Working with PDF documents online is definitely a breeze with this PDF tool. Anyone can fill in form cc 1680 master here painlessly. To make our tool better and easier to work with, we continuously develop new features, with our users' feedback in mind. To get started on your journey, consider these simple steps:

Step 1: Access the PDF doc inside our tool by pressing the "Get Form Button" in the top part of this webpage.

Step 2: After you access the PDF editor, you'll see the document ready to be filled in. Aside from filling out different blanks, you could also perform many other actions with the file, specifically putting on any words, editing the initial textual content, adding graphics, putting your signature on the form, and more.

It is actually easy to finish the document using out detailed guide! Here's what you must do:

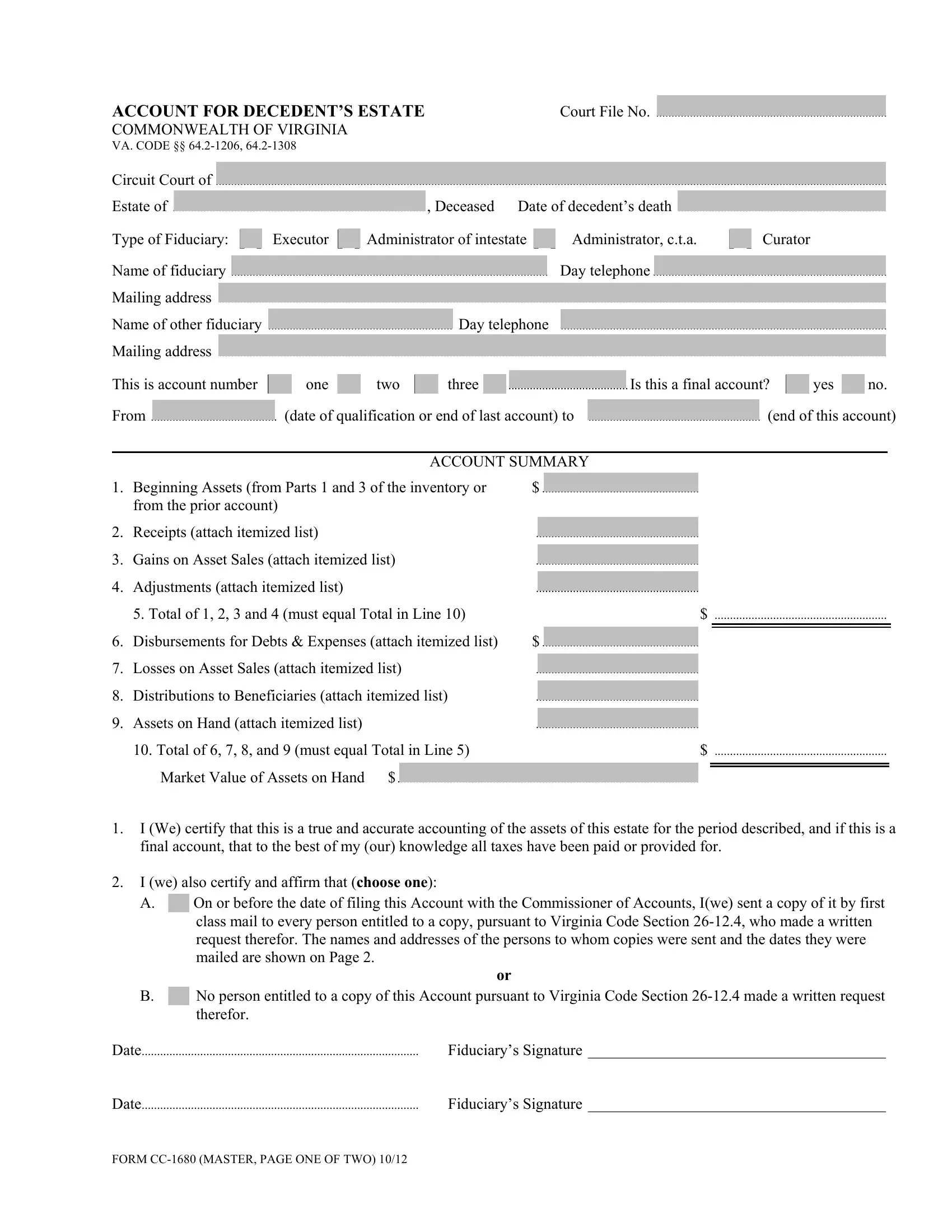

1. Firstly, once filling out the form cc 1680 master, beging with the area that features the subsequent blank fields:

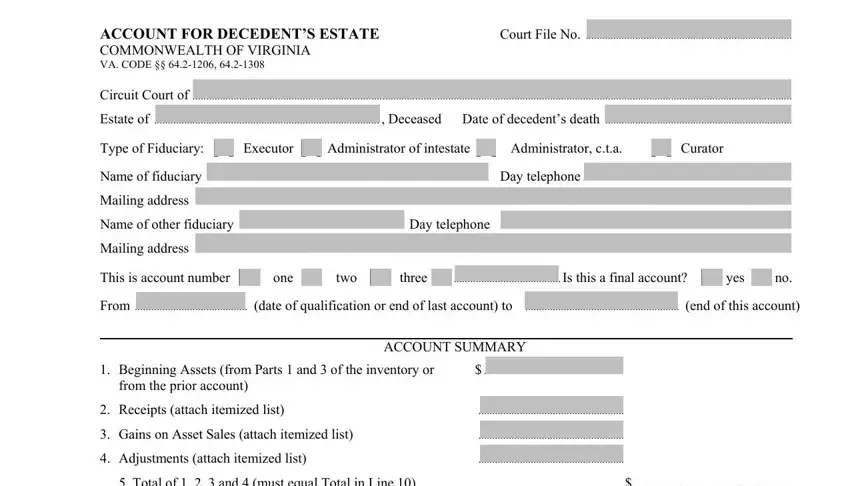

2. Soon after this section is completed, go to enter the suitable information in these - Total of and must equal Total, Disbursements for Debts Expenses, Losses on Asset Sales attach, Distributions to Beneficiaries, Assets on Hand attach itemized, Total of and must equal Total, Market Value of Assets on Hand, I We certify that this is a true, I we also certify and affirm that, class mail to every person, mailed are shown on Page, B No person entitled to a copy, therefor, Date, and Fiduciarys Signature.

