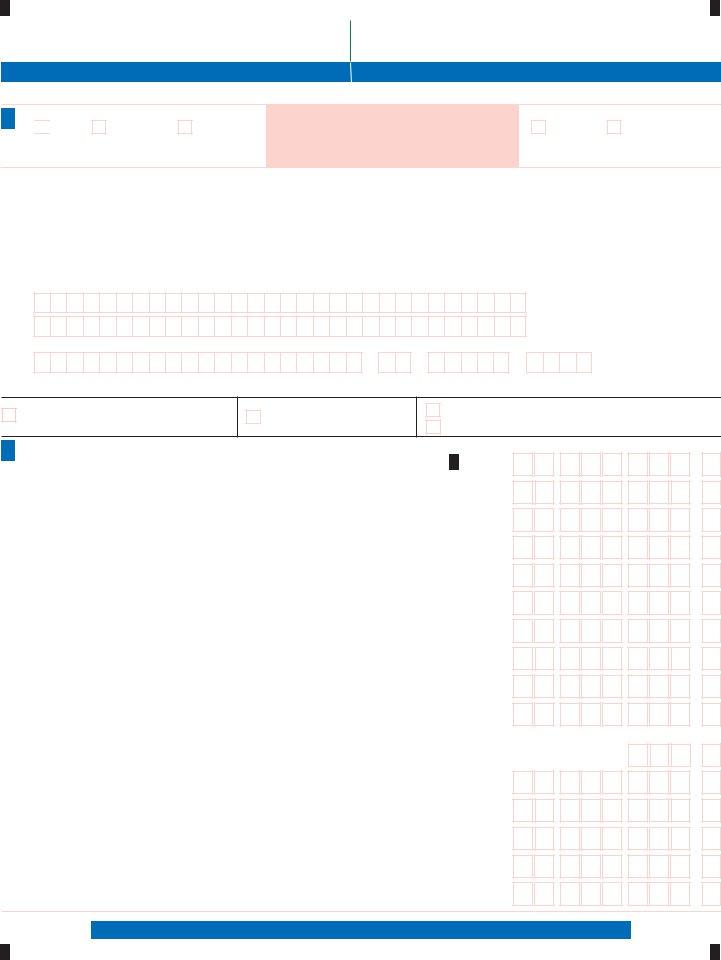

The Form CT-1040, known as the Connecticut Resident Income Tax Return, stands as a crucial document for the state's residents, encapsulating a range of financial information crucial for the calculation of state income tax for the fiscal year. The form outlines various sections that require the filer to disclose their income, including federal adjusted gross income, additions or subtractions to this income as applicable under Connecticut law, tax deductions, and credits for which they are eligible. Additionally, it delves into specifics such as income tax paid to other jurisdictions, property tax credits, individual use tax liability, and contributions to designated charities—all designed to ensure accurate tax liability calculation and potential refunds or amounts due. Filled out with either blue or black ink, the form mandates the provision of personal identification details, including Social Security numbers for both the filer and spouse if filing jointly, addresses, and incomes, as well as thorough verification of the tax payer's declaration against perjury. Furthermore, supplementary schedules attached to the main form offer space for detailing modifications to federal adjusted gross income, credits for out-of-state taxes paid, property tax credit eligibility, use tax liability, and charity contributions, thereby painting a comprehensive picture of an individual's fiscal responsibilities and contributions over the given tax year, making it an indispensable resource for Connecticut residents navigating their state tax obligations.

| Question | Answer |

|---|---|

| Form Name | Form Ct 1040 Connecticut |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | ct 1040 fillable form, preparer, 70e, 18d |

Form

Connecticut Resident Income Tax Return

Complete return in blue or black ink only.

For DRS |

|

|

2009 |

2 0 |

|

||

|

|

||

Use Only |

|

||

|

|

|

|

|

|

|

Taxpayers must sign declaration on reverse side.

For the year January 1 - December 31, 2009, or other taxable year beginning: _________________ , 2009 and ending: __________________, ______ .

1Filing Status

Single

Filing jointly for federal and Connecticut

Filing jointly for |

|

Filing separately for |

|

Filing separately for |

|

|

|

||||

|

federal and Connecticut |

|

Connecticut only |

||

|

|

||||

|

|||||

Connecticut |

|

|

|

|

|

|

|

|

|

||

only |

|

|

|

||

|

|

|

|

|

|

Enter spouse’s name here and SSN below.

