When you want to fill out government form ccc 901, there's no need to install any sort of software - simply try our PDF tool. In order to make our editor better and less complicated to use, we constantly implement new features, with our users' feedback in mind. All it requires is a few easy steps:

Step 1: Simply press the "Get Form Button" in the top section of this webpage to launch our pdf file editing tool. This way, you will find all that is required to work with your file.

Step 2: After you start the online editor, you'll see the document prepared to be filled out. In addition to filling out various fields, you could also do some other things with the PDF, specifically adding any text, modifying the initial textual content, adding graphics, affixing your signature to the document, and more.

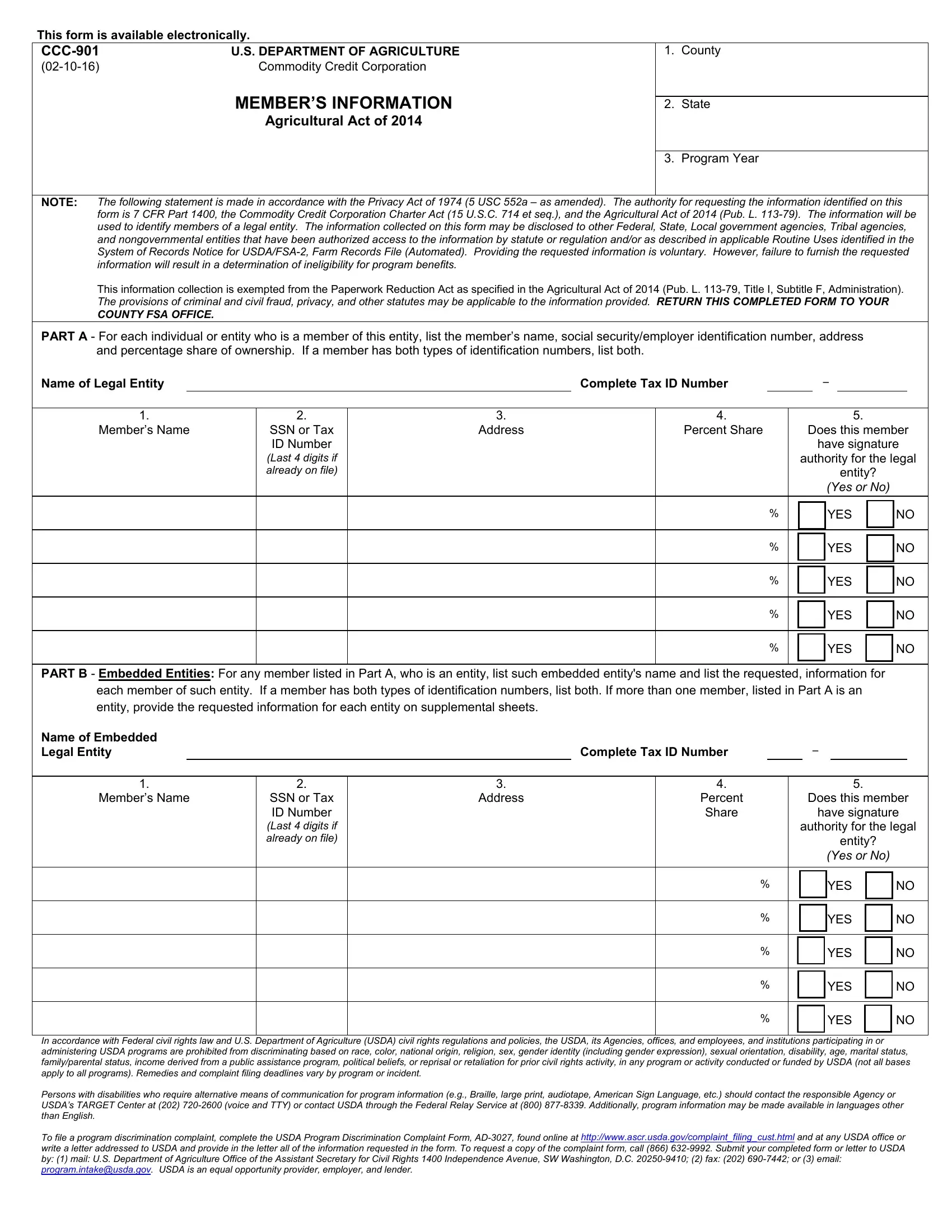

To be able to finalize this PDF form, be certain to provide the required details in each blank field:

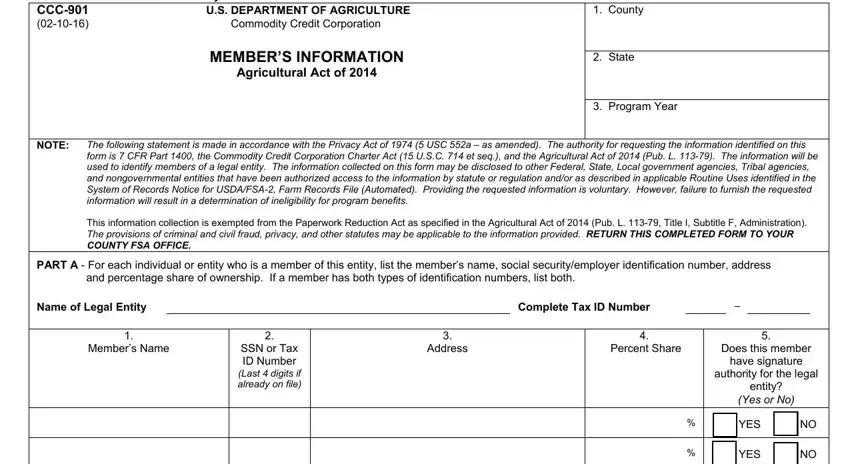

1. Start completing the government form ccc 901 with a number of major blanks. Note all of the information you need and make certain there is nothing neglected!

