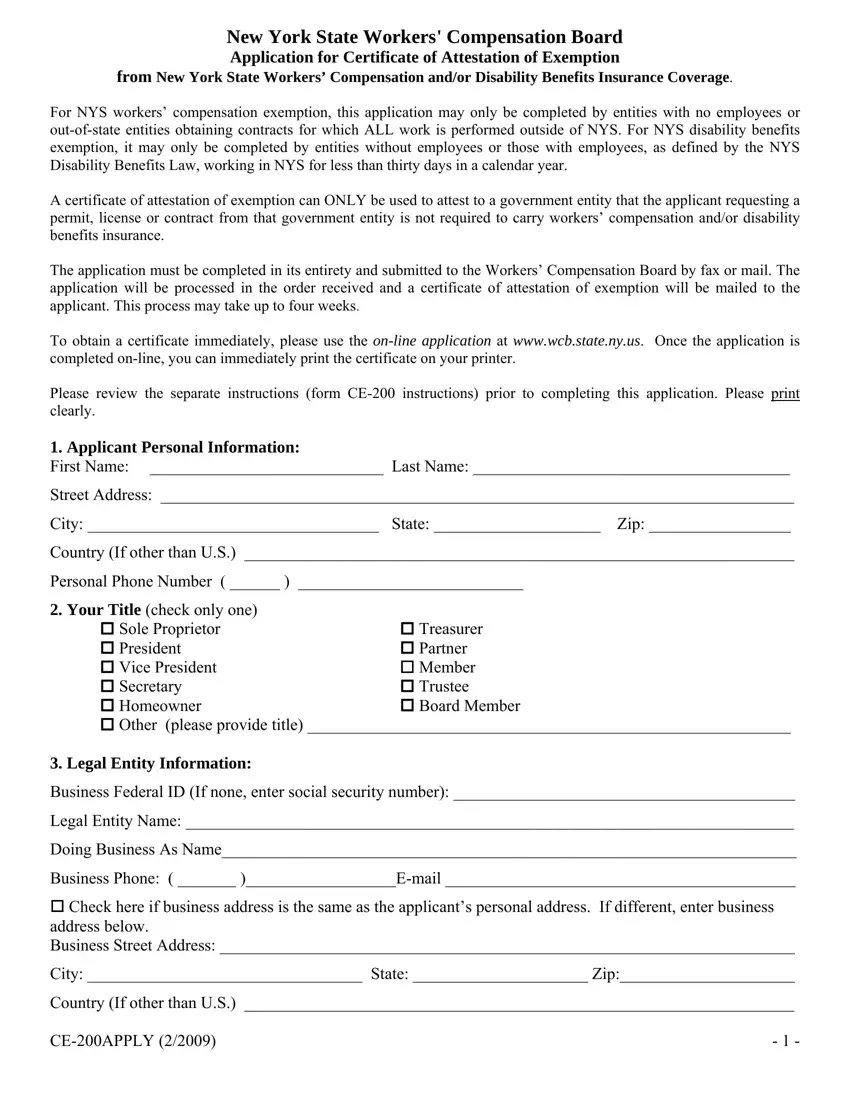

New York State Workers' Compensation Board

Application for Certificate of Attestation of Exemption

from New York State Workers’ Compensation and/or Disability Benefits Insurance Coverage.

For NYS workers’ compensation exemption, this application may only be completed by entities with no employees or out-of-state entities obtaining contracts for which ALL work is performed outside of NYS. For NYS disability benefits exemption, it may only be completed by entities without employees or those with employees, as defined by the NYS Disability Benefits Law, working in NYS for less than thirty days in a calendar year.

A certificate of attestation of exemption can ONLY be used to attest to a government entity that the applicant requesting a permit, license or contract from that government entity is not required to carry workers’ compensation and/or disability benefits insurance.

The application must be completed in its entirety and submitted to the Workers’ Compensation Board by fax or mail. The application will be processed in the order received and a certificate of attestation of exemption will be mailed to the applicant. This process may take up to four weeks.

