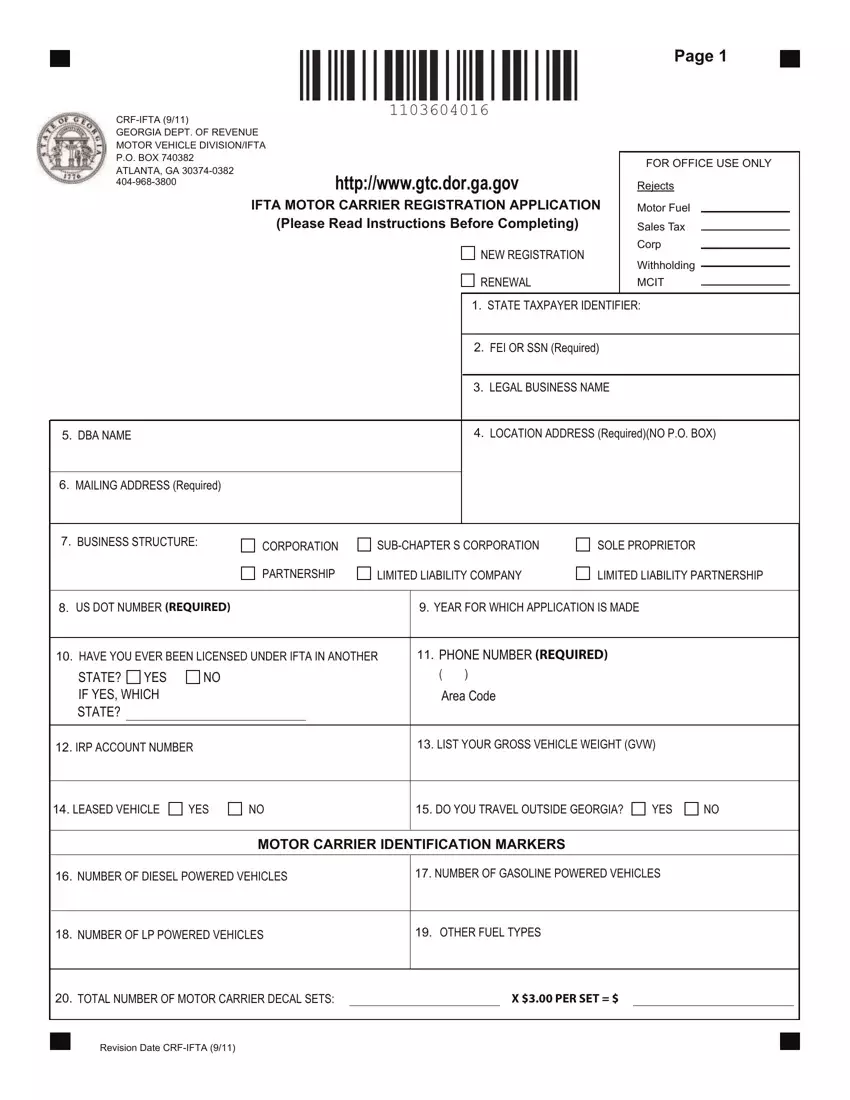

Page 1

CRF-IFTA (9/11)

