Dealing with PDF forms online is certainly a piece of cake with this PDF tool. Anyone can fill in Boe 571 L Form here painlessly. The editor is constantly updated by us, getting additional functions and becoming better. Here is what you'd want to do to begin:

Step 1: Hit the orange "Get Form" button above. It's going to open our pdf editor so that you can begin completing your form.

Step 2: After you open the file editor, you will find the document all set to be completed. In addition to filling out different blank fields, you may also perform other things with the PDF, that is putting on any text, modifying the original text, inserting graphics, placing your signature to the form, and much more.

Pay close attention when completing this form. Make sure every single field is completed correctly.

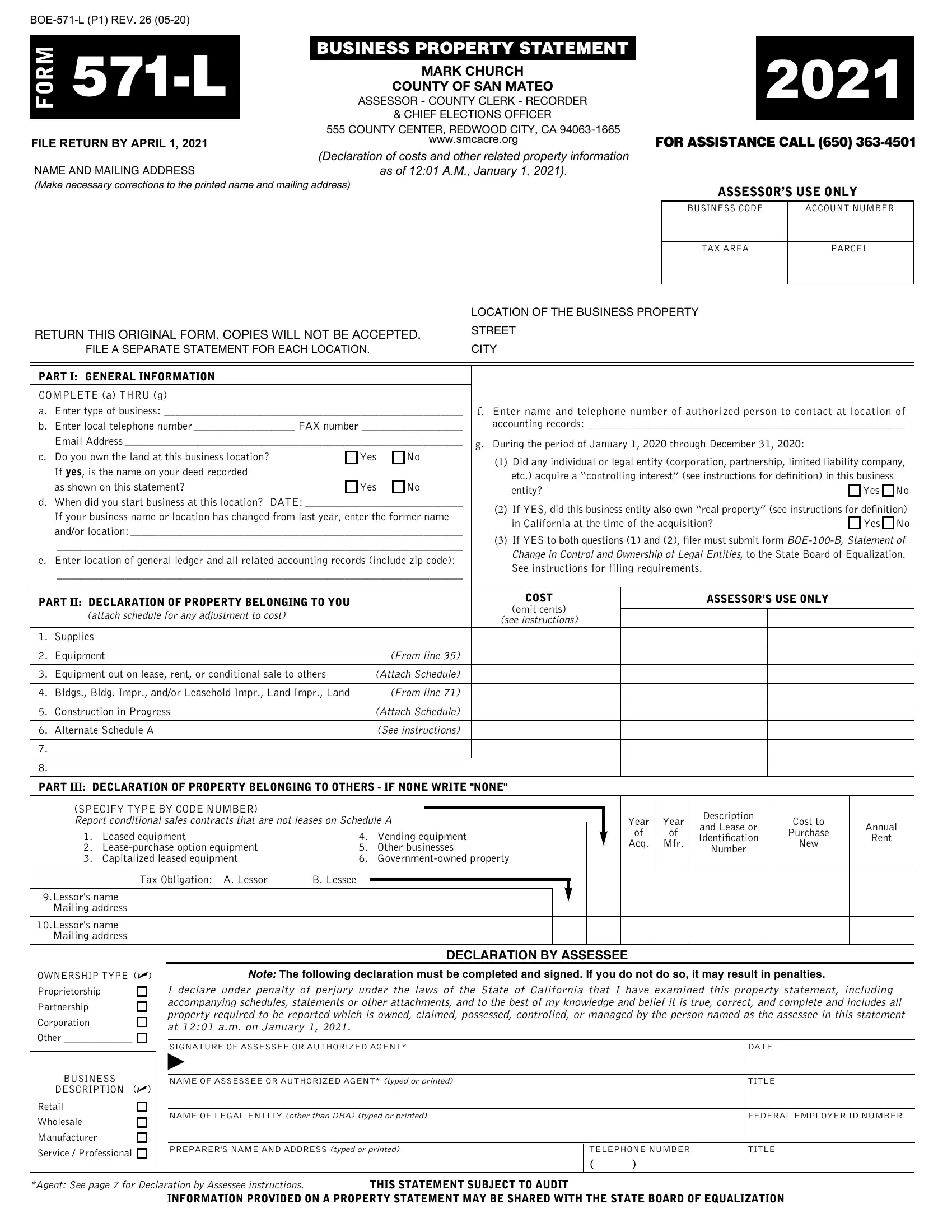

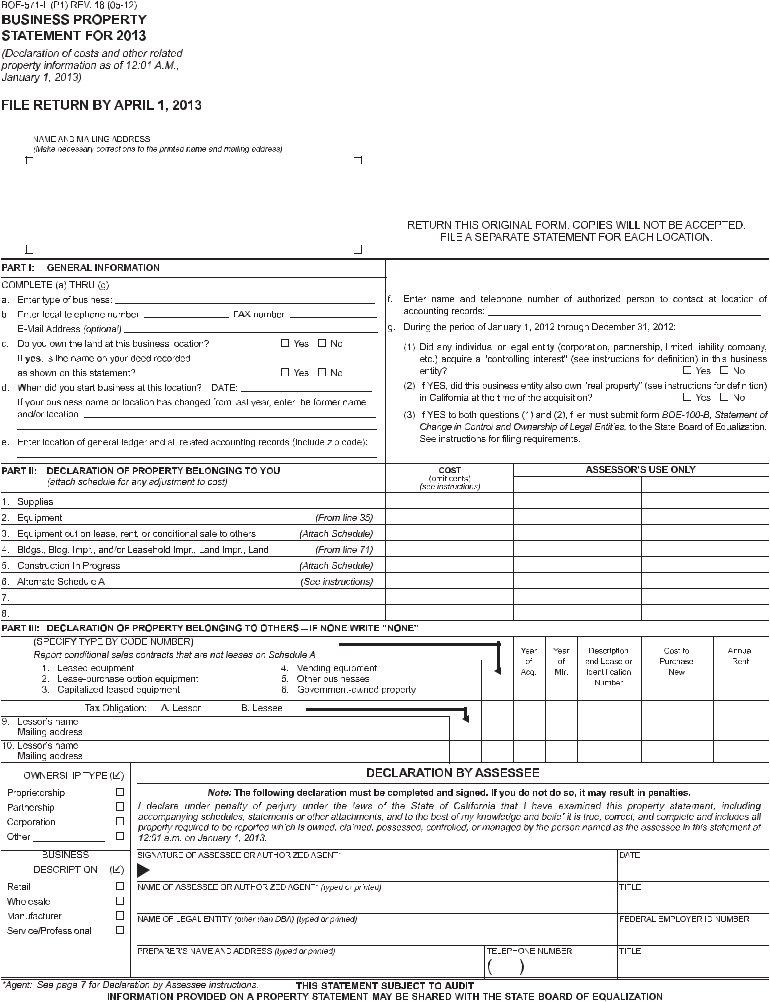

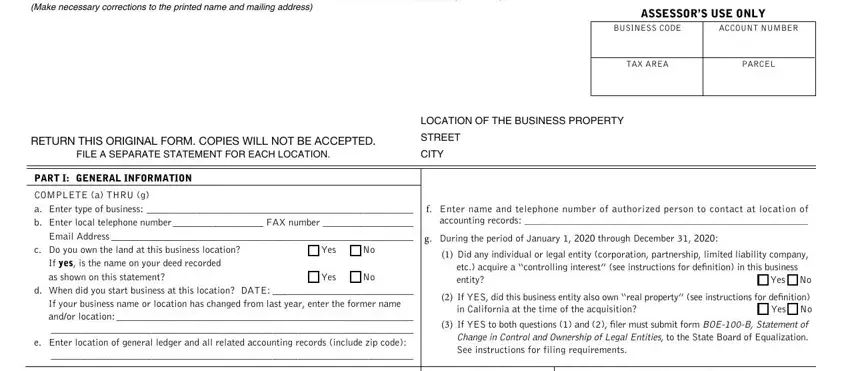

1. Start completing the Boe 571 L Form with a selection of major blanks. Note all the necessary information and be sure nothing is overlooked!

