In case you want to fill out Form Cms 838, you won't need to download and install any sort of programs - just make use of our PDF editor. Our editor is constantly evolving to grant the very best user experience attainable, and that's due to our dedication to continual improvement and listening closely to user comments. To get the ball rolling, take these easy steps:

Step 1: Open the PDF doc inside our tool by clicking on the "Get Form Button" above on this page.

Step 2: The tool provides the opportunity to modify nearly all PDF forms in a variety of ways. Enhance it with any text, adjust what's originally in the PDF, and put in a signature - all within several mouse clicks!

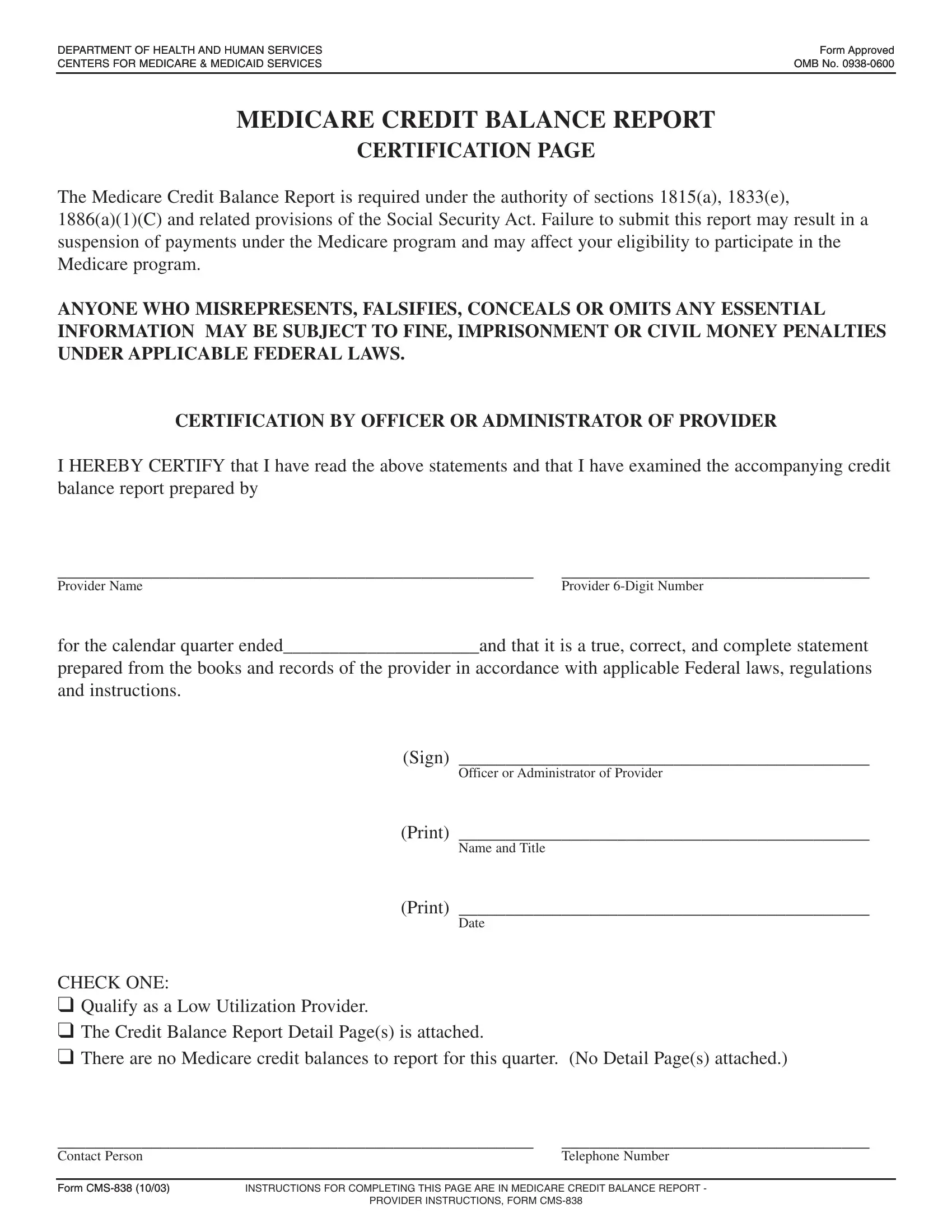

For you to finalize this PDF form, ensure you provide the required information in each and every blank field:

1. Whenever filling in the Form Cms 838, make certain to include all important fields in the relevant area. It will help to speed up the work, allowing your details to be processed promptly and appropriately.

