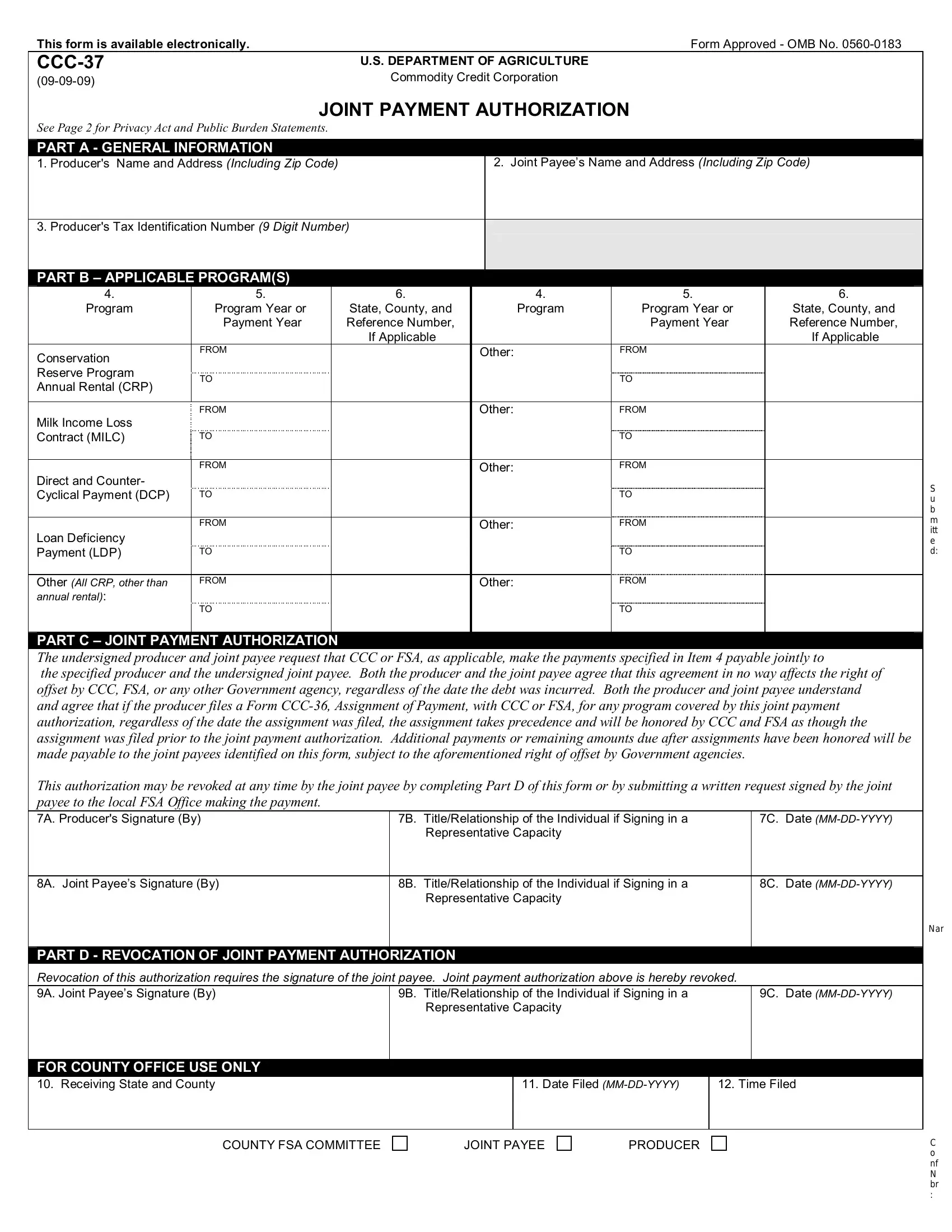

This form is available electronically. |

Form Approved - OMB No. 0560-0183 |

CCC-37 |

U.S. DEPARTMENT OF AGRICULTURE |

(09-09-09) |

Commodity Credit Corporation |

|

JOINT PAYMENT AUTHORIZATION

See Page 2 for Privacy Act and Public Burden Statements.

