The CRF-013 form serves as a crucial application for owners and operators in Georgia looking to lawful operate coin-operated amusement machines. Issued by the Georgia Department of Revenue, this comprehensive document outlines the steps and requirements for registering such entertainment devices, including pinball and video game machines, amongst others. It emphasizes the legal business name, type of ownership, and intricate details concerning fees for licenses and decals essential for operating within legal boundaries. The form intricately details different license levels based on the number of machines operated, alongside the potential penalties for non-compliance such as the failure to affix decals or timely applying for a Master License, both attracting specific fines. Additionally, it specifies the necessity of listing pertinent information ranging from tax identifiers to the physical location of the business. Rigorously structured, the CRF-013 form not only aids in regulatory compliance but also serves as a protective measure against unauthorized operation, signaling stringent enforcement by the Georgia Department of Revenue. This form thereby underscores the department’s commitment to ensuring fair play and regulation adherence in the amusement machine industry, encapsulating the legal, fiscal, and operational facets pivotal to securing and maintaining licensure in Georgia.

| Question | Answer |

|---|---|

| Form Name | Form Crf 013 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | CRF_013 form crf 013 |

|

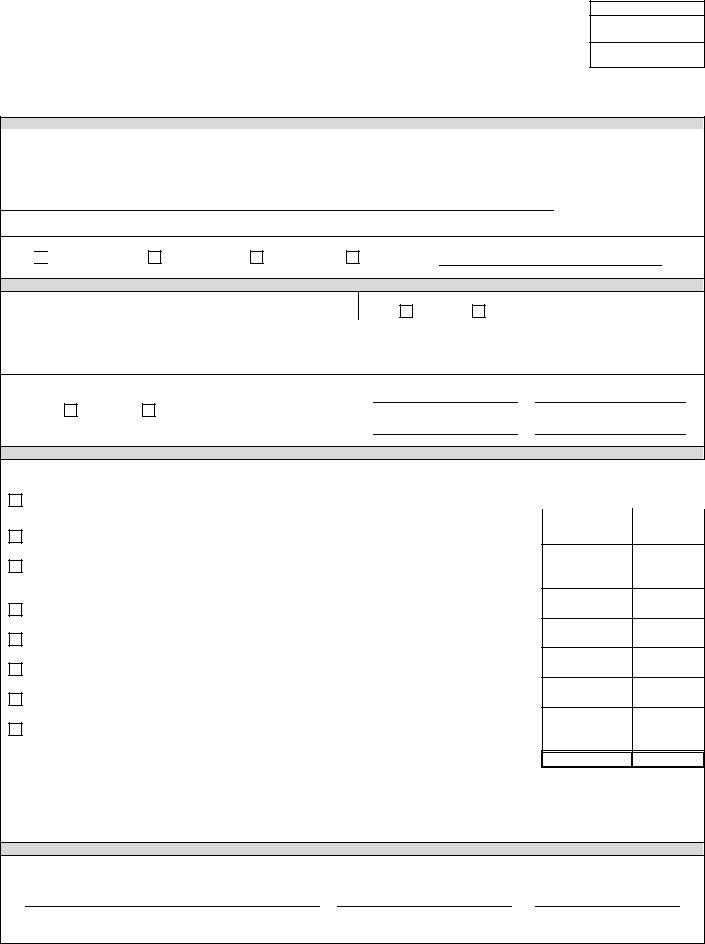

AMUSEMENT MACHINE APPLICATION |

GEORGIA DEPARTMENT OF REVENUE CENTRALIZED TAXPAYER REGISTRATION UNIT P. O. BOX 49512

ATLANTA, GA

(FORM

(PLEASE PRINT OR TYPE)

OFFICE USE ONLY

Total Amount Received

$

Master License Number

IDENTIFICATION SECTION

1. |

If you have a State Taxpayer Identifier (STI) Number, Enter it here: |

1a. |

Enter you Federal Employer Identification Number (FEI |

|

|

|

|

2. |

LEGAL BUSINESS NAME |

2a. |

DBA OR TRADE NAME (If applicable) |

|

|

|

|

3.PRIMARY LOCATION ADDRESS (number and street)

4. CITY |

COUNTY |

STATE ZIP CODE +4 |

PHONE |

|

|

|

( ) |

5.TYPE OF OWNERSHIP

Proprietorship

Partnership

Corporation

Other (specify)

AMUSEMENT MACHINE INFORMATION SECTION

6.Date you first plan to operate

6a. Will you renew you license next year? (Check one)

YES |

NO |

7. Alcohol License Number |

8. |

Sales Tax Number |

9. |

Withholding Tax Number |

|

|

|

|

|

10.To which local governments will you pay ad valorem tax?

11. Which local governments will be issuing your business license(s)? |

Name(s) |

City

County

FEE SECTION

12.LICENSE FEES: (Check the appropriate box(es) and return the total amount due with the application.)