Head of household

Qualifying widow(er) with dependent child

|

|

name, |

SSN here. |

Print your |

address,and |

|

|

Your Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

Spouse Social Security Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

|

- |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check if |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

deceased |

|

|

|

|

||||||||

Your first name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MI |

|

Last name (If two last names, insert a space between names.) |

Suffix (Jr./Sr.) |

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint return, spouse’s first name |

|

|

|

|

|

|

|

|

|

|

MI |

|

Last name (If two last names, insert a space between names.) |

Suffix (Jr./Sr.) |

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address (number and street, apartment number, suite number, PO Box)

City, town, or post office (If town is two words, leave a space between the words.) State |

ZIP code |

-

Check here if you do not want forms sent to you next year. This does not relieve you of your responsibility to file.

Check here if you filed Form

Form |

Check here if you are filing the |

|

following and attach the form to the |

||

|

||

Form |

||

21. Federal adjusted gross income from federal Form 1040, Line 37;

|

|

|

|

Form 1040A, Line 21; or Form 1040EZ, Line 4 |

1. |

|||

|

|

|

2. |

Additions to federal adjusted gross income from Schedule 1, Line 39 |

2. |

|||

|

|

|

3. |

Add Line 1 and Line 2. |

3. |

|||

|

4. |

Subtractions from federal adjusted gross income from Schedule 1, Line 50 |

4. |

|||||

|

|

|

|

|

||||

staple.notDo |

forms.1099or |

5. |

Connecticut adjusted gross income: Subtract Line 4 from Line 3. |

5. |

||||

6. |

Income tax from tax tables or Tax Calculation Schedule: See instructions, Page 15. |

6. |

||||||

|

|

|

||||||

|

|

|

7. |

Credit for income taxes paid to qualifying jurisdictions from Schedule 2, Line 59 |

7. |

|||

|

|

|

8. |

Subtract Line 7 from Line 6. If Line 7 is greater than Line 6, enter “0.” |

8. |

|||

here.checkClip |

9. |

Connecticut alternative minimum tax from Form |

9. |

|||||

10. |

Add Line 8 and Line 9. |

10. |

||||||

|

|

|

||||||

|

|

|

11. |

Credit for property taxes paid on your primary residence, motor vehicle, or both: |

|

|||

|

|

|

|

Complete and attach Schedule 3 on Page 4 or your credit will be disallowed. |

11. |

|||

|

|

|

12. |

Subtract Line 11 from Line 10. If less than zero, enter “0.” |

12. |

|||

|

|

|

|

|

|

|||

|

|

|

13. |

Adjusted net Connecticut minimum tax credit from Form |

|

|

13. |

|

|

14. |

Connecticut income tax: Subtract Line 13 from Line 12. If less than zero, enter “0.” |

14. |

|||||

|

|

|

||||||

|

|

|

15. |

Individual use tax from Schedule 4, Line 69: If no tax is due, enter “0.” |

15. |

|||

|

|

|

16. |

Add Line 14 and Line 15. |

16. |

|||

|

|

|

|

|

|

|

|

|

Whole Dollars Only

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

, |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

. 00

. 00

. 00

. 00

. 00

Due date: April 15, 2010 - Attach a copy of all applicable schedules and forms to this return.

For a faster refund, see Page 2 of the booklet for electronic filing options.