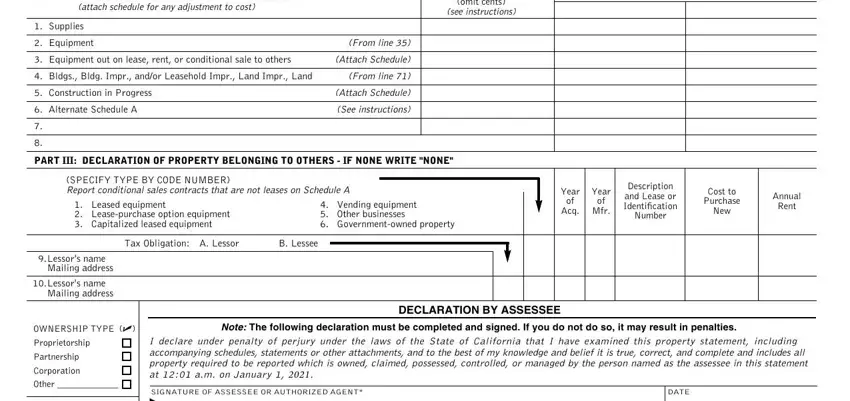

2. Right after this selection of fields is completed, go on to type in the relevant information in these - PART II DECLARATION OF PROPERTY, attach schedule for any adjustment, omit cents, see instructions, Supplies, Equipment, From line , Equipment out on lease rent or, Attach Schedule, Bldgs Bldg Impr andor Leasehold, From line , Construction in Progress, Alternate Schedule A, Attach Schedule, and See instructions.

In terms of From line and Attach Schedule, be certain that you don't make any errors here. These two are certainly the key fields in this page.

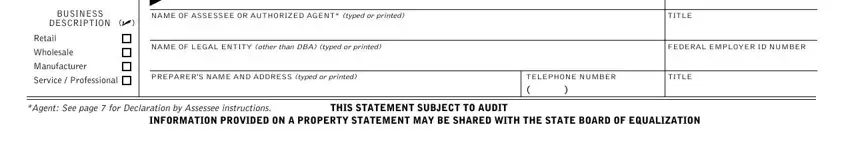

3. This part is generally hassle-free - fill in every one of the fields in BUSINESS, DESCRIPTION , Retail, Wholesale, Manufacturer, Service Professional , NAME OF ASSESSEE OR AUTHORIZED, TITLE, NAME OF LEGAL ENTITY other than, FEDERAL EMPLOYER ID NUMBER, PREPARERS NAME AND ADDRESS typed, TELEPHONE NUMBER, TITLE, Agent See page for Declaration by, and THIS STATEMENT SUBJECT TO AUDIT to conclude this part.