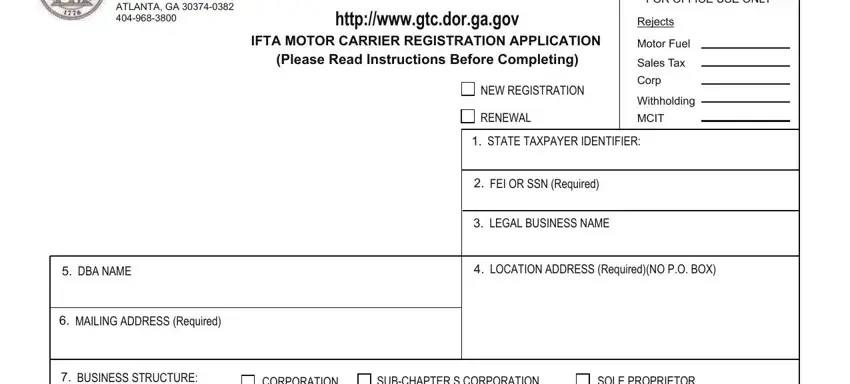

GEORGIA DEPT. OF REVENUE

MOTOR VEHICLE DIVISION/IFTA

P.O. BOX 740382 ATLANTA, GA 30374-0382 404-968-3800

|

|

FOR OFFICE USE ONLY |

http://www.gtc.dor.ga.gov |

Rejects |

IFTA MOTOR CARRIER REGISTRATION APPLICATION |

Motor Fuel |

|

|

(Please Read Instructions Before Completing) |

Sales Tax |

|

|

|

|

NEW REGISTRATION |

Corp |

|

|

|

Withholding |

|

|

|

RENEWAL |

|

|

|

|

|

MCIT |

|

|

|

|

|

|

|

|

|

1.STATE TAXPAYER IDENTIFIER:

2.FEI OR SSN (Required)

3.LEGAL BUSINESS NAME

4.LOCATION ADDRESS (Required)(NO P.O. BOX)

6.MAILING ADDRESS (Required)

SUB-CHAPTER S CORPORATION

LIMITED LIABILITY COMPANY

SOLE PROPRIETOR

LIMITED LIABILITY PARTNERSHIP

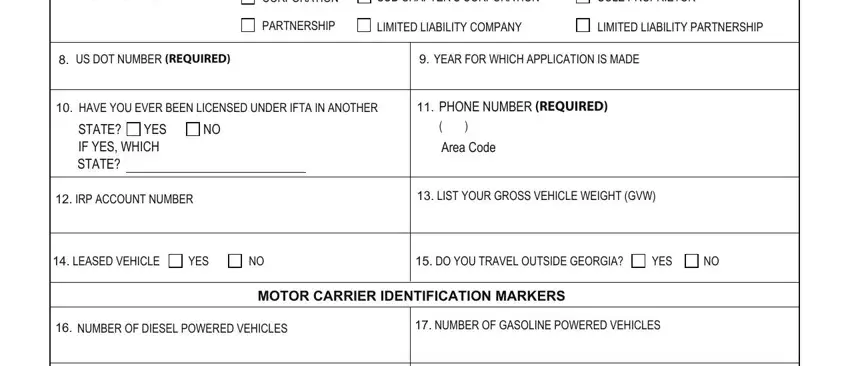

8. |

US DOT NUMBER (REQUIRED) |

|

|

|

9. YEAR FOR WHICH APPLICATION IS MADE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. HAVE YOU EVER BEEN LICENSED UNDER IFTA IN ANOTHER |

11. PHONE NUMBER (REQUIRED) |

|

|

|

|

|

STATE? YES |

NO |

|

|

|

( ) |

|

|

|

|

|

|

|

IF YES, WHICH |

|

|

|

|

Area Code |

|

|

|

|

|

STATE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12. IRP ACCOUNT NUMBER |

|

|

|

13. LIST YOUR GROSS VEHICLE WEIGHT (GVW) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. LEASED VEHICLE |

YES |

NO |

15. DO YOU TRAVEL OUTSIDE GEORGIA? |

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MOTOR CARRIER IDENTIFICATION MARKERS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16. |

NUMBER OF DIESEL POWERED VEHICLES |

17. NUMBER OF GASOLINE POWERED VEHICLES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18. |

NUMBER OF LP POWERED VEHICLES |

19. OTHER FUEL TYPES |

|

|

|

|

|

|

|

|

|

|

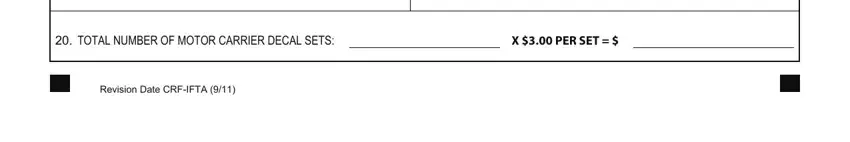

20. |

TOTAL NUMBER OF MOTOR CARRIER DECAL SETS: |

|

|

X $3.00 PER SET = $ |

|

|

|

|

Revision Date CRF-IFTA (9/11)

