City of Gold Ppc Form 4700 is required for all real estate purchases in the city, whether you are a resident or not. The form serves as an agreement between the City and the property owner that outlines the rules and regulations associated with owning property in the city. The City of Gold depends on revenue generated from property taxes to fund many of its public services, so it is important to understand what is expected of you as a property owner. By complying with the terms outlined in Form 4700, you can help contribute to the success of our city while enjoying all that it has to offer. Thank you for your cooperation!

| Question | Answer |

|---|---|

| Form Name | Form Cg Ppc 4700 |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | W-4, SSN, cg ppc 4700, NOAA |

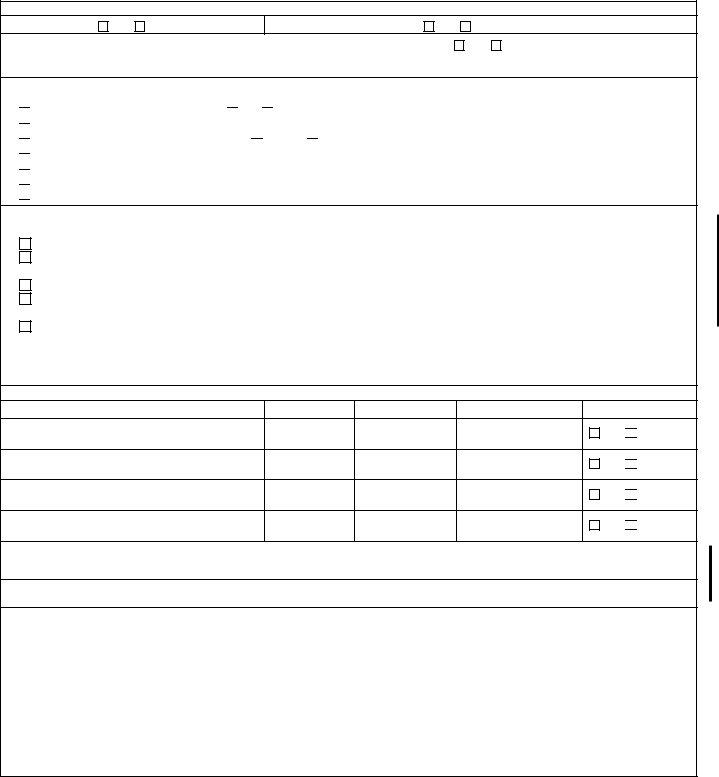

Department of Homeland Security

U. S. Coast Guard

CG

COAST GUARD & NOAA RETIRED PAY ACCOUNT

WORKSHEET AND SURVIVOR BENEFIT PLAN ELECTION

Privacy Act Statement: This information is collected under 5 USC section 552a(e)(3), Public Law

Purpose: Provide an address for correspondence with Coast Guard Personnel Service Center

Designate your direct deposit account

Specify number of exemptions and marital status for Federal income tax withholding

Designate State and withholding amount for Voluntary State Tax withholding

Designate beneficiaries for unpaid retired pay.

Certify eligibility and entitlement to retired pay

Enroll in the Survivor Benefit Plan

Section I: IDENTIFICATION AND ADDRESS (complete all sections, if not applicable enter N/A)

1A. ENTER YOUR APPROVED RETIREMENT DATE

1b. Retiring from the following Service (select one):

[ ] NOAA |

[ ] Coast Guard Active Duty |

[ ] Coast Guard Reserve |

1c. Name (Last, First, MI.)

4. Date of Birth

|

2. Rank/Pay Grade |

3. |

Employee ID Number (EMPLID): |

|

|

|

|

5. Correspondence Address, Street, City, State and Zip Code |

6. |

Area Code & Telephone Number |

|

|

|

Work: |

|

|

|

Home: |

|

|

|

Cell/Other: |

|

|

|

|

|

6a. Please provide your Home & Business (if applicable) email addresses if you would you like PPC (RAS) to contact you via

(H)______________________________________________(B)____________________________________________

Section II: PAY DELIVERY (See instructions for proper completion and don’t forget to attach a voided check to your application.)

|

|

|

|

Public Law |

|||||||||||||||||

7a. |

[ |

] Continue direct deposit to the same account used for your active duty/reserve pay (attach current copy of LES). |

|||||||||||||||||||

7b. |

[ |

] Direct deposit account shown below. |

|||||||||||||||||||

8. |

Type of Account: [ ] Checking |

|

|

[ ] Savings |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9a. |

Routing Transit Number (RTN) |

|

|

|

|

|

|

|

|

|

|

|

|

Check Digit |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9b. |

Account Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.Financial Institution Name

11.