LEVEL 1 LICENSE |

|

Master License Fee - $250 (Plus $1250.00 if |

during the year). Six (6) Month Master License Fee - $175 |

||

LEVEL 2 LICENSE |

|

Master License Fee - $1,500 (Plus $1000.00 if 61st or more machines are |

acquired during the year). Six (6) Month Master License Fee - $1,050 |

||

LEVEL 3 LICENSE |

(61 or More) |

Master License Fee - $2,500 |

|

|

Six (6) Month Master License Fee - $1,750 |

FULL YEAR |

6 MONTHS |

|

|

ANNUAL PERMIT STICKER FEE (Per Machine): $25 Sticker must be affixed to the machine.

$50.00 PENALTY FEE: (Per machine) Machine in operation without a sticker affixed.

DUPLICATE ORIGINAL LICENSE FEE

FAILURE TO PAY TIMELY MASTER LICENSE FEE - $125

PENALTY TO RELEASE SEIZURE OF MACHINE - $75 per machine.

TOTAL FEES DUE

No REFUND of any of these fees is authorized if owner ceases operation prior to the end of the calendar year.

MAKE CHECK PAYABLE TO THE “GEORGIA DEPARTMENT OF REVENUE”. GEORGIA LAW STIPULATES THAT TAXES AND FEES SHALL BE PAID IN LAWFUL MONEY OF THE U.S. FREE OF EXPENSE TO GEORGIA.

SIGNATURE SECTION

THIS APPLICATION HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE IS TRUE AND CORRECT.

Signature |

Title |

Date |

(Must be signed by owner, partner or authorized officer of corporation. Stamped signature is not acceptable.)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

INSTRUCTIONS FOR THE COMPLETION OF THE COIN OPERATED

STATE AMUSEMENT MACHINE APPLICATION (FORM

TYPE OR PRINT IN INK – DO NOT USE PENCIL

Use this form to apply for a license and decals for

This pertains to completion of

INSTRUCTIONS FOR COMPLETING FORM

A.IDENTIFICATION SECTION

Line 1- Enter your Georgia State Taxpayer Identifier. (If you do not yet have one, leave blank.)

(1a) Enter your Federal Employer Identification Number if applicable.

Line 2- Enter your legal business name listed on Form

Line 5- Check type of ownership.

B.AMUSEMENT MACHINE INFORMATION SECTION

Line 6- Enter the date you plan to first operate in Georgia. (6a) If you are in a business for only part of the year (i.e., six

months) do you want a renewal form sent to you for the next year?

Line 7- Enter your State Liquor/Beer and/or Wine License number, if applicable.

Line 8- Enter your Sales and Use Tax Number. If you do not have a Sales and Use Tax Number and are responsible for the collection of sales tax, complete the Sales and Use Tax part of Form

Line 9- Enter your Georgia Withholding Number. If you have employees in Georgia and do not have a Withholding

Number, complete |

the Withholding part of Form |

Line 10- List the local governments/counties in which you pay ad valorem tax. If additional space is needed, attach a list to the application.

Line 11- List the local governments where you have a business license. If additional space is needed, attach a list to the application.

C.FEE SECTION

“Failure to apply for a Master License will result in the imposition of a $125.00 penalty. Failure to order and affix decals for machines will result in the imposition of a $50.00 per machine penalty.” Any violation of this law can result in suspension or revocation of your license, seizure of equipment, and debarment for repeat offenders. Equipment can be sold at public auction after 30 days’ advertisement. The Revenue Commissioner will charge a fee of $75.00 per machine for the release of any machine that has been seized and sealed. No one is authorized to remove the seals after they are in place without written authorization from the Commissioner or his authorized agents after payment of penalties.

If you apply for a six (6) months’ license that expires before the end of the calendar year, you must reapply if you decide to stay in business for the rest of the calendar year. At that time, another license fee is due. Annual Licenses and all decals expire December 31. Licenses for six months or less expire six months from the date of issue or December 31, whichever comes first. License fees are not prorated.

When applying for a duplicate of your original license you must attach an affidavit, showing the reason that you need a duplicate (e.g., lost license, etc.).

The registration fee must be made payable to the GEORGIA DEPARTMENT OF REVENUE. Georgia law stipulates that taxes and fees shall be paid in lawful money of the U.S. and be free of expense to Georgia.

D.SIGNATURE SECTION

This application must be signed by the owner, a partner, or an authorized officer of the corporation.

E.INSTRUCTIONS FOR MAILING:

Mail the original application, with fees attached, to the address shown below. You should retain a copy of this application for your file.

GEORGIA DEPARTMENT OF REVENUE

CENTRALIZED TAXPAYER REGISTRATION UNIT

P. O. BOX 49512

ATLANTA, GA

Please allow 4 to 6 weeks for processing. For further information, call (404)

IMPORTANT NOTICE: Your permits will NOT be issued if there are any outstanding liabilities against your account(s).