You'll be able to fill out Form Clgs 32 1 instantly using our online tool for PDF editing. To retain our editor on the leading edge of practicality, we work to adopt user-driven features and improvements regularly. We are at all times looking for suggestions - join us in revampimg how we work with PDF docs. Getting underway is effortless! Everything you need to do is follow the next basic steps directly below:

Step 1: Click on the "Get Form" button above. It's going to open up our editor so that you could begin filling in your form.

Step 2: The tool provides you with the capability to customize your PDF document in various ways. Improve it by including your own text, adjust what's already in the PDF, and include a signature - all within a few mouse clicks!

It will be easy to complete the form with this detailed guide! This is what you want to do:

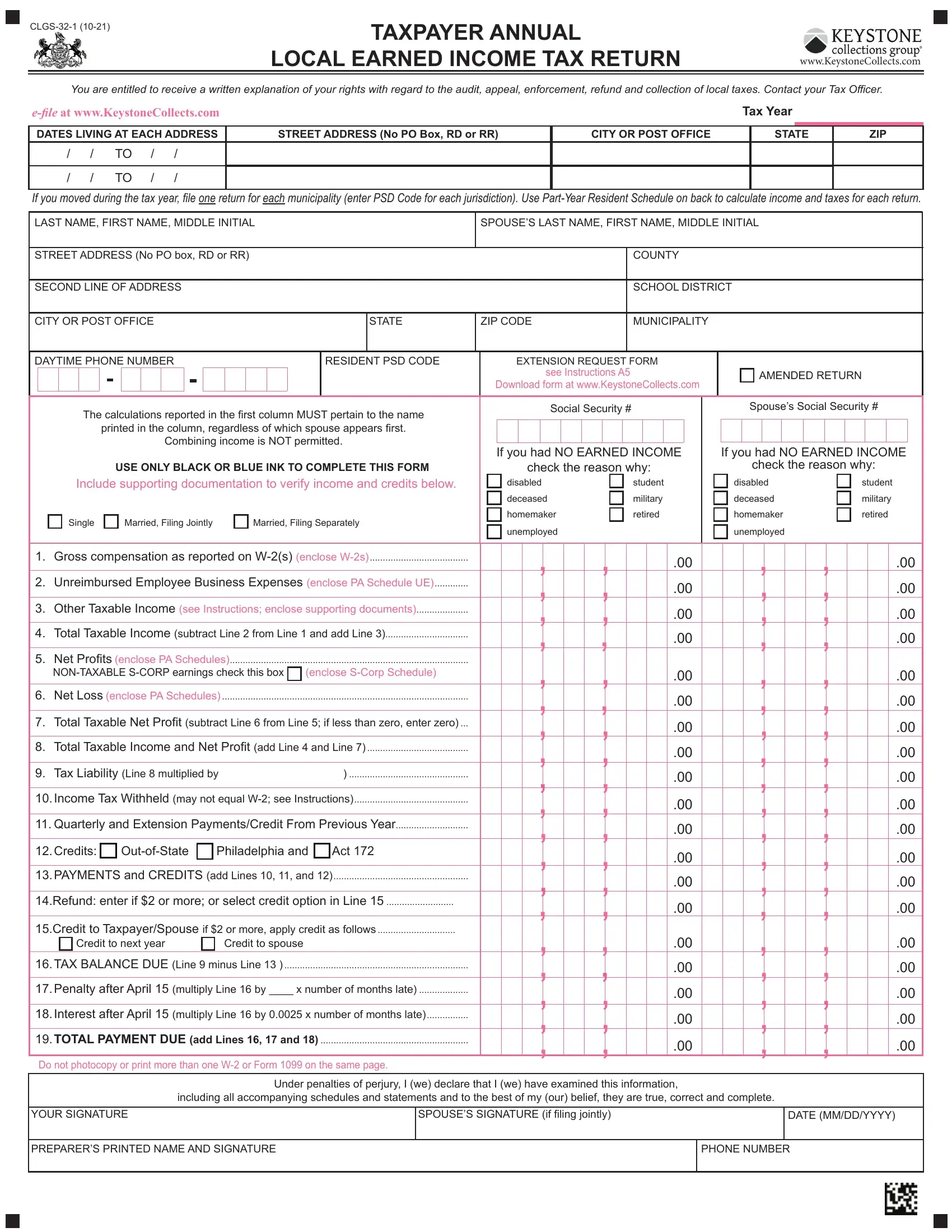

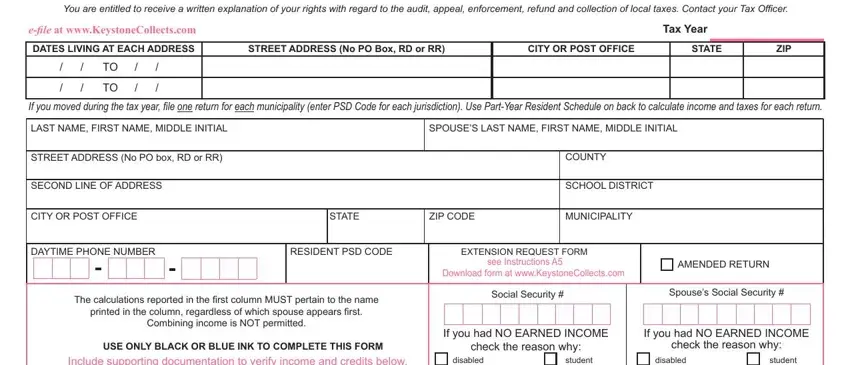

1. Begin completing your Form Clgs 32 1 with a number of major fields. Collect all the information you need and make certain absolutely nothing is left out!