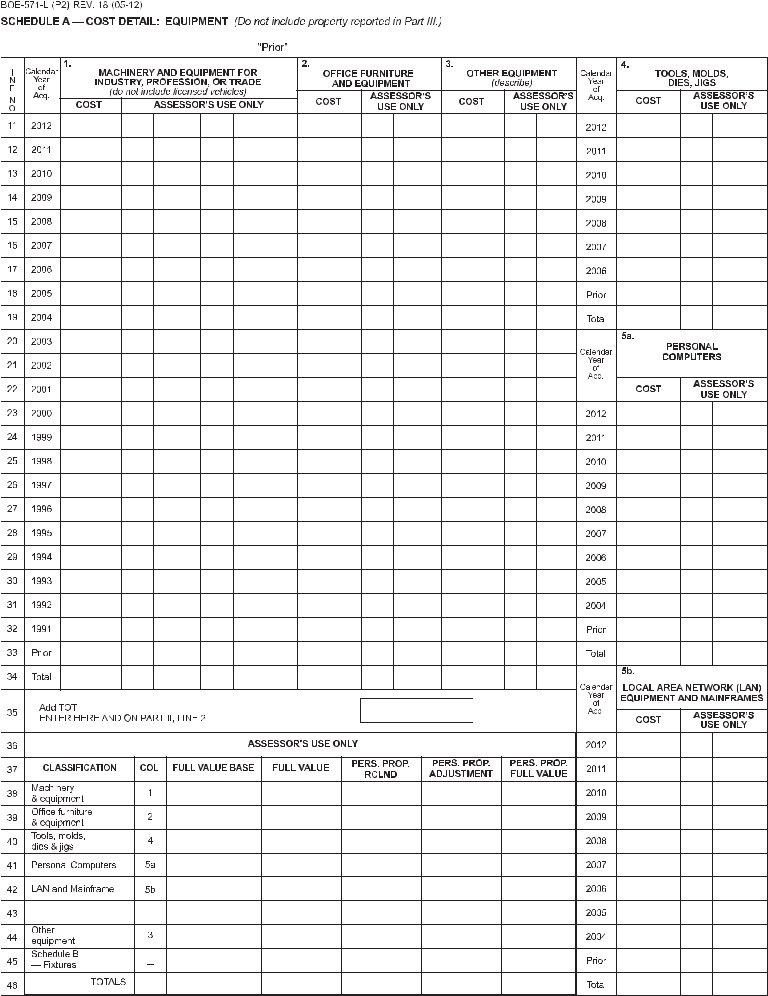

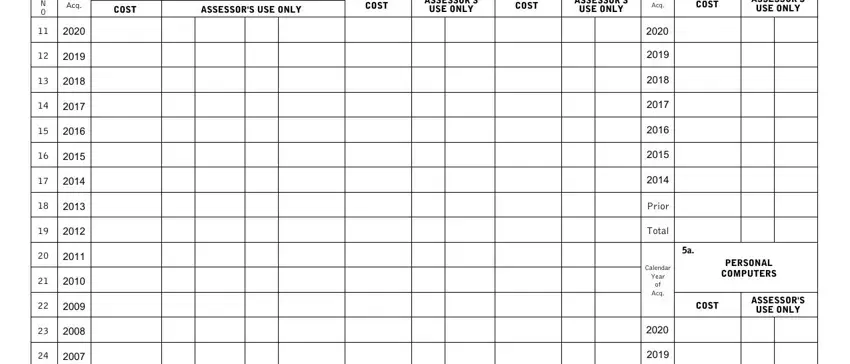

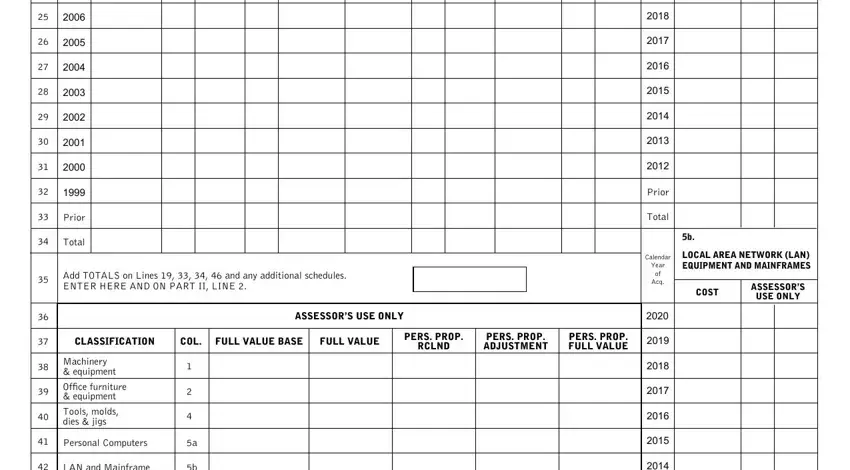

4. The subsequent part requires your involvement in the following areas: COST, ASSESSORS USE ONLY, COST, ASSESSORS, USE ONLY, COST, ASSESSORS, USE ONLY, L I N E N O, dar Yr of, Acq, COST, ASSESSORS, USE ONLY, and PERSONAL COMPUTERS. Just remember to type in all of the requested information to move further.