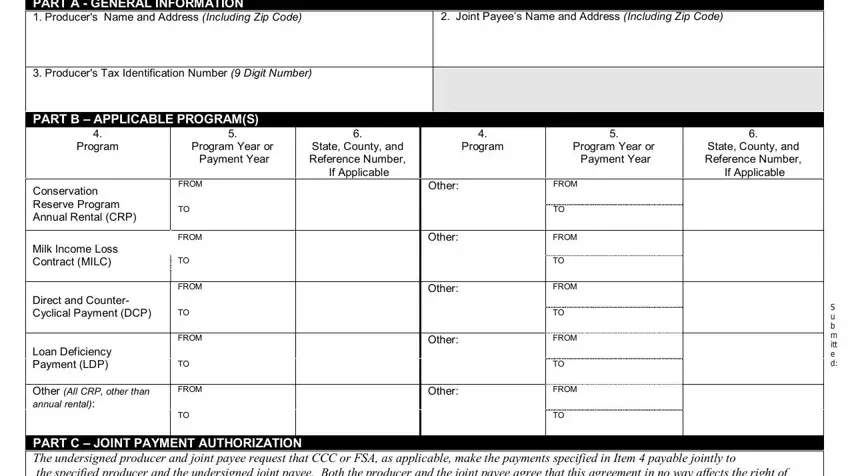

PART A - GENERAL INFORMATION

1. Producer's Name and Address (Including Zip Code) |

|

|

2. Joint Payee’s Name and Address (Including Zip Code) |

|

|

|

|

|

|

|

3. Producer's Tax Identification Number (9 Digit Number) |

|

|

|

|

|

|

|

|

|

|

|

|

PART B – APPLICABLE PROGRAM(S) |

|

|

|

|

|

4. |

5. |

|

6. |

4. |

5. |

6. |

Program |

Program Year or |

|

State, County, and |

|

Program |

Program Year or |

State, County, and |

|

Payment Year |

|

Reference Number, |

|

|

Payment Year |

Reference Number, |

|

|

|

If Applicable |

|

|

|

If Applicable |

Conservation |

FROM |

|

|

Other: |

FROM |

|

|

|

|

|

|

|

|

Reserve Program |

TO |

|

|

|

|

TO |

|

Annual Rental (CRP) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FROM |

|

|

Other: |

FROM |

|

Milk Income Loss |

|

|

|

|

|

|

|

Contract (MILC) |

TO |

|

|

|

|

TO |

|

|

|

|

|

|

|

|

|

FROM |

|

|

Other: |

FROM |

|

Direct and Counter- |

|

|

|

|

|

|

|

Cyclical Payment (DCP) |

TO |

|

|

|

|

TO |

|

|

|

|

|

|

|

|

|

FROM |

|

|

Other: |

FROM |

|

Loan Deficiency |

|

|

|

|

|

|

|

Payment (LDP) |

TO |

|

|

|

|

TO |

|

|

|

|

|

|

|

|

Other (All CRP, other than |

FROM |

|

|

Other: |

FROM |

|

annual rental): |

|

|

|

|

|

|

|

|

TO |

|

|

|

|

TO |

|

|

|

|

|

|

|

|

|

PART C – JOINT PAYMENT AUTHORIZATION |

|

|

|

|

|

The undersigned producer and joint payee request that CCC or FSA, as applicable, make the payments specified in Item 4 payable jointly to

the specified producer and the undersigned joint payee. Both the producer and the joint payee agree that this agreement in no way affects the right of offset by CCC, FSA, or any other Government agency, regardless of the date the debt was incurred. Both the producer and joint payee understand and agree that if the producer files a Form CCC-36, Assignment of Payment, with CCC or FSA, for any program covered by this joint payment authorization, regardless of the date the assignment was filed, the assignment takes precedence and will be honored by CCC and FSA as though the assignment was filed prior to the joint payment authorization. Additional payments or remaining amounts due after assignments have been honored will be made payable to the joint payees identified on this form, subject to the aforementioned right of offset by Government agencies.

This authorization may be revoked at any time by the joint payee by completing Part D of this form or by submitting a written request signed by the joint payee to the local FSA Office making the payment.

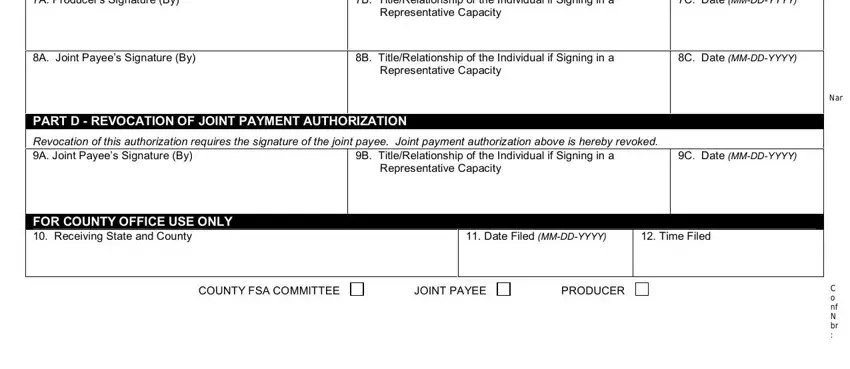

7A. Producer's Signature (By) |

7B. |

Title/Relationship of the Individual if Signing in a |

7C. |

Date (MM-DD-YYYY) |

|

|

Representative Capacity |

|

|

|

|

|

|

|

8A. Joint Payee’s Signature (By) |

8B. |

Title/Relationship of the Individual if Signing in a |

8C. |

Date (MM-DD-YYYY) |

|

|

Representative Capacity |

|

|

|

|

|

|

|

PART D - REVOCATION OF JOINT PAYMENT AUTHORIZATION

Revocation of this authorization requires the signature of the joint payee. Joint payment authorization above is hereby revoked.