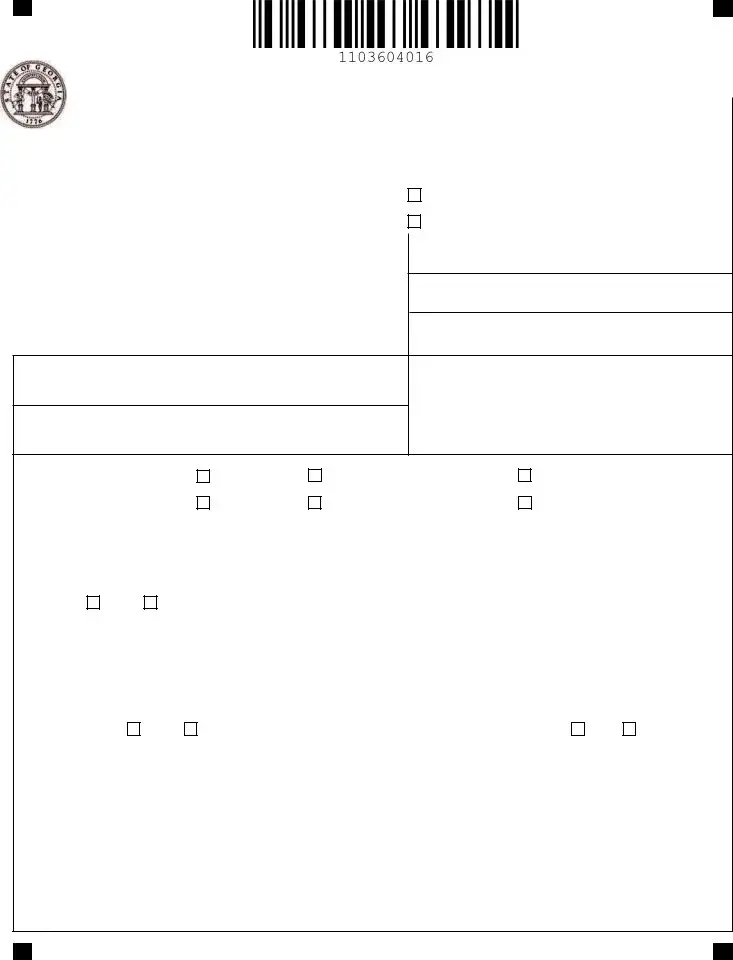

Page 2

CRF-IFTA (9/11)

GEORGIA DEPTARTMENT OF REVENUE MOTOR VEHICLE DIVISION/IFTA

P.O. BOX 740382 ATLANTA, GA 30374-0382 404-968-3800

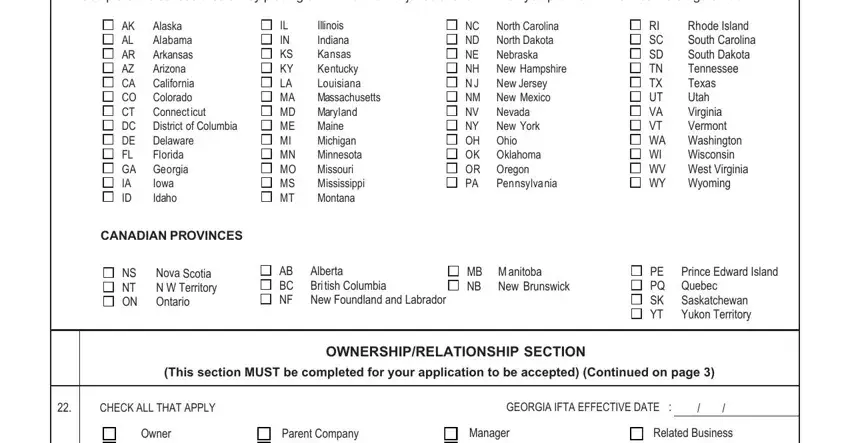

2 1.OPERATING JURISDICTIONS

Complete the schedule below by placing an “X” next to the jurisdictions in which you plan to maintain bulk storage of fuel.

