Navigating the complexities of tax forms can often feel daunting, but understanding the Form CT-941 HHE can significantly streamline the reconciliation process for household employers in Connecticut. This form is designed to facilitate the annual reconciliation of Connecticut income tax withholding for employers who have domestic employees. The State of Connecticut's Department of Revenue Services mandates the completion of this form to ensure that household employers have correctly withheld state income taxes from their employees' wages throughout the year. Key aspects include noting gross wages, gross Connecticut wages, the total amount of Connecticut income tax withheld, and any applicable taxes or interest due for late filings. Additionally, the form provides options for employers in terms of crediting overpayments to the next year or requesting refunds, with consideration for direct deposit to expedite refunds. Detailed instructions accompany the form to assist employers in accurately reporting and rounding off amounts, thereby avoiding common pitfalls and ensuring compliance with state tax laws. Notably, the form underscores the importance of timely filing by the set deadline to avert penalties, emphasizing the proactive engagement of employers in upholding their fiscal responsibilities. By adhering to these guidelines, household employers can navigate tax season with confidence, ensuring they meet their obligations both to their employees and to the state.

| Question | Answer |

|---|---|

| Form Name | Form Ct 941 Hhe |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | ct 941hhe drs form ct 941 hhe 2015 |

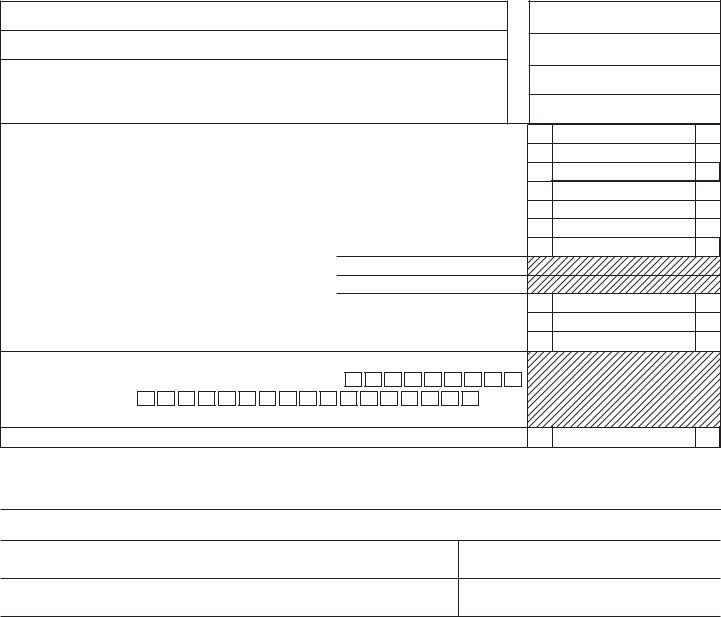

Department of Revenue Services

State of Connecticut

PO Box 2931

Hartford CT

(Rev.12/12)

Form |

2012 |

Connecticut Reconciliation of Withholding

for Household Employers

General Instructions

Complete the return in blue or black ink only.

Household employers registered to withhold Connecticut income tax from their household employee wages must file one Form

Amendedreturns:Use

Rounding Off to Whole Dollars: You must round off cents to the nearest whole dollar on your returns and schedules. If you do not round, the Department of Revenue Services (DRS) will disregard the cents.

Round down to the next lowest dollar all amounts that include 1 through 49 cents. Round up to the next highest dollar all

amounts that include 50 through 99 cents. However, if you need to add two or more amounts to compute the amount to enter on a line, include cents and round off only the total.

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50) to enter on a line. $4.50 is rounded to $5.00 and entered on the line.

When to File

Form

Return Instructions

Complete all requested information on the front and back of this return. See instructions on back. Sign and date the return in the space provided. If payment is due, remit payment with this return.

Name

Address

City |

|

|

State |

Zip Code |

|

|

|

||||

Check here If you no longer have employees in Connecticut, and enter date |

|

||||

of last payroll: |

|

/ |

/ |

|

|

|

M M |

D D |

Y Y Y Y |

|

|

Connecticut Tax Registration Number

Federal Employer ID Number (FEIN)

Annual Filer

4

Due date

April 15, 2013

1. |

Gross wages |

|

|

|

1 |

|

2. |

Gross Connecticut wages |

|

|

|

2 |

|

3. |

Connecticut tax withheld |

|

|

|

3 |

|

4. |

Credit from prior year |

|

|

|

4 |

|

5. |

Payments made for this year |

|

|

|

5 |

|

6. |

Total payments: Add Line 4 and Line 5 |

|

|

|

6 |

|

7. |

Net tax due (or credit): Subtract Line 6 from Line 3 |

|

|

|

7 |

|

8a. |

Penalty: |

|

|

00 |

|

|

|

8a |

|

|

|||

8b. |

Interest: |

|

8b |

|

00 |

|

8 |

...............................................................Total penalty and interest: Add Line 8a and Line 8b. |

|

|

|

8 |

|

9. |

Amount to be credited |

|

|

|

9 |

|

10. |

Amount to be refunded |

|

|

10 |

||

For faster refund, use Direct Deposit by completing Lines 10a, 10b, and 10c.

