get the ccc 867 form can be filled in online without any problem. Just open FormsPal PDF editor to get it done fast. Our development team is continuously working to expand the tool and make it even faster for people with its multiple functions. Make the most of today's revolutionary possibilities, and discover a myriad of unique experiences! Here is what you would want to do to get going:

Step 1: Simply hit the "Get Form Button" in the top section of this webpage to get into our pdf editing tool. This way, you'll find everything that is required to work with your file.

Step 2: As soon as you launch the tool, you'll see the document ready to be completed. Apart from filling in different blanks, you may as well perform other sorts of things with the Document, particularly putting on any textual content, modifying the original textual content, inserting images, signing the form, and much more.

It's an easy task to finish the form following this helpful guide! Here is what you have to do:

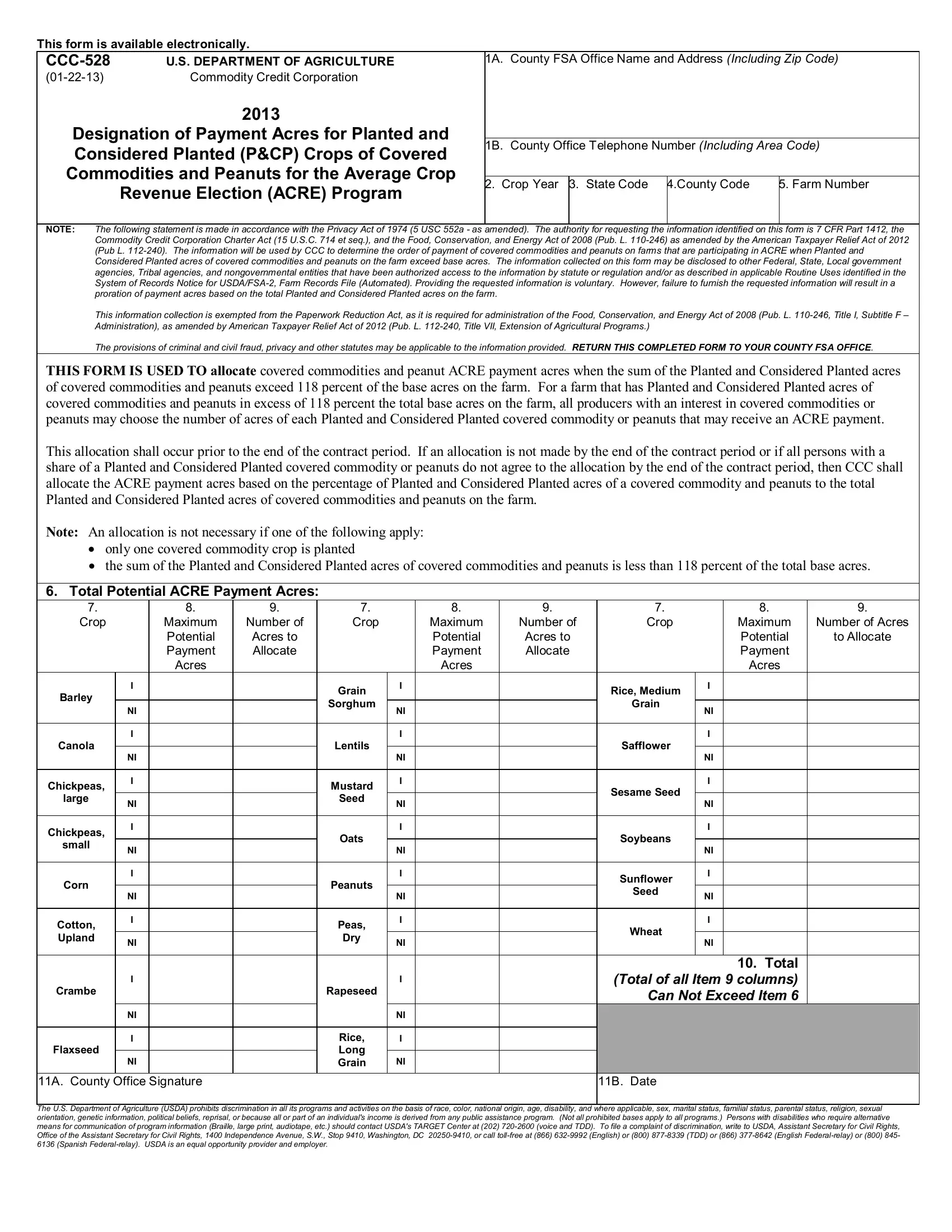

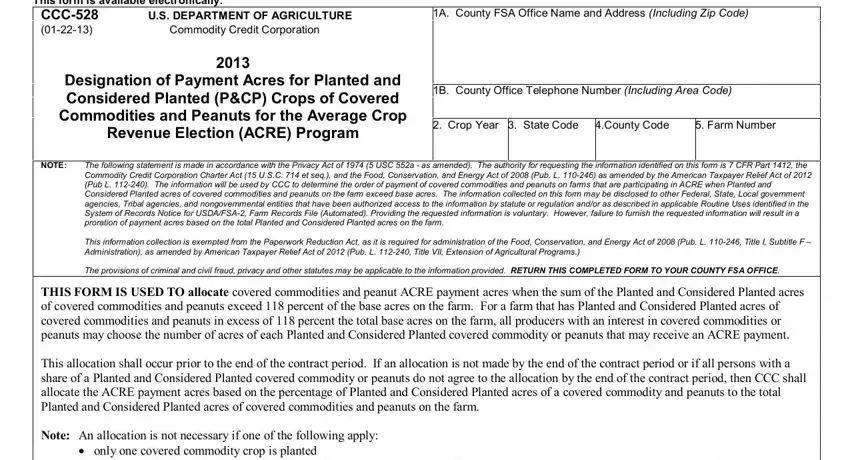

1. While completing the get the ccc 867 form, make certain to complete all needed fields in their corresponding section. It will help to expedite the process, which allows your information to be processed promptly and appropriately.

