Working with PDF documents online is definitely surprisingly easy using our PDF editor. You can fill out reassessment parent child here effortlessly. The tool is continually updated by our staff, receiving handy features and growing to be greater. To get the ball rolling, consider these easy steps:

Step 1: First, access the pdf tool by clicking the "Get Form Button" at the top of this webpage.

Step 2: After you access the file editor, you will see the form made ready to be filled out. Other than filling out various blank fields, you might also do other sorts of actions with the file, that is adding custom textual content, editing the initial textual content, inserting images, signing the form, and much more.

It's straightforward to finish the document following our helpful guide! This is what you have to do:

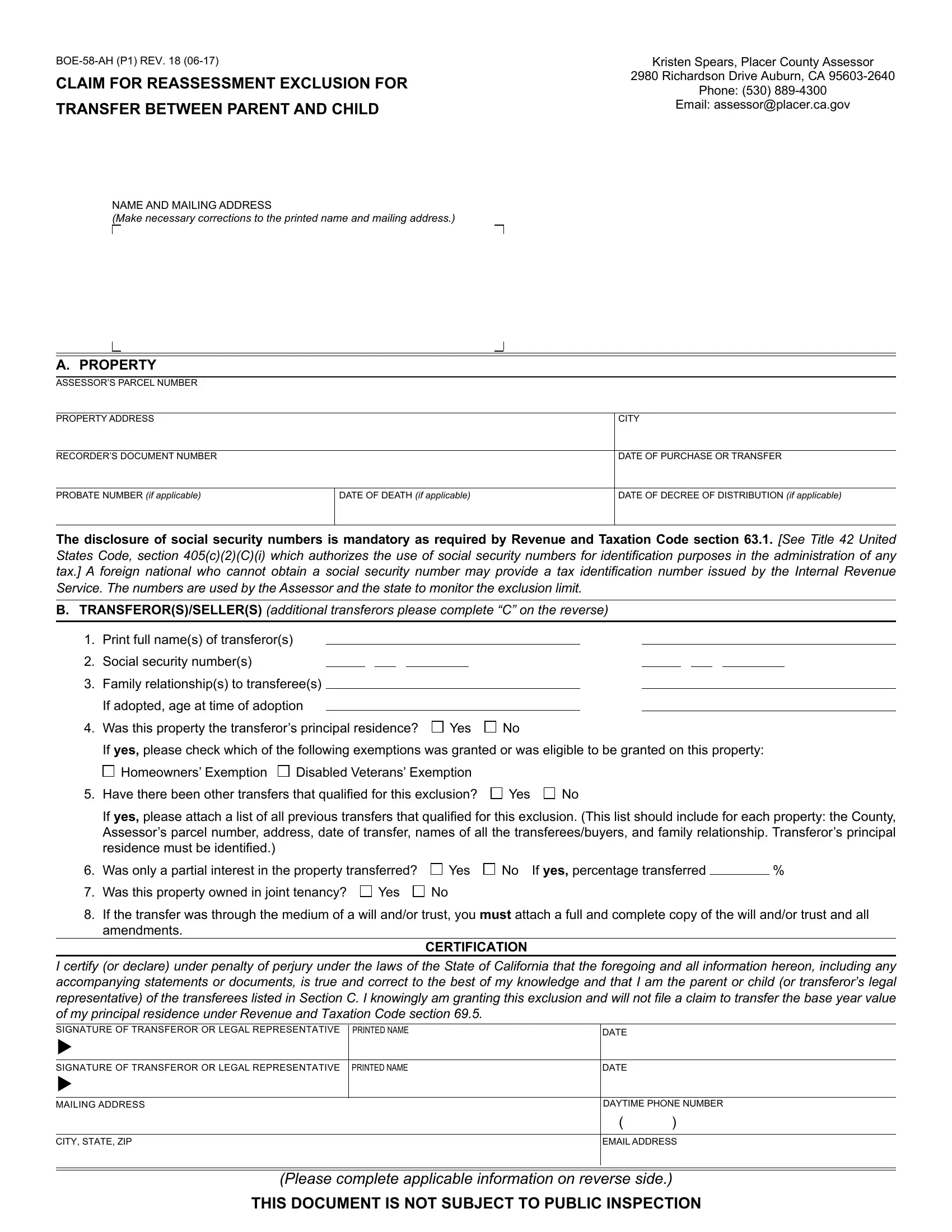

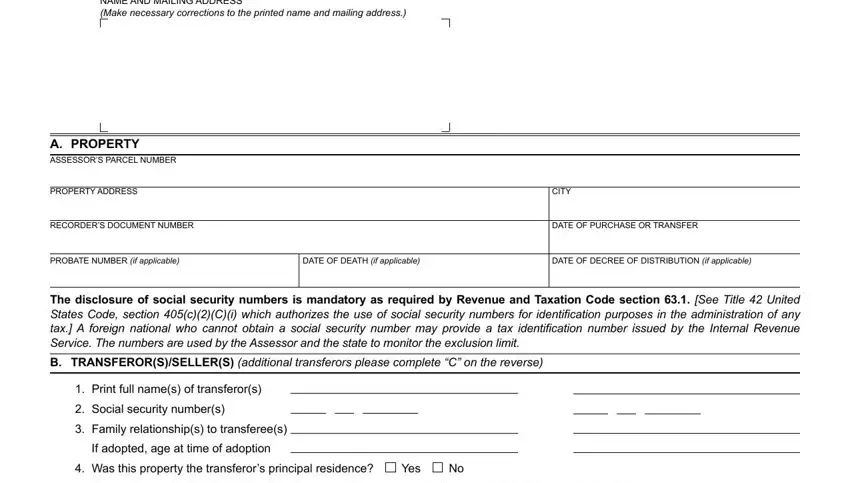

1. Firstly, while filling in the reassessment parent child, start with the form section that includes the subsequent blanks:

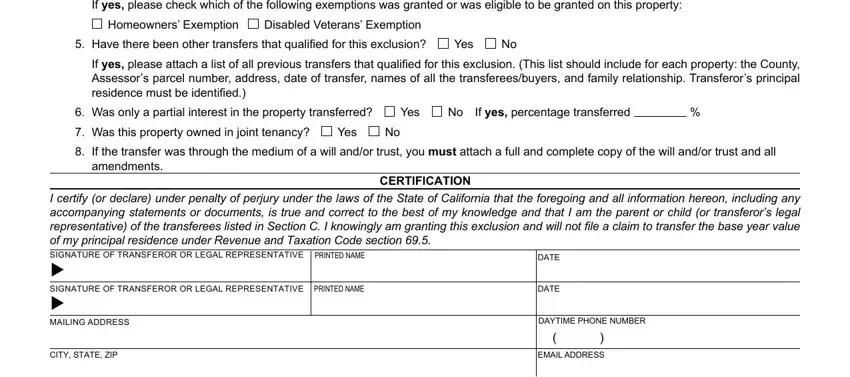

2. The next step would be to submit these blanks: If yes please check which of the, Homeowners Exemption, Disabled Veterans Exemption Have, Yes, If yes please attach a list of all, Was only a partial interest in, Yes, If yes percentage transferred, Was this property owned in joint, Yes, If the transfer was through the, CERTIFICATION, I certify or declare under penalty, PRINTED NAME, and DATE.

