This form is available electronically.

|

|

|

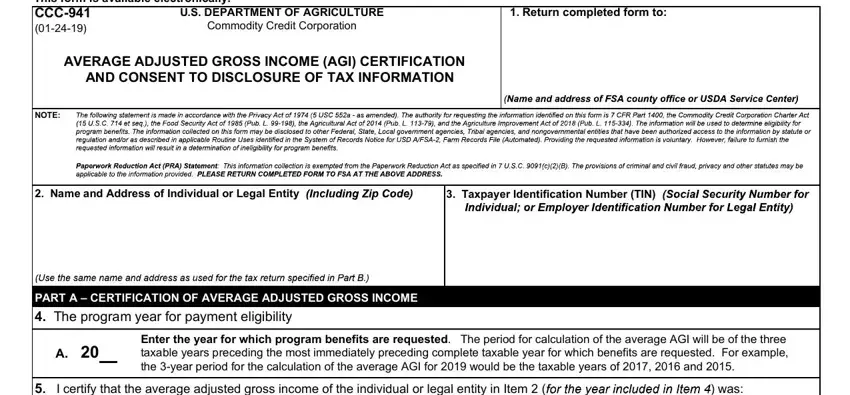

CCC-941 |

U.S. DEPARTMENT OF AGRICULTURE |

1. Return completed form to: |

(01-24-19) |

Commodity Credit Corporation |

|

AVERAGE ADJUSTED GROSS INCOME (AGI) CERTIFICATION

AND CONSENT TO DISCLOSURE OF TAX INFORMATION

NOTE:

2. Name and Address of Individual or Legal Entity

3. Taxpayer Identification Number (TIN)

PART A – CERTIFICATION OF AVERAGE ADJUSTED GROSS INCOME

4.The program year for payment eligibility

A. 20 |

Enter the year for which program benefits are requested. The period for calculation of the average AGI will be of the three |

taxable years preceding the most immediately preceding complete taxable year for which benefits are requested. For example, |

the 3-year period for the calculation of the average AGI for 2019 would be the taxable years of 2017, 2016 and 2015.

5. I certify that the average adjusted gross income of the individual or legal entity in Item 2 ( |

) was: |

A. |

Less than |

$900,000 |

|

B. |

More than $900,000 |

|

|

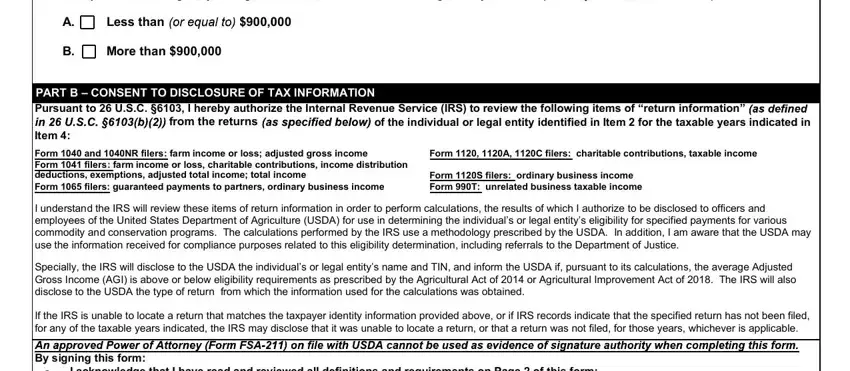

PART B – CONSENT TO DISCLOSURE OF TAX INFORMATION

Pursuant to 26 U.S.C. §6103, I hereby authorize the Internal Revenue Service (IRS) to review the following items of “return information”

from the returns |

of the individual or legal entity identified in Item 2 for the taxable years indicated in |

Item 4: |

|

|

Form 1040 and 1040NR filers: farm income or loss; adjusted gross income |

|

Form 1120, 1120A, 1120C filers: charitable contributions, taxable income |

Form 1041 filers: farm income or loss, charitable contributions, income distribution |

Form 1120S filers: ordinary business income |

deductions, exemptions, adjusted total income; total income |

|

Form 1065 filers: guaranteed payments to partners, ordinary business income |

Form 990T: unrelated business taxable income |

I understand the IRS will review these items of return information in order to perform calculations, the results of which I authorize to be disclosed to officers and employees of the United States Department of Agriculture (USDA) for use in determining the individual’s or legal entity’s eligibility for specified payments for various commodity and conservation programs. The calculations performed by the IRS use a methodology prescribed by the USDA.In addition, I am aware that the USDA may use the information received for compliance purposes related to this eligibility determination, including referrals to the Department of Justice.