Be extremely attentive while filling in Total of and must equal Total and B No person entitled to a copy, because this is the section in which a lot of people make mistakes.

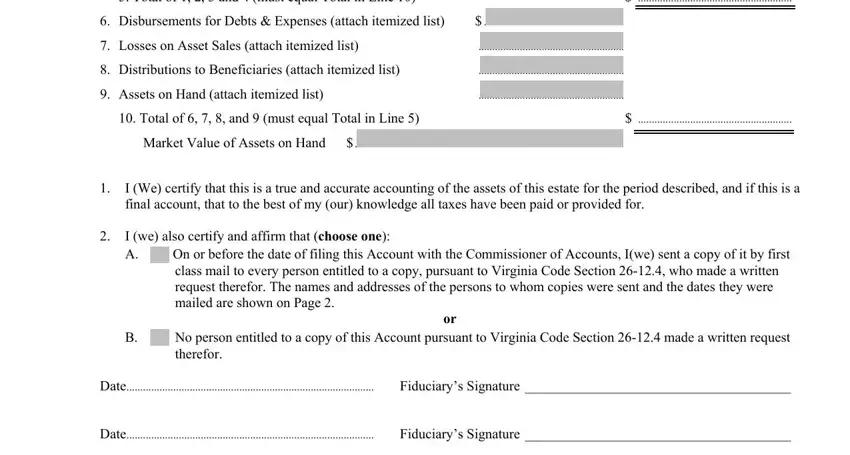

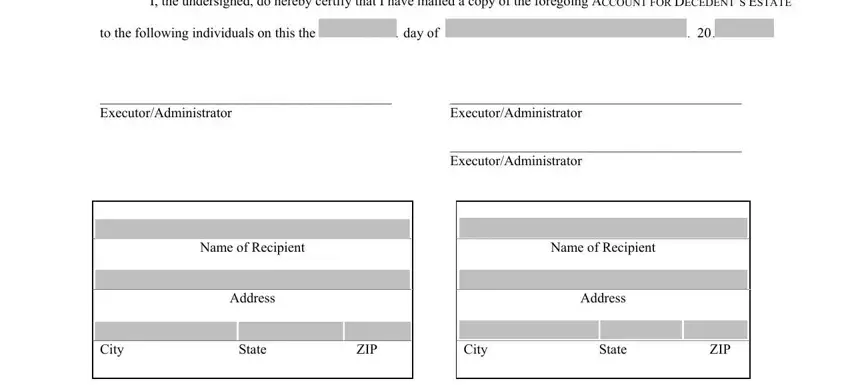

3. The next step is generally fairly straightforward, I the undersigned do hereby, to the following individuals on, ExecutorAdministrator, ExecutorAdministrator, Name of Recipient, Address, City State ZIP, ExecutorAdministrator, Name of Recipient, Address, and City State ZIP - all these fields will have to be completed here.

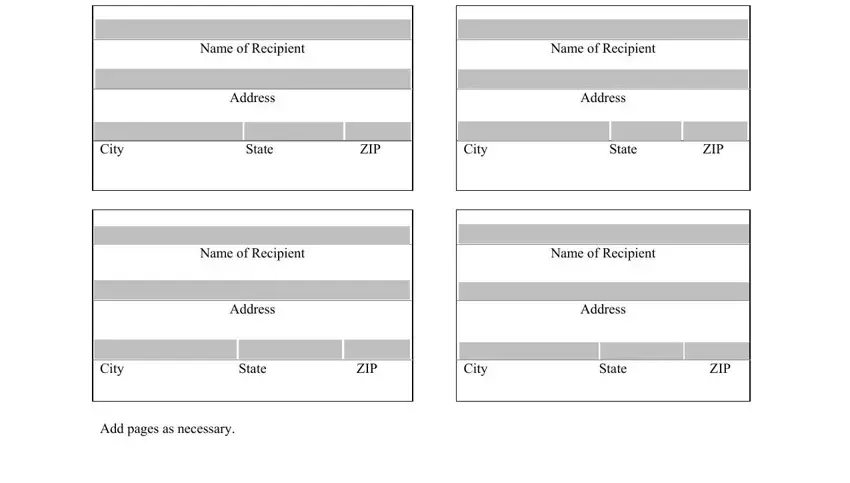

4. Filling in City State ZIP, Name of Recipient, Address, City State ZIP, Name of Recipient, Address, City State ZIP, City State ZIP, Name of Recipient, Address, City State ZIP, Name of Recipient, Address, City State ZIP, and Add pages as necessary is essential in the next section - be certain to invest some time and fill out every empty field!

Step 3: Before moving on, make sure that form fields have been filled out properly. As soon as you verify that it's correct, press “Done." Join FormsPal right now and easily access form cc 1680 master, ready for download. Each edit made is handily kept , which means you can edit the file at a later stage when necessary. FormsPal ensures your information confidentiality via a secure method that never records or distributes any sort of private data used in the form. Rest assured knowing your docs are kept confidential whenever you work with our services!