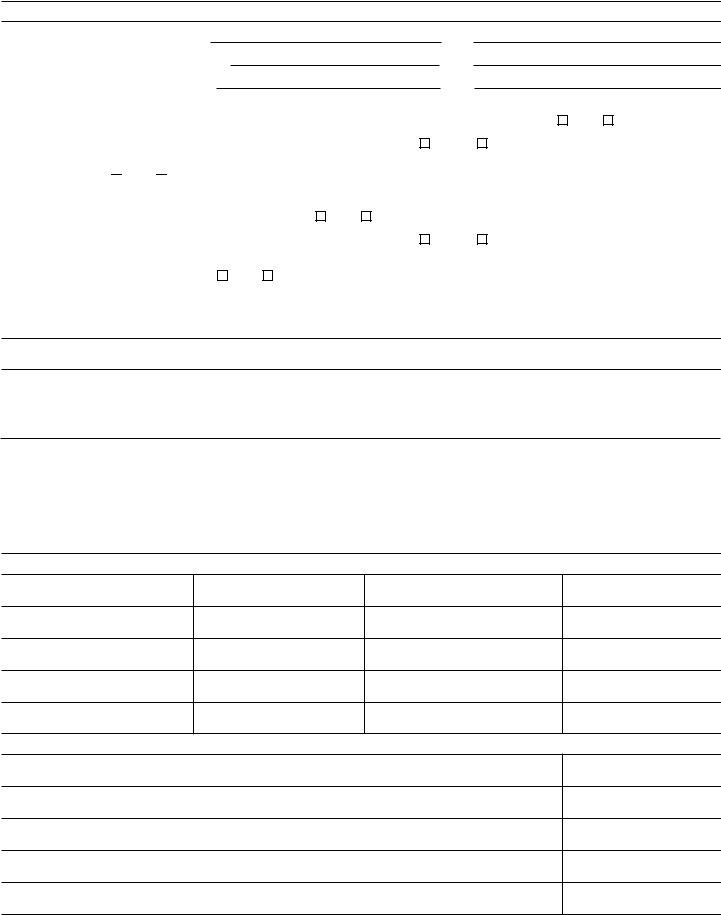

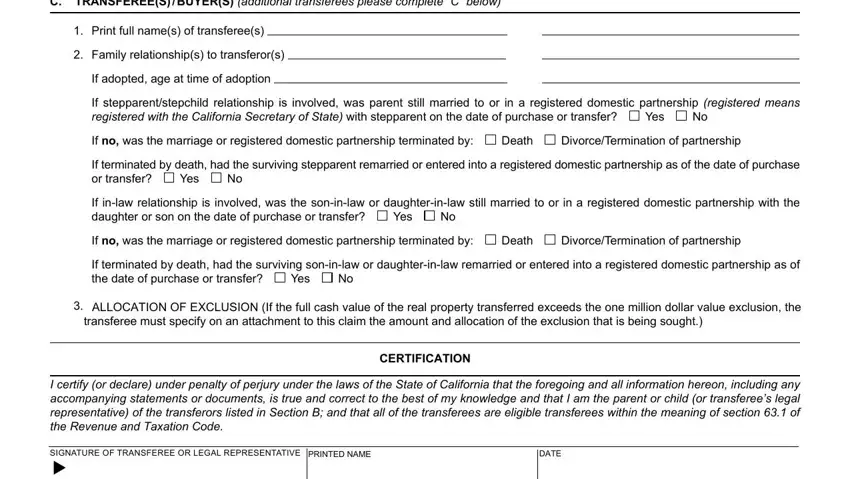

3. This stage is normally simple - fill out all the blanks in C TRANSFEREES BUYERS additional, Print full names of transferees, Family relationships to, If adopted age at time of adoption, If stepparentstepchild, Yes, If no was the marriage or, Death, DivorceTermination of partnership, If terminated by death had the, Yes, If inlaw relationship is involved, Yes, If no was the marriage or, and Death in order to complete this part.

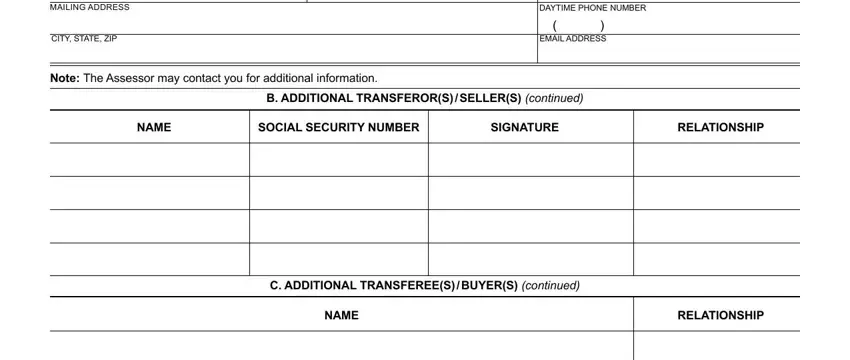

4. The subsequent paragraph will require your input in the subsequent places: MAILING ADDRESS, CITY STATE ZIP, DAYTIME PHONE NUMBER, EMAIL ADDRESS, Note The Assessor may contact you, B ADDITIONAL TRANSFERORS SELLERS, NAME, SOCIAL SECURITY NUMBER, SIGNATURE, RELATIONSHIP, C ADDITIONAL TRANSFEREES BUYERS, NAME, and RELATIONSHIP. Be sure to type in all of the required information to go onward.

5. Now, this last segment is what you have to wrap up prior to finalizing the PDF. The blank fields under consideration include the next: .

Be very attentive while completing this field and next field, as this is where many people make errors.

Step 3: Right after you have looked once again at the details you filled in, press "Done" to conclude your form. Download your reassessment parent child as soon as you register at FormsPal for a 7-day free trial. Readily get access to the pdf document within your FormsPal cabinet, together with any modifications and changes automatically saved! FormsPal is committed to the privacy of all our users; we make sure that all personal information coming through our editor is secure.