AK |

Alaska |

AL |

Alabama |

AR |

Arkansas |

AZ |

Arizona |

CA |

California |

CO |

Colorado |

CT |

Connect icut |

DC |

District of Columbia |

DE |

Delaware |

FL |

Florida |

GA |

Georgia |

IA |

Iowa |

ID |

Idaho |

IL |

Illinois |

IN |

Indiana |

KS |

Kansas |

KY |

Kentucky |

LA |

Louisiana |

MA |

Massachusetts |

MD |

Maryland |

ME |

Maine |

MI |

Michigan |

MN |

Minnesota |

MO |

Missouri |

MS |

Mississippi |

MT |

Montana |

NC |

North Carolina |

ND |

North Dakota |

NE |

Nebraska |

NH |

New Hampshire |

N J |

New Jersey |

NM |

New Mexico |

NV |

Nevada |

NY |

New York |

OH |

Ohio |

OK |

Oklahoma |

OR |

Oregon |

PA |

Pennsylva nia |

RI |

Rhode Island |

SC |

South Carolina |

SD |

South Dakota |

TN |

Tennessee |

TX |

Texas |

UT |

Utah |

VA |

Virginia |

VT |

Vermont |

WA |

Washington |

WI |

Wisconsin |

WV |

West Virginia |

WY |

Wyoming |

NS |

Nova Scotia |

NT |

N W Territory |

ON |

Ontario |

AB |

Alberta |

BC |

Bri tish Columbia |

NF |

New Foundland and Labrador |

MB |

M anitoba |

NB |

New Brunswick |

PE |

Prince Edward Island |

PQ |

Quebec |

SK |

Saskatchewan |

YT |

Yukon Territory |

|

|

|

|

|

OWNERSHIP/RELATIONSHIP SECTION |

|

|

|

|

|

|

|

(This section MUST be completed for your application to be accepted) (Continued on page 3) |

|

|

|

|

|

|

|

|

|

22. |

CHECK ALL THAT APPLY |

|

|

|

GEORGIA IFTA EFFECTIVE DATE : / / |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner |

|

Parent Company |

|

Manager |

|

|

Related Business |

|

|

|

|

|

|

|

|

|

|

Partner |

|

Officer |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

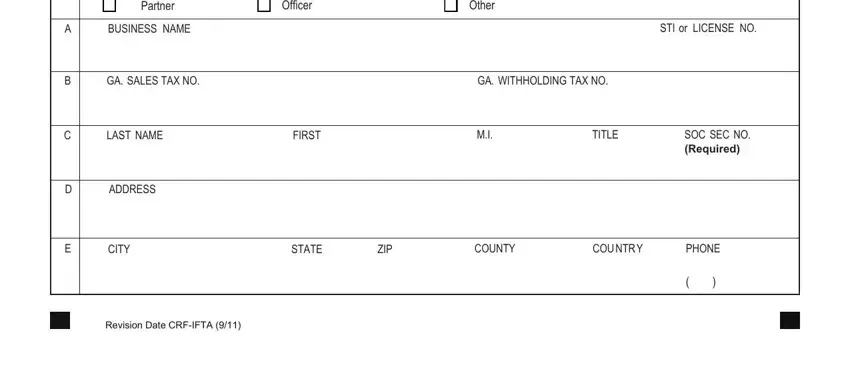

A |

|

BUSINESS NAME |

|

|

|

|

|

|

STI or LICENSE NO. |

|

|

|

|

|

|

|

|

|

|

|

B |

|

GA. SALES TAX NO. |

|

|

|

GA. WITHHOLDING TAX NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

LAST NAME |

|

FIRST |

|

M.I. |

TITLE |

|

|

SOC SEC NO. |

|

|

|

|

|

|

|

|

|

|

|

(Required) |

CITY |

STATE |

ZIP |

COUNTY |

COU NTR Y |

PHONE |

Revision Date CRF-IFTA (9/11)