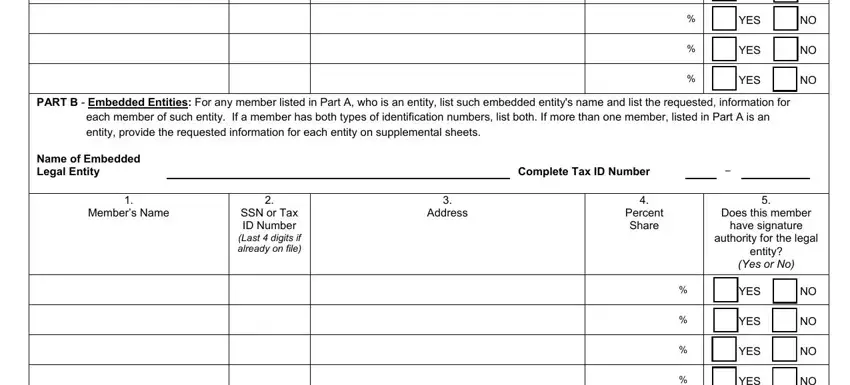

2. After this array of fields is finished, you need to insert the necessary details in YES, YES, YES, PART B Embedded Entities For any, Complete Tax ID Number, Members Name, SSN or Tax ID Number Last digits, Address, Percent Share, Does this member, have signature, authority for the legal, entity, Yes or No, and YES so that you can go to the third stage.

3. This next segment is related to YES, YES, and In accordance with Federal civil - fill in all of these blanks.

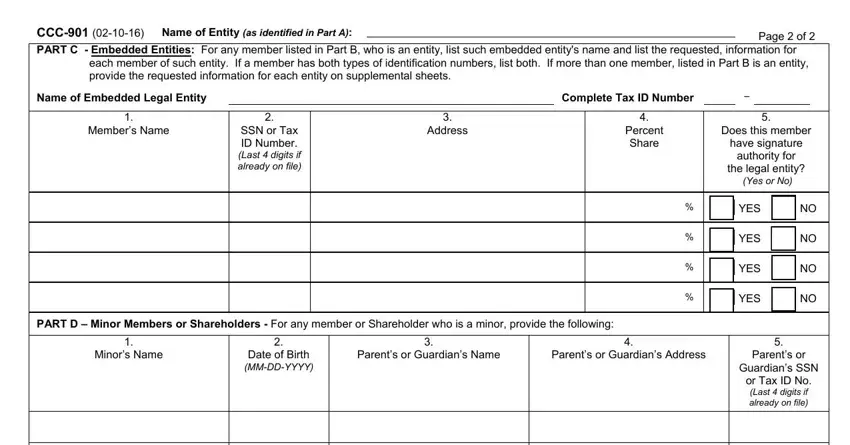

4. This next section requires some additional information. Ensure you complete all the necessary fields - CCC Name of Entity as identified, Page of, Name of Embedded Legal Entity, Complete Tax ID Number, Members Name, SSN or Tax ID Number Last digits, Address, Percent Share, Does this member, have signature authority for, the legal entity, Yes or No, YES, YES, and YES - to proceed further in your process!

As to Yes or No and Address, be certain you take another look here. Both of these are viewed as the most significant ones in the page.

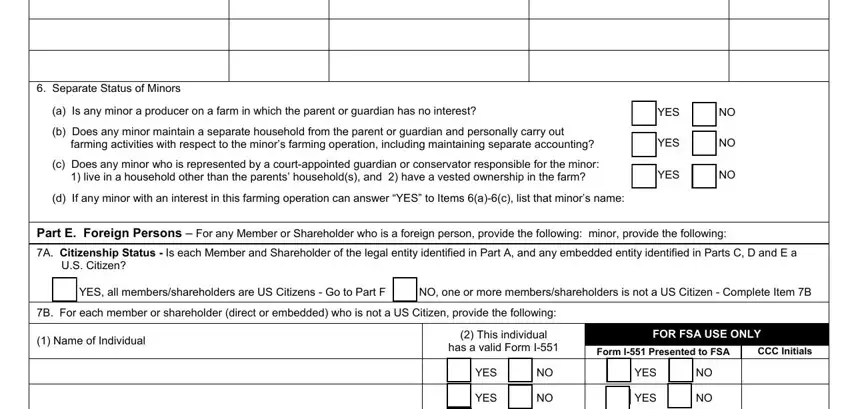

5. To wrap up your document, the last part features a couple of additional blanks. Completing Separate Status of Minors, a Is any minor a producer on a, b Does any minor maintain a, YES, YES, c Does any minor who is, YES, d If any minor with an interest in, Part E Foreign Persons For any, A Citizenship Status Is each, YES all membersshareholders are US, NO one or more membersshareholders, B For each member or shareholder, Name of Individual, and This individual is going to wrap up the process and you will be done before you know it!

Step 3: After you have glanced through the information you given, just click "Done" to conclude your form. Make a free trial account at FormsPal and get direct access to government form ccc 901 - available from your personal account. Here at FormsPal, we do everything we can to guarantee that your details are stored protected.