Form |

Your Social |

|

|

|

Security Number |

||

|

|

|

|

-

-

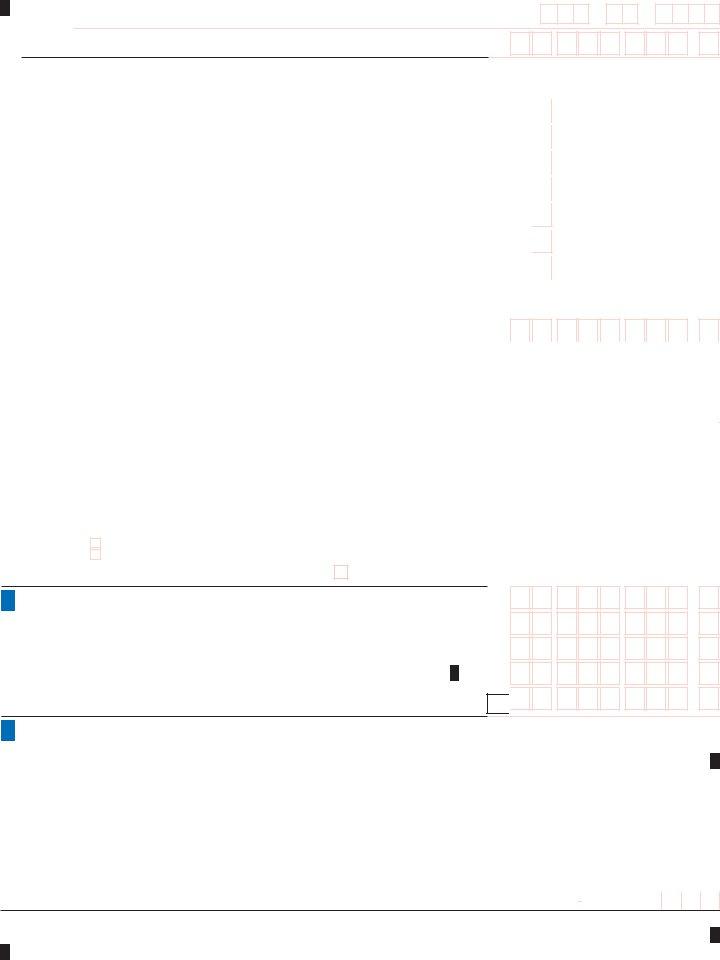

17. Enter amount from Line 16. |

17. |

,

,

.00

|

|

|

|

|

|

|

|

|

|

|

|

Column A |

|

Column B |

|

|

|

|

|

|

|

|

Column C |

|

|

|

||||||||||||||

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

Employer’s federal ID No. from Box b of |

|

Connecticut wages, tips, etc. |

|

|

|

Connecticut income tax withheld |

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

or payer’s federal ID No. from Form 1099 |

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

18a. |

|

|

|

|

|

|

|

|

|

|

|

18a. |

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

Information |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

. 00 |

18b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||

Only enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

information |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

. 00 |

18c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18c. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

|||||||||||||

from your |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

and 1099 forms |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

18d. |

|

|

|

|

|

|

|

|

|

|

|

18d. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

||||||||||||

if Connecticut |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

income tax |

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

. 00 |

18e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

18e. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

00 |

|||||||||||||

was withheld. |

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

, |

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

18f. |

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

18f. |

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. 00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

18g. |

|

|

|

– |

|

|

|

|

|

|

|

|

|

18g. |

|

|

, |

|

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18h. Enter amount from Supplemental Schedule |

18h. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18.Total Connecticut income tax withheld: Add amounts in Column C and enter here.

|

|

|

You must complete Columns A, B, and C or your withholding will be disallowed. |

18. |

, |

, |

|

|

. |

|

00 |

|

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

19. |

All 2009 estimated tax payments and any overpayments applied from a prior year |

19. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

20. |

Payments made with Form |

20. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

21. |

Total payments: Add Lines 18, 19, and 20. |

|

|

|

|

|

|

21. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

22. |

Overpayment: If Line 21 is more than Line 17, subtract Line 17 from Line 21. |

22. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|||||||||||||||||

23. |

Amount of Line 22 you want applied to your 2010 estimated tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

|||||||||||||||||

23. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

|

00 |

|

|||||||||||||||||||||

24. |

Total contributions of refund to designated charities from Schedule 5, Line 70 |

24. |

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

||||||||||||||||||

25. |

Refund: Subtract Lines 23 and 24 from Line 22. |

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

|

|

|

, |

|

|

|

|

|

. |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

For faster refund, use Direct Deposit by completing Lines 25a, 25b, and 25c. |

25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25a. |

Checking |

25b. Routing |

|

|

|

|

|

|

|

|

|

25c. Account |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

number |

|

|

|

|

|

|

|

|

|

number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25d.Will this refund go to a bank account outside the U.S.? |

|

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

526. Tax due: If Line 17 is more than Line 21, subtract Line 21 from Line 17.

27.If late: Enter penalty. Multiply Line 26 by 10% (.10).