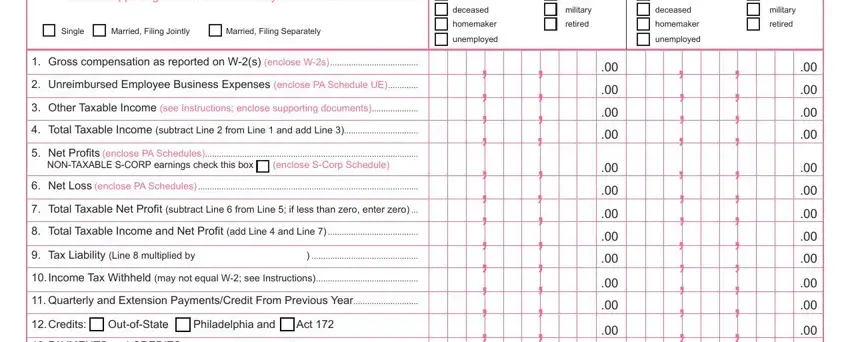

2. Right after completing the previous step, go to the next part and complete all required particulars in these blank fields - Include supporting documentation, Single, Married Filing Jointly, Married Filing Separately, Gross compensation as reported on, Unreimbursed Employee Business, Other Taxable Income see, Total Taxable Income subtract, Net Profits enclose PA Schedules, NONTAXABLE SCORP earnings check, enclose SCorp Schedule, Net Loss enclose PA Schedules, Total Taxable Net Profit subtract, Tax Liability Line multiplied by, and Income Tax Withheld may not equal.

When it comes to enclose SCorp Schedule and Other Taxable Income see, be certain that you do everything right here. Both these are definitely the most significant ones in the page.

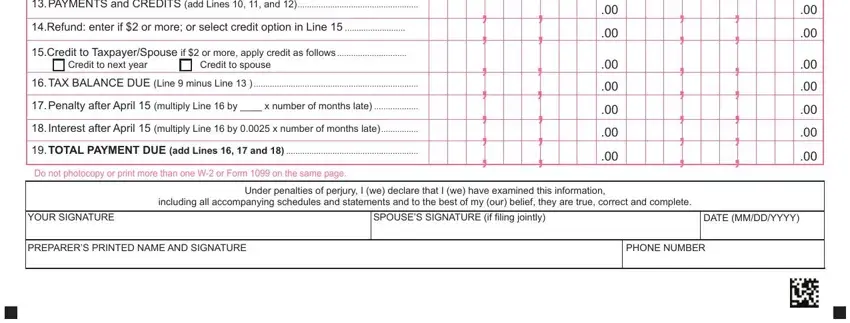

3. Within this stage, review PAYMENTS and CREDITS add Lines, Refund enter if or more or, Credit to TaxpayerSpouse if or, Credit to next year, Credit to spouse, TAX BALANCE DUE Line minus Line, Penalty after April multiply, Interest after April multiply, TOTAL PAYMENT DUE add Lines and, Do not photocopy or print more, YOUR SIGNATURE, SPOUSES SIGNATURE if filing jointly, DATE MMDDYYYY, including all accompanying, and Under penalties of perjury I we. All these will have to be filled out with highest attention to detail.