Section III: TAX WITHHOLDING INFORMATION (use instructions for IRS Form

FEDERAL WITHHOLDING |

|

VOLUNTARY STATE WITHHOLDING |

|

||

12. |

Marital Status (check one): [ ] Single, |

[ ] Married or |

16. State designated to receive tax |

|

|

|

[ ] Married but withhold at higher single rate |

|

|||

|

|

|

|||

|

|

|

17. Requested Monthly Amount for State |

|

|

13. |

Total No. of Exemptions Claimed |

|

Tax (Whole dollar amount but not less |

$ |

|

|

|

|

$10.00) |

||

|

|

|

|

||

14. |

Additional Withholding (optional) |

$ |

Note: The State you designate to receive tax must have an |

||

agreement with the Department of Defense for withholding |

|||||

|

|

|

|||

15. |

“I claim exemption from withholding” |

|

state tax. A listing of states that have agreements for |

||

Enter “EXEMPT”. If you claim EXEMPT |

|

withholding is included with the instructions for this form. |

|||

status, you must attach current year IRS |

|

This election will remain in effect until changed by you. |

|||

form |

|

||||

(Page 1 of 4) |

|

Previous editions are obsolete and shall not be used |

|||

FOR ANY CORRECTIONS/CHANGES A NEW FORM MUST BE COMPLETED PRIOR TO DATE OF RETIREMENT

Section IV: DESIGNATION OF BENEFICIARIES FOR UNPAID RETIRED PAY

I hereby designate the following beneficiary(ies) to receive retired pay due and payable at my death. I am aware that under the provisions of 10 U.S.C. 2771 and 4 CFR Part 34, this designation will remain in effect unless canceled or changed by me.

18a. Name (Last, First, Middle Initial) |

18b. Relationship |

18c. Address (City, State & ZIP Code) |

18d. Telephone (Including Area Code) |

18e. Share (Total |

|

|

|

|

|

|

must equal 100%) |

|

|

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

Section V: CERTIFICATION DATA FOR PAYMENT OF RETIRED PERSONNEL (must be completed)

“I |

[ |

] |

have |

[ |

] have not been convicted of any offense involving the National Security (5 U.S.C. 8312). |

“I |

[ |

] |

have |

[ |

] have not failed or refused to testify before a Federal Grand Jury, Court of the United States, |

congressional committee in connection with any matter endangering the National Security, or defense of the United States or any relationship I have or have not had with a foreign government (5 U.S.C. 8314).

“I |

[ |

] have [ |

] have not knowingly or willfully remained outside of the United States or its territories or possessions to avoid |

prosecution (5 U.S.C. 8313). |

|||

“I |

[ |

] have [ |

] have not knowingly or willfully made a false, fictitious, or fraudulent statement or representation, or knowingly and |

willfully concealed a material fact in an employment application for a civilian or military office or position in or under the Legislative, Executive, or the Judicial branch of Government of the United States or the government of the District of Columbia(5 U.S.C. 8315).

“I [ ] am [ ] am not employed by any foreign government, company, educational institution, or other concern which is controlled in whole or in part by a foreign government nor have I made application for such employment and I have not negotiated for such employment. I understand that before I accept such employment I must obtain advance approval from Commandant

I [ ] am [ ] am not drawing a pension, retired pay, or disability compensation from the Department of Veterans Affairs (VA), Civil Service Commission, or other Government agency nor have I made application for such benefits.

If you are drawing a VA or civil service pension, retired pay, or disability compensation, or have made application therefore, please provide the name and address of the agency and the monthly amount received (if any) in the space below.