To obtain a certificate immediately, please use the on-line application at www.wcb.state.ny.us. Once the application is completed on-line, you can immediately print the certificate on your printer.

Please review the separate instructions (form CE-200 instructions) prior to completing this application. Please print clearly.

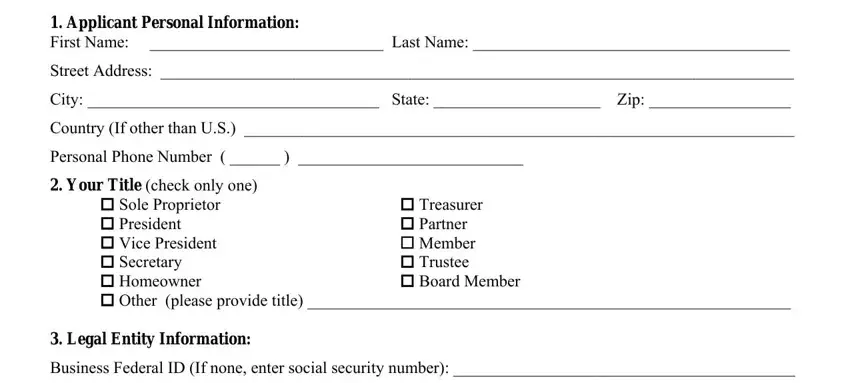

1. Applicant Personal Information:

First Name: ____________________________ Last Name: ______________________________________

Street Address: ____________________________________________________________________________

City: ___________________________________ State: ____________________ Zip: _________________

Country (If other than U.S.) __________________________________________________________________

Personal Phone Number ( ______ ) ___________________________

2.Your Title (check only one)

Sole Proprietor |

Treasurer |

President |

Partner |

Vice President |

Member |

Secretary |

Trustee |

Homeowner |

Board Member |

Other (please provide title) __________________________________________________________

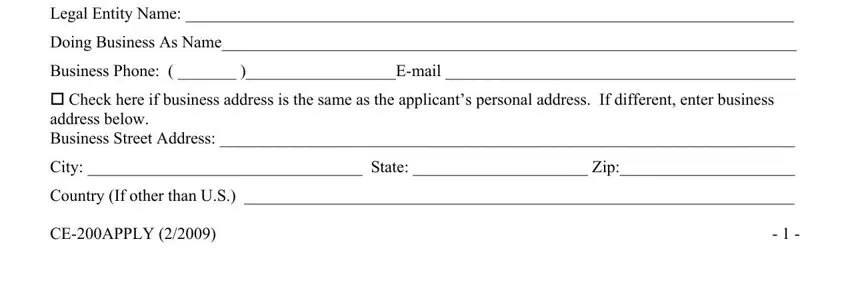

3.Legal Entity Information:

Business Federal ID (If none, enter social security number): _________________________________________

Legal Entity Name: _________________________________________________________________________

Doing Business As Name_____________________________________________________________________

Business Phone: ( _______ )__________________E-mail __________________________________________

Check here if business address is the same as the applicant’s personal address. If different, enter business address below.

Business Street Address: _____________________________________________________________________

City: _________________________________ State: _____________________ Zip:_____________________

Country (If other than U.S.) __________________________________________________________________

CE-200APPLY (2/2009) |

- 1 - |

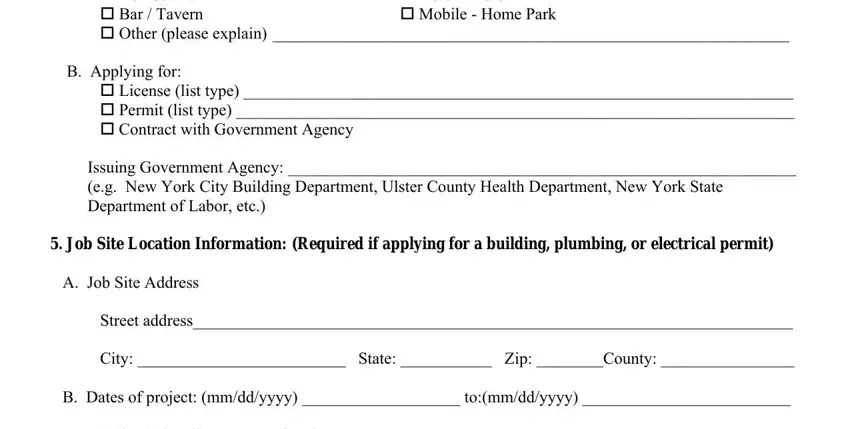

4.Permit/License/Contract Information:

A. Nature of Business:(please check only one)

Construction/Carpentry |

Electrical |

Demolition |

Landscaping |

Plumbing |

Farm |

Restaurant / Food Service |

Trucking / Hauling |

Food CartVendor |

Horse Trainer/Owner |

Homeowner |

Hotel / Motel |

Bar / Tavern |

Mobile - Home Park |

Other (please explain) ______________________________________________________________

B. Applying for:

License (list type) __________________________________________________________________

Permit (list type) ___________________________________________________________________

Contract with Government Agency

Issuing Government Agency: _____________________________________________________________

(e.g. New York City Building Department, Ulster County Health Department, New York State Department of Labor, etc.)

5.Job Site Location Information: (Required if applying for a building, plumbing, or electrical permit) A. Job Site Address

Street address________________________________________________________________________

City: _________________________ State: ___________ Zip: ________County: ________________

B. Dates of project: (mm/dd/yyyy) ___________________ to:(mm/dd/yyyy) _________________________

Estimated Dollar amount of project: |

|

$0 - $10,000 |

$50,001 - $100,000 |

10,001- $25,000 |

Over $100,000 |

$25,001 - $50,000

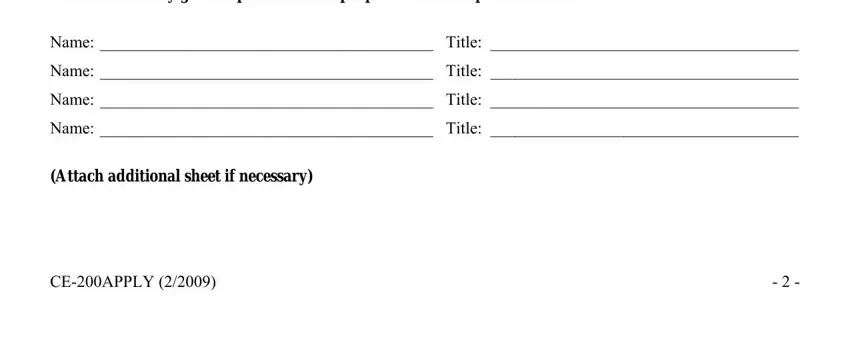

6.Partners/Members/Corporate Officers -must list all with titles except for limited partnerships which must include only general partners. Sole proprietors can skip this section.

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

Name: ________________________________________ |

Title: _____________________________________ |

(Attach additional sheet if necessary) |

|

CE-200APPLY (2/2009) |

- 2 - |

Employees of the Workers’ Compensation Board cannot assist applicants in answering questions in the following two sections. Please contact an attorney if you have any questions regarding these sections.

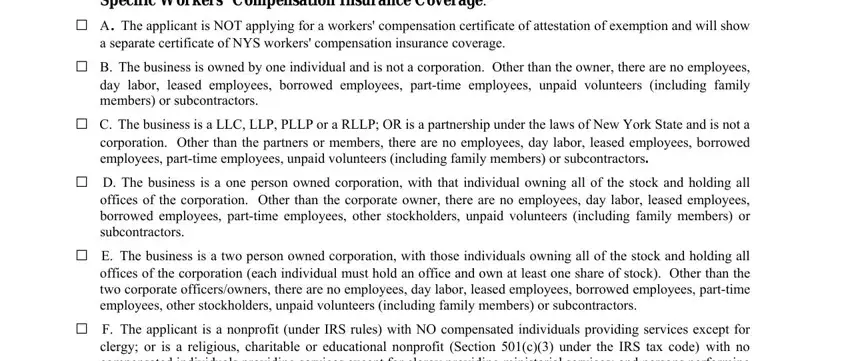

7.Please select the reason that the legal entity is NOT required to obtain New York State Specific Workers’ Compensation Insurance Coverage:

□A. The applicant is NOT applying for a workers' compensation certificate of attestation of exemption and will show a separate certificate of NYS workers' compensation insurance coverage.

