depreciation

2232 (Less): Accrued Amortization

2333 Operating Oil Supply

2434 Noncarrier Property

2535 (Less): Accrued Depreciation

26 |

Total Tangible Property (lines 20 thru 25) |

OTHER ASSETS AND DEFERRED CHARGES

2740 Organization Costs and Other Intangibles

2841 (Less): Accrued Amortization

2943 Miscellaneous Other Assets

3044 Other Deferred Charges

3145 Accumulated Deferred Income Tax Charges

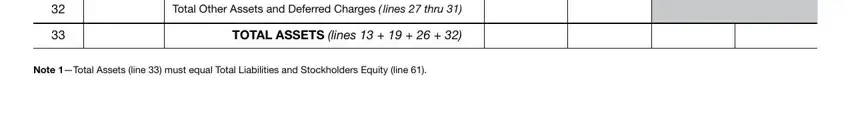

32 |

Total Other Assets and Deferred Charges ( lines 27 thru 31) |

|

|

|

33 |

TOTAL ASSETS (lines 13 + 19 + 26 + 32) |

|

|

|

|

Note 1—Total Assets (line 33) must equal Total Liabilities and Stockholders Equity (line 61).

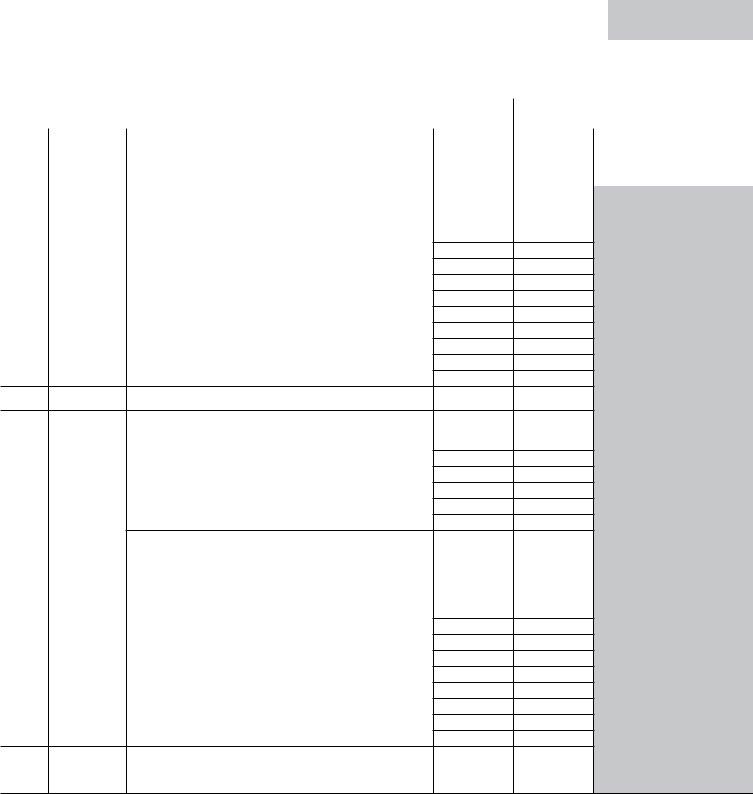

BOE-517-PC (S2B) REV. 34 (12-13) |

|

|

|

STATE OF CALIFORNIA |

|

|

|

|

|

|

|

|

|

|

|

|

BOARD OF EQUALIZATION |

|

|

|

|

|

|

2014 |

|

|

SCHEDULE A—COMPARATIVE BALANCE SHEET (2 OF 2) |

|

|

|

|

|

(see Note 1) |

|

|

|

|

|

|

|

|

|

|

|

COMPANY NAME |

|

|

|

|

SBE NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

B |

C |

D |

LINE |

FERC |

|

|

SYSTEM |

SYSTEM |

CALIFORNIA |

CALIFORNIA |

ITEM |

ACCOUNT |

ASSETS AND OTHER DEBITS |

|

BALANCE AT |

BALANCE AT |

BALANCE AT |

BALANCE AT |

NO. |

NO. |

|

|

BEGINNING |

END OF 2013 |

BEGINNING |

END OF 2013 |

|

|

|

|

OF 2013 |

|

OF 2013 |

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

34 |

50 |

Notes Payable |

|

|

|

|

|

|

|

|

|

|

3551 Payables to Affiliated Companies

3652 Accounts Payable

3753 Salaries and Wages Payable

3854 Interest Payable

3955 Dividends Payable

4056 Taxes Payable

4157 Long-Term Debt Payable Within One Year

4258 Other Current Liabilities

4359 Deferred Income Tax Credits

44 |

Total Current Liabilities (lines 34 thru 43) |

NONCURRENT LIABILITIES

4560 Long-Term Debt Payable After One Year

4661 Unamortized Premium on Long-Term Debt

4762 (Less): Unamortized Discount on Long-Term Debt

4863 Other Noncurrent Liabilities

4964 Accumulated Deferred Income Tax Credits

50 |

|

Total Noncurrent Liabilities (lines 45 thru 49) |

|

|

|

51 |

|

Total Liabilities (lines 44 + 50) |

|

|

|

|

|

STOCKHOLDERS EQUITY |

52 |

70 |

Capital Stock |

5371 Premiums on Capital Stock

5472 Capital Stock Subscriptions

5573 Additional Paid-In Capital

5674 Appropriated Retained Income

5775 Unappropriated Retained Income

5875.5 (Less): Net Unrealized Loss on Securities

5976 (Less): Treasury Stock

60 |

Total Stockholders Equity (lines 52 thru 59) |

|

|

61 |

TOTAL LIABILITIES AND STOCKHOLDERS EQUITY (lines 51 + 60) |

Note 1—Total Assets (line 33) must equal Total Liabilities and Stockholders Equity (line 61).