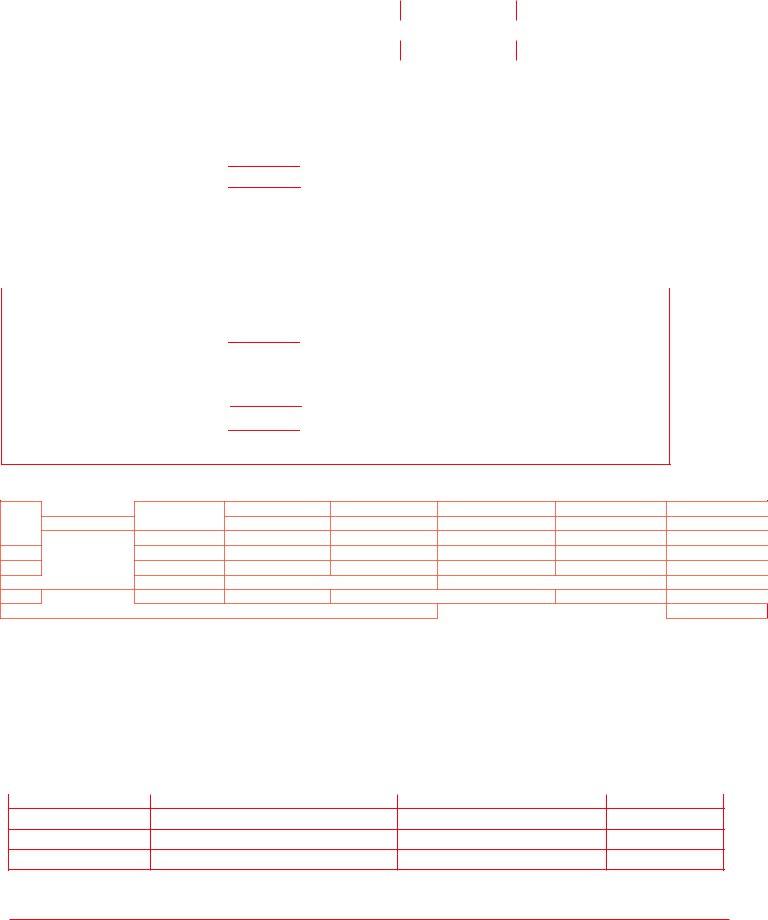

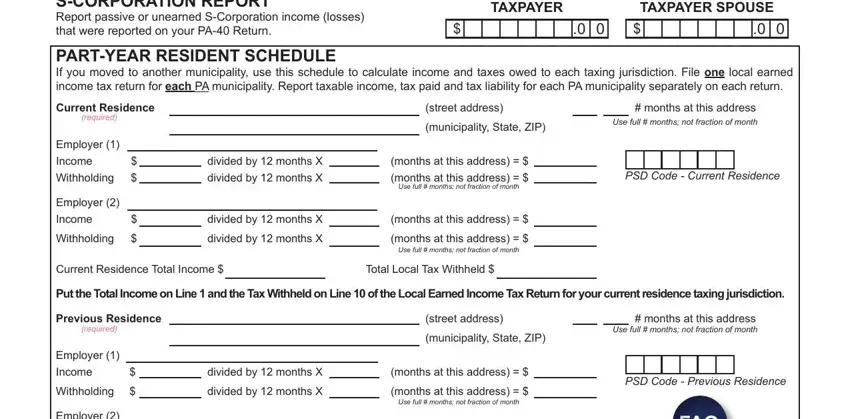

4. Filling out SCORPORATION REPORT Report passive, TAXPAYER, TAXPAYER SPOUSE, PARTYEAR RESIDENT SCHEDULE If you, Current Residence, required, Employer, Income, Withholding, Employer, Income, Withholding, street address, municipality State ZIP, and months at this address Use full is paramount in this next step - be certain to don't rush and be mindful with every empty field!

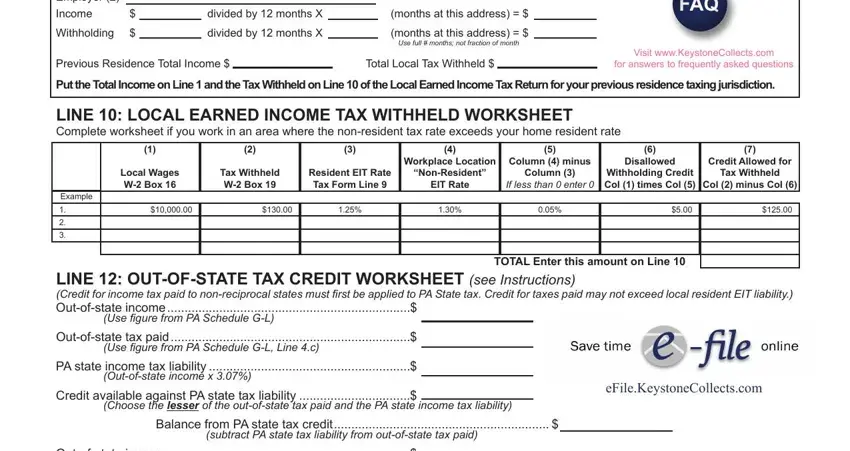

5. While you come close to the final parts of your form, you will find a couple more things to do. In particular, Employer, Income, Withholding, divided by months X, months at this address, divided by months X, months at this address, Use full months not fraction of, Previous Residence Total Income, Total Local Tax Withheld, Visit wwwKeystoneCollectscom, for answers to frequently asked, Put the Total Income on Line and, LINE LOCAL EARNED INCOME TAX, and Local Wages W Box should all be filled out.

Step 3: Go through everything you have inserted in the blank fields and click on the "Done" button. Make a 7-day free trial account at FormsPal and gain immediate access to Form Clgs 32 1 - downloadable, emailable, and editable from your FormsPal account. We do not sell or share the details you enter when working with documents at our site.