□B. The business is owned by one individual and is not a corporation. Other than the owner, there are no employees, day labor, leased employees, borrowed employees, part-time employees, unpaid volunteers (including family members) or subcontractors.

□C. The business is a LLC, LLP, PLLP or a RLLP; OR is a partnership under the laws of New York State and is not a corporation. Other than the partners or members, there are no employees, day labor, leased employees, borrowed employees, part-time employees, unpaid volunteers (including family members) or subcontractors.

□D. The business is a one person owned corporation, with that individual owning all of the stock and holding all

offices of the corporation. Other than the corporate owner, there are no employees, day labor, leased employees, borrowed employees, part-time employees, other stockholders, unpaid volunteers (including family members) or subcontractors.

E.The business is a two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (each individual must hold an office and own at least one share of stock). Other than the two corporate officers/owners, there are no employees, day labor, leased employees, borrowed employees, part-time employees, other stockholders, unpaid volunteers (including family members) or subcontractors.

F.The applicant is a nonprofit (under IRS rules) with NO compensated individuals providing services except for

clergy; or is a religious, charitable or educational nonprofit (Section 501(c)(3) under the IRS tax code) with no compensated individuals providing services except for clergy providing ministerial services; and persons performing teaching or nonmanual labor. [Manual labor includes but is not limited to such tasks as filing; carrying materials such as pamphlets, binders, or books; cleaning such as dusting or vacuuming; playing musical instruments; moving furniture; shoveling snow; mowing lawns; and construction of any sort.]

□G. The business is a farm with less than $1,200 in payroll the preceding calendar year.

□H. The applicant is a homeowner serving as the general contractor for his/her primary/secondary personal residence. The homeowner has no employees, day labor, leased employees, borrowed employees, part-time employees or subcontractors. The homeowner ONLY has uncompensated friends and family working on his/her residence.

I.Other than the business owner(s) and individuals obtained from a temporary service agency, there are no employees, day labor, leased employees, borrowed employees, part-time employees, unpaid volunteers (including family members) or subcontractors. Other than the business owner(s), all individuals providing services to the business are obtained from a temporary service agency and that agency has covered these individuals for New York State workers' compensation insurance. In addition, the business is owned by one individual or is a partnership under the laws of New York State and is not a corporation; or is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation, each individual must be an officer and own at least one share of stock). A Temporary Service Agency is a business that is classified as a temporary service agency under the business’s North American Industrial Classification System (NAICS) code.

Temporary Service Agency

Name _________________________________________________ Phone #_______________________________

J.The out-of-state entity has no NYS employees and/or NYS subcontractors AND ALL work related to the permit, license or contract is done outside of NYS; OR ALL employees are direct employees of a government entity outside of New York. Please provide coverage information.

Carrier______________________________________Policy #__________________________________________

Policy start date _____________________________Policy expiration date ________________________________

CE-200APPLY (2/2009) |

- 3 - |

8.Please select the reason that the legal entity is NOT required to obtain New York State Statutory Disability Benefits Insurance Coverage:

A.The applicant is NOT applying for a disability benefits exemption and will show a separate certificate of NYS statutory disability benefits insurance coverage.

B.The business MUST be either: 1) owned by one individual; OR 2) is a partnership (including LLC, LLP, PLLP, RLLP, or LP) under the laws of New York State and is not a corporation; OR 3) is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation each individual must be an officer and own at least one share of stock); OR 4) is a business with no NYS location. In addition, the business does not require disability benefits coverage at this time since it has not employed one or more individuals on at least 30 days in any calendar year in New York State. (Independent contractors are not considered to be employees under the Disability Benefits Law.)

C.The applicant is a political subdivision that is legally exempt from providing statutory disability benefits coverage.

