Working with PDF files online is definitely easy with this PDF editor. Anyone can fill out ca 24 form here with no trouble. In order to make our editor better and easier to use, we continuously come up with new features, considering suggestions from our users. This is what you would need to do to get going:

Step 1: Press the orange "Get Form" button above. It's going to open up our pdf editor so that you could start filling in your form.

Step 2: With this online PDF editor, you're able to accomplish more than just fill out blank form fields. Edit away and make your docs look great with customized text added, or modify the original content to excellence - all comes with the capability to incorporate stunning graphics and sign the file off.

Pay close attention when completing this document. Make sure every single blank is filled in accurately.

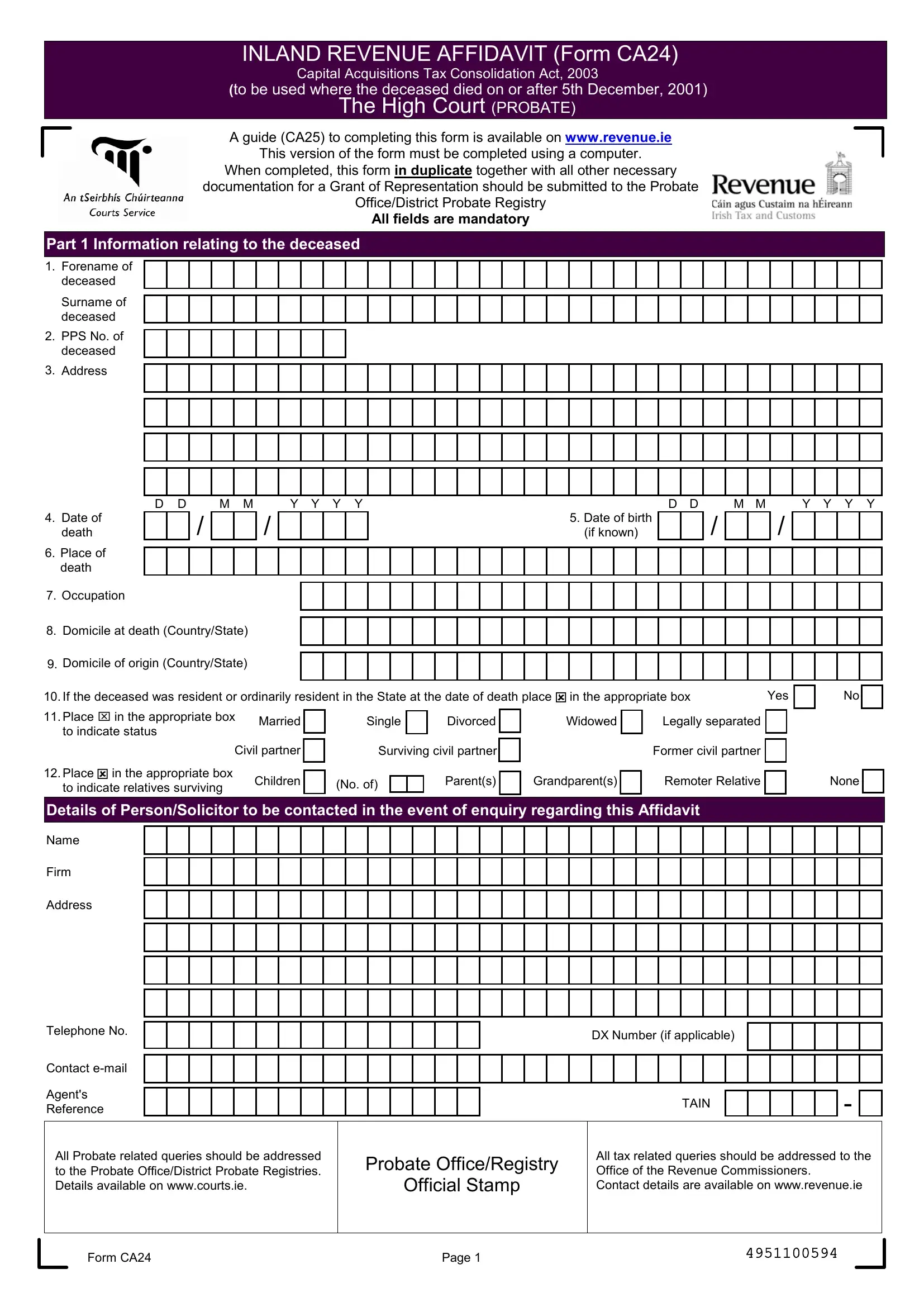

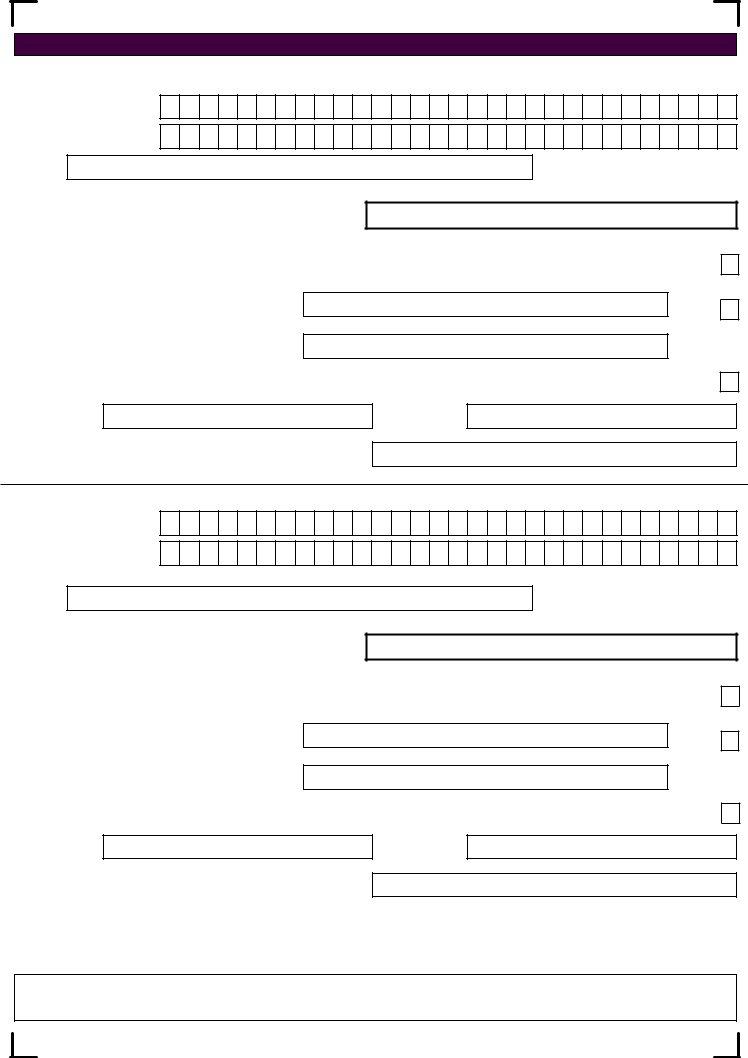

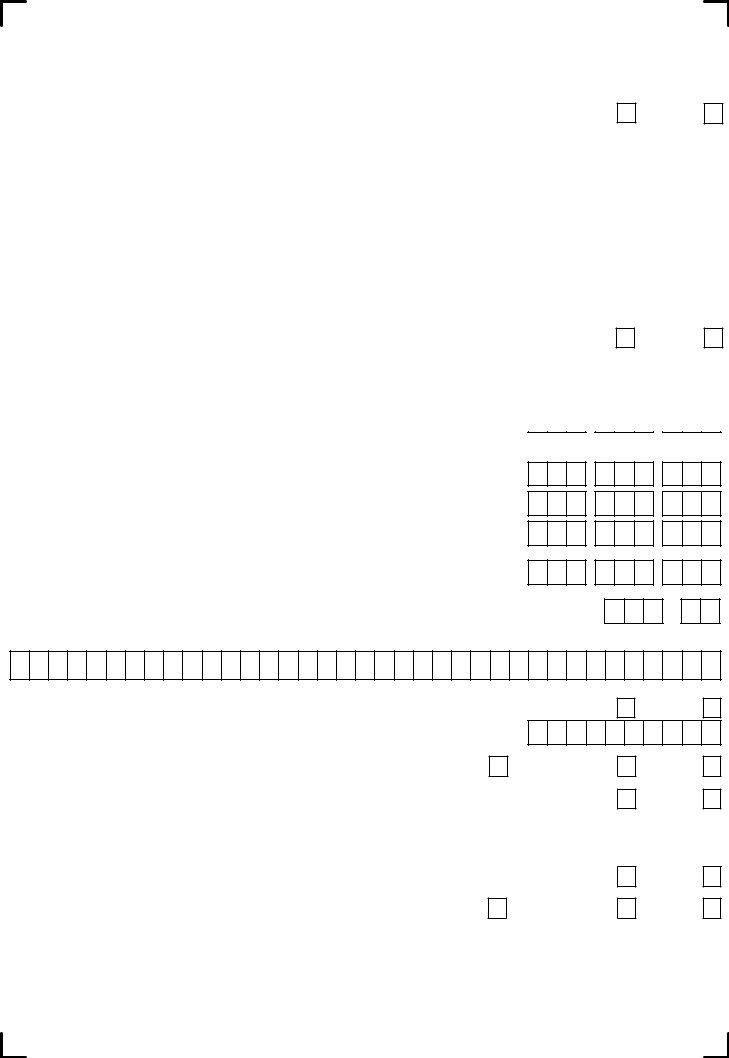

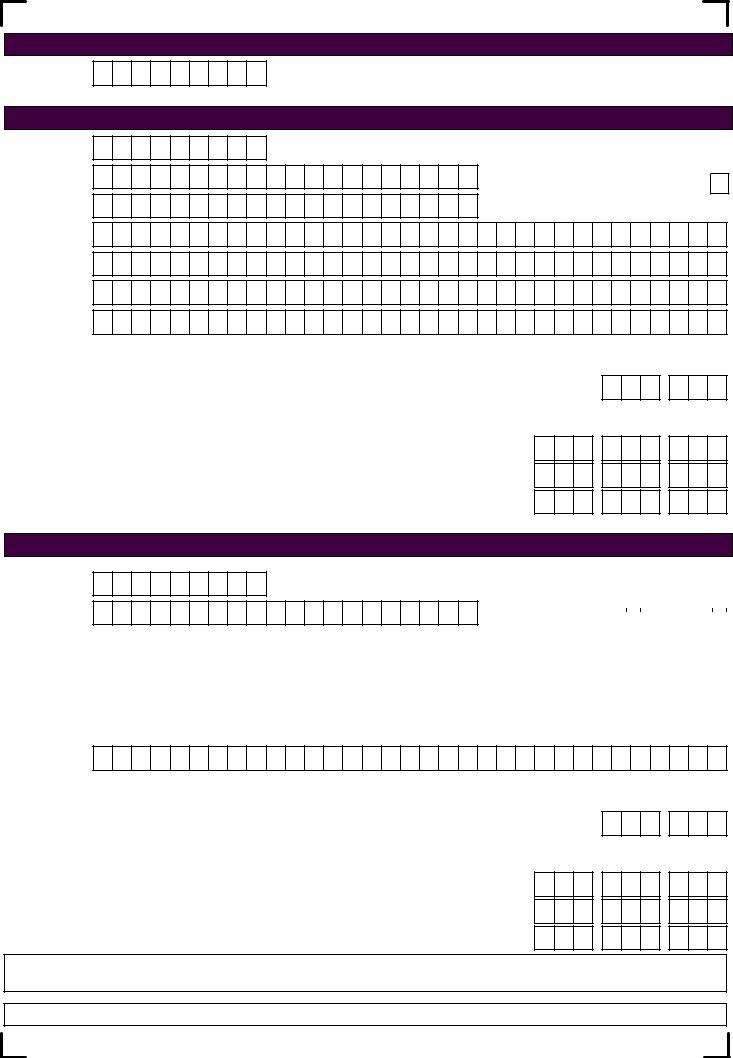

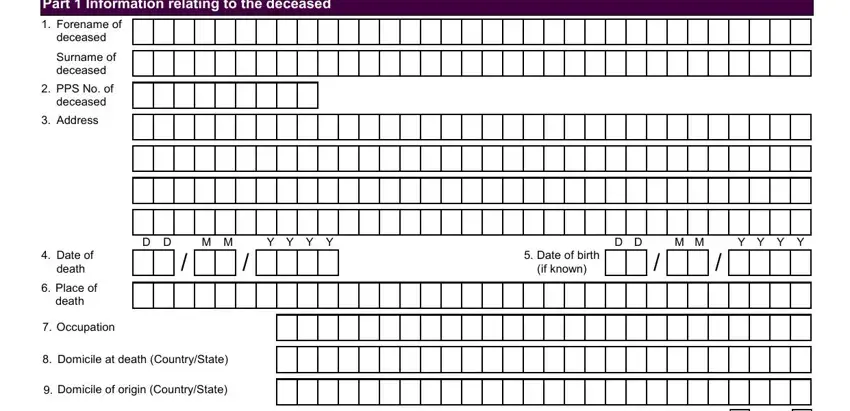

1. When filling in the ca 24 form, ensure to include all necessary blanks in its corresponding area. It will help to hasten the process, which allows your details to be processed promptly and appropriately.

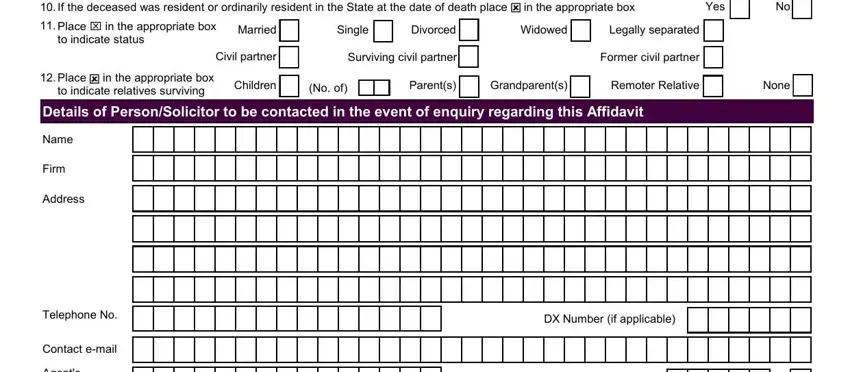

2. Immediately after the first section is completed, proceed to type in the relevant details in these - If the deceased was resident or, Widowed, Married, Single, Divorced, Legally separated, cid, Yes, Civil partner, Surviving civil partner, Former civil partner, cid, Place in the appropriate box to, Children, and No of.