Specially, the IRS will disclose to the USDA the individual’s or legal entity’s name and TIN, and inform the USDA if, pursuant to its calculations, the average Adjusted Gross Income (AGI) is above or below eligibility requirements as prescribed by the Agricultural Act of 2014 or Agricultural Improvement Act of 2018. The IRS will also disclose to the USDA the type of return from which the information used for the calculations was obtained.

If the IRS is unable to locate a return that matches the taxpayer identity information provided above, or if IRS recordsindicate that the specified return has not been filed, for any of the taxable years indicated, the IRS may disclose that it was unable to locate a return, or that a return was notfiled, for those years, whichever is applicable.

By signing this form:

-I acknowledge that I have read and reviewed all definitions and requirements on Page 2 of this form;

-I certify that all information contained within this certification is true and correct; and is consistent with the taxreturns filed with the IRS;

-I agree to authorize CCC to obtain tax data from the IRS for AGI compliance verification purposes by filing this form;

-I am aware that without this consent to disclosure, the returns and return information of the individual or legal entity identified in Item 2 are confidential and are protected by law under the Internal Revenue Code;

-I certify that I am authorized under applicable state law to execute this consent on behalf of the legal entity identified in Item 2 (for legal entity only).

CCC-941 (01-24-19) |

Page 2 of 2 |

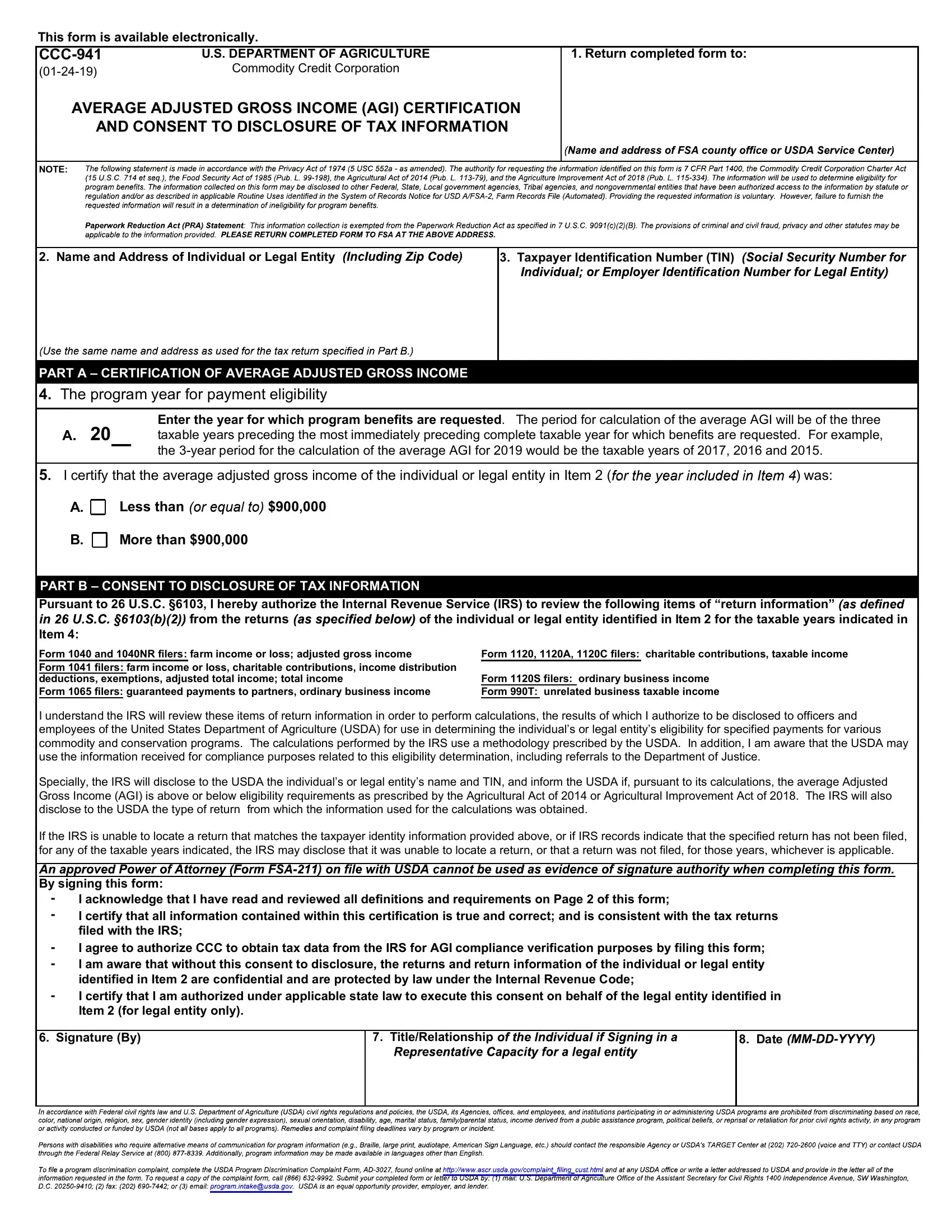

GENERAL INFORMATION ON AVERAGE ADJUSTED GROSS INCOME – PART A