28.If late: Enter interest. Multiply Line 26 by number of months or fraction of a month late, then by 1% (.01).

29. Interest on underpayment of estimated tax from Form

30. Total amount due: Add Lines 26 through 29.

26.

27.

28.

29.

30.

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

6Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to DRS is a fine of not more than $5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Keep a copy for your records.

Sign Here

Your signature |

|

|

|

Date |

|

|

Daytime telephone number |

|||||||||||

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Spouse’s signature (if joint return) |

|

|

|

Date |

|

|

Daytime telephone number |

|||||||||||

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Paid preparer’s signature |

|

Date |

|

Telephone number |

|

Preparer’s SSN or PTIN |

||||||||||||

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s name, address, and ZIP code |

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Third Party Designee - Complete the following to authorize DRS to contact another person about this return.

Designee’s name |

Telephone number |

Personal identification number (PIN) |

|

|||||||||

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Complete applicable schedules on Pages 3 and 4 and send all four pages of the return to DRS.

Form |

Your Social |

|

|

Security Number |

|

|

|

|

-

-

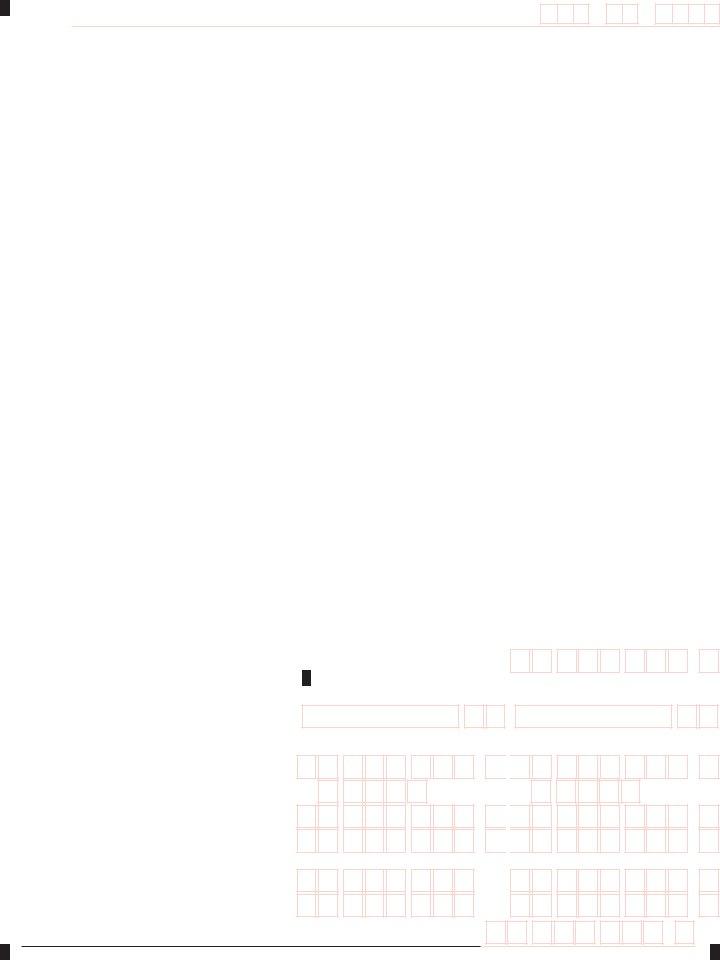

Schedule 1 - Modifi cations to Federal Adjusted Gross Income |

|

Enter all items as positive numbers. |

|

|

|

||||||||||||||||||||||||||||||||||||||||

See instructions, Page 18. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||

31. Interest on state and local government obligations other than Connecticut |

31. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

32. Mutual fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||||||||

government obligations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

33. Cancellation of debt income: See instructions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

34. Taxable amount of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||||||||

adjusted gross income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

35. Benefi ciary’s share of Connecticut fi duciary adjustment: Enter only if greater than zero. |

35. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36. Loss on sale of Connecticut state and local government bonds |

|

|

|

|

|

36. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

37. Domestic production activity deduction from federal Form 1040, Line 35 |

37. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38. Other - specify ________________________________________________________ |

38. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

39. Total additions: Add Lines 31 through 38. Enter here and on Line 2. |

39. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40. Interest on U.S. government obligations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

