The CRF-005 form, issued by the Georgia Department of Revenue, serves as a crucial document for businesses operating within the state, ensuring compliance with tax regulations. This comprehensive form is meticulously designed to identify and register individuals responsible for collecting, accounting for, and paying specific taxes and charges on behalf of their corporation, limited liability company, or limited liability partnership. These taxes include sales tax, withholding tax, and 911 charges on prepaid wireless services, as stipulated under section 48-2-52 of the Official Code of Georgia Annotated. The form highlights the potential personal liability that officers, employees, members, managers, and partners may face for non-payment of assessed taxes. Moreover, the CRF-005 facilitates the update process when there are changes in the responsible parties, ensuring that business information remains current with the Department of Revenue. Completion instructions guide the registrant through providing business details, identifying responsible parties, and specifying the tax types or charges for which they are accountable. The form also requires details such as social security numbers, mailing addresses, and contact information, ensuring a direct line of communication between the department and those responsible for tax obligations. Through its detailed structure, the CRF-005 form plays an essential role in fostering tax compliance and accountability among Georgia businesses.

| Question | Answer |

|---|---|

| Form Name | Form Crf 005 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | crf 005, Annotated, licensedor, georgia form crf 005 |

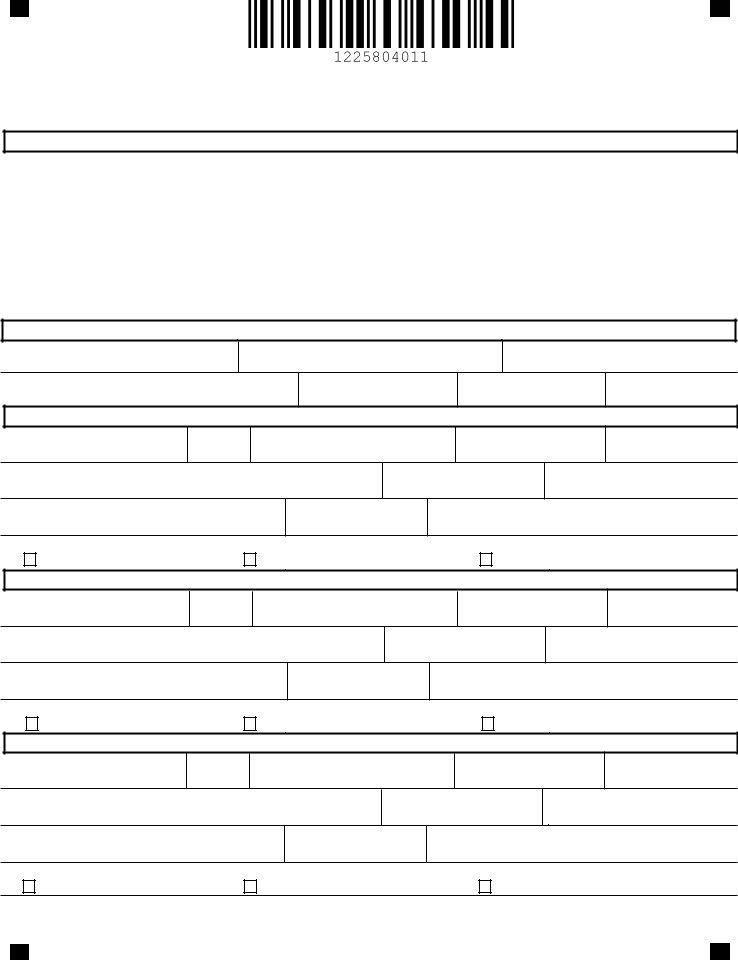

Form |

|

|

Georgia Department of Revenue |

|

|

Registration & Licensing Unit |

|

|

PO Box 49512 |

|

|

Atlanta, GA |

|

|

Fax: |

|

|

Call: |

Georgia Department of Revenue |

|

Email: |

||

|

||

Step 1 Read this information first

Under section

corporation officer or employee,

limited liability company member, manager or employee, or

limited liability partnership, partner or employee

may be held personally liable for unpaid sales tax, withholding tax, and 911 charges on prepaid wireless services assessed against such corporation, limited liability company, or limited liability partnership.

Form

Form

Step 2 Identify the business registered or to be registered for any of the tax types or charges listed in Step 1

Business Name

Business Address

Federal Employer Identification Number

Name of person completing this form

Title

Daytime Telephone Number Date

Step 3 Identify the person(s) responsible for filing your business' returns and/or paying all tax or charges due

First Name

Middle Initial Last Name

Job Title

Social Security Number

Mailing Address (number, street, and room or suite no.)

City

State |

ZIP code |

|

|

Email Address

Phone Number

Enter dates when responsibility begins and ends (if applicable):

From:To:

Check all for which person is responsible:

Sales and Use Tax

Withholding Tax

911 Charges on Prepaid Wireless Services

Complete the following if you need to identify another person

First Name

Middle Initial Last Name

Job Title

Social Security Number

Mailing Address (number, street, and room or suite no.)

City

State |

ZIP code |

|

|

Email Address

Phone Number

Enter dates when responsibility begins and ends (if applicable):

From:To:

Check all for which person is responsible:

Sales and Use Tax

Withholding Tax

911 Charges on Prepaid Wireless Services

Complete the following if you need to identify another person

First Name

Middle Initial Last Name

Job Title

Social Security Number

Mailing Address (number, street, and room or suite no.)

City

State |

ZIP code |

|

|

Email Address

Phone Number

Enter dates when responsibility begins and ends (if applicable):

From:To:

Check all for which person is responsible:

Sales and Use Tax

Withholding Tax

911 Charges on Prepaid Wireless Services