9A. Joint Payee’s Signature (By) |

9B. Title/Relationship of the Individual if Signing in a |

9C. Date (MM-DD-YYYY) |

|

Representative Capacity |

|

|

|

|

FOR COUNTY OFFICE USE ONLY

10. Receiving State and County |

11. Date Filed (MM-DD-YYYY) |

12. Time Filed |

|

|

|

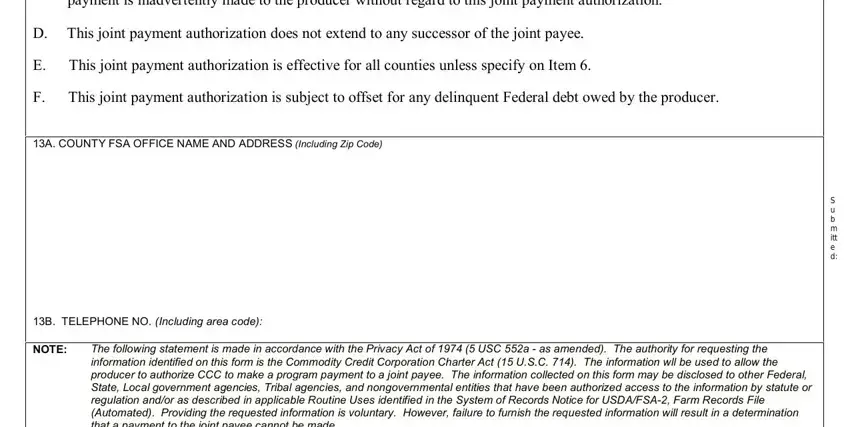

SPECIAL PROVISIONS RELATING TO JOINT PAYMENT AUTHORIZATION

A.The original of this joint payment authorization, properly executed, must be filed in the Farm Service Agency office.

B.CCC and FSA will recognize only 1 joint payment authorization at any given time per producer for each program per program year or group of years if multi-year is selected.

C.Neither the United States of America, the Commodity Credit Corporation, the Secretary of Agriculture, any disbursing officer, nor any other Government employee or official shall be subject to any suit or liable for payment of any amount if payment is inadvertently made to the producer without regard to this joint payment authorization.

D.This joint payment authorization does not extend to any successor of the joint payee.

E.This joint payment authorization is effective for all counties unless specify on Item 6.

F.This joint payment authorization is subject to offset for any delinquent Federal debt owed by the producer.

13A. COUNTY FSA OFFICE NAME AND ADDRESS (Including Zip Code)

13B. TELEPHONE NO. (Including area code):

NOTE: The following statement is made in accordance with the Privacy Act of 1974 (5 USC 552a - as amended). The authority for requesting the information identified on this form is the Commodity Credit Corporation Charter Act (15 U.S.C. 714). The information wll be used to allow the producer to authorize CCC to make a program payment to a joint payee. The information collected on this form may be disclosed to other Federal, State, Local government agencies, Tribal agencies, and nongovernmental entities that have been authorized access to the information by statute or regulation and/or as described in applicable Routine Uses identified in the System of Records Notice for USDA/FSA-2, Farm Records File (Automated). Providing the requested information is voluntary. However, failure to furnish the requested information will result in a determination that a payment to the joint payee cannot be made.

According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0560-0183. The time required to complete this information collection is estimated to average 10 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. RETURN

THIS COMPLETED FORM TO YOUR COUNTY FSA OFFICE.

The U.S. Department of Agriculture (USDA) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, genetic information, political beliefs, reprisal, or because all or part of an individual's income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA's TARGET Center at (202) 720-2600 (voice and TDD). To file a complaint of Discrimination, write to USDA, Director, Office of Adjudication and Compliance, 1400 Independence Avenue, SW., Washington, DC 20250-9410, or call toll-free at (866) 632-9992 (English) or (800) 845-6136 (Spanish) or (800) 877-8339 (TDD) or (866) 377-8642 (Federal-relay). USDA is an equal opportunity provider and employer.