Individuals or legal entities that receive benefits under most programs administered by CCC cannot have incomes thatexceed a certain limit set by law. For entities, both the entity itself, and its members cannot exceed the income limitation. If a member, whether an individual or an entity, of an entity exceeds the limitation, payments to that entity will be commensurately reduced according to that member’s direct or indirect ownership share in the entity. (All members of the entity must also submit this form to verify income the limitation is met.)

Adjusted Gross Income is the individual’s or legal entity’s IRS-reported adjusted gross income consisting of both farm and nonfarm income. A three-year average of that income will be computed for the three years of the relevant base period identified on the first page of this form to determine eligibility for the applicable program year. Individuals or legal entities with average adjusted gross income greater than $900,000 shall be ineligible for all payments and benefits under the commodity, price support, disaster assistance, and conservation programs .

HOW TO DETERMINE ADJUSTED GROSS INCOME (AGI)

Individual – Internal Revenue Service (IRS) Form 1040 filers, specific lines on that form represent the adjusted gross income andthe income from farming, ranching, or forestry operations.

Trust or Estate – the adjusted gross income is the total income and charitable contributions reported to IRS.

Corporation – the adjusted gross income is the total of the final taxable income and any charitable contributions reported to IRS.

Limited Partnership (LP), Limited Liability Company (LLC), Limited Liability Partnership (LLP) or Similar Entity – the adjusted gross income is the total income from trade or business activities plus guaranteed payments to the members as reported to the IRS.

Tax-exempt Organization – the adjusted gross income is the unrelated business taxable income excluding any income from non-commercial activities as reported to the IRS.