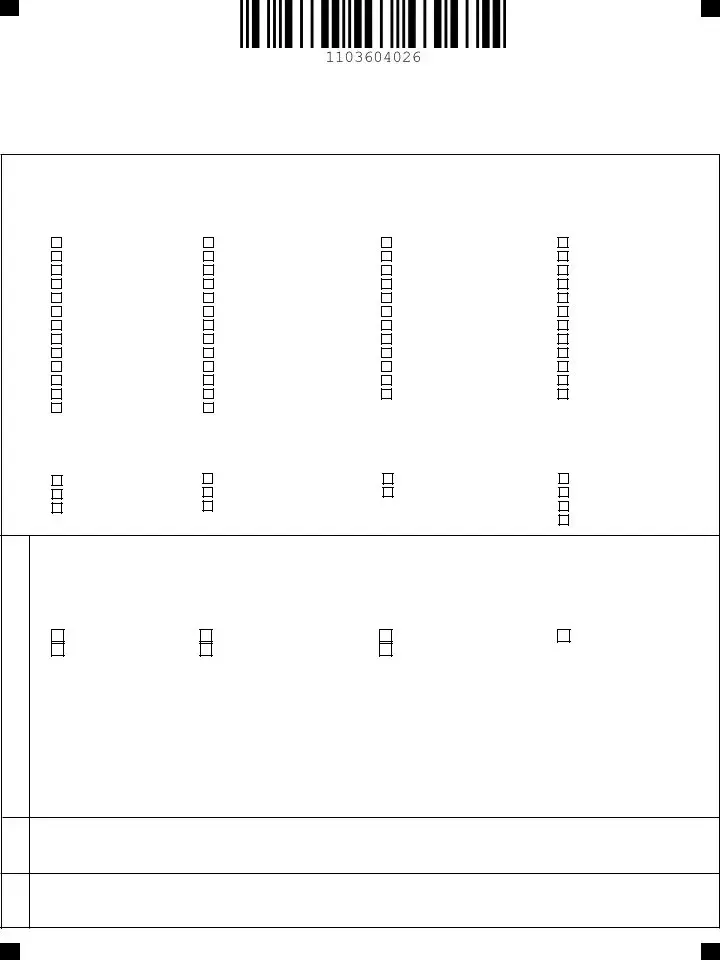

Page 3

CRF-IFTA (9/11)

GEORGIA DEPARTMENT OF REVENUE MOTOR VEHICLE DIVISION/IFTA P.O. BOX 740382

ATLANTA, GA 30374-0382 404-968-3800

|

|

|

|

|

|

OWNERSHIP/RELATIONSHIP SECTION |

|

|

|

|

|

|

|

|

|

(This section MUST be completed for your application to be accepted) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

23. |

CHECK ALL THAT APPLY |

|

|

|

|

|

GEORGIA IFTA EFFECTIVE DATE : |

|

/ |

/ |

|

|

|

Owner |

|

|

Parent Company |

|

|

Manager |

|

Related Business |

|

|

|

|

|

|

|

|

|

|

|

Partner |

|

|

Officer |

|

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

BUSINESS NAME |

|

|

|

|

|

|

|

STI or LICENSE NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

B |

|

GA. SALES TAX NO. |

|

|

|

|

|

GA. WITHHOLDING TAX NO. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

LAST NAME |

|

|

FIRST |

|

|

M.I. |

TITLE |

|

SOC SEC NO. |

|

|

|

|

|

|

|

|

|

|

|

|

(Required) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

D |

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E |

|

CITY |

|

|

STATE |

ZIP |

|

COUNTY |

COU NTR Y |

|

PHONE |

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DECLARATION STATEMENT

The applicant agrees to comply with reporting payment, record keeping and license display requirements as specified in the Georgia IFTA Procedures Manual. The applicant authorizes the State of Georgia to withhold any refund of tax over- payment, if deliquent taxes are due to any member IFTA jurisdiction. Failure to comply with these provisions shall be grounds for revocation or suspension of the license in all member jurisdictions.

The applicant, certifies with his signature that to the best of his/her knowledge, the information is true, accurate and com- plete and any falsification subjects him/her to the offense of making a written false statement to a government official.

Print Name:

(Must be signed by owner, partner, or authorized officer of corporation - Stamped signature not acceptable)

Revision Date CRF-IFTA (9/11)

STATE OF GEORGIA

DEPARTMENT OF REVENUE

INSTRUCTIONS FOR THE COMPLETION OF THE MOTOR CARRIER APPLICATION (CRF-IFTA)

All vehicles that operate in two or more jurisdictions and meet the following criteria, must complete the IFTA Motor Carrier Registration Application.

Vehicles are used, designed or maintained for transportation of persons or property and having two axles and a gross vehicle weight or registered gross vehicle weight exceeding 26,000 pounds or 11,197 kilograms; or having three or more axles regardless of kilograms gross vehicle or registered gross vehicle weight must be licensed and have identification markers before operation in Georgia. For exceptions please refer to GA. Code 48-9-30.

Type or print In Ink- DO NOT USE PENCIL

INSTRUCTIONS FOR COMPLETING THE APPLICATION:

Line 1. Enter your Georgia State Taxpayer Identifier. (If you do not have one, leave blank)

Line 2. Enter your Federal Employer Identification Number or Social Security number. Failure to provide this information will cause the application to be returned.

Line 3. Enter the name under your business which is legally registered with the Secretary of State. If your business is not registered with the Secretary of State, enter the name under which your business owns property or incurs debts. If the business is a partnership, the legal name would be in the partnership name. If the legal name is a sole proprietorship, the legal name would be in the individual name.