Monthly Amount

Name and Address (Street, City, State and ZIP) of Agency

_____________________________________________________________

______________________________________________________________

Page 2 of 4. FOR ANY CORRECTIONS/CHANGES A NEW FORM MUST BE COMPLETED PRIOR TO DATE OF RETIREMENT

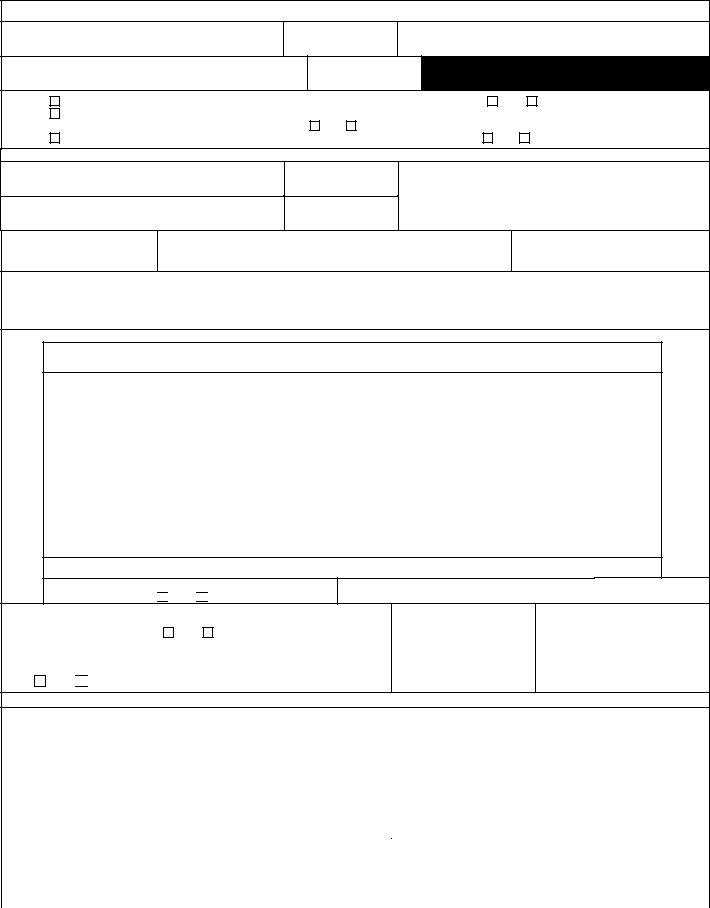

Section VI: SURVIVOR BENEFIT PLAN (SBP) ELECTION (Complete all blocks)

19. Are you married?

20. Do you have dependent children?

Yes No

Yes

No

21. FOR Reserve Retiree Only – Have you elected RCSBP (option B or C) prior to this date |

Yes No |

IF YES, ATTACH A COPY OF THE ELECTION FORM and skip to Section VIII

IF NO or elected (option A), complete the remainder of Section VI & VII

22.Beneficiary Category (ies)

a I elect coverage for spouse only. I do do not have dependent children. b I elect coverage for spouse and child(ren).

c I elect coverage for child(ren) only. I do do not have a spouse.

d I elect coverage for the person named in block 45 who has an insurable interest in me.

e I elect coverage for the person named in block 39 who is my former spouse.

f I elect coverage for the person named in block 39 who is my former spouse and dependent child(ren) of that marriage g I elect not to participate in SBP. (Blocks

23.Level of coverage (do not complete if 22d or 22g was elected above)

aI did NOT elect the Career Status Bonus and REDUX. I elect SBP coverage as follows (choose one):

I elect coverage based on full gross retired pay.

I elect coverage with a reduced base amount of $________ ($300 minimum base amount).

bI DID elect the Career Status Bonus and REDUX. I elect SBP coverage as follows (choose one):

I elect coverage based on the amount of retired pay I would have received had I NOT elected the Career Status Bonus. I elect coverage based on my current gross retired pay.

I understand this represents a reduced base amount and requires spousal concurrence.

I elect coverage with a reduced base amount of $________ ($300 minimum base amount). This requires spousal concurrence.

24. |

Spouse Name (Last, First, MI.) |

25. Spouse SSN |

26. Spouse Date of Birth |

|

|

|

|

27. |

Date of Marriage: |

|

|

List your dependent child(ren) (Designate which children resulted from marriage to former spouse, if any)

28. Name (Last , First, Middle Initial.) |

29. Relationship |

30. Date of Birth |

31. SSN |

32. *Disabled Child |

a.

Yes No

b.

Yes No

c.

Yes No

d.

Yes No

*BLOCK 32 NOTE: Disabled Child – If yes, provide a current physician's statement dated within 90 days of the date of retirement describing the medical condition and whether it is temporary or permanent and why the condition is considered incapacitating (e.g. the dependent is unable to take care of basic activities of daily living).

