Our PDF editor makes it easy to complete documents. You won't have to do much to change bt1 application files. Simply keep to the next actions.

Step 1: Click the button "Get Form Here".

Step 2: Now you are on the file editing page. You may edit, add information, highlight specific words or phrases, insert crosses or checks, and add images.

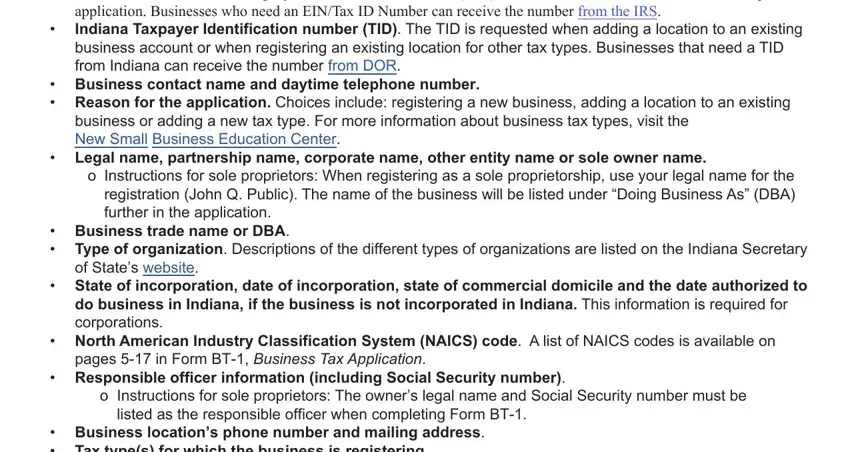

Feel free to enter the next details to prepare the in bt 1 PDF:

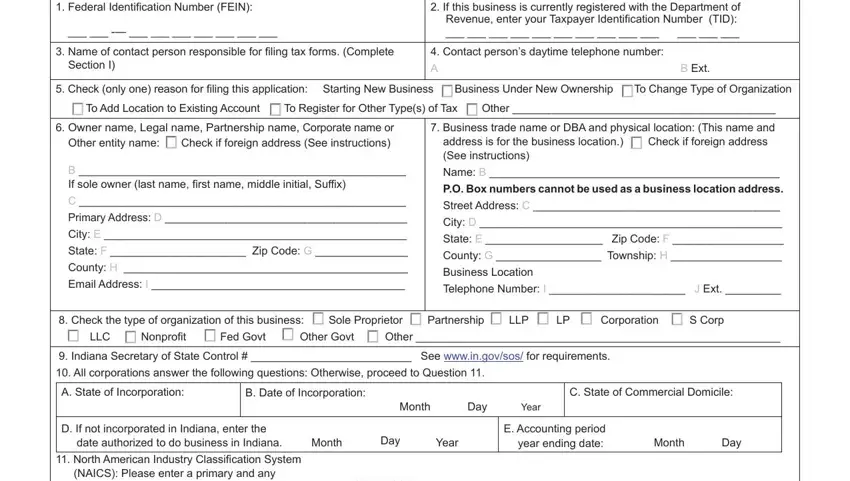

Enter the requested details in the space Federal Identification Number FEIN, If this business is currently, Name of contact person, Contact persons daytime telephone, Section I, B Ext, Check only one reason for filing, To Add Location to Existing, Owner name Legal name Partnership, B If sole owner last name first, Primary Address D, City E, State F Zip Code G, County H, and Email Address I.

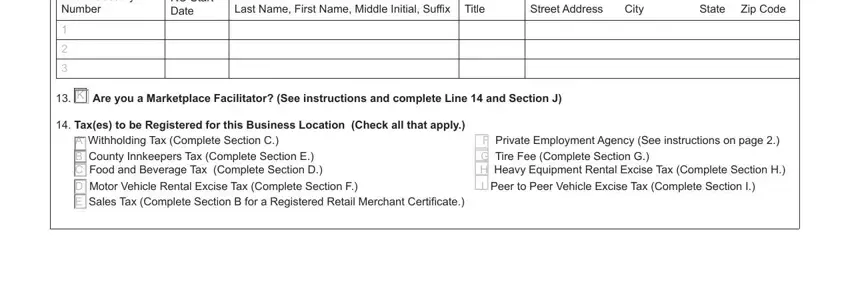

Write the valuable particulars once you are on the Last Name First Name Middle, Title, Street Address City, State Zip Code, A Social Security Number, B RO Start Date, K Are you a Marketplace, Taxes to be Registered for this, A Withholding Tax Complete Section, D Motor Vehicle Rental Excise Tax, F Private Employment Agency See, and I Peer to Peer Vehicle Excise Tax box.

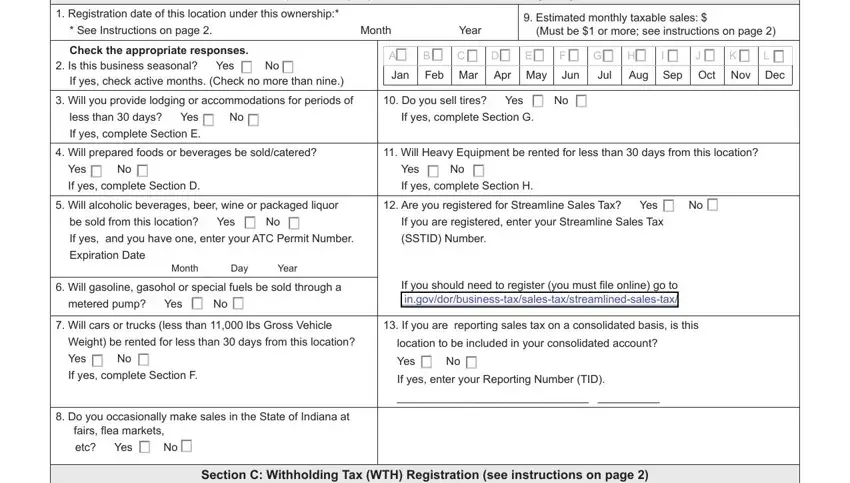

The field Section B Sales Tax RST Tax, Registration date of this, Estimated monthly taxable sales, See Instructions on page, Month, Year, Must be or more see instructions, Check the appropriate responses, Is this business seasonal Yes No, If yes check active months Check, Jan, Feb Mar, Apr May, Jun, and Jul will be where you insert both parties' rights and responsibilities.

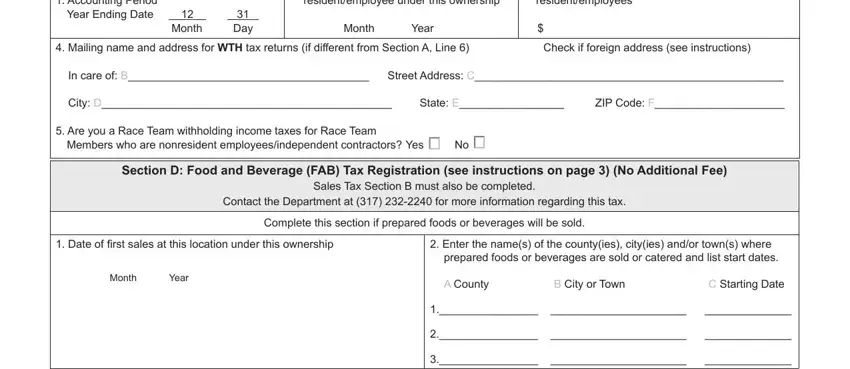

Check the fields Accounting Period Year Ending Date, Month Day, Date taxes first withheld from an, residentemployees, Month Year, Mailing name and address for WTH, In care of B Street Address C, City D State E ZIP Code F, Are you a Race Team withholding, Members who are nonresident, Section D Food and Beverage FAB, Complete this section if prepared, Date of first sales at this, Month Year, and Enter the names of the countyies and then fill them in.

Step 3: Choose the "Done" button. Now it's easy to transfer the PDF document to your electronic device. As well as that, it is possible to forward it via electronic mail.

Step 4: Produce as much as a few copies of the file to remain away from all of the forthcoming concerns.