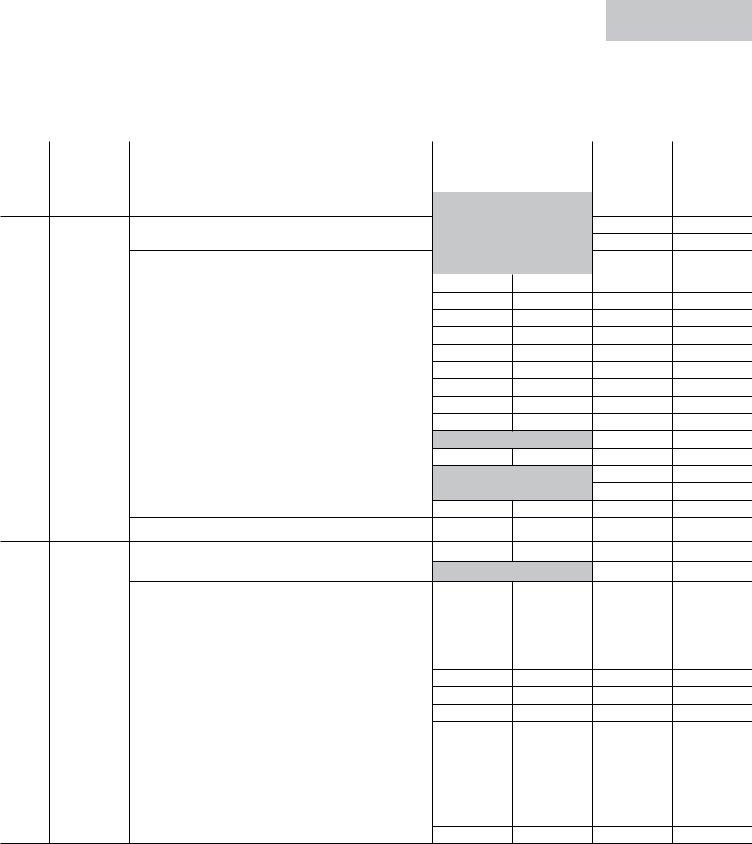

BOE-517-PC (S3F) REV. 34 (12-13) |

STATE OF CALIFORNIA |

|

|

BOARD OF EQUALIZATION |

|

2014 |

SCHEDULE B—TOTAL CALIFORNIA PLANT AND EQUIPMENT

(SUMMARY OF SCHEDULES B2 + B3 + B4)

|

COMPANY NAME |

|

|

|

SBE NO. |

|

|

|

|

|

|

|

|

|

|

|

LINE |

FERC |

|

A |

B |

C |

D |

|

|

(SCH B2 COL. D) |

(SCH B3 COL. D) |

(SCH B4 COL. D) |

BALANCE AT END |

|

ITEM |

ACCOUNT |

ACCOUNT NAME |

|

|

|

|

OF 2013 |

|

NO. |

NO. |

|

|

|

|

|

|

|

|

|

(A + B + C) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

140 Organization and Other Intangibles

2101,151,171 Land

3102,152 Right of Way

4 |

|

Total Land and Right-of-Way (lines 2 + 3) |

|

|

|

5 |

103,153 |

Line Pipe |

6104,154 Line Pipe Fittings

7105,155 Pipeline Construction

8106,156,176 Buildings

9107,157 Boilers

10108,158 Pumping Equipment

11109,159,179 Machine Tools and Machinery

12110,160 Other Station Equipment

13111,161 Tanks

14112,162 Delivery Facilities

15113,163,183 Communication Systems (see Note 1)

16114,164,184 Office Furniture and Equipment

17115,165,185 Vehicles and Other Work Equipment (see Note 2)

18116,166,186 Other Property (not materials and supplies)

19 |

Total Machinery and Equipment (lines 5 thru 18) |

20187 Construction Work in Progress (CWIP)

2117 Materials and Supplies

22 |

Total CWIP and Materials & Supplies (lines 20 + 21) |

|

|

|

|

23 |

Total California Taxable Property (lines 4 + 19 + 22) |

|

|

|

|

|

NONTAXABLE PROPERTY (see NOTE 3) |

FROM |

|

|

NOTE 3 |

24113,163,183 Communication Systems in Licensed Vehicles

25115,165,185 Licensed Vehicles

26187 Construction Work in Progress

27 |

Other Nontaxable (attach schedule) |

28 |

|

Total Nontaxable Property (lines 24 thru 27) |

|

|

29 |

California Summary of Accounts Property (lines 1+23 + 28) |

|

|

|

ACCRUED DEPRECIATION |

Applicable to Taxable Property (line 23)

Note 1—Do not include radios in licensed vehicles—see line 24. Note 2—Do not include licensed vehicles—see line 25.

Note 3—This category is in addition to Schedules B2, B3, B4. ATTACH SEPARATE SCHEDULE.