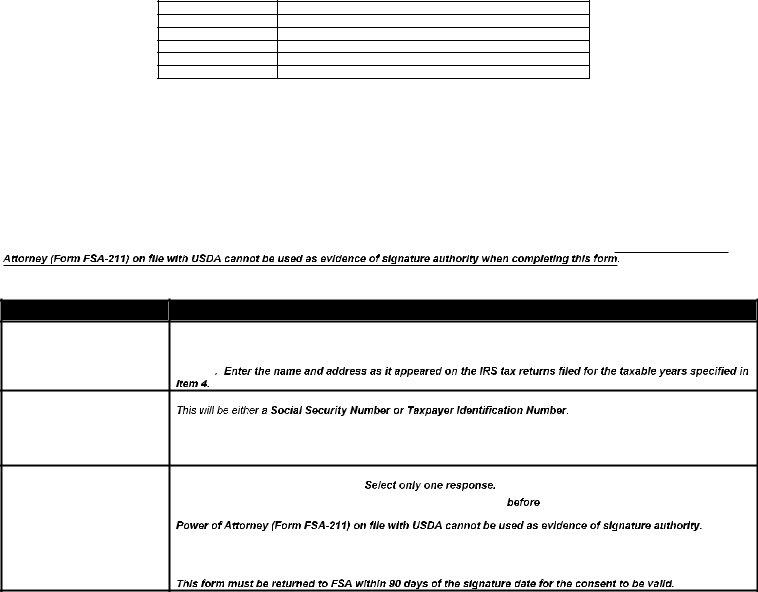

HOW TO DETERMINE AVERAGE ADJUSTED GROSS INCOME

The period for calculation of the average AGI will be of the three taxable years preceding the most immediately preceding complete taxable year for which benefits are requested. This table shows examples for applicable years to be used in determining average AGI.

IF the crop year is… |

THEN… Average AGI will be based on the following years…. |

2019 |

2017, 2016, and 2015 |

2020 |

2018, 2017, and 2016 |

2021 |

2019, 2018, and 2017 |

2022 |

2020, 2019, and 2018 |

2023 |

2021, 2020, and 2019 |

GENERAL INFORMATION ON CONSENT TO DISCLOSURE OF TAX INFORMATION – PART B

This consent allows IRS’s access to, and use of, certain items of return information to perform calculations, using a methodology prescribed by the USDA, that will assist USDA in its verification of a program participant’s compliance with the adjusted gross income (AGI) limitations necessary for participation in, and receipt of, commodity, conservation, price support or disaster program benefits. This consent also permits the USDAto receive certain items of return information for its eligibility determination.

This consent authorizes the disclosure of these items of return information for only the time period specified. Each item of information requested on this form is needed for the IRS to (1) locate, and verify, your tax information; (2) perform the requisite Average AGI calculations; and (3) provide the USDA with the legal entity’s name and Taxpayer Identification Number (TIN), the type of return from which the specified items were located for use in the calculation, and whether or not the average AGI is above or below eligibility requirements. The IRS will not provide the USDA with any of the items specified on this consent form that it uses to perform the calculations or the average AGI figure.

This form can only be signed by the person authorized under state law to sign this consent for the legal entity identified in Item 2.

INSTRUCTIONS FOR COMPLETION OF CCC-941

Item No./Field name |

Instruction |

1.Return Completed Form Enter the name and address of the FSA county office or USDA service center where the completed CCC-941 will be

|

To |

submitted. |

|

2. Person or Legal Entity’s |

Enter the person’s or legal entity’s name and address for commodity, conservation, price support, or disaster program |

|

benefits |

|

Name and Address |

|

|

3.Taxpayer Identification In the format provided, enter the complete taxpayer identification number of the person or legal entity identified inItem 2.

Number

4. Program Year |

Enter the year for which program benefits are being requested. The program year entered determines the 3-year period |

used for the calculation of the average adjusted gross income (AGI) for payment eligibility and the years for which this |

|

consent allows access to tax information. |

5.Average Adjusted Gross Select the box next to the response that describes the average adjusted gross income for the applicable 3-year period

|

Income |

for the program year entered in Item 4. |

|

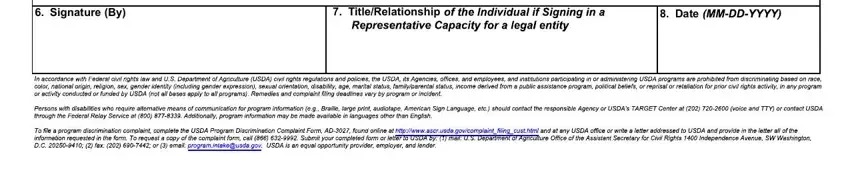

6. |

Signature |

Read the acknowledgments, responsibilities and authorizations, |

affixing your signature. |

|

|

|

|

|

|

7. |

Title/Relationship |

Enter title or relationship to the legal entity identified in Item 2. |

|

|

|

|

|

8. |

Date |

Enter the signature date in month, day and year. |

|

|

|