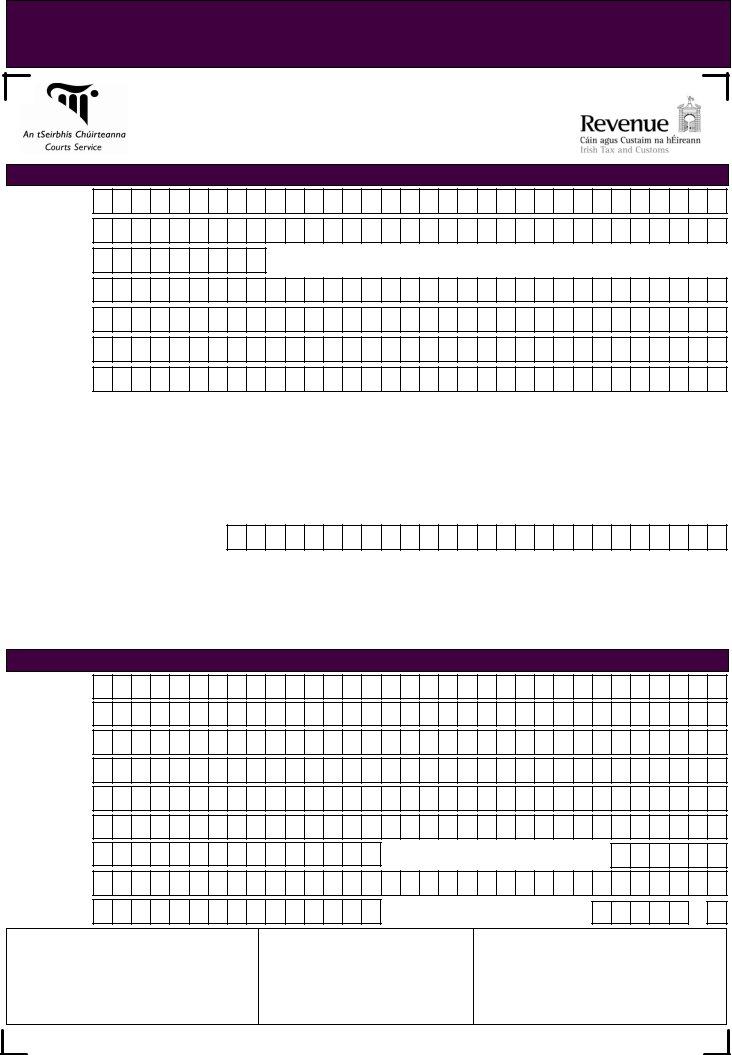

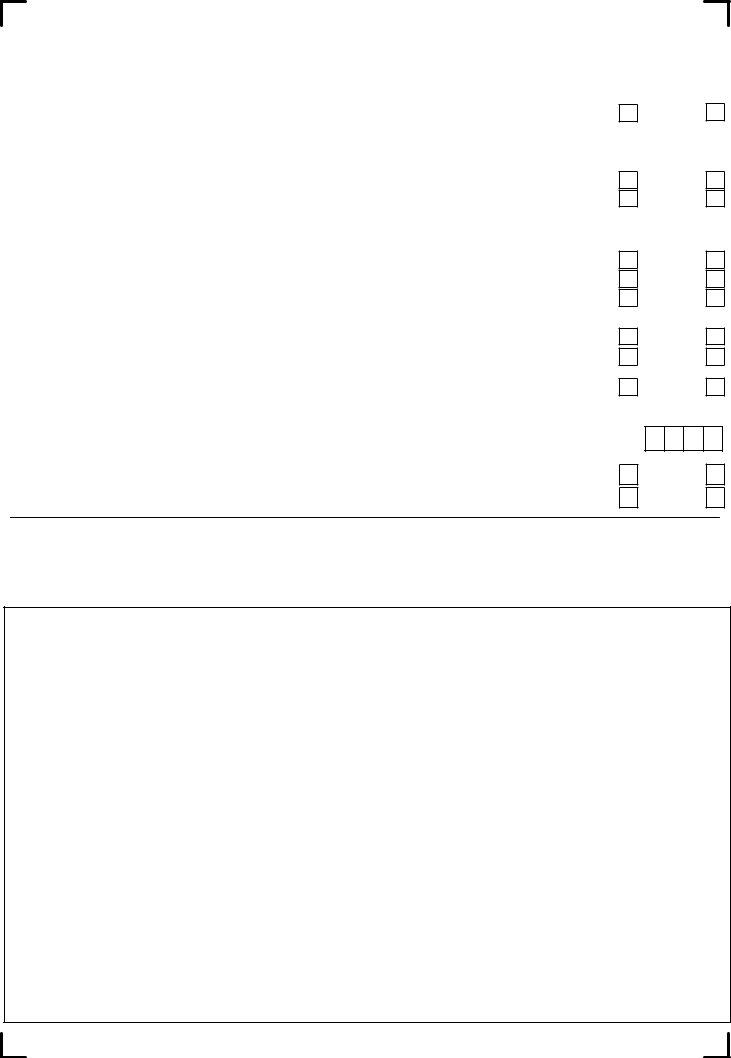

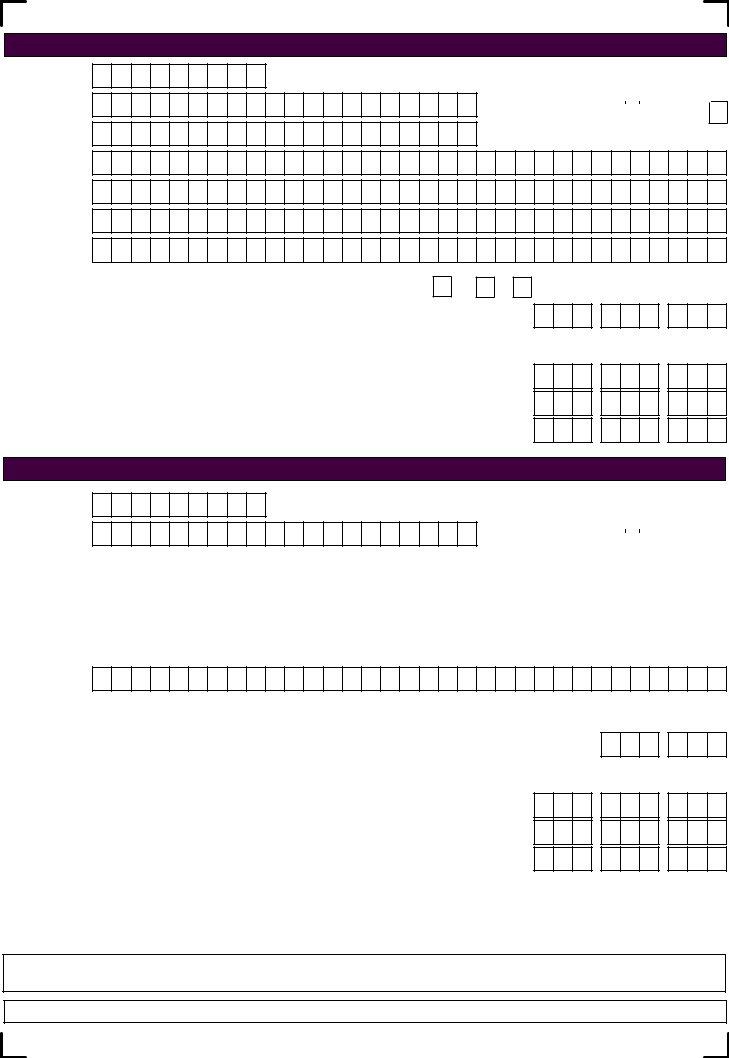

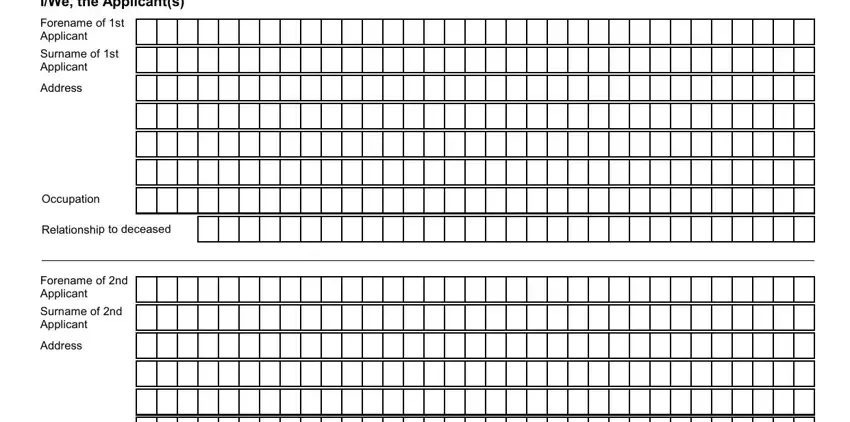

3. Completing Part Details of the applicants, Forename of st Applicant, Surname of st Applicant, Address, Occupation, Relationship to deceased, Forename of nd Applicant, Surname of nd Applicant, and Address is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

