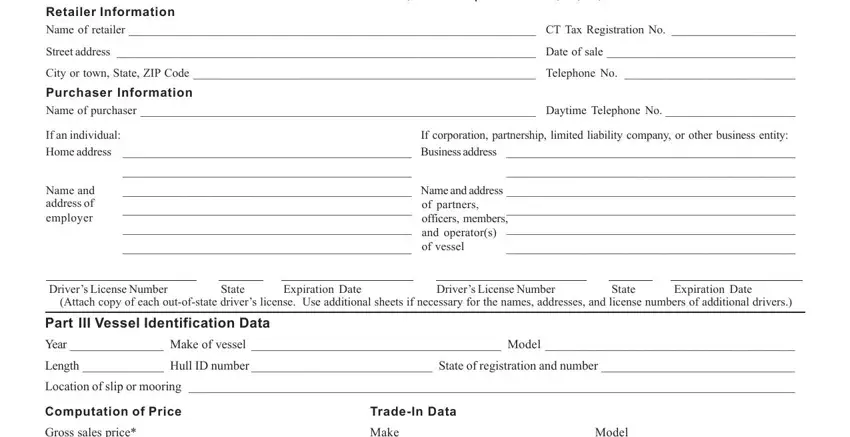

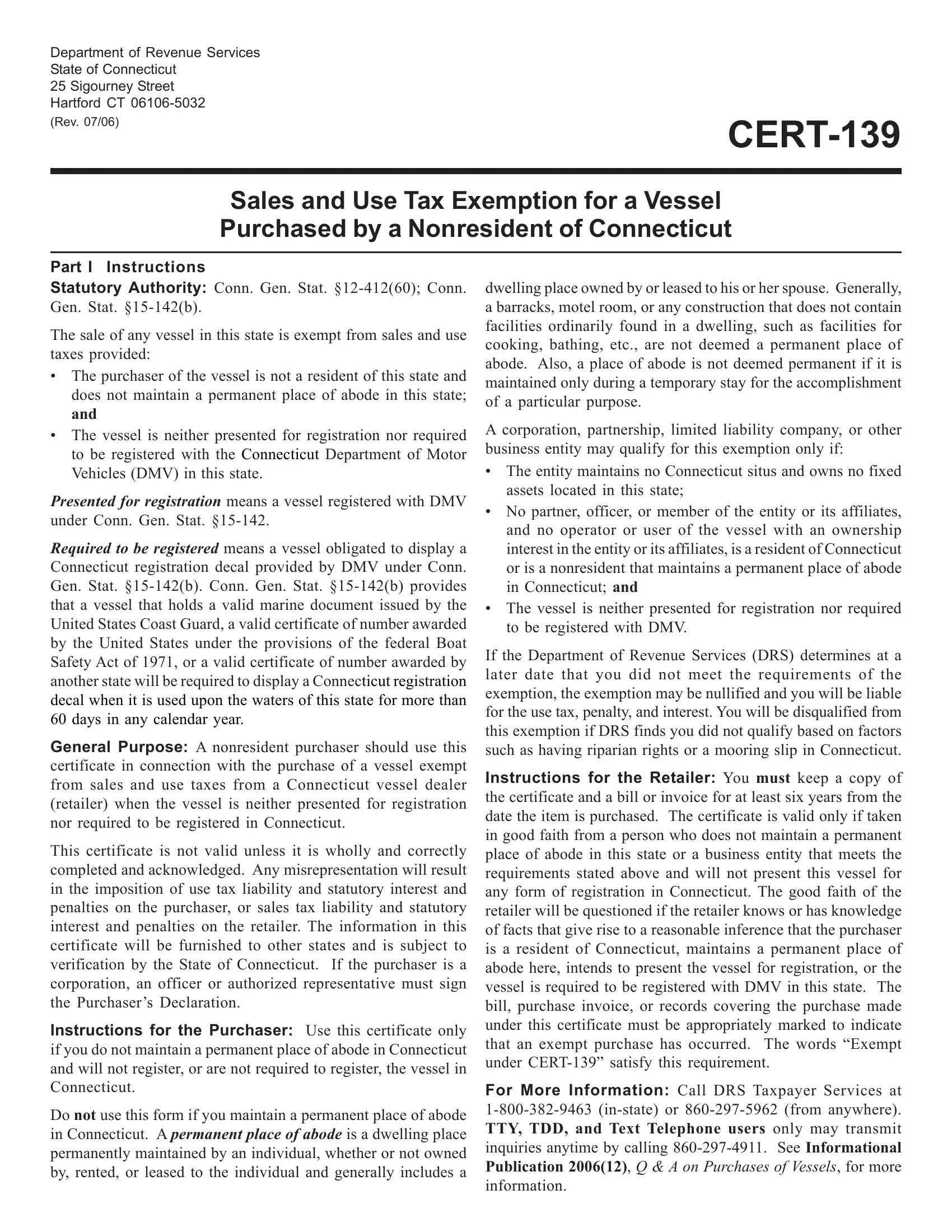

Part II Retailer and Purchaser - Read instructions first, then complete Parts II, III, IV, and V.