D.The applicant is a nonprofit (under IRS rules) with NO compensated individuals providing services except for

clergy; or is a religious, charitable or educational nonprofit (Section 501(c)(3) under the IRS tax code) with no compensated individuals providing services except for executive officers, clergy, sextons, teachers or professionals.

E.The business is a farm and all employees are farm laborers.

F.The applicant is a homeowner serving as the general contractor for his/her primary/secondary personal residence. The homeowner has not employed one or more individuals on at least 30 days in any calendar year in New York State. (Independent contractors are not considered to be employees under the Disability Benefits Law.)

□G. Other than the business owner(s) and individuals obtained from the temporary service agency, there are no other employees. Other than the business owner(s), all individuals providing services to the business are obtained from a temporary service agency and that agency has covered these individuals for New York State disability benefits insurance. In addition, the business is owned by one individual or is a partnership under the laws of New York State and is not a corporation; or is a one or two person owned corporation, with those individuals owning all of the stock and holding all offices of the corporation (in a two person owned corporation, each individual must be an officer and own at least one share of stock). A Temporary Service Agency is a business that is classified as a temporary service agency under the business’s North American Industrial Classification System (NAICS) code.

9.I affirm that due to my position with the above-named business I have the knowledge, information and legal authority to make this Application for Certificate of Attestation of Exemption. I hereby affirm that the information provided above is true and that I have not submitted any materially false statements and I make this application for a Certificate of Attestation of Exemption under the penalties of perjury. I further affirm that I understand that any false statement, representation, or concealment will subject me to felony prosecution, including jail and civil liability in accordance with the Workers’ Compensation Law and all other New York State Laws.

CE-200APPLY (2/2009) |

- 4 - |

STATE OF NEW YORK

WORKERS' COMPENSATION BOARD

BUREAU OF COMPLIANCE

100BROADWAY ALBANY. NY 12241-0005

THIS AGENCY EMPLOYS AND SERVES PEOPLE WITH DISABILITIES WITHOUT DISCRIMINATION.

Attached is an application for a certificate of attestation of exemption from New York State Workers' Compensation and/or Disability Benefits insurance coverage.

A certificate of attestation of exemption can ONLY be used to attest to a government entity that the applicant requesting a permit, license or contract from that government entity is not required to carry workers' compensation and/or disability benefits insurance.

Please carefully review the instructions before completing the application.

Exemption Application Instructions:

This application must be completed in its entirety and submitted to the Workers' Compensation Board by mailor fax. The application will be processed in the order received and a certificate of attestation of exemption will be mailed to the applicant. This process may take up to four weeks to complete.

For those who require an exemption immediately, please access the on-line application that can be found on the Board'swebsite, www.wcb.state.nv.us. Click the "WCIDB Exemption" button on the Board's mainwebpage and then click on "Request for WCIDB Exemption (Form CE-200)." You will be able to immediately print the certificate of attestation of exemption after completing the on-line application.

Instructions:

1.Applicant Personal Information: Enter the name (first and last), address and phone number. The applicant must have the knowledge, information and legal authority to file the application. An accountant or lawyer may not file the application on behalf of a client. The applicant will also be required to sign the certificate of attestation of exemption prior to filing it with the government entity.

2.Your title: Title refers to the position held by the applicant. Example: Sole Proprietor, Partner, Member, President, Secretary, Treasurer.

3.Legal Entity Information: Enter Federal ID number used for tax purposes. If the entity does not have a Federal

ID number, enter your social security number. Legal Entity is the business's legally filed name with the Department of State or County Clerk. Example: Corporation (ABC, Inc.) or LLC name ( XYZ, LLC). If this does not apply, enter the applicant's name. Doing business as refersto trade name or the name the business is known by.

4.Permit/License/Contract Information: Nature of business refers to what type of work is being performed. Enter the type of permit, license or contract for which you are applying. Examples: Building permit, health permit, liquor license. Issuing Government Agency is the agency to which you will give the certificate. Examples: City of Albany,

(Continued on reverse)