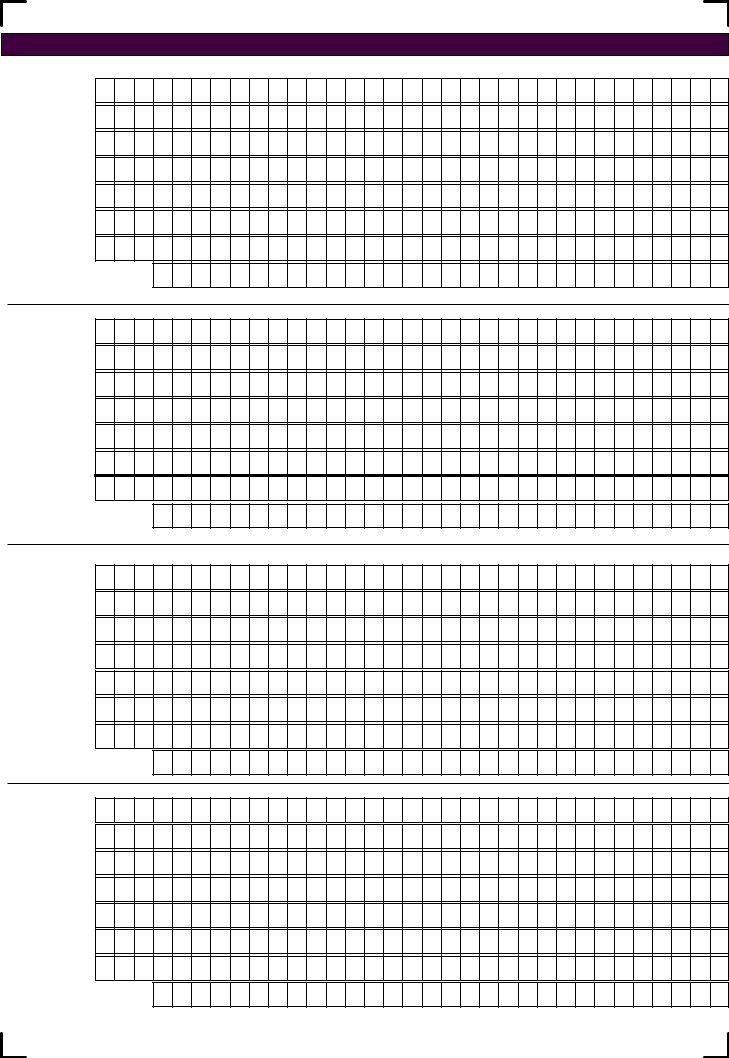

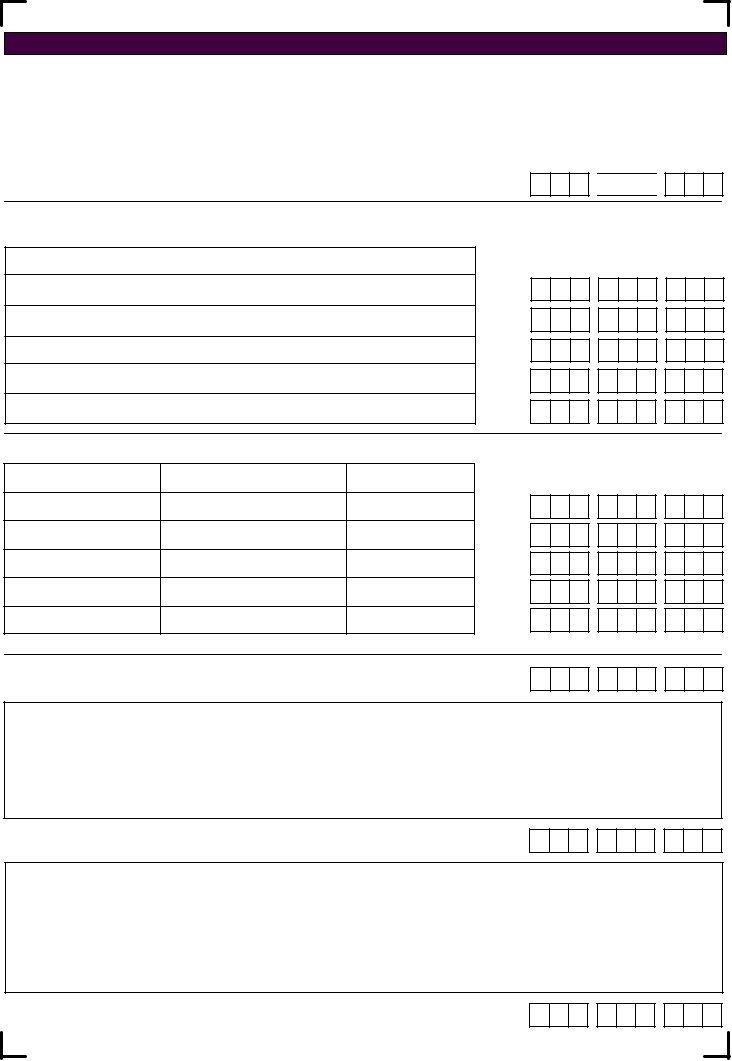

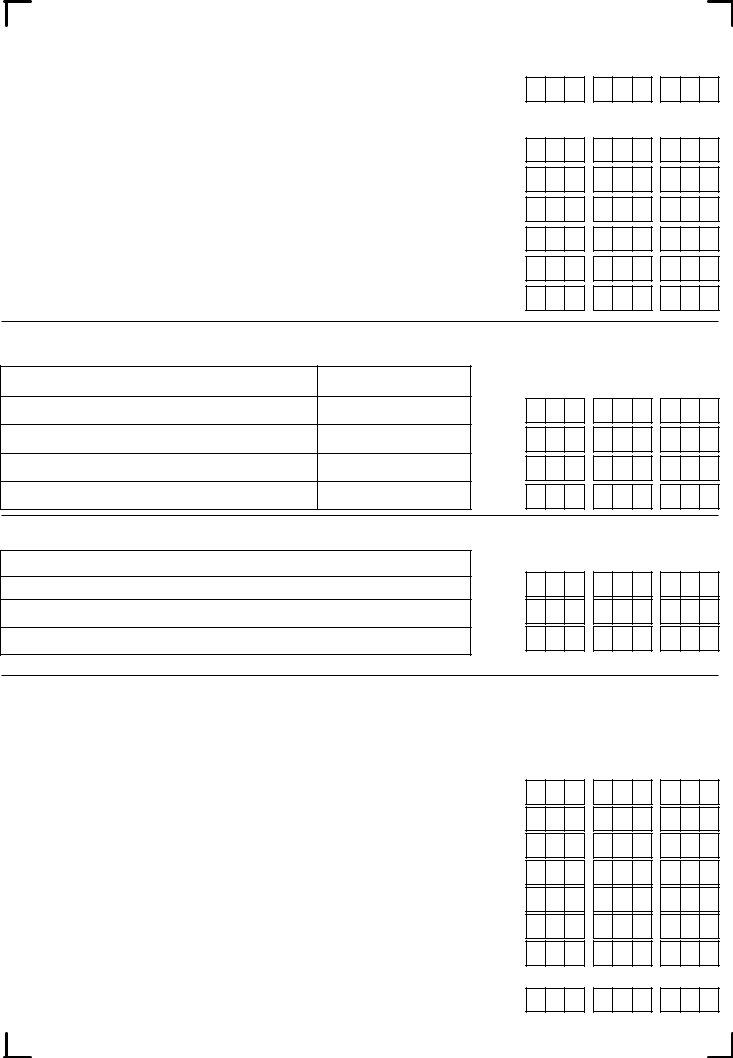

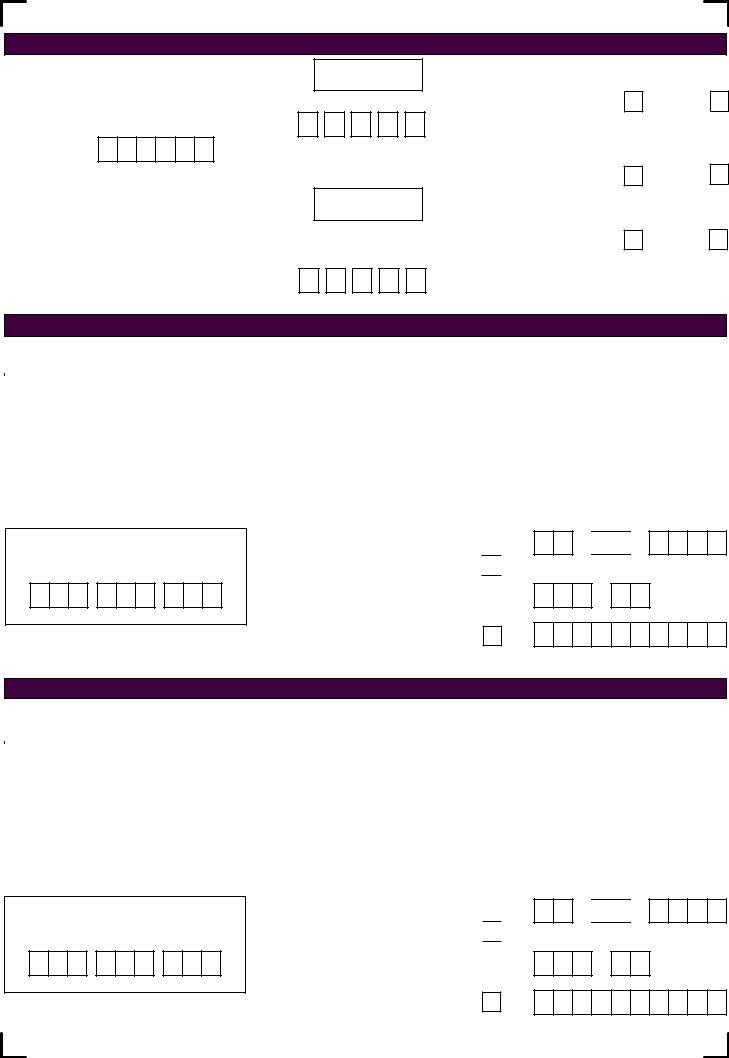

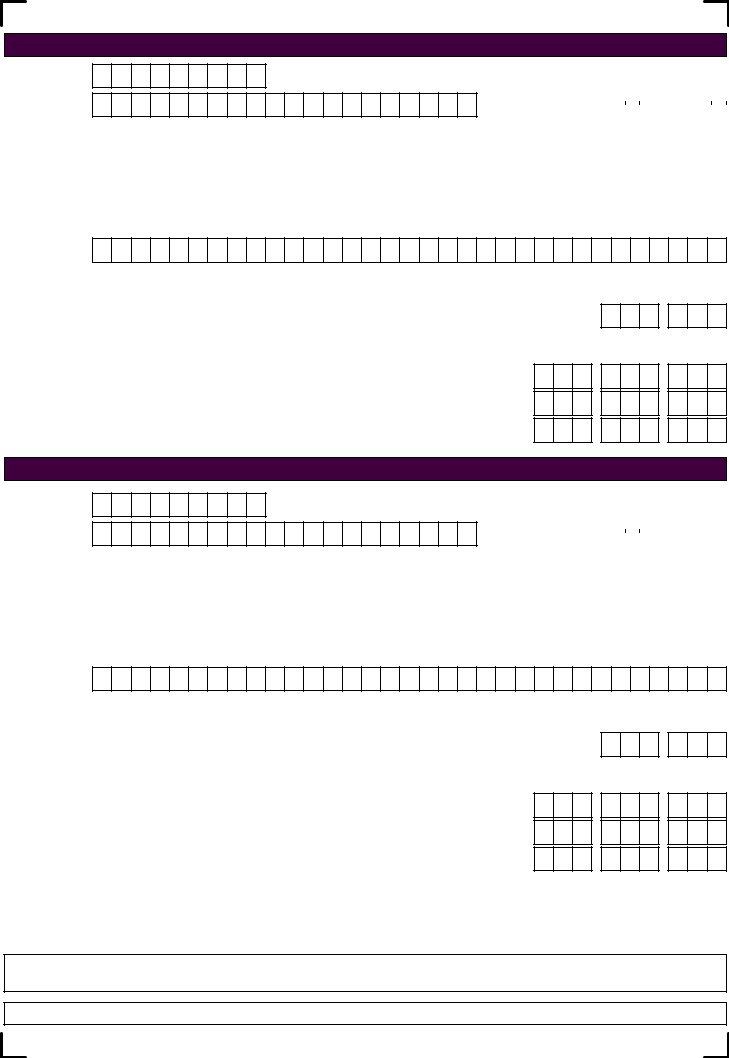

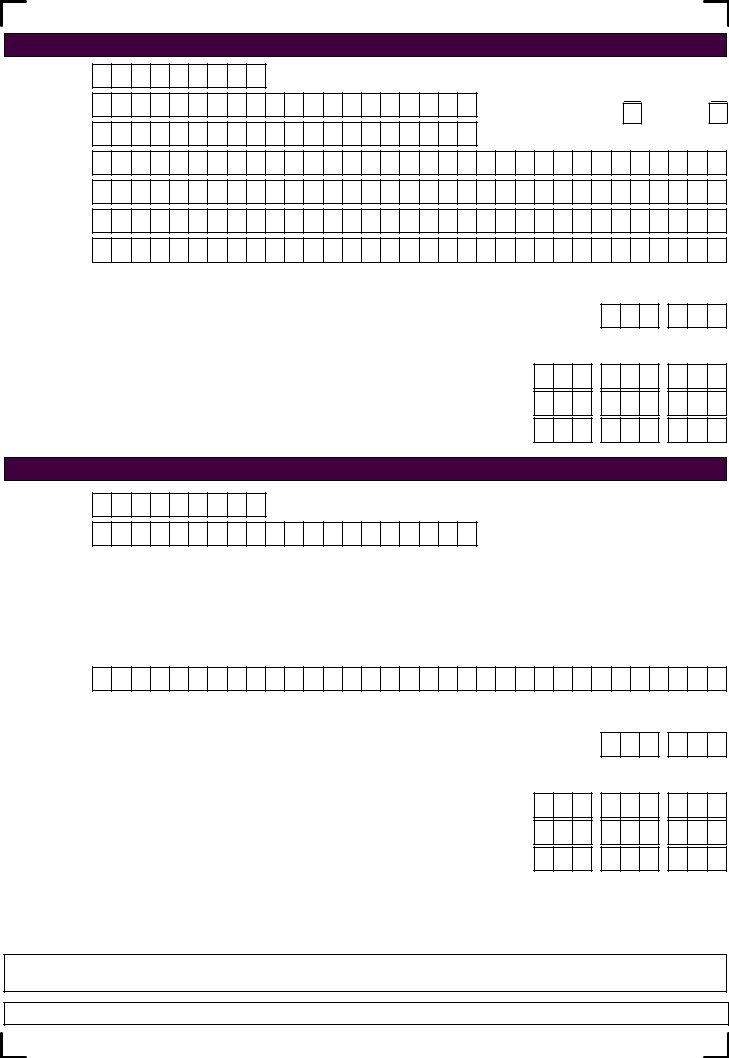