10a. |

Checking Savings |

10b. Routing number |

|

10c. |

Account number |

|

|

10d. |

Will this refund go to a bank account outside the U.S.? Yes |

|

|

11. |

Total amount due: Add Line 7 and Line 8 |

11 |

|

Mail to: Department of Revenue Services

P.O. Box 2931

Hartford, CT

00

00

00

00

00

00

00

00

00

00

00

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct.

Signature

Title

Date

Telephone number

()

Form

Line Instructions

Where to File

Use the Taxpayer Service Center (TSC) to electronically fi le this return. See TSC below.

If filing by mail, make check payable to Commissioner of Revenue Services. Write your Connecticut Tax Registration Number on your check. DRS may submit your check to your bank electronically. Mail the completed return and payment (if applicable) to the address on the return.

Taxpayer Service Center The TSC allows taxpayers to electronically file, pay, and manage state tax responsibilities. To make electronic transactions or administer your tax account online, visit www.ct.gov/TSC and select Business.

Forms and Publications

Visit the DRS website at www.ct.gov/DRS to download and print Connecticut tax forms and publications.

For More Information

Call DRS during business hours, Monday through Friday:

•

•

TTY, TDD, and Text Telephone users only may transmit inquiries anytime by calling

Line 1: Enter gross wages, for federal income tax withholding purposes, paid to all household employees during the year.

Line 2: Enter gross Connecticut wages paid during the year. Connecticut wages are all wages paid to employees who are residents of Connecticut, even if those wages are paid for work performed outside Connecticut by those resident employees, and wages paid to employees who are nonresidents of Connecticut if those wages are paid for work performed in Connecticut by those nonresident employees.

Line 3: Enter total Connecticut income tax withheld on wages during the year. Include any amounts overcollected and not repaid to employee(s) during calendar year 2012.

Line 4: Enter credit from your prior year Form

Line 5: Enter the sum of all payments made for the year.

Line 6: Add Line 4 and Line 5. This is your total payments and credits for the year.

Line 7: Subtract Line 6 from Line 3 and enter the difference. If Line 3 is more than Line 6, complete Line 8a and Line 8b, if necessary, then go to Line 11. If Line 6 is more than Line 3, complete Line 9 and Line 10.

Line 8: Enter penalty on Line 8a, interest on Line 8b, and the total on Line 8.

Late Payment Penalty: The penalty for paying all or a portion of the tax late is 10% of the tax paid late.

Late Filing Penalty: If no tax is due, DRS may impose a $50 penalty for the late fi ling of this return.

Interest:Interest is computed on the tax paid late at the rate of 1% per month or fraction of a month.

Line 9 and Line 10: Enter the amount from Line 7 you want credited to the next year on Line 9. Enter the amount from Line 7 you want refunded on Line 10. However, if any portion of the amount on Line 7 was overwithheld from your employee(s) during calendar year 2012 and not repaid to your employee(s) prior to the end of calendar year 2012 or prior to filing the return for that year, whichever is earlier, the amount not repaid must be subtracted from the amount on Line 7. Enter the difference on Line 9 or Line 10.

If you overwithheld Connecticut income tax from your employee(s), the amount overwithheld should be reimbursed to the employee in the same calendar year the overcollection occurred.

Any Connecticut income tax overwithheld and not reimbursed in the same calendar year must be reported and paid to DRS on Form

Do not reimburse any overwithheld Connecticut income tax that is the result of an incorrect withholding code claimed by an employee on Form

Lines 10a through 10c: Get the refund faster by choosing direct deposit. Complete Lines 10a, 10b, and 10c to have the refund directly deposited into a checking or savings account.

Enter the |

|

|

|

|

|

|

|

|

|

|

|

|

Name of Depositor |

|

|

|

|

No. 101 |

|||||

routing number and the |

|

Street Address |

|

Date |

|||||||

|

City, State, Zip Code |

|

|

|

|

|

|

|

|||

|

Pay to the |

|

$ |

|

|

|

|||||

bank account number in |

|

Order of |

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lines 10b and 10c. The |

|

|

|

|

|

|

|

|

|

|

|

|

Name of your Bank |

|

|

|

|

|

|

|

|||

bank routing number is |

|

Street Address |

|

|

|

|

|

|

|

||

|

City, State, Zip Code |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

normally the first nine- |

|

092125789 |

091 025 025413 |

0101 |

|

|

|||||

digit number printed on |

|

|

|

|

|

|

|

|

|

|

|

Routing Number |

Account Number |

|

|

|

|

|

|

||||

the check or savings

withdrawal slip. The bank account number generally follows the bank routing number. Do not include the check number as part of the account number. Bank account numbers can be up to 17 characters.

If any of the bank information supplied for direct deposit does not match, or the applicable bank account is closed prior to the deposit of the refund, the refund will automatically be mailed.

Line 10d: Federal banking rules require DRS to request information about foreign bank accounts when the taxpayer requests the direct deposit of a refund into a bank account. If the refund is to be deposited into a bank account outside of the United States, DRS will mail the refund

Line 11: If the amount on Line 7 is net tax due, add Line 7 and Line 8. This is the total amount due.

Form