41. Exempt dividends from certain qualifying mutual funds derived from U.S. government obligations |

41. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

42. Social Security benefit adjustment: See Social Security Benefit Adjustment Worksheet, Page 20. |

42. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43. Refunds of state and local income taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

43. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

44. Tier 1 and Tier 2 railroad retirement benefi ts and supplemental annuities |

44. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45. 50% of military retirement pay |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

45. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

46. Benefi ciary’s share of Connecticut fi duciary adjustment: Enter only if less than zero. |

46. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

47. Gain on sale of Connecticut state and local government bonds |

47. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

48. Connecticut Higher Education Trust (CHET) contributions |

48. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

Enter CHET account number: |

|

|

|

|

|

|

|

– |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(can be up to 14 digits) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49. Other - specify: Do not include out of state income. ___________________________ |

49. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

|||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

50. Total subtractions: Add Lines 40 through 49. |

Enter here and on Line 4. |

50. |

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

00 |

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 2 - Credit for Income Taxes Paid to Qualifying Jurisdictions

You must attach a copy of your return fi led with the qualifying jurisdiction(s) or your credit will be disallowed.

51.Modifi ed Connecticut adjusted gross income See instructions, Page 24.

52.Enter qualifying jurisdiction’s name and

code: See instructions, Page 24. |

52. |

53.

54.Divide Line 53 by Line 51. May not exceed 1.0000 54.

55.Income tax liability: Subtract Line 11 from Line 6. 55.

56. Multiply Line 54 by Line 55. |

56. |

57. Income tax paid to a qualifying jurisdiction |

|

See instructions, Page 25. |

57. |

58. Enter the lesser of Line 56 or Line 57. |

58. |

Column A

Name

, |

, |

. |

|

, |

, |

, |

, |

, |

, |

, |

, |

51.

Code

.00

.00

.00

. |

00 |

|

|

. |

00 |

, |

, |

Column B

Name

, |

, |

. |

|

, |

, |

, |

, |

, |

, |

, |

, |

. 00

Code

. 00

. 00

. 00

. 00

. 00

59. Total credit: Add Line 58, all columns. Enter here and on Line 7.

59. |

, |

, |

.00

Complete applicable schedules on Page 4 and send all four pages of the return to DRS.