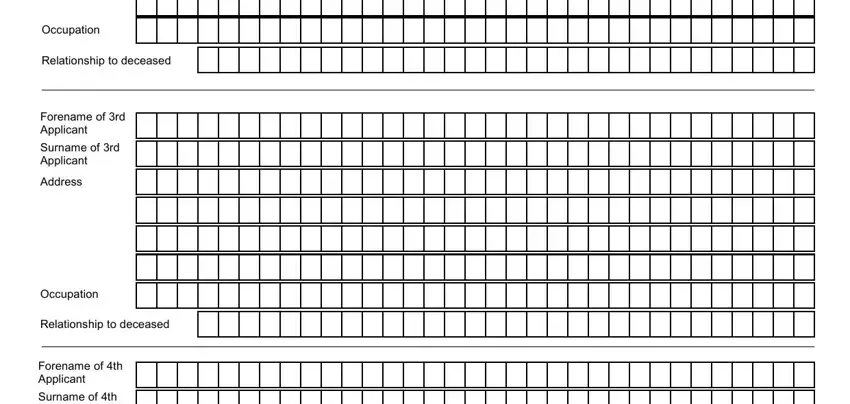

4. This next section requires some additional information. Ensure you complete all the necessary fields - Occupation, Relationship to deceased, Forename of rd Applicant, Surname of rd Applicant, Address, Occupation, Relationship to deceased, Forename of th Applicant, and Surname of th Applicant - to proceed further in your process!

Those who work with this form often get some points wrong while completing Forename of th Applicant in this area. Be sure to re-examine whatever you type in here.

