|

FORM |

ALABAMA DEPARTMENT OF REVENUE |

TAXABLE/FORM YEAR |

|

BPT-V |

2021 |

|

INCOME TAX ADMINISTRATION DIVISION |

Business Privilege Tax Payment Voucher

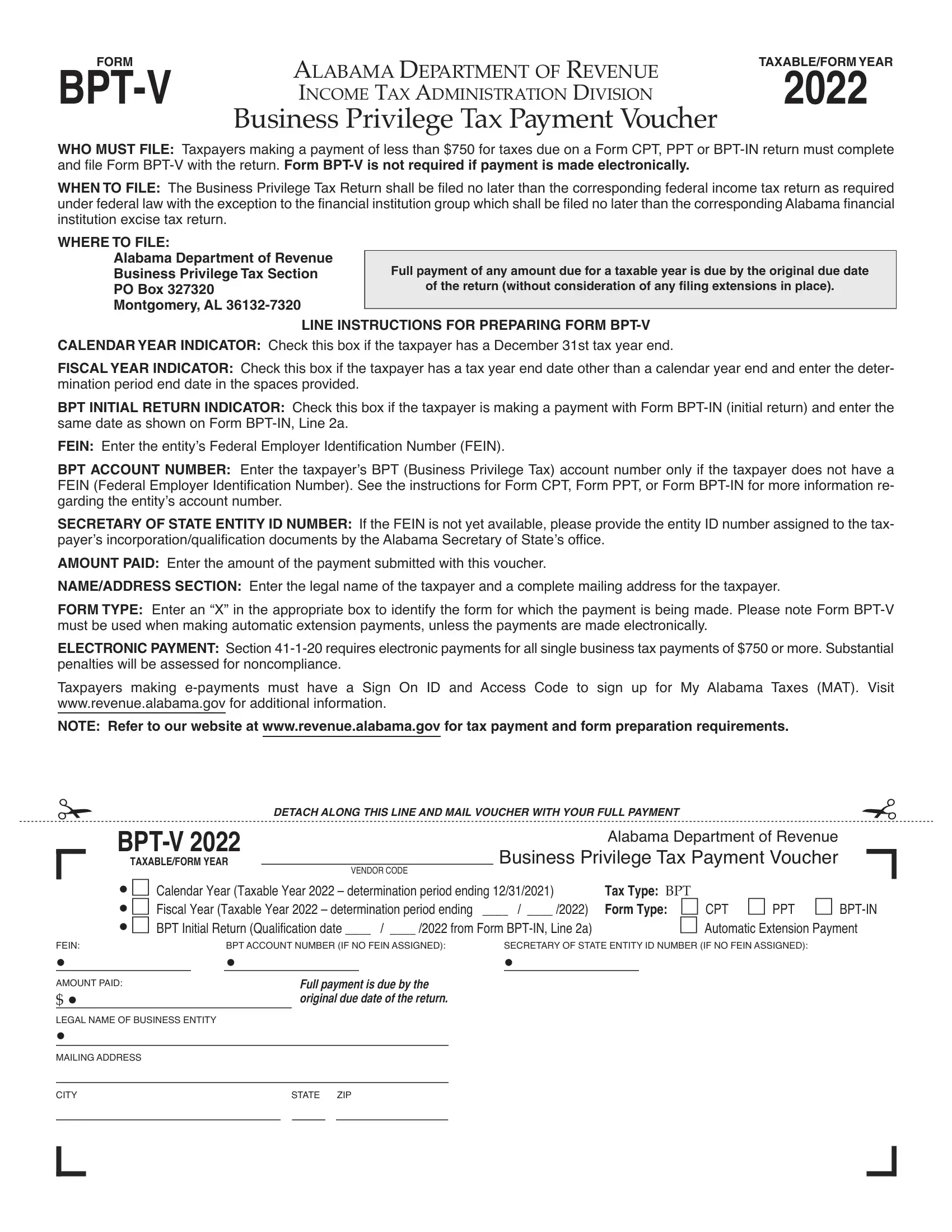

WHO MUST FILE: Taxpayers making a payment of less than $750 for taxes due on a Form CPT, PPT or BPT-IN return must complete and file Form BPT-V with the return. Form BPT-V is not required if payment is made electronically.