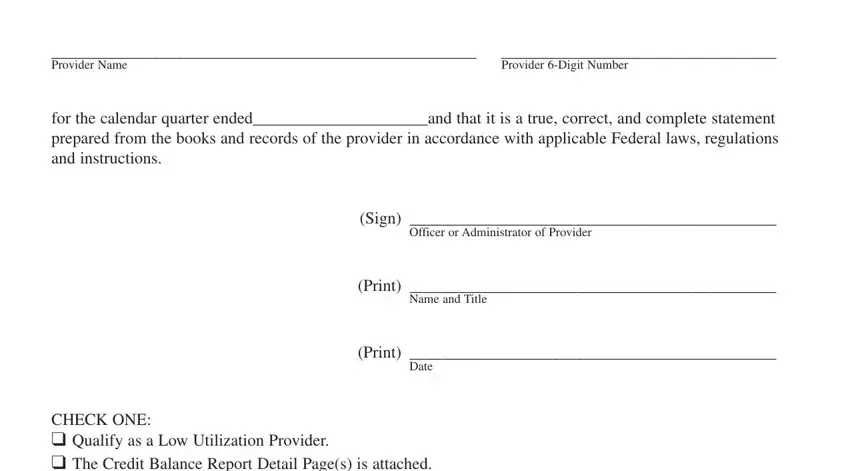

2. When this array of fields is completed, proceed to type in the applicable information in these - CHECK ONE Qualify as a Low, Contact Person, Telephone Number, Form CMS Form CMS, INSTRUCTIONS FOR COMPLETING THIS, and PROVIDER INSTRUCTIONS FORM CMS.

People often get some points incorrect while completing PROVIDER INSTRUCTIONS FORM CMS in this section. You should review what you enter here.

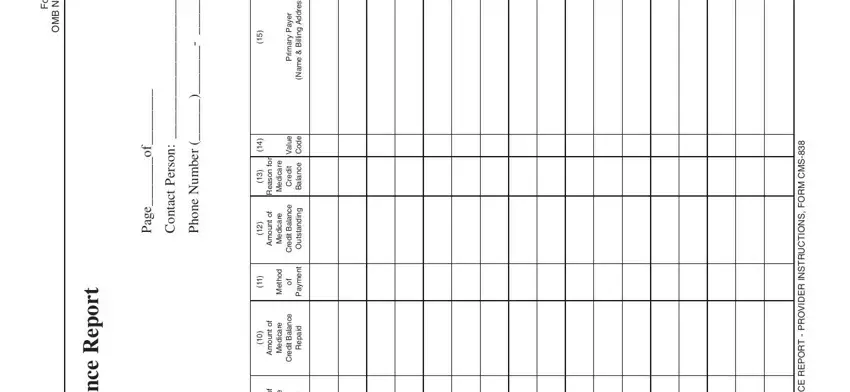

3. The following segment is about d e v o r p p A m r o F, o N B M O, t r o p e R e c n a l a B, e g a P, n o s r e P, t c a t n o C, r e b m u N e n o, f o e g a P, r o, n o s a e R, n u o m A, n u o m A, r e y a P y r a m, i r, and s s e r d d A g n - fill in each one of these blank fields.

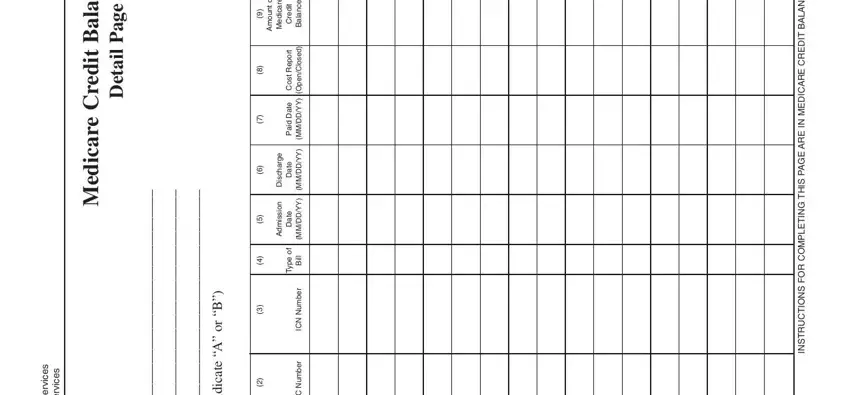

4. The following paragraph will require your attention in the subsequent parts: s e c v r e S n a m u H d n a, s e c v r e S d a c d e M e r a c, t r o p e R e c n a l a B, t i d e r C e r a c i d e M, e g a P, l i a t e D, B r o, A e t a c i d n I, n u o m A, e r a c d e M, e g r a h c s D, n o s s m d A, t i, d e r C, and e c n a a B. Ensure that you fill in all of the needed info to move forward.

5. This final section to complete this form is crucial. Make sure that you fill in the required fields, consisting of According to the Paperwork, Form CMS, and Page, prior to using the pdf. Failing to accomplish that could give you an unfinished and probably invalid paper!

Step 3: After you've looked once more at the information you filled in, click "Done" to finalize your document creation. Right after registering afree trial account with us, it will be possible to download Form Cms 838 or email it immediately. The PDF will also be at your disposal through your personal account with all your modifications. FormsPal ensures your information privacy via a protected system that in no way saves or shares any kind of sensitive information used. You can relax knowing your documents are kept safe each time you work with our tools!