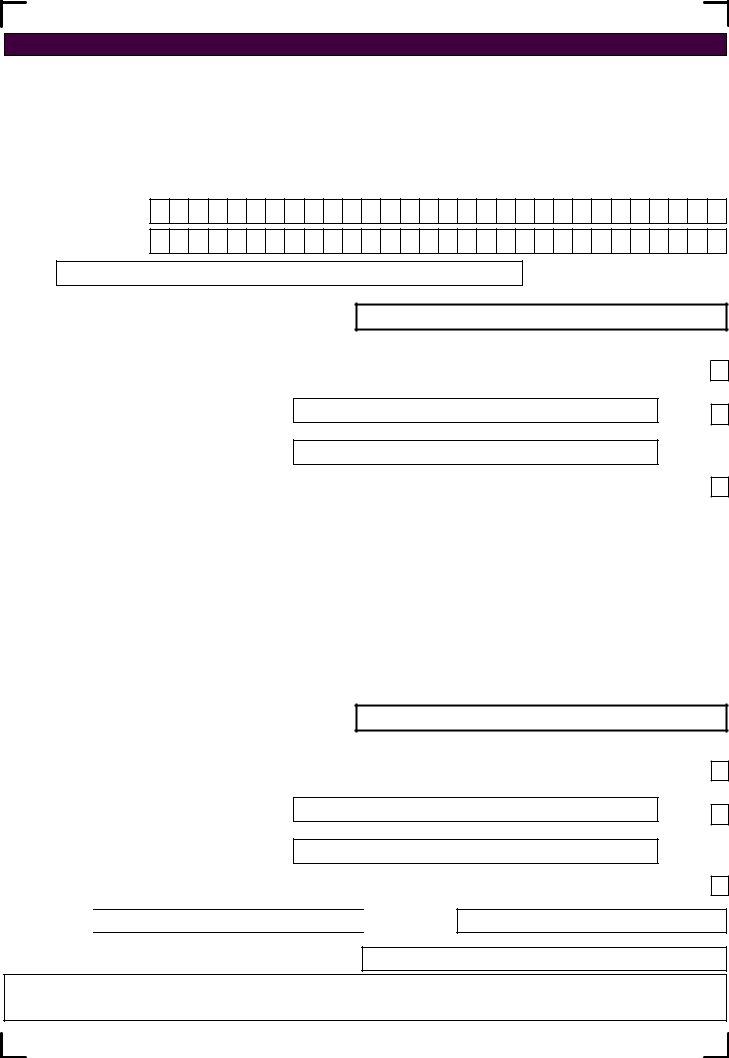

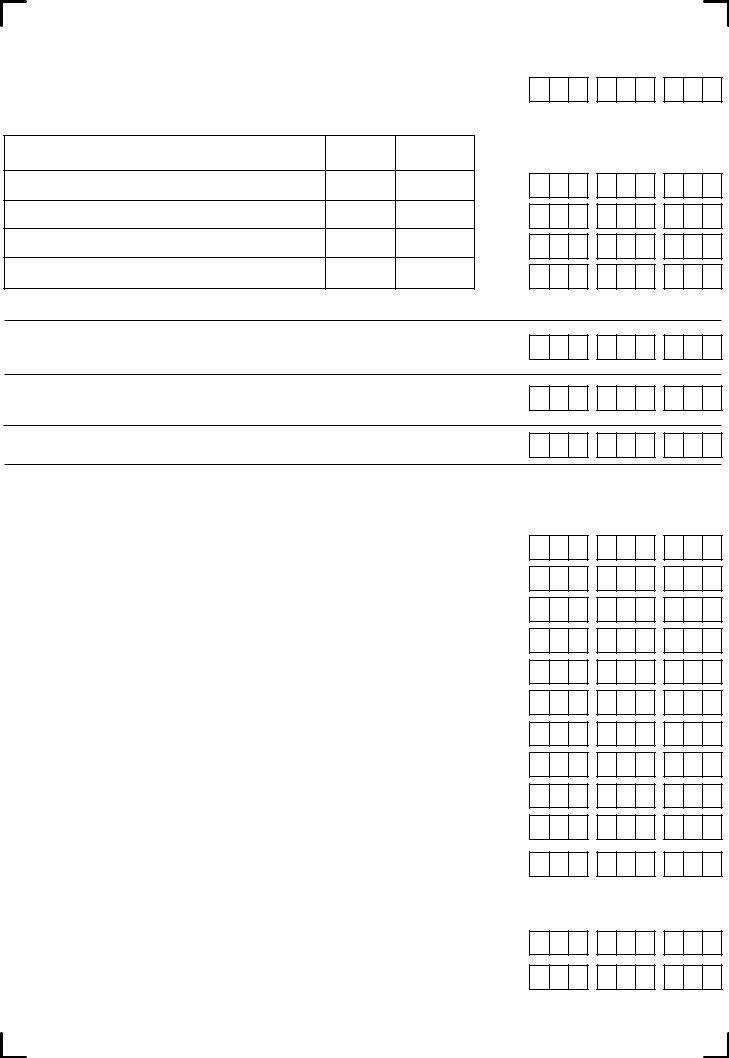

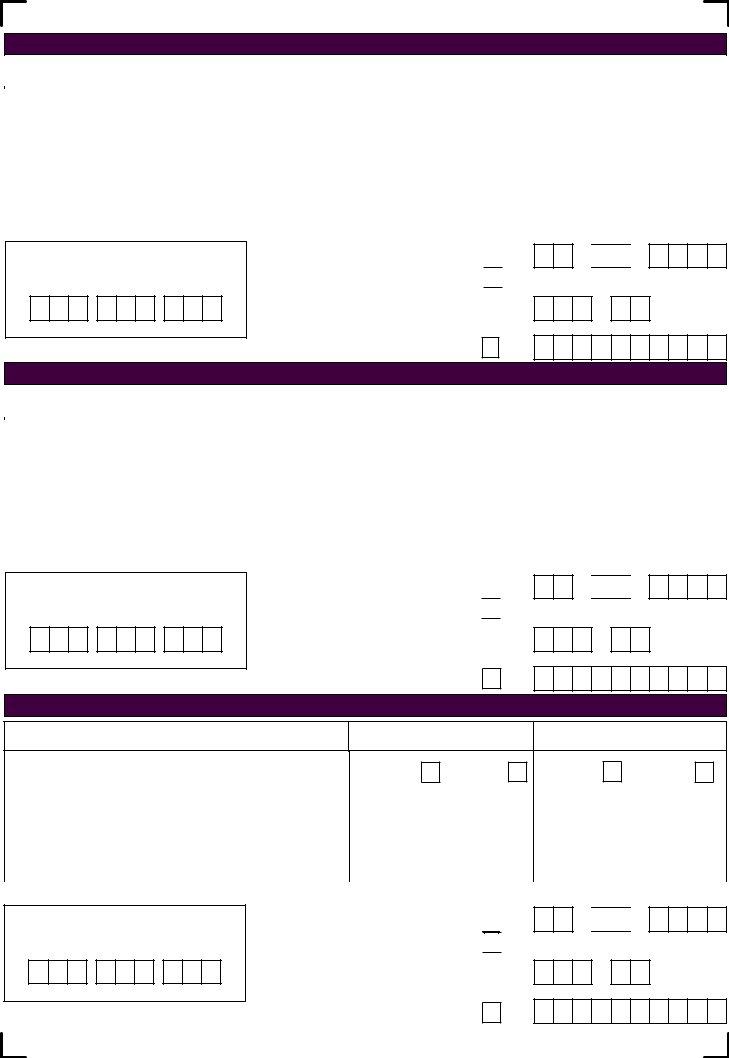

5. Last of all, the following last part is what you should complete before finalizing the PDF. The blanks in question are the following: Surname of th Applicant, Address, Occupation, Relationship to deceased, Form CA, and Page.

Step 3: Spell-check all the details you've typed into the blank fields and click on the "Done" button. After creating afree trial account at FormsPal, it will be possible to download ca 24 form or email it without delay. The PDF form will also be readily accessible in your personal account with all your adjustments. We don't share the details you provide while working with forms at our website.