Managing the new jersey cbt 200 tc form is not difficult using our PDF editor. Follow the next steps to get the document ready straight away.

Step 1: First, pick the orange "Get form now" button.

Step 2: You are now on the document editing page. You may edit, add information, highlight certain words or phrases, insert crosses or checks, and add images.

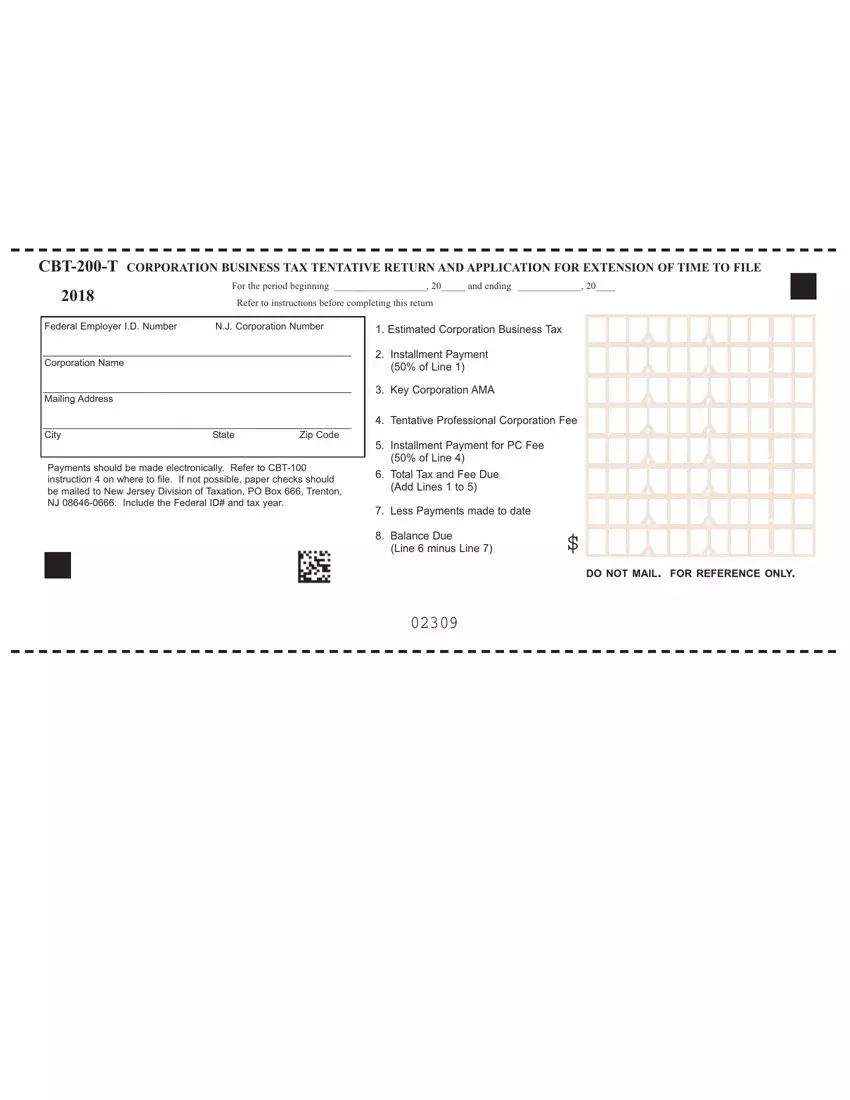

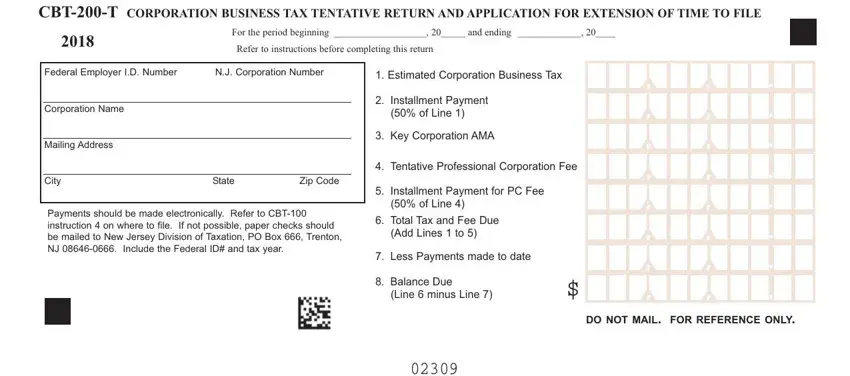

The next parts are inside the PDF template you will be completing.

Step 3: Select "Done". You can now export the PDF form.

Step 4: Make copies of your document - it will help you prevent possible future challenges. And don't worry - we do not display or look at the information you have.