Form Cigar 2 can be filled in easily. Simply use FormsPal PDF tool to perform the job quickly. Our tool is consistently developing to deliver the very best user experience possible, and that is because of our resolve for constant enhancement and listening closely to testimonials. Getting underway is easy! All you should do is follow the next simple steps directly below:

Step 1: Simply click on the "Get Form Button" in the top section of this page to start up our form editor. This way, you will find all that is necessary to work with your document.

Step 2: This tool provides the ability to change your PDF form in a range of ways. Improve it by writing your own text, correct existing content, and include a signature - all within a couple of mouse clicks!

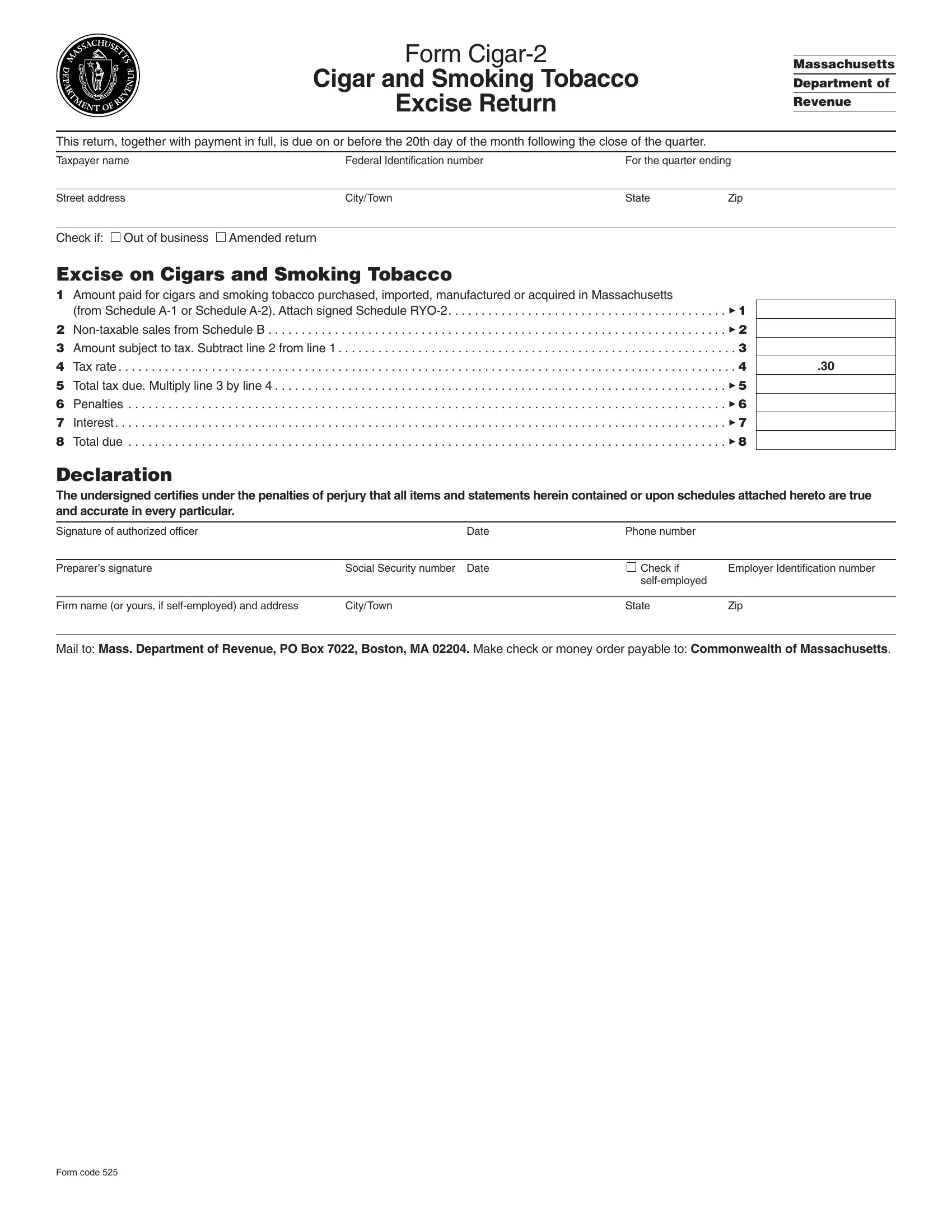

In order to complete this form, ensure that you enter the required information in each field:

1. To get started, once filling in the Form Cigar 2, beging with the section containing next blank fields:

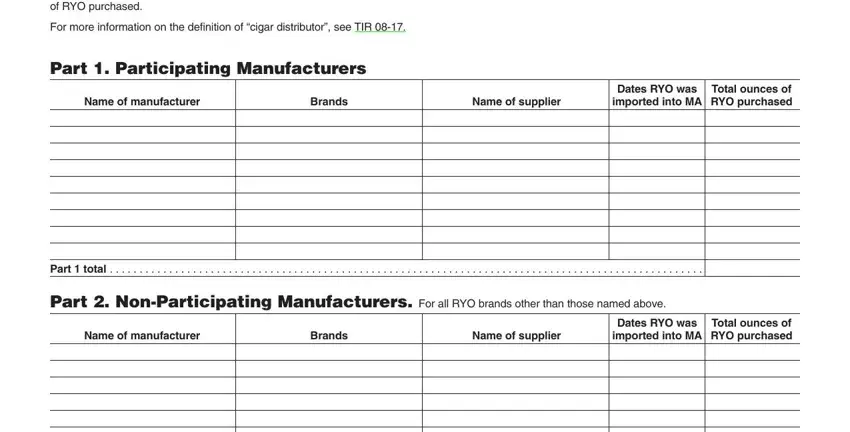

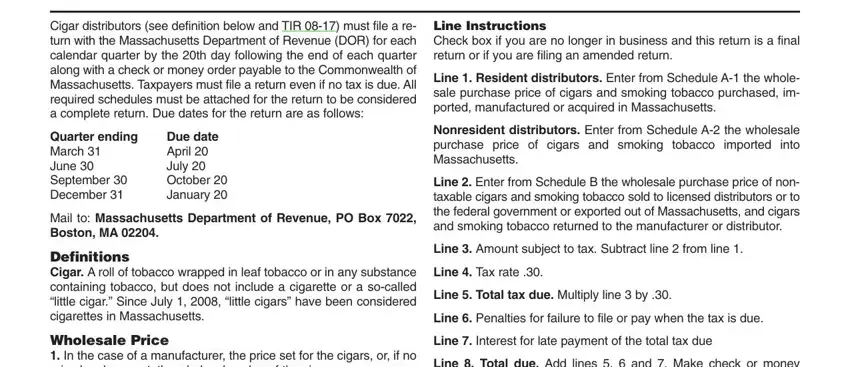

2. After the previous part is completed, you'll want to add the needed details in Cigar distributors see definition, Quarter ending March June, Due date April July October, Mail to Massachusetts Department, Definitions Cigar A roll of, Wholesale Price In the case of a, Line Instructions Check box if you, Line Resident distributors Enter, Nonresident distributors Enter, Line Enter from Schedule B the, Line Amount subject to tax, Line Tax rate, Line Total tax due Multiply line, Line Penalties for failure to, and Line Interest for late payment of in order to move on to the third stage.

Regarding Mail to Massachusetts Department and Wholesale Price In the case of a, be certain that you double-check them in this current part. These are thought to be the most significant fields in this page.

Step 3: Prior to finishing your file, ensure that blank fields have been filled out right. The moment you establish that it is correct, click on “Done." Go for a free trial option with us and obtain instant access to Form Cigar 2 - accessible inside your personal account page. FormsPal offers risk-free document completion without personal information record-keeping or distributing. Rest assured that your details are safe here!