Line 4. Enter the physical location of the business (cannot be a P O Box). Failure to provide this information will cause the application to be returned.

Line 5. Enter the “doing business as” name (DBA).

Line 6. Enter the address to which your IFTA correspondence should be mailed. Line 7. Check type of company.

Line 8. Enter your US DOT number. You can obtain a DOT number online at: www.safersys.org or you can contact The Federal Motor Carrier Safety Administration at (800) 832-5660.

Line 9. Enter the year to which the license and decal(s) applies.

Line 10. Check whether you have been previously IFTA registered in another state. If yes, list the state. If you have been registered in more than one state, list the last state.

Line 11. Enter the phone number at which you or your representative can be contacted. Failure to provide this information will cause the application to be returned. Make sure you include your area code.

Line 12. Enter your Georgia International Registration Plan (IRP) account number. Bus company or leasing company enter N/A. If you need an account number, you may contact the IRP

office at 404-968-3800. The IRP office is located at 1200 Tradeport Blvd. Hapeville, Ga.30354. Line 13. Enter your gross vehicle weight.

Line 14. Check “Yes” or “No” to indicate if the vehicle is leased.

Line 15. Check “Yes” or “No” to indicate if you travel outside of Georgia.

Motor Carrier Identification Markers Section:

Line 16. Enter the number of diesel powered vehicles you are registering. Line 17. Enter the number of gasoline powered vehicles you are registering. Line 18. Enter the number of LP powered vehicles you are registering.

Line 19. Enter the number of other fuel type powered vehicles you are registering.

Line 20. Enter the total number of motor carrier decal sets for which you are applying and the total cost of the sets.

Line 21. OperatingJurisdictions Section: Place an “X” in each State or Canadian Province which you plan to maintain bulk storage fuel.

Line 22. & 23. Ownership/Relationship Section: Georgia IFTA Effective Date- Enter the date you first plan to do business as an interstate carrier using the Georgia IFTA decal.

The Department of Revenue requires the following information on all related individuals or businesses to determine the ownership of the applying business. This section must be completed for your application to be accepted. Complete one Section for each related business or individual, check the relationships that apply, and enter the effective date of that relationship. For all applications provide information for the following:

A. Owner- The owner of the business, complete lines C, D and E.

B. Partner-If the business is a partnership, complete lines A through E for each partner. C. Officer- If the business is a corporation, complete lines A through E for each officer.

D. LLC- If the business is a Manager Member complete lines A through E for each manager member. E. Partner Company - If the business is a subsidiary branch or division or another business,

complete lines A through E.

INSTRUCTIONS FOR SIGNING:

The Declaration Statement must be signed by the owner, a partner or authorized officer of the corporation before the registration can be accepted.

INSTRUCTIONS FOR PAYMENT:

Send a money order or certified funds payable to the Georgia Revenue Collection Account for the total amount. Georgia law stipulates that taxes and fees be paid in lawful money of U.S. funds and be free on any expense to Georgia.

IMPORTANT NOTICE:

Your motor carrier license will not be issued, if there are any outstanding liabilities against your account, or if you do not return the registration form with a proper signature on the Declaration Statement.

INSTRUCTIONS FOR MAILING AND REQUESTING INFORMATION:

The taxpayer should retain a copy of this application for his files and for inspection by the Revenue Commissioner or his agents. Mail the original to the address shown below. Call 404-968-3800 or E- mail if you have any questions or need assistance in completing the application.

DECLARATION STATEMENT:

The applicant agrees to comply with reporting payments record keeping and license requirements as specified in the Georgia IFTA Procedures Manual. The applicant authorizes the State of Georgia to withhold any refund or tax payment, if delinquent taxes are due any IFTA jurisdiction member. Failure to comply with these provisions shall be grounds for Revocation or Suspension of the license in all member jurisdictions.

Applicant certifies with his signature that to the best of his knowledge, the information is true, accurate and complete and any falsification subjects him to the offense of making a written false statement to a government official.

E-Mail: Commercialvehicles@dor.ga.gov.

P.O. Box 740382

Atlanta, Ga. 30374-0382 404-968-3800

THE PROCESSING OF THIS APPLICATION WILL BE DELAYED IF NOT PROPERLY COMPLETED AND SIGNED.