Form |

Your Social |

|

|

Security Number |

-

-

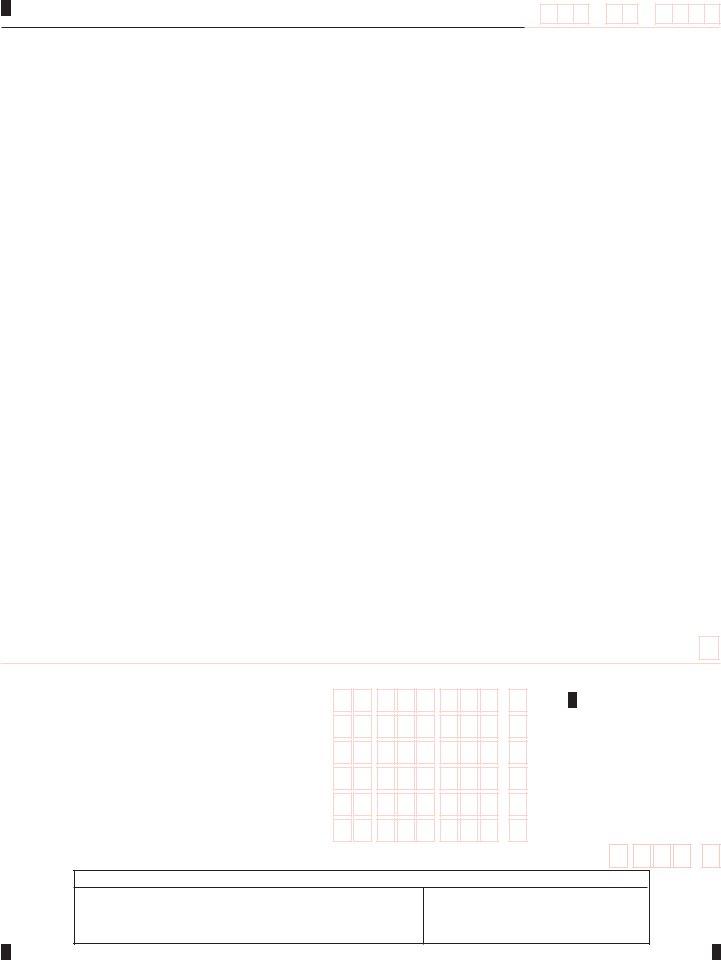

Schedule 3 - Property Tax Credit See instructions, |

Page 25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Auto 2 |

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

Qualifying Property |

|

|

|

Primary Residence |

|

|

|

|

|

|

|

Auto 1 |

|

|

|

|

|

|

|

|

(joint returns or qualifying widow(er) only) |

|

|

|

|||||||||||||||||||||||||||||||

Name of Connecticut Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Town or District |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Description of Property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

If primary residence, enter |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

street address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

If motor vehicle, enter year, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

make, and model. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Date(s) Paid |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

_ _ /_ _ / 2009 |

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

||||||||||||

|

Amount Paid 60. |

|

|

|

|

, |

|

|

|

. |

00 |

|

|

61. |

|

|

|

|

|

, |

|

|

|

|

|

. |

00 |

|

62. |

|

|

|

|

|

, |

|

|

|

|

|

|

00 |

||||||||||||||

63. Total property tax paid: Add Lines 60, 61, and 62. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

63. |

|

|

|

|

|

, |

|

|

|

|

|

. |

|

00 |

||||||||||||||||||||||||

64. Maximum property tax credit allowed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

64. |

|

|

|

|

500 . |

|

00 |

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

65. Enter the lesser of Line 63 or Line 64. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

65. |

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

00 |

|||||||||||||||||||||

66. Enter the decimal amount for your fi ling status and Connecticut AGI from the Property Tax |

|

|

|

|

|

|

|

|

. |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

Credit Table exactly as it appears on Page 27. If zero, enter the amount from Line 65 on Line 68. |

66. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

67. Multiply Line 65 by Line 66. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

67. |

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

00 |

||||||||||||||||||

68. Subtract Line 67 from Line 65. Enter here and on Line 11. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

||||||||||||||||||||||||

|

Attach Schedule 3 to your return or your credit will be disallowed. |

|

|

|

|

|

|

|

|

|

|

|

|

|

68. |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

Schedule 4 - Individual Use Tax - Do you owe use tax? See instructions, Page 28. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

Complete this worksheet to calculate your Connecticut individual use tax liability and attach Page 4 to your return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

Column A |

|

|

Column B |

|

|

Column C |

|

|

|

|

Column D |

|

Column E |

|

|

Column F |

|

|

|

Column G |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tax, if any, |

|

|

Balance due |

||||||||||||||

|

Date of |

|

Description of |

|

|

Retailer or |

|

|

|

|

Purchase |

|

CT tax due |

|

|

|

|

paid to |

|

|

(Column E minus |

|||||||||||||||||||||||||||||||||||

|

purchase |

|

goods or services |

|

service provider |

|

|

|

|

|

price |

(.06 X Column D) |

|

|

|

another |

|

|

Column F but not |

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

jurisdiction |

|

|

less than zero) |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Total of individual purchases under $300 not listed above |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

69. Individual use tax: Add all amounts for Column G. Enter here and on Line 15. |

69. |

|

|

|

, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Schedule 5 - Contributions to Designated Charities

.00

70a. AIDS Research |

|

70a. |

70b. Organ Transplant |

|

70b. |

70c. Endangered Species/Wildlife |

|

70c. |

70d. Breast Cancer Research |

|

70d. |

70e. Safety Net Services |

|

70e. |

70f. Military Family Relief Fund |

|

70f. |

|

,

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

70. Total Contributions: Add Lines 70a through 70f. Enter amount here and on Line 24. |

70. |

|

|

, |

|

|

Use envelope provided, with correct mailing label, or mail to: |

|

|

|

|

|

|

,

.00

For refunds and all other tax forms without payment: Department of Revenue Services

PO Box 2976

Hartford CT

For all tax forms with payment: Department of Revenue Services PO Box 2977

Hartford CT

Make your check payable to: Commissioner of Revenue Services

To ensure proper posting, write your SSN(s) (optional) and “2009 Form