Form Cl 1 can be completed in no time. Simply make use of FormsPal PDF tool to accomplish the job in a timely fashion. To retain our editor on the cutting edge of practicality, we aim to adopt user-driven features and enhancements on a regular basis. We're routinely looking for suggestions - play a pivotal part in reshaping how we work with PDF forms. To get the ball rolling, take these simple steps:

Step 1: Press the orange "Get Form" button above. It'll open up our tool so that you can start filling in your form.

Step 2: With the help of our state-of-the-art PDF tool, you could do more than just fill out blank form fields. Try all of the features and make your forms seem great with customized textual content put in, or fine-tune the file's original input to excellence - all that comes along with an ability to incorporate stunning graphics and sign it off.

It will be simple to finish the form following our helpful guide! This is what you must do:

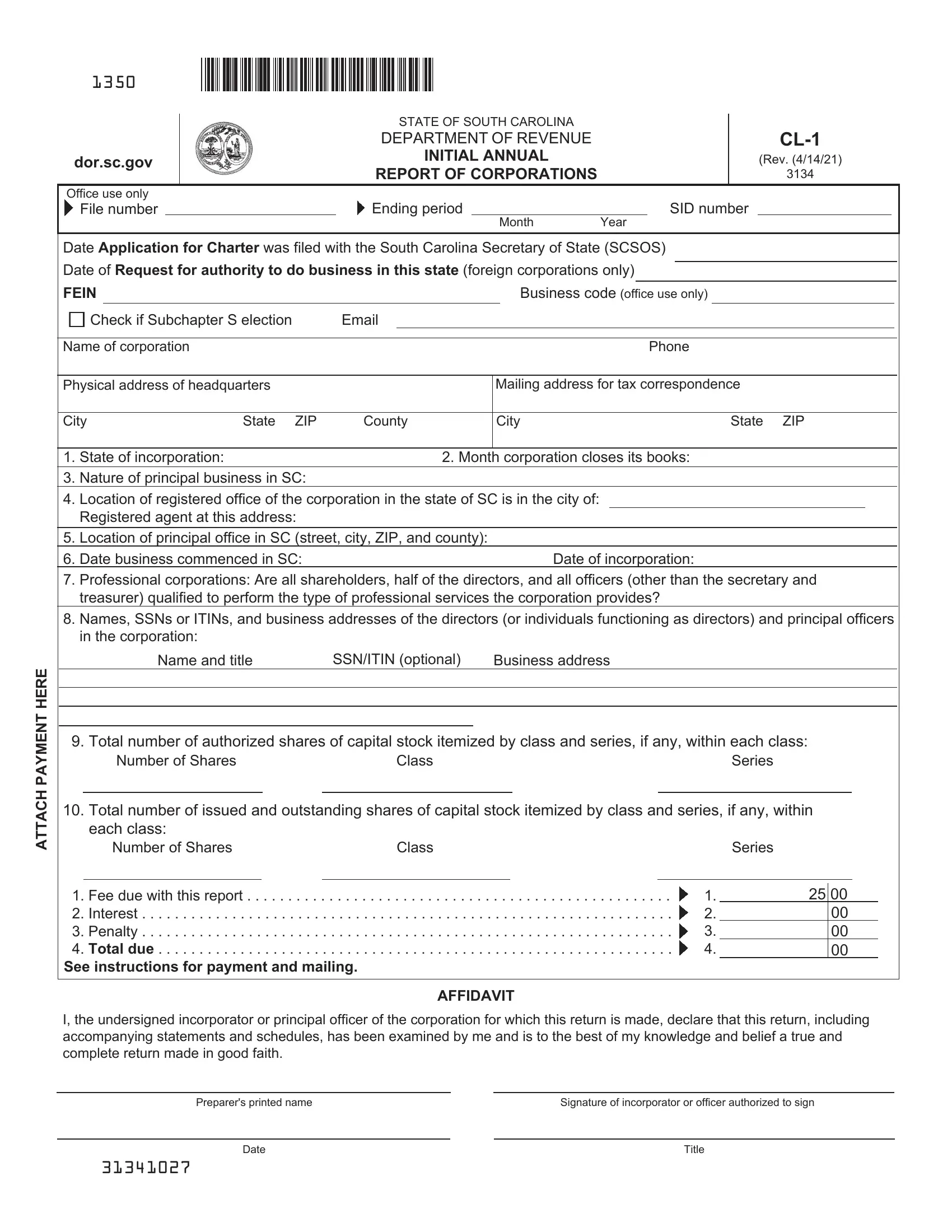

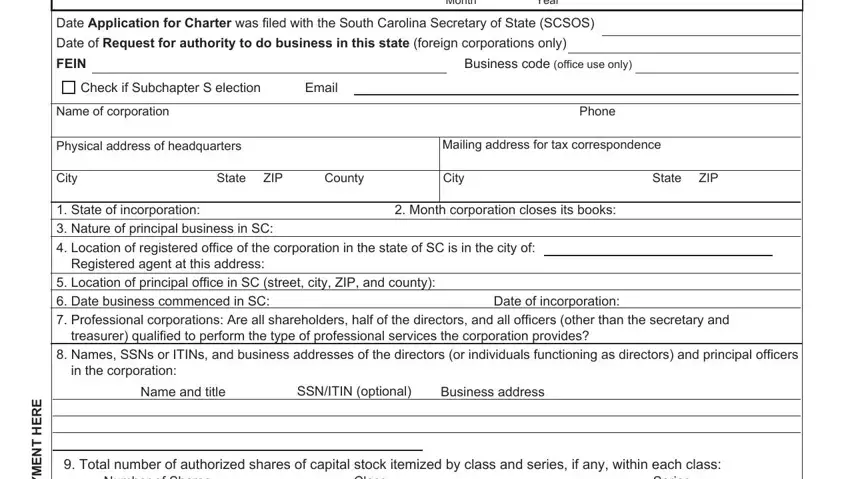