WHEN TO FILE: The Business Privilege Tax Return shall be filed no later than the corresponding federal income tax return as required under federal law with the exception to the financial institution group which shall be filed no later than the corresponding Alabama financial institution excise tax return.

WHERE TO FILE:

Alabama Department of Revenue

Business Privilege Tax Section |

Full payment of any amount due for a taxable year is due by the original due date |

PO Box 327320 |

of the return (without consideration of any filing extensions in place). |

Montgomery, AL 36132-7320 |

|

LINE INSTRUCTIONS FOR PREPARING FORM BPT-V

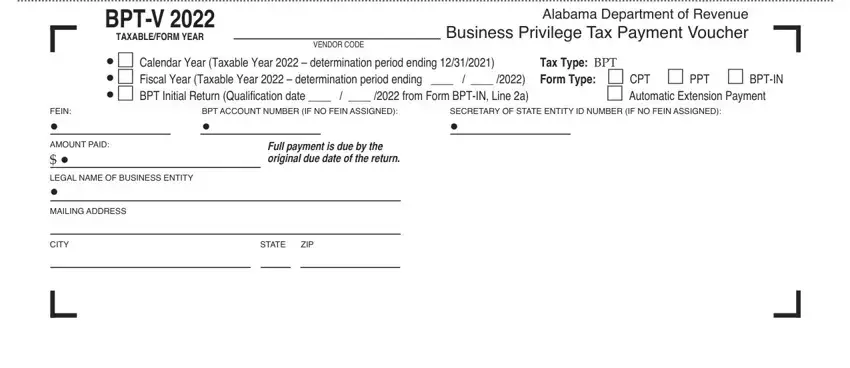

CALENDAR YEAR INDICATOR: Check this box if the taxpayer has a December 31st tax year end.

FISCAL YEAR INDICATOR: Check this box if the taxpayer has a tax year end date other than a calendar year end and enter the deter- mination period end date in the spaces provided.

BPT INITIAL RETURN INDICATOR: Check this box if the taxpayer is making a payment with Form BPT-IN (initial return) and enter the same date as shown on Form BPT-IN, Line 2a.

FEIN: Enter the entity’s Federal Employer Identification Number (FEIN).

BPT ACCOUNT NUMBER: Enter the taxpayer’s BPT (Business Privilege Tax) account number only if the taxpayer does not have a FEIN (Federal Employer Identification Number). See the instructions for Form CPT, Form PPT, or Form BPT-IN for more information re- garding the entity’s account number.

SECRETARY OF STATE ENTITY ID NUMBER: If the FEIN is not yet available, please provide the entity ID number assigned to the tax- payer’s incorporation/qualification documents by the Alabama Secretary of State’s office.

AMOUNT PAID: Enter the amount of the payment submitted with this voucher.

NAME/ADDRESS SECTION: Enter the legal name of the taxpayer and a complete mailing address for the taxpayer.

FORM TYPE: Enter an “X” in the appropriate box to identify the form for which the payment is being made. Please note Form BPT-V must be used when making automatic extension payments, unless the payments are made electronically.

ELECTRONIC PAYMENT: Section 41-1-20 requires electronic payments for all single business tax payments of $750 or more. Substantial penalties will be assessed for noncompliance.

Taxpayers making e-payments must have a Sign On ID and Access Code to sign up for My Alabama Taxes (MAT). Visit www.revenue.alabama.gov for additional information.

NOTE: Refer to our website at www.revenue.alabama.gov for tax payment and form preparation requirements.

6Calendar Year (Taxable Year 2021 – determination period ending 12/31/2020)

6Fiscal Year (Taxable Year 2021 – determination period ending ____ / ____ /2021)

6 BPT Initial Return (Qualification date ____ / ____ /2021 from Form BPT-IN, Line 2a)