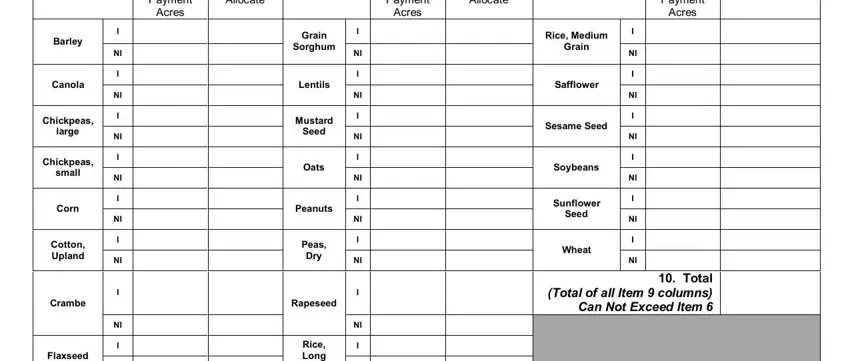

2. When the last array of fields is done, you're ready to insert the essential details in Barley, Canola, Chickpeas, large, Chickpeas, small, Corn, Cotton Upland, Crambe, Flaxseed, Maximum Potential Payment, Acres, Acres to Allocate, Maximum Potential Payment, and Acres so you're able to progress to the next part.

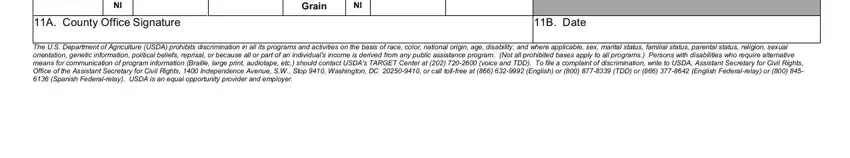

3. In this step, look at Flaxseed, Rice Long Grain, A County Office Signature, B Date, and The US Department of Agriculture. All of these will have to be taken care of with utmost precision.

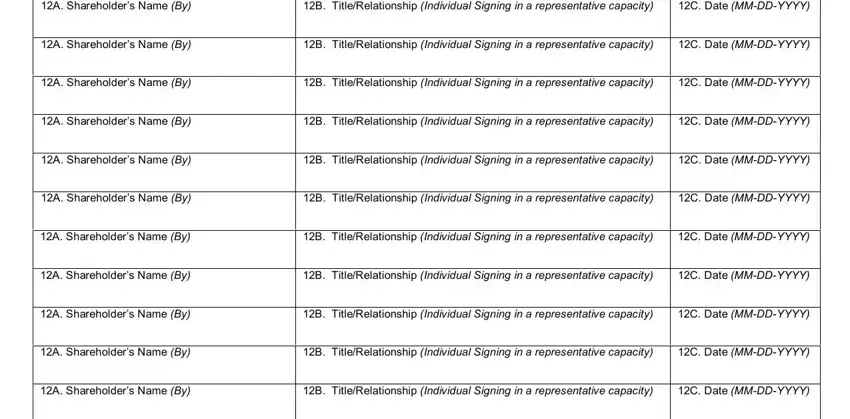

4. Now complete this next section! Here you will get these A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, B TitleRelationship Individual, C Date MMDDYYYY, B TitleRelationship Individual, and C Date MMDDYYYY blank fields to fill in.

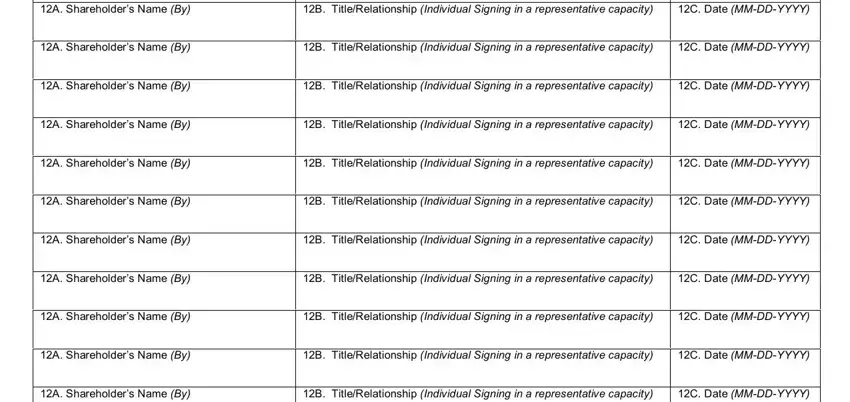

5. Now, this final part is what you will have to wrap up prior to finalizing the document. The blanks here include the next: A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, A Shareholders Name By, B TitleRelationship Individual, C Date MMDDYYYY, B TitleRelationship Individual, and C Date MMDDYYYY.

Always be really careful when completing A Shareholders Name By and A Shareholders Name By, because this is the section where many people make a few mistakes.

Step 3: Reread the details you have entered into the blank fields and press the "Done" button. Go for a 7-day free trial subscription with us and get direct access to get the ccc 867 form - accessible in your personal account. Whenever you work with FormsPal, it is simple to fill out documents without having to be concerned about data leaks or entries being shared. Our secure system helps to ensure that your personal information is maintained safe.