Retailer Information

|

Name of retailer _____________________________________________________________________ |

CT Tax Registration No. _____________________ |

|

Street address |

_______________________________________________________________________ |

Date of sale ________________________________ |

|

City or town, State, ZIP Code __________________________________________________________ |

Telephone No. _____________________________ |

|

Purchaser Information |

|

|

|

|

Name of purchaser ___________________________________________________________________ |

Daytime Telephone No. ______________________ |

|

If an individual: |

If corporation, partnership, limited liability company, or other business entity: |

|

Home address |

_________________________________________________ |

Business address |

_________________________________________________ |

|

|

_________________________________________________ |

|

_________________________________________________ |

|

Name and |

_________________________________________________ |

Name and address _________________________________________________ |

|

address of |

_________________________________________________ |

of partners, |

_________________________________________________ |

|

employer |

|

|

officers, members, |

|

|

|

_________________________________________________ |

and operator(s) |

_________________________________________________ |

|

|

_________________________________________________ |

of vessel |

_________________________________________________ |

Driver’s License Number State Expiration Date Driver’s License Number State Expiration Date (Attach copy of each out-of-state driver’s license. Use additional sheets if necessary for the names, addresses, and license numbers of additional drivers.)

Part III Vessel Identification Data

Year _______________ Make of vessel ________________________________________ Model ________________________________________

Length _____________ Hull ID number _____________________________ State of registration and number _______________________________

Location of slip or mooring _________________________________________________________________________________________________

Computation of Price |

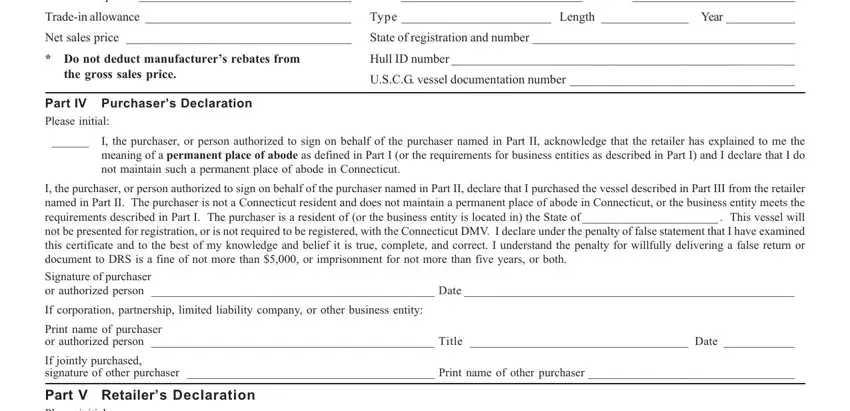

Trade-In Data |

Gross sales price* __________________________________ |

Make _____________________________ Model __________________________ |

Trade-in allowance _________________________________ |

Type ________________________ Length ______________ Year ___________ |

Net sales price ____________________________________ |

State of registration and number __________________________________________ |

* Do not deduct manufacturer’s rebates from |

Hull ID number _______________________________________________________ |

the gross sales price. |

U.S.C.G. vessel documentation number ____________________________________ |

|

Part IV Purchaser’s Declaration

Please initial:

______ I, the purchaser, or person authorized to sign on behalf of the purchaser named in Part II, acknowledge that the retailer has explained to me the

meaning of a permanent place of abode as defined in Part I (or the requirements for business entities as described in Part I) and I declare that I do not maintain such a permanent place of abode in Connecticut.

I, the purchaser, or person authorized to sign on behalf of the purchaser named in Part II, declare that I purchased the vessel described in Part III from the retailer named in Part II. The purchaser is not a Connecticut resident and does not maintain a permanent place of abode in Connecticut, or the business entity meets the requirements described in Part I. The purchaser is a resident of (or the business entity is located in) the State of _______________________ . This vessel will

not be presented for registration, or is not required to be registered, with the Connecticut DMV. I declare under the penalty of false statement that I have examined this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Signature of purchaser

or authorized person ________________________________________________ Date ________________________________________________________

If corporation, partnership, limited liability company, or other business entity:

Print name of purchaser

or authorized person ________________________________________________ Title _____________________________________ Date ____________

If jointly purchased,

signature of other purchaser __________________________________________ Print name of other purchaser ___________________________________

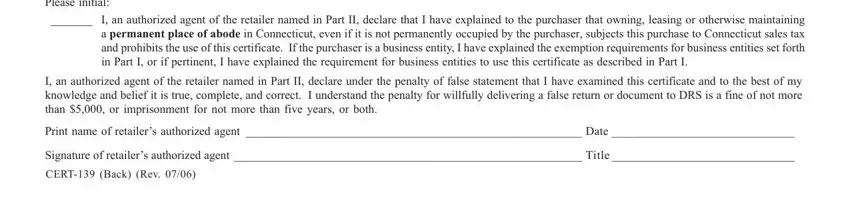

Part V |

Retailer’s Declaration |

Please initial: |

_______ |

I, an authorized agent of the retailer named in Part II, declare that I have explained to the purchaser that owning, leasing or otherwise maintaining |

|

a permanent place of abode in Connecticut, even if it is not permanently occupied by the purchaser, subjects this purchase to Connecticut sales tax |

|

and prohibits the use of this certificate. If the purchaser is a business entity, I have explained the exemption requirements for business entities set forth |

|

in Part I, or if pertinent, I have explained the requirement for business entities to use this certificate as described in Part I. |

I, an authorized agent of the retailer named in Part II, declare under the penalty of false statement that I have examined this certificate and to the best of my knowledge and belief it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both.

Print name of retailer’s authorized agent _________________________________________________________ Date _______________________________

Signature of retailer’s authorized agent ___________________________________________________________ Title _______________________________