Section VII: SBP SPOUSAL CONCURRENCE (Required when member is married and elects child(ren) only coverage, does not elect full spouse coverage, or declines coverage)

I hereby concur with the Survivor Benefit Plan election made by my spouse. I have received information that explains the options available and the effects of those options. I know that retired pay stops on the date the retiree dies. I have signed this statement of my free will.

33. Spouse Signature: ___________________________________________________ |

38. NOTARY SEAL HERE |

|

34.Subscribed and Sworn to before me in County ______________ State ________

35.On Month_________________ Day___________, 20______

36.My Commission expires the___________ day ____________,20________

37.Notary Public (Signature) ___________________________________________

Page 3 of 4. FOR ANY CORRECTIONS/CHANGES A NEW FORM MUST BE COMPLETED PRIOR TO DATE OF RETIREMENT

Former Spouse (Complete ONLY if 22e or 22f was elected above)

39. Name (Last, First, MI)

40. SSN

41. Address (Street, City, State and Zip Code)

42. Date of divorce/dissolution of marriage

43. Date of Birth

44.a b

c

The election indicated above is being made pursuant to the requirements of court order |

Yes |

No |

The election indicated above is being made pursuant to a written agreement I previously entered into voluntarily as part of or incident to

a preceding of divorce, dissolution, or annulment |

Yes |

No |

|

|

The written agreement has been incorporated in, or ratified or approved by a court order |

Yes |

No |

||

Insurable Interest (Complete ONLY if 22d was elected above)

45. Name (Last, First, MI)

46. SSN

47. Address (Street, City, State and Zip Code):

48. Relationship

49. Date of Birth

Section VIII: DECLARATION OF SERVICE

50. Date you first became a member of the Uniformed Services (see note below)

51. Date of current rank

Note: Under the law, you “first became a member” of the Uniformed Services on the date first enlisted, inducted, or appointed. For

52. PRIOR SERVICE BREAKDOWN (FOR COAST GUARD ACTIVE DUTY OR NOAA PERSONNEL ONLY)

|

FROM |

|

TO |

||

|

|

|

|

|

|

DAY |

MONTH |

YEAR |

DAY |

MONTH |

YEAR |

|

|

|

|

|

|

ARMED SERVICE

IF ANY OF THE ABOVE SERVICE WAS IN A RESERVE COMPONENT:

DID YOU PERFORM RESERVE DRILLS? Yes No

Number of reserve retirement points earned (attach |

_________________ |

copies of points statements if available) |

|

53. |

Have you ever held a Rank/Rate higher than your current one? |

If yes, what rank did you |

When did you hold this rank? |

|

|

Yes |

No |

hold? |

|

|

|

|

||

|

|

|

|

|

54. |

Have you ever received severance, separation or readjustment pay from a |

If yes, what amount did you |

When did you receive such |

|

|

military service in connection with separation or release from active duty? |

receive? |

payment? |

|

Yes No

Section IX: MEMBER’S CERTIFICATION (member and witness signature and date (must sign on same date) required for start of retired pay)

Under penalties of perjury, I certify that the number of withholding exemptions claimed does not exceed the number to which I am entitled, and that all statements on this form are made with full knowledge of the penalties for making false statements. (18 U.S.C. 287 and 1001 provide for a penalty of not more than $10,000 fine, or 5 years in prison, or both). Also, I have been counseled that I can terminate SBP participation, with my spouse's written concurrence, within one year after the second anniversary of commencement of retired pay. However, if I exercise my option to terminate SBP, future participation is barred.

55. |

Member’ Name (last, first, middle initial) |

|

|

56. |

Member’s Employee ID Number: |

|

|

|

|

|

|

57. |

Member’ Signature |

|

|

58. |

Date |

|

|

|

|

|

|

59. Witness Name (Last, First, MI) (over 18 years old & not a member of your family) |

60. |

Witness Signature |

|

|

|

|

|

|

|

|

|

61. |

Witness Address (Street, City, State and Zip Code |

62. |

Witness telephone number |

63. |

Date |

|

|

|

|

|

|

Page 4 of 4. FOR ANY CORRECTIONS/CHANGES A NEW FORM MUST BE COMPLETED PRIOR TO DATE OF RETIREMENT