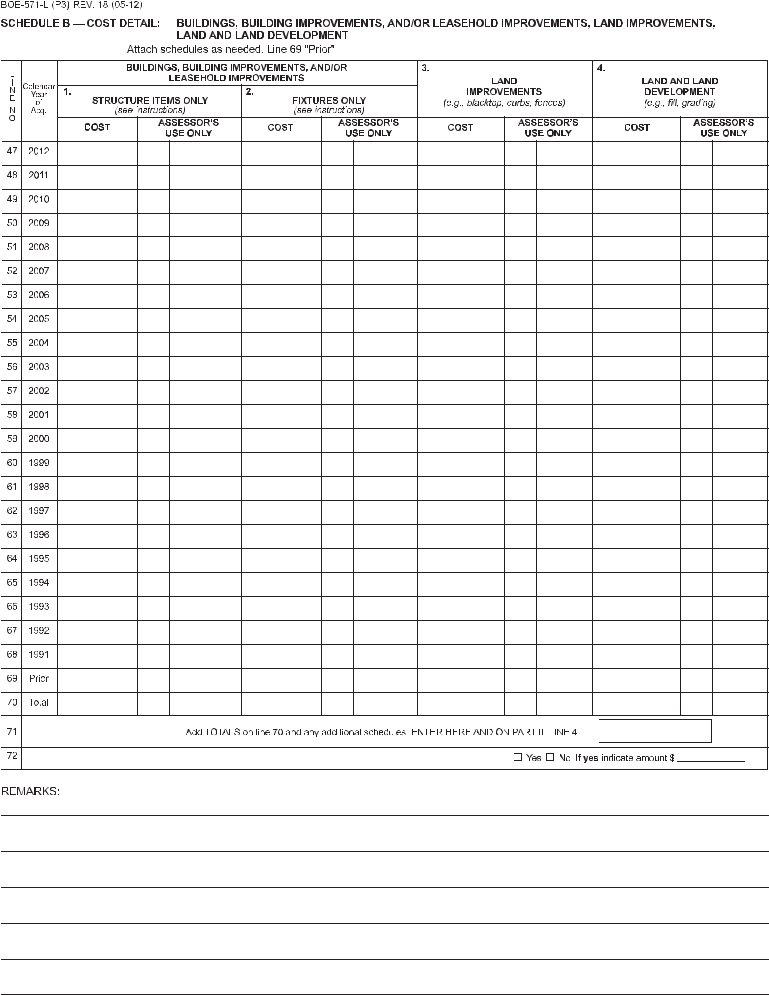

5. This very last step to finalize this PDF form is pivotal. Make sure you fill out the necessary form fields, consisting of Prior, Total, Add TOTALS on Lines and any, CLASSIFICATION, COL, FULL VALUE BASE, FULL VALUE, PERS PROP, RCLND, PERS PROP ADJUSTMENT, PERS PROP FULL VALUE, ASSESSORS USE ONLY, Machinery equipment, Office furniture equipment, and Tools molds dies jigs, before finalizing. Neglecting to do this may generate a flawed and probably unacceptable document!

Step 3: Check that your information is accurate and just click "Done" to finish the process. Go for a free trial plan with us and gain direct access to Boe 571 L Form - which you can then start using as you want from your personal account. FormsPal is focused on the privacy of our users; we make sure that all personal data going through our system is kept protected.