1. Whenever completing the Form Cl 1, make certain to incorporate all needed blank fields within the relevant part. It will help speed up the process, allowing for your information to be handled fast and accurately.

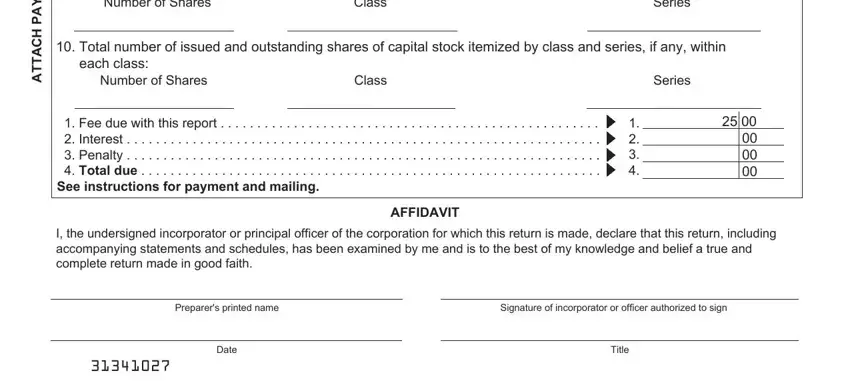

2. Just after the prior section is completed, proceed to type in the applicable information in all these - Total number of authorized shares, Total number of issued and, Fee due with this report, I the undersigned incorporator or, AFFIDAVIT, Preparers printed name, Signature of incorporator or, Date, Title, and E R E H T N E M Y A P H C A T T A.

You can certainly make an error when filling in the Total number of issued and, consequently make sure that you go through it again before you finalize the form.

Step 3: Revise the details you've inserted in the blank fields and then press the "Done" button. Join FormsPal right now and immediately obtain Form Cl 1, prepared for downloading. Every single edit you make is handily preserved , helping you to edit the form at a later point when necessary. Here at FormsPal, we aim to make sure that all your details are kept protected.