115 c w can be completed without difficulty. Just try FormsPal PDF editing tool to perform the job promptly. FormsPal expert team is always working to enhance the tool and enable it to be much easier for clients with its extensive functions. Take your experience one step further with continually developing and unique opportunities we offer! To start your journey, go through these easy steps:

Step 1: Click the "Get Form" button in the top area of this page to access our editor.

Step 2: The tool will allow you to customize PDF forms in many different ways. Transform it by adding customized text, adjust existing content, and add a signature - all manageable in minutes!

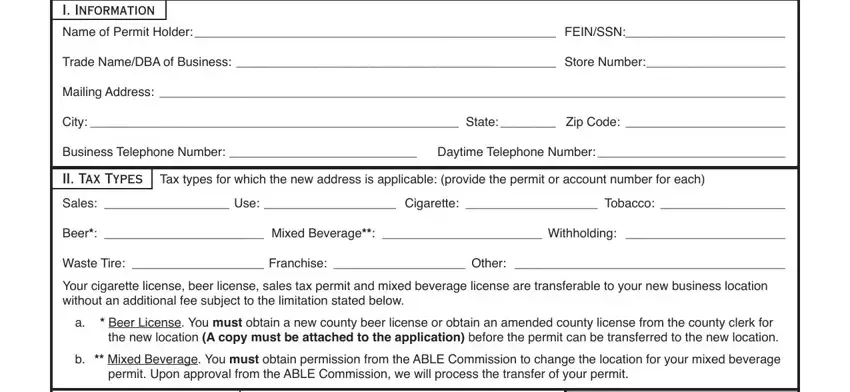

It will be an easy task to fill out the form following this detailed guide! Here's what you should do:

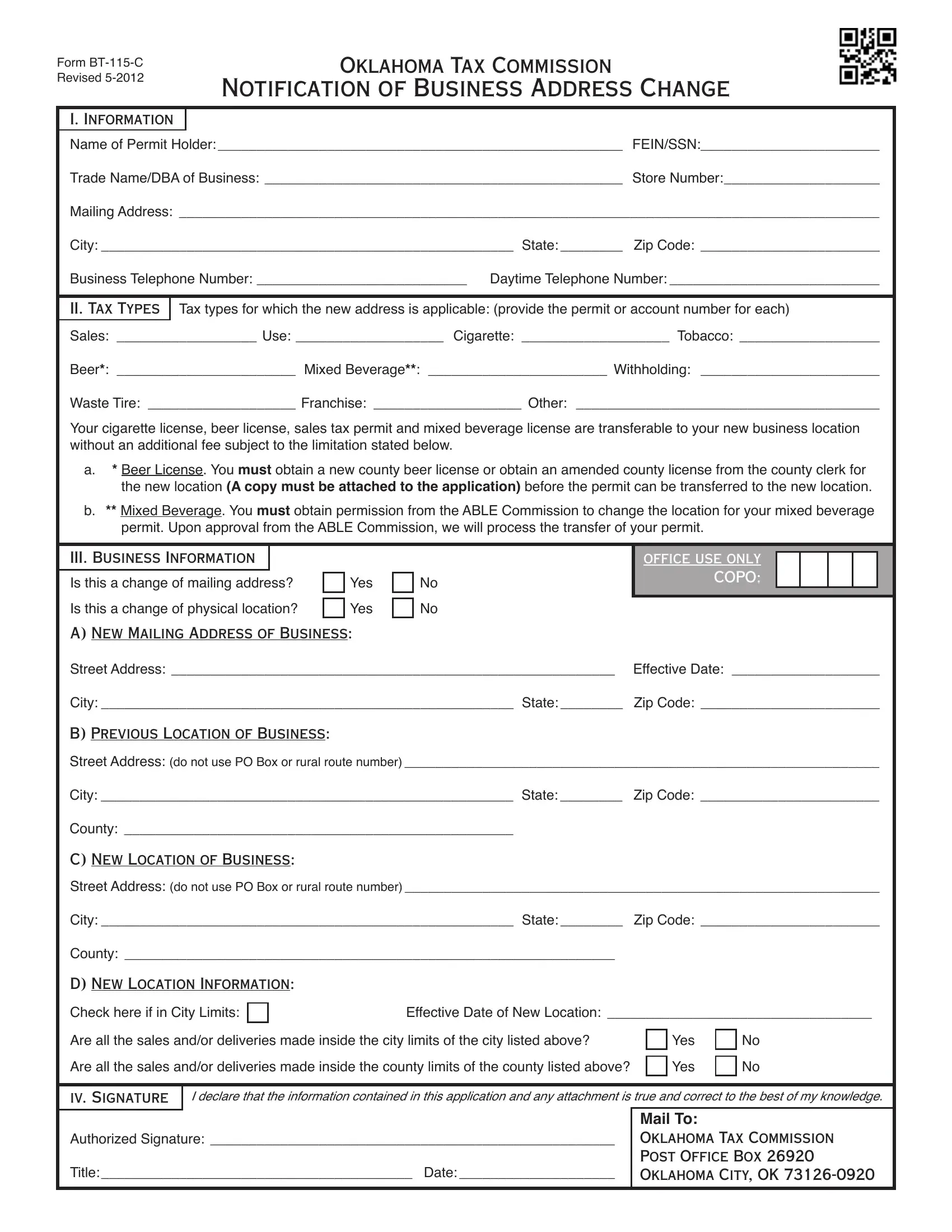

1. Begin filling out your 115 c w with a number of major blanks. Get all the necessary information and ensure not a single thing forgotten!

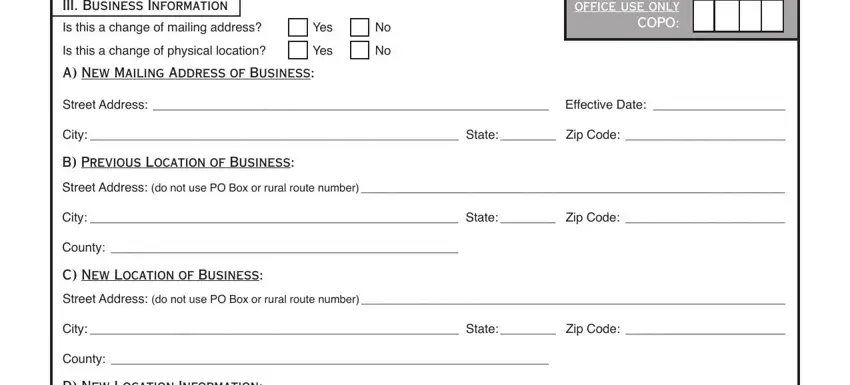

2. The third part is usually to complete these particular blank fields: III Business Information, Is this a change of mailing address, Is this a change of physical, Yes, Yes, A New Mailing Address of Business, office use only COPO, Street Address Effective Date, City State Zip Code, B Previous Location of Business, Street Address do not use PO Box, City State Zip Code, County, C New Location of Business, and Street Address do not use PO Box.

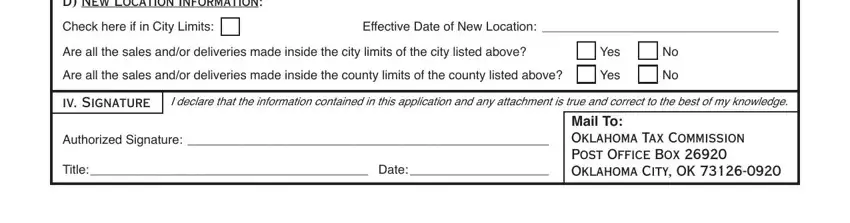

3. This subsequent segment is considered pretty uncomplicated, D New Location Information, Check here if in City Limits, Effective Date of New Location, Are all the sales andor deliveries, Are all the sales andor deliveries, Yes, Yes, iv Signature, I declare that the information, Authorized Signature, Title Date, and Mail To Oklahoma Tax Commission - every one of these form fields needs to be completed here.

Be very mindful when completing Mail To Oklahoma Tax Commission and D New Location Information, since this is the section in which a lot of people make some mistakes.

Step 3: Prior to submitting your form, ensure that all blanks were filled in right. Once you’re satisfied with it, click “Done." After setting up a7-day free trial account here, you will be able to download 115 c w or send it through email without delay. The document will also be easily accessible from your personal cabinet with your adjustments. FormsPal guarantees your information privacy by using a protected method that never saves or distributes any sort of private information provided. Rest assured knowing your docs are kept protected every time you work with our tools!