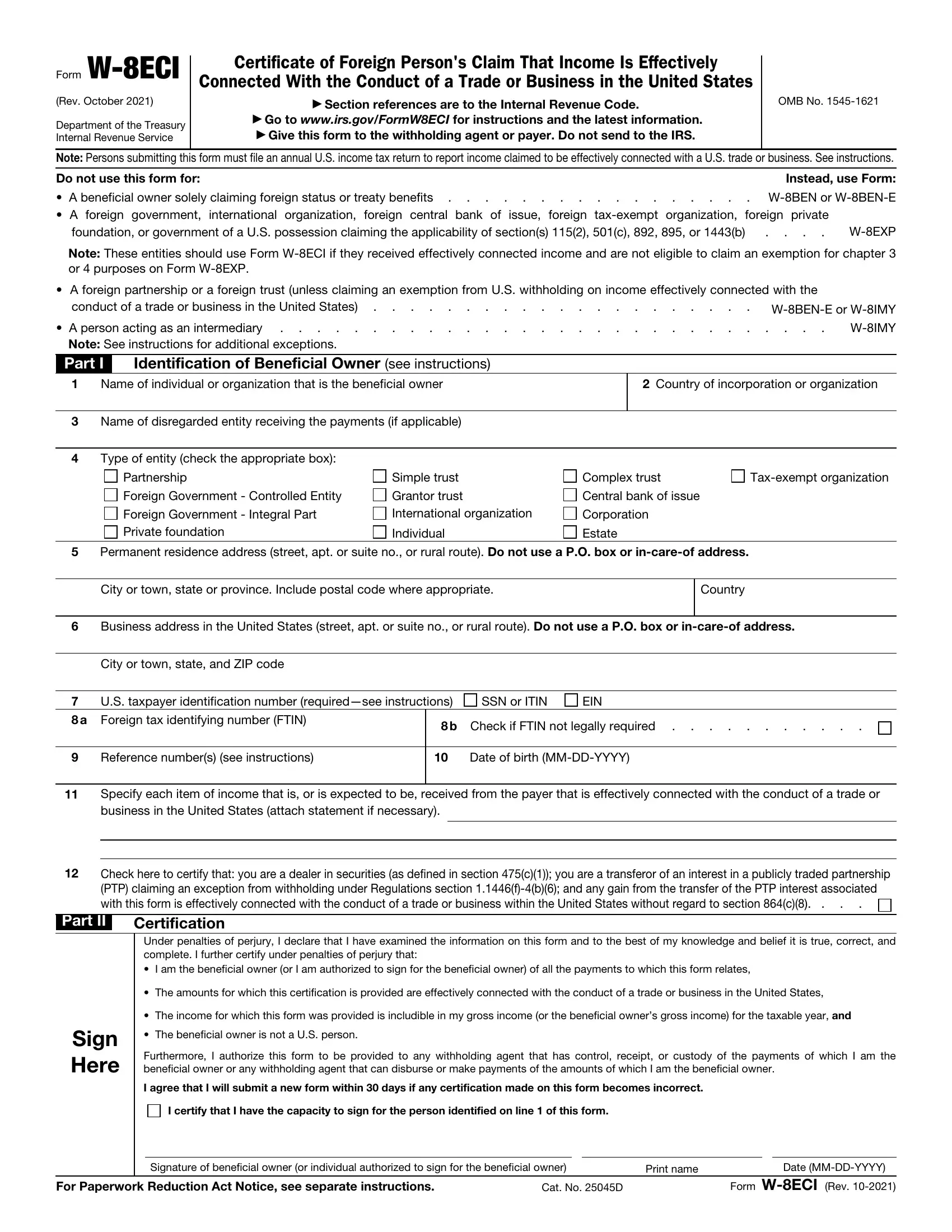

Using PDF documents online is always very simple with our PDF tool. You can fill out Certificate of Foreign Person's Claim ... here painlessly. The tool is constantly improved by our staff, getting new awesome features and growing to be much more versatile. Starting is simple! Everything you should do is stick to the next basic steps down below:

Step 1: Click on the "Get Form" button above. It's going to open up our pdf tool so you could start filling in your form.

Step 2: Using this advanced PDF file editor, you may accomplish more than just complete forms. Express yourself and make your documents look high-quality with customized text put in, or modify the file's original input to excellence - all that comes along with an ability to add stunning photos and sign it off.

This PDF doc will require some specific information; to ensure accuracy and reliability, be sure to take heed of the following steps:

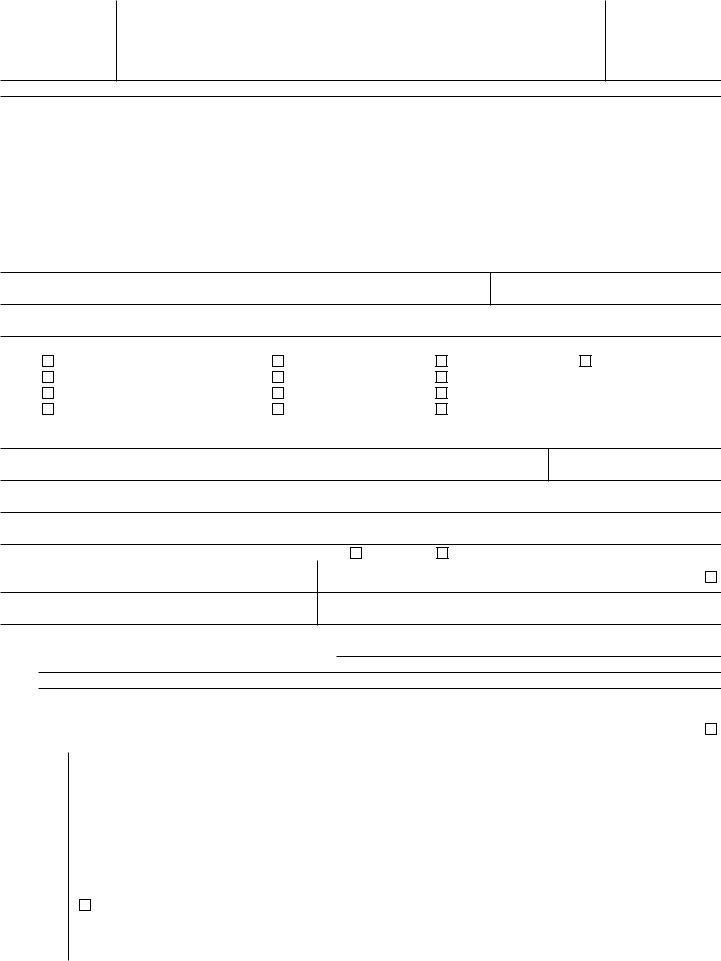

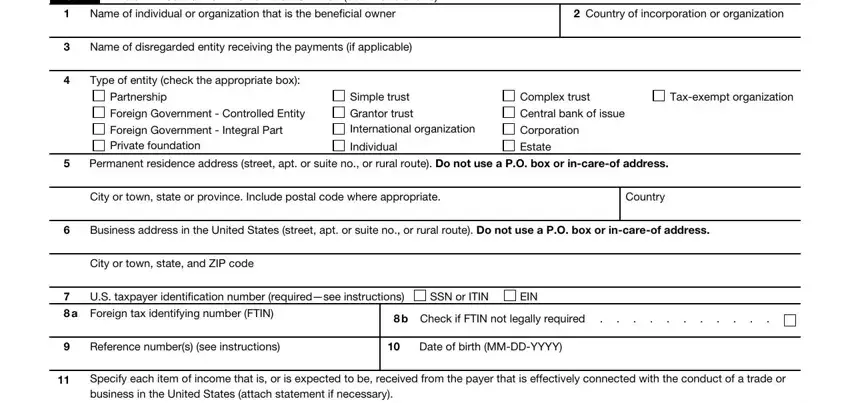

1. You will want to fill out the Certificate of Foreign Person's Claim ... accurately, so be attentive while filling in the sections containing all of these blanks:

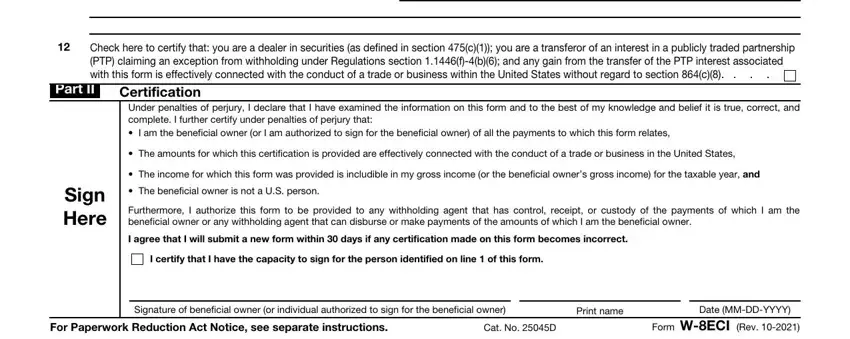

2. Right after finishing this part, go on to the next part and complete the essential particulars in all these blank fields - Check here to certify that you are, Part II, Certification, Under penalties of perjury I, The amounts for which this, The income for which this form, The beneficial owner is not a US, Furthermore I authorize this form, Sign Here, I agree that I will submit a new, I certify that I have the capacity, Signature of beneficial owner or, Print name, Date MMDDYYYY, and For Paperwork Reduction Act Notice.

People often make some errors when completing Under penalties of perjury I in this section. You should definitely review everything you enter here.

Step 3: Right after you've glanced through the details in the fields, click "Done" to complete your form at FormsPal. Right after creating a7-day free trial account here, you'll be able to download Certificate of Foreign Person's Claim ... or send it through email at once. The file will also be easily accessible via your personal cabinet with your adjustments. At FormsPal.com, we